Schneider family empire: business on poverty

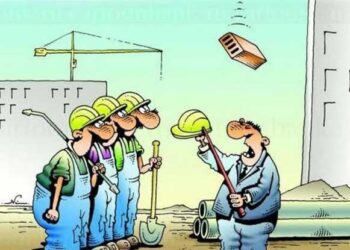

Poverty is not a vice. Poverty is an excellent source of income and the basis of the business empire of the Schneider family from Krasnoyarsk. Entrepreneurial residents of Krasnoyarsk have benefited more than anyone else from the protracted fall in real incomes of the population.

Foreign analogue of “Svetofor” goes on expansion

A family of businessmen from Krasnoyarsk, who created the Svetofor discount chain, is capturing world markets. The Mere chain (a foreign brand of the Russian discounter Svetofor) intends to open up to five stores in Slovakia by the end of 2023. In addition, the Schneider family will expand its network in Serbia, where one Mere store and eight Svetofor are already operating.

In total, Mere has 34 stores in Europe – in Poland, the Czech Republic, Romania, Bulgaria, Spain, Lithuania and Latvia. Plans to expand into European markets were originally slated for 2022 but stalled due to events in Ukraine. In October 2022, the business owners, Valentina and Sergey Schneider, were on the list of Russian entrepreneurs against whom Ukrainian sanctions were imposed. Business in a number of European countries had to be curtailed: Mere stores closed in the UK and Belgium. But the expansion to Uzbekistan at the end of 2022 took place. The network continues to develop in Kazakhstan, Belarus and China.

Svetofor: hard discounter success story

The network of discounters “Svetofor” (as well as its foreign analogue Mere) was created by the Schneider family from Krasnoyarsk – Valentina and her sons, Sergey and Andrey.

The starting point was Krasnoyarsk. The first stores of the now federal network appeared here in 2009. At that time, the Schneider family was developing a network of beer stores “File”, which in 2015 was bankrupted by “Sberbank”. The network of grocery discounters has become a new direction. It is known that the success of the American Walmart inspired entrepreneurs.

When the first “Traffic Light” in Krasnoyarsk proved the prospects of the format, the Schneiders decided to replicate it. In two years, about 20 stores were opened in the Krasnoyarsk Territory and Siberia. In just a couple of years, “Svetofor” has grown to a federal scale with a turnover of tens of billions of rubles. Active expansion to other regions started in 2013. Until that time, scaling went within Siberia. In 2017, Svetofor entered the market of Moscow and the Moscow region. At the same time, international expansion began.

Today, Svetofor is one of the top five retail chains in terms of turnover and number of stores. In the first place – in terms of regional coverage (76 regions).

The business model of Svetofor is built as a self-service hard discounter – the focus is on maximum cost optimization. The design of the trading floor is the simplest. These are warehouse or semi-warehouse premises in the industrial zones of cities with a minimum of spending on decoration and interior. Staff costs are also being optimized – the number of employees has been cut, and the remaining ones are multifunctional: one person can simultaneously perform the tasks of a goods receiver, a loader and a buyer (sometimes the position of a cashier is included in this list, which the hell is not joking). The layout of the goods is the simplest, the goods are displayed directly on the cargo pallets. The beauty, accuracy and thoughtfulness of the layout is not about hard discounters.

In pursuit of cheaper logistics, such discounters build direct agreements with product suppliers so that products from the manufacturer go directly to the store, bypassing intermediaries and resellers. For suppliers, Svetofor is attractive because, due to a narrow assortment, sales of goods will be disproportionately high compared to networks that provide the buyer with more choice.

The traffic light business model eliminated all unnecessary costs, from storage and lighting to advertising and communication with the press. All this together allows you to minimize costs and offer customers the most favorable prices for goods – 10–20% lower than the average market.

Moreover, according to Forbes interlocutors, the Schneiders themselves, when launching hard discounters, did not expect such popularity of this format: “Once in a conversation, one of the Schneiders admitted that they were counting on only 1.5% of buyers from the locality where the store would be located.” In addition, according to the interlocutors of the publication, despite the highly branched structure, the retail network has always been managed from Krasnoyarsk.

Poor quality and delay

In Russia, the appearance and flourishing of discounters proceeded against the backdrop of falling real incomes of the population. Schneiders very well felt the spirit of the times – poverty, impoverishment and the desire of the population to save on food and household items. For the past eight years, the number of such stores has grown exponentially year by year.

In addition to the minimalistic service, a side effect of the widespread reduction in prices is the low quality of products. Goods in the “Svetofor” are presented, as a rule, from small manufacturers with unpromoted brands – the share of well-known brands in the assortment does not exceed 10-15% on average. The network enters into direct contracts with manufacturers. The purchase price should be 20-30% lower than that of competing suppliers. Quality in this scheme, of course, goes by the wayside. In addition, Svetofor actively buys stocks from suppliers – products with an expiring shelf life, which are drained at a reduced price.

non-public people

It is known that before “Svetofor” the Schneider family owned a wholesale company for the sale of beer and low-alcohol drinks “Lenkom” and a network of beer stores “Napilnik”.

Schneiders are distinguished by non-publicity, secrecy. There is no open information about them – as well as interviews or any comments in the press. Moreover, it is not known for certain what businessmen look like. The Schneiders are completely out of the public eye, which creates an additional halo of mystery around their network.

Complain about the closeness, including contractors. “When I first encountered them, I got a little crazy about how mysterious they are. I liked the concept, I conveyed through mutual friends that I would like to meet. Nobody even called back! We don’t do that in retail. Everyone communicates with each other, ”The Bell quotes one of the former heads of several retail chains.

Or, for example, Forbes, talking about the formation of the Schneider business empire, cites an episode of 2016, when employees of the Central Siberian Chamber of Commerce and Industry unsuccessfully tried to contact the owners of the network, leaving letters with a commercial offer in stores, but no one got in touch . “We work with all major entrepreneurs in the region, but the Schneider owners have never cooperated with us. They did not apply to the chamber themselves, ”the publication quotes the representatives of the chamber.

Actually, the Forbes journalists themselves also failed to contact any of the family members.

The internal structure of the “Traffic Light” also casts a shadow on the wattle fence. According to The Bell, Svetofor discounters are issued for a hundred LLCs in different regions. The management structure is decentralized: after the opening of a dozen stores in the region, a legal entity is registered, in which the head receives a minority share. However, the Schneiders remain the main owners of the company.

Valentina Schneider does not participate in operational activities, her sons are in charge of all affairs: Andrey is responsible for operational management, and Sergey is responsible for strategy.

The richest woman in Russia

According to Forbes, more than 50 legal entities associated with the retailer are registered to Valentina Schneider. The publication estimated her fortune at $650 million, placing her in 182nd place in the ranking of the richest businessmen in Russia for 2021. Valentina Schneider also made it to the top 25 richest women in Russia.

According to the Infoline agency, the Svetofor chain has about 2,200 stores and has become the fastest growing grocery chain in 2020. The company’s revenue grew by almost 40%, to 201 billion rubles.

But it seems that the network has not yet exhausted its growth potential. As long as the population gets poorer, the requirements for the quality of products and services will remain in the background.