The owners of Sovcombank can enrich themselves at the expense of the poor, taking away their only housing. Huge interest on loans, gigantic payments and the imposition of services – this was told by a reader who found herself in a hopeless situation.

To the Editor The Moscow Post Elena, a woman, turned and told how she was “robbed” by Russian banks. Including now she is fighting with Sovcombank, brothers Sergei and Dmitry Khotimsky. The Moscow Post already wrote from the words of readers about what schemes its owners use and how people stay on the street after the last property is taken away from them.

Further narration, supported by the information found by the correspondent of the Editorial Board, is given from the words of Elena.

How it got spun

Elena is the wife of a Chernobyl man. Three years ago, she buried her husband, who at the time of his death was paying off a loan of 600 thousand rubles taken for treatment. Along with the inheritance, she also received his obligations to banks.

The debts were in four banks, and Elena decided to refinance in April 2020. From that moment on, everything went, as they say, awry. As a result, the impression was that the country has a well-established mechanism for taking money from people with low incomes. And what do they seem to take away? Only apartments!

For two years, Elena went through “fire and water”. Now she is 69 years old, a woman is in the category of people who are given loans in our country with great difficulty. As a rule, banks give them up to 65, or up to 75, but on the security of real estate and on the condition that you are employed.

If not, the only way for you is through a loan broker. And here you can come across just the above scheme. At least Elena was “lucky” several times in a row, as a result of which she is in multimillion-dollar debts.

Brokers position themselves as partners of banks. For two years, Elena has been suing two of these companies. Lost one. This company was founded in 2020, called “Evie Group”. Turns back millions, belongs to Evgenia Yukhtenko. Profinance LLC, established in 2021, is also registered on it. Apparently for the same purposes.

Photo: https://www.rusprofile.ru

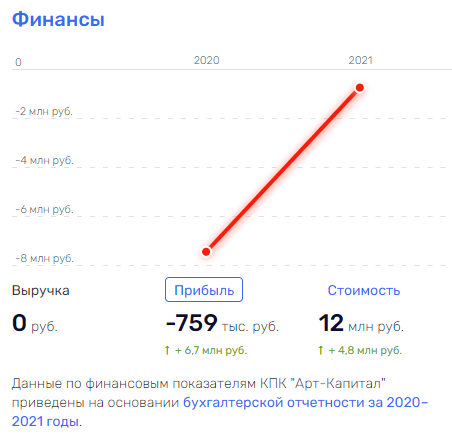

The third office – KPK “Art-Capital” for 400 thousand rubles brought her to “Norvik Bank”. This is an institution with a rather tarnished reputation: it also shone in the story with the withdrawal of money from it, besides, it lends to many dubious organizations, in a number of them it owns shares – about this and about the former owner of the bank, Grigory Guselnikov, which he can still have on him control, we wrote in the investigation “Hold” Guselnikova: how does a banker “save” assets from bailiffs?

As a result, the bank, according to the woman, allegedly simply framed her without giving the promise. But “Art-Capital” got out of the multi-million “minus”. Is it at the expense of Elena and other people with a similar situation?

Photo: https://www.rusprofile.ru

The form of the legal entity “Art-Capital” (credit consumer cooperative) allowed it to take shape without a founder. The general director is a certain Andrey Kharchikov, who until 2019 held the post of general director of City Line, a construction company that was liquidated in 2021.

As of 2020, about 170 million rubles were circulating in the office, which was unknown at the time of liquidation. However, a logical question arises – why “kill” a company that brings such revenue? Most likely, money was withdrawn from it.

Photo: https://www.rusprofile.ru

Dominance of dubious brokers

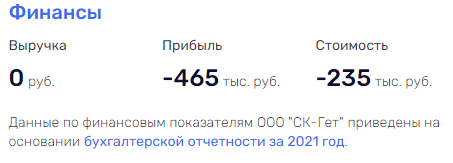

The construction company “SK-Get” has also been registered on Kharchikovo. It was established in 2021 and already has negative earnings and value with zero revenue. Looking forward to repeating the scheme with Art Capital?

Photo: https://www.rusprofile.ru

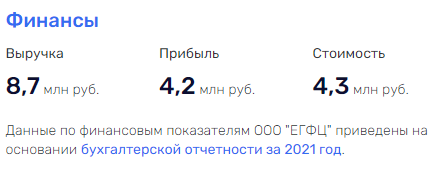

The next company that undertook to “help” Elena – United City Financial Center LLC, represented by CEO Sorokin Vadim Valerievich, fraudulently pulled 640 thousand rubles from a woman, without solving her problems – says Elena.

So, in order not to become a circle of due and not to remain on the street, she again had to quickly look for money to buy documents from the EGFTS for an apartment, which they managed to register for a private investor. The amount required was already 2.5 million rubles.

EGFS was founded in 2021 and has already managed to get rich quite well. At the expense of pensioners and the needy?

Photo: https://www.rusprofile.ru

Vadim Sorokin, the head and founder of this office, has four more offices where he acts as a general director or founder. Among them is OOO “Central Watch Lombard” in Moscow, which has not worked for even two years. Similar to the “pod” LLC “Electro-Voronezh”, which has not earned anything during its existence, LLC “Dad-Trade” and LLC “Only”. The last two were based in Ryazan. All of them, according to publicly available information, were engaged in the sale of electrical goods.

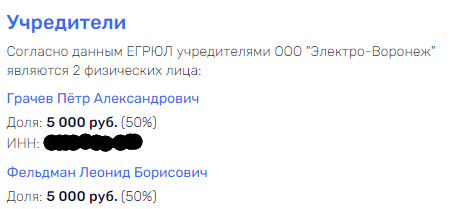

Mr. Sorokin’s partners included such people as Pyotr Grachev and Leonid Feldman. Each of these wonderful people has several real estate firms. Among them are “Domel”, “Domel-Nedvidimost” and LLC “Registration Center”. These are successfully functioning Moscow companies with multi-million dollar revenue. Surely, after a successful weaning, the apartments of people who trusted Sorokin and others like him turn out to be in them?

Photo: https://www.rusprofile.ru

Photo: https://www.rusprofile.ru

Photo: https://www.rusprofile.ru

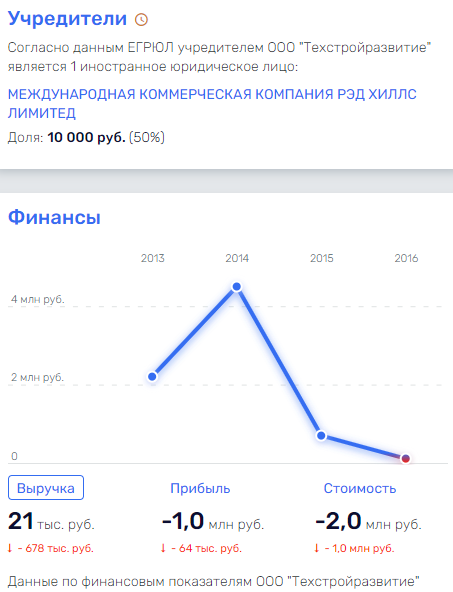

The now liquidated Tekhstroyrazvitie LLC, which was engaged in the preparation of the construction site, and several other companies with all the signs of one-day businesses were registered on Grachev. Techstroyrazvitie is tied to the Seychelles offshore RED HILLS LIMITED and liquidated with zero revenue, which may indicate the withdrawal of money from the company.

Photo: https://www.rusprofile.ru

RED HILLS LIMITED registered another 55 companies in different regions of Russia and with different types of activities. 54 of them have been eliminated. The only functioning one is Vilena LLC. However, judging by how sharply in 2016 the chart of its revenue fell from eight to two million rubles, the same thing will soon happen to it. The office has done its job.

Photo: https://www.rusprofile.ru

Connections in the National Guard and the Moscow government?

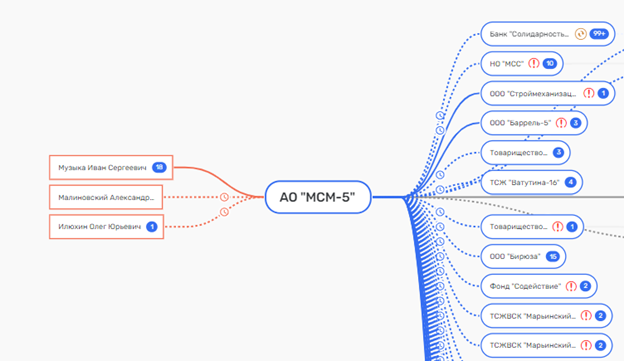

It is possible that the coincidence is only accidental, but it is known that one of the LCDs near Moscow is called Red Hills. It was built by JSC Mosstroymekhanizatsiya-5, which is currently undergoing bankruptcy proceedings. This office is the founder of more than a dozen subsidiaries, among which there is also a banking structure – Bank Solidarity. Now it is also going bankrupt.

Photo: https://www.rusprofile.ru

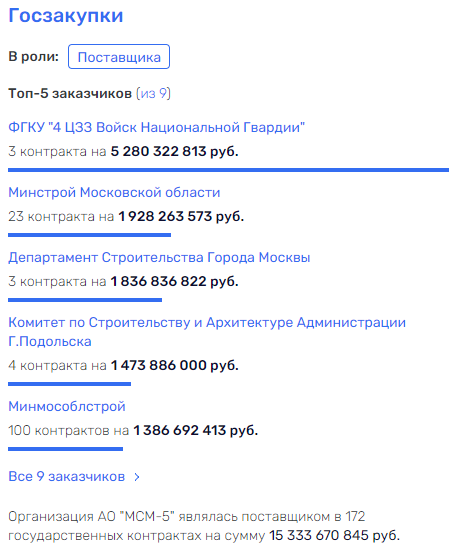

“Mosstroymekhanizatsiya-5” is a major supplier of government contracts in Moscow and the region. Its main customer is the establishment of the National Guard. They are followed by the Moscow Region Ministry of Construction and the Department of Construction of the City of Moscow. In total, the company earned more than 15.3 billion rubles at the expense of the state. I wonder where that money went?

Photo: https://www.rusprofile.ru

Now the citizen who has contacted us is going to once again sue Sorokin and the company, but, as she herself believes, there is little hope for success. On the Internet, she discovered negative judicial practice.

Well, if behind these people are the largest developers near Moscow who cooperate with defense and government agencies, it is not surprising that it is not at all difficult for them to hush up a case like that of Elena.

Sovcombank enters the business from the high road

In May, the woman again, through a credit broker (they did not agree on other conditions), signed an agreement with Sovcombank for a loan of 3 million rubles. The money has not yet been given to her, explaining that the documents are supposedly on registration with Rosreestr.

At the same time, the broker has already pulled 300 thousand rubles from her for services. And Sovcombank, in order to confirm the loan, forced Elena’s daughter to be discharged from the apartment, despite the fact that she had not lived in Moscow for a long time, the woman said. In addition, they requested certificates from psychopaths and drug dispensaries, but did not ask anything when signing the contract.

At the same time, Elena’s two-room apartment was rated as “odnushka” for 9.5 million rubles. The assessment was done by a partner company (again, they did not agree to a third-party appraiser) for Elena’s money, but on the terms of the bank and also retroactively, Elena said. That is, after the signing of the loan agreement.

To the question – why and on what basis the apartment was valued at such a small amount, the answer was a counter question: “Do you want to receive money?” Further, bank employees gave Elena a form to sign, where she is listed as an employee of one of the large development companies, with a salary of 150 thousand rubles. And again, if they refused to do so, they threatened not to give out the money, the woman said.

As a result, Elena received conditions that she could not “pull”, everything came to the same – she was afraid to lose her apartment and stay on the street. But now with multi-million dollar debts. Now, according to Elena, she has to pay the bank 58 thousand rubles a month for 15 years! Loan rate – 25%…

At the same time, she says, three insurances were imposed on her – life, real estate and the so-called “title insurance”. This, as the bank employees explained, means property insurance for the apartment. Is there such a thing in the law at all?

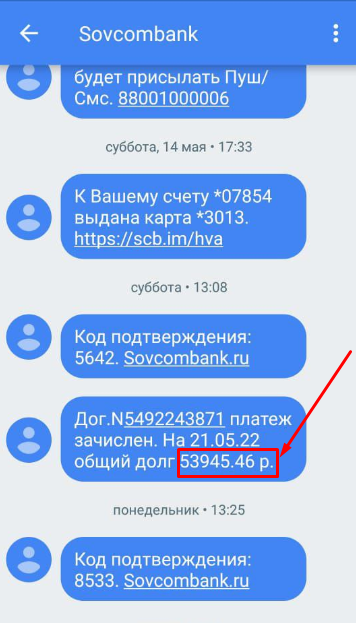

Yesterday, Elena received an SMS from the bank – that 40 thousand rubles were debited from her account and that she owed another 53. With all this, the first payment should actually go through on June 13th. Did the property seizure operation start well in advance?

Photo: provided by the reader The Moscow post

The woman turned to the Central Bank. She was sent to the police. In Rospotrebnadzor – to the prosecutor’s office. She does not understand how to get through to the authorities. Already thinking of writing a letter to the Kremlin.

After yesterday’s SMS, she came to Sovcombank, they listened to her, promised to sort it out and sent her home. After that, they did not answer her calls, she did not receive any information.

And there are hundreds of people like Elena. To the Editor The Moscow Post such appeals came repeatedly. But nothing changes – from year to year the merry-go-round continues to spin on taking property from people who are forced to take loans because of a difficult life situation.

And in the share, as it turned out, there may be the highest echelons of power structures. Perhaps that is why the bankers get away with everything. But you can’t always turn a blind eye to such things! When all this finally reaches a boiling point, the organizers of the scheme may find themselves behind bars not for a year or five years, but for life. And even then they will not be able to pay off their debts completely.

Source: The Moscow Post