Come tomorrow: Andrey Kostin got into the throat of investors

Clients of the VTB broker say they want to see Andrei Kostin in the dock.

Clients of the VTB broker have been deprived of the right to use and dispose of their assets for the second year, but a review of the claim may help turn the situation around in their favor. The situation has escalated to the point that the victims are no longer averse to seeing Mr. Kostin in the dock.

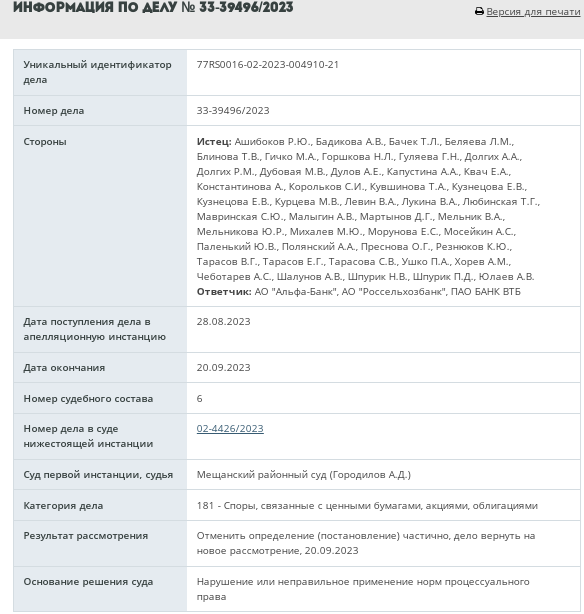

Private investors – former clients of the VTB broker – became hostages of the situation not only because of the sanctions and the behavior of the other party, but now the strange behavior of the judge has also been added to the treasury. Instead of returning to the clients their property, which turned out to be “blocked” after the broker’s manipulations, the judge of the Meshchansky Court of Moscow Gorodilov, for far-fetched (according to the plaintiffs) reasons, left the claim without consideration, but a higher authority recently sent the case for a new trial. Will justice finally prevail and after two years will investors get their assets back?

Earlier, the media had already begun to talk about the situation in which hundreds of thousands of Russians – private investors – found themselves.

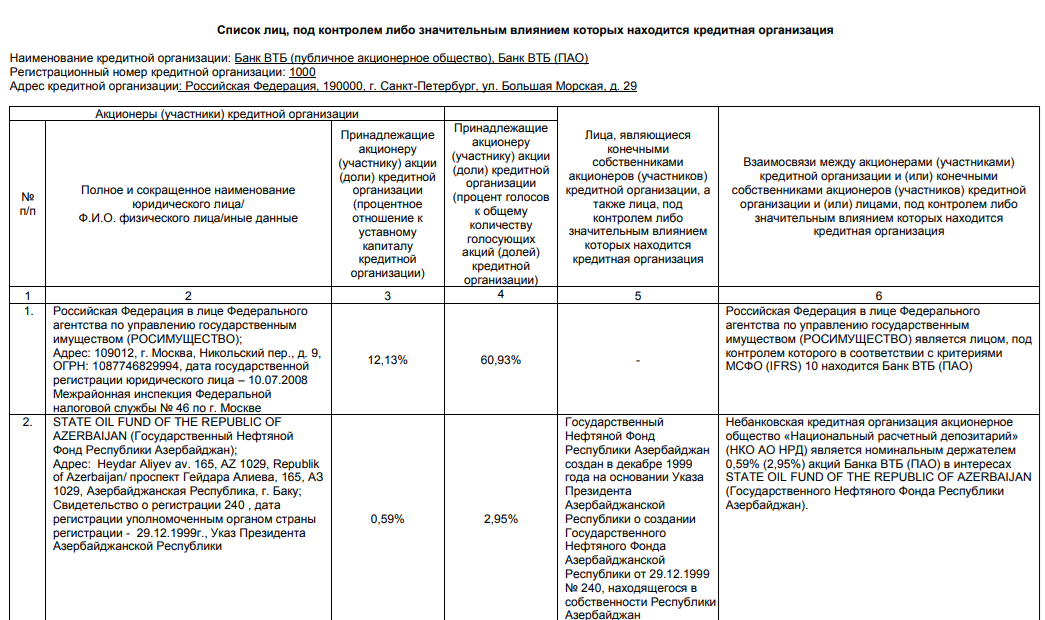

Let us remember that, having decided to independently ensure a peaceful old age, some Russians became private investors. They chose VTB broker for cooperation, believing that a group with state participation could be trusted.

Photo: https://analizbankov.ru

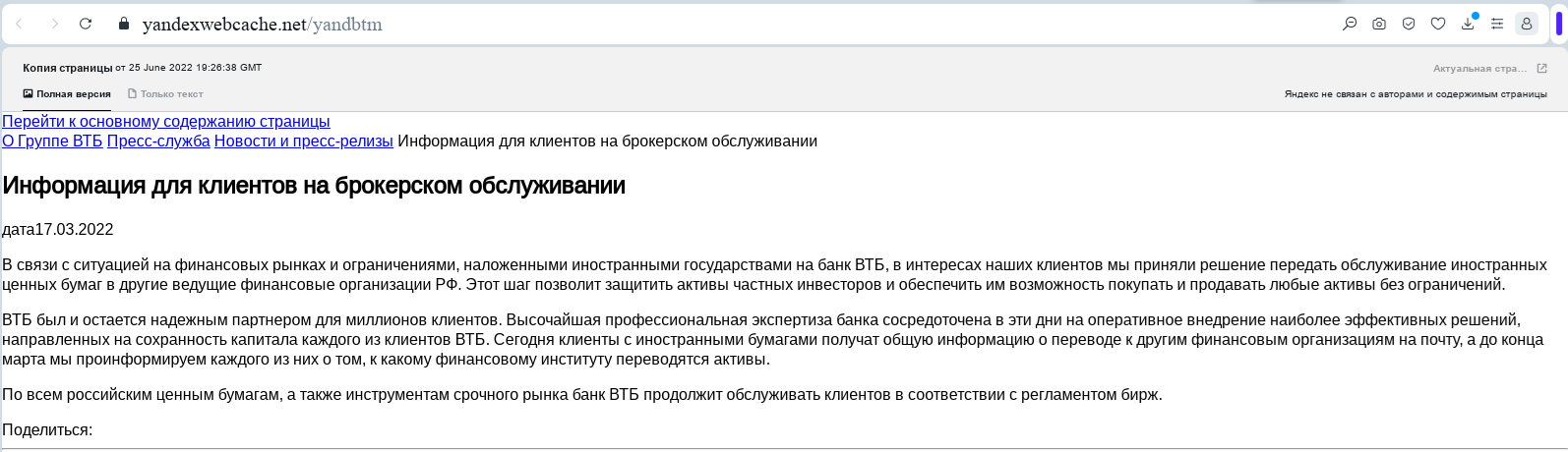

But after the bank under the leadership of Andrei Kostin came under sanctions, VTB’s behavior quite surprised clients. Instead of, like the same Sovcombank, notifying clients about the need to promptly close positions in foreign securities and sell securities in foreign currency by March 26, 2022, it began to report that for its part it was taking “all necessary measures to minimize negative consequences for clients.” And while clients of the same Sovcombank independently minimized risks by disposing of their property, the VTB broker already announced on March 17, 2022 that he had decided to “transfer the servicing of foreign securities to other leading financial organizations of the Russian Federation,” adding that this step supposedly “will allow protect the assets of private investors and ensure that they can buy and sell any asset without restrictions.” As a result, the clients’ assets were transferred to Alfa Bank JSC and Rosselkhozbank JSC, ended up in non-trading accounts, and were unavailable for disposal.

As investors noted in the conversation, the transfer of assets to other banks took place without their consent, and instead of giving clients the opportunity to dispose of their property within the month allotted by the sanctioners, the VTB Bank broker did not allow them to participate in organized trading on the St. Petersburg Exchange in foreign securities (listed on American exchanges) before the entry into force of sanctions against VTB Bank (March 26, 2022) and the blocking of assets of the MSE CC (March 11, 2022), namely: March 3, 9 and 10, 2022.

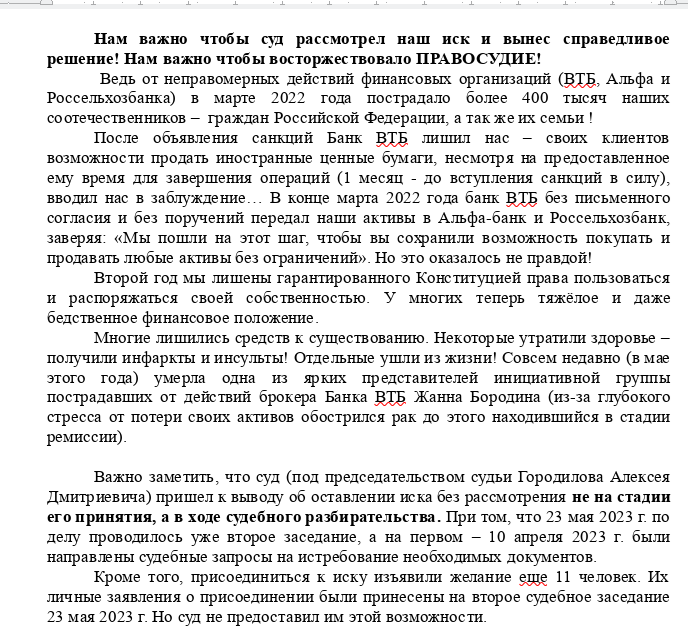

“After the announcement of sanctions, VTB Bank deprived us, its clients, of the opportunity to sell foreign securities, despite the time given to it to complete operations (1 month before the sanctions entered into force), misled us… At the end of March 2022, VTB Bank, without a written consent and without instructions transferred our assets to Alfa Bank and Rosselkhozbank, assuring: “We took this step so that you retain the opportunity to buy and sell any assets without restrictions.” But this turned out to be not true! For the second year we have been deprived of the right to use the constitutionally guaranteed and dispose of their property. Many now have a difficult and even disastrous financial situation. Many have lost their means of livelihood. Some have lost their health – suffered heart attacks and strokes! Some have passed away!” – former VTB clients said in court.

That is, the sanctioned bank actually transferred some of its problems to non-sanctioned clients, Andrei Kostin himself washed his hands of it and apparently had nothing to do with it.

What’s interesting: some of VTB’s “calming” releases are not available today, the page displays errors. Did you prepare for the trial by clearing the evidence base? But no one has canceled the site cache.

Photo: vtb.ru/o-banke/

Justice in Gorodilov style

According to available data, there are already about 400 thousand “deceived investors” in Russia. Some of them tried to defend their rights in court, but the judge of the Meshchansky Court of Moscow, Alexey Gorodilov, rejected the claim for formal, and partly far-fetched reasons.

Photo: provided to The Moscow Post by the authors of the appeal

“We, citizens of the Russian Federation (42 people) who suffered from the unlawful actions of the banks VTB PJSC, Alfa Bank JSC and Rosselkhozbank JSC came to court to protect our Rights! For justice and fairness! But we were deprived of this opportunity,” said former VTB clients.

On September 20, 2023, a higher court partially canceled Gorodilov’s ruling (resolution) and returned the case for a new trial.

Photo: https://mos-gorsud.ru

As one of the plaintiffs noted, it is the bank to whose cash desk she deposited cash dollars and euros that must compensate for all losses and return dividends, which have not been paid for the second year. The client’s shares are in a non-trading account and, according to her, she has not received any income for two years.

“It’s just a piece of paper. And if I need money tomorrow, I won’t be able to sell these shares,” the investor noted, adding that no one gives a clear answer about when these assets will be unfrozen.

Photo: provided to The Moscow Post by the authors of the appeal

Today, according to investors, the bank does not even familiarize securities holders with the depository chain of custody, which raises concerns about whether the assets are still available or have already disappeared into obscurity. The anxiety is especially pronounced against the backdrop of the fact that clients of some banks were given the opportunity to get off this train rushing towards the cliff in March 2022, but VTB clients were not.

Mr. Kostin, don’t you think that this whole story smells bad and lowers the authority of the bank with state participation in the eyes of people? It seems that at the expense of ordinary Russians they decided to correct the sad picture of 2022, when VTB Group’s losses according to IFRS amounted to 612.6 billion rubles, becoming a record negative financial result in the history of the bank.

After all, there is still no answer to the most important question, on what basis did the VTB Bank broker refuse to accept clients’ orders, accept and execute applications for the purchase/sale of foreign securities on March 3, 2022 and on other days before the amendments to the Regulations came into force refuse the bank this? The regulations themselves in the new edition were published on March 6, 2022, and came into force on March 9 of the same year.

Photo: provided to The Moscow Post by the authors of the appeal

Thus, for the second year, former VTB clients have been deprived of the constitutionally guaranteed right to use and dispose of their property, and for many this has resulted in a difficult financial situation. Now there is a chance to defend your rights. According to investors, other victims will be able to join the lawsuit.