RBI (Raiffeisen) will not leave Russia

The Austrian financial group continues to work in Russia, writes EP.

“The owners of Raiffeisen Bank are affiliated with Russia and support the war. We plan to close their accounts this week and stop all transactions“. Aleksey Zinevich, the owner of an Internet provider from Irpen, the city that suffered the most from Russian aggression, wrote about this on the social network.

This is not a rare case. Recently, the Austrian bank is causing more and more anger on the part of the Ukrainians, and these emotions have obvious grounds. Russian “daughter” of the Austrian “Raiffeisen bank international» (RBI) provides tax holidays to mobilized Russians.

After eleven months of war, international banking groups are in no hurry to leave the Russian market, and some of them even increase their income from activities in the Russian Federation. Austrian bank executives promised to reduce activities on the territory of the aggressor country, but the matter did not come to concrete actions.

Credit holidays and recognition of annexation

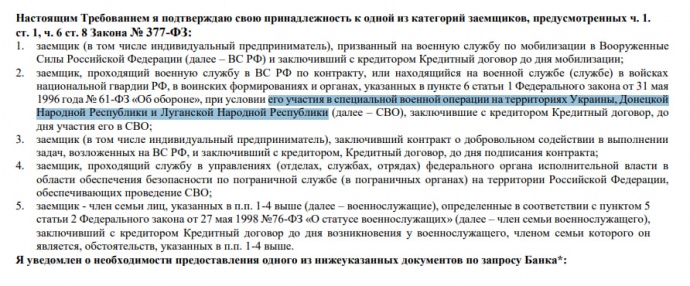

New Year for Raiffeisen Bank International began with a loud scandal. Screenshots of an application for a loan holiday that the bank offered to customers mobilized for the war against Ukraine circulated on social networks.

This is not an initiative of an Austrian bank, but a requirement of Russian legislation. The head of the Kremlin signed the law introducing this benefit in the fall of 2022.

Ukrainians were outraged not only by the fact that Raiffeisen provides benefits to the occupiers, but also wording in the document. In an application for a loan holiday, the bank uses Russian names for the occupied parts of the Donetsk and Luhansk regions, and also calls the Russian invasion of Ukraine a special military operation.

RBI (Raiffeisen) will not leave Russia

Later, the samples of applications for credit holidays for the mobilized disappeared from the website of the Russian “Raiffeisen Bank“. The appearance of this information caused a flurry of criticism against one of the largest Western banking groups.

In Ukraine, they proposed to add the Russian Raiffeisen Bank, the head of its supervisory board, to the sanctions list Johanna Stroblya and member of the supervisory board Andreas Gshenter. The National Bank of Ukraine also expressed its position.

Head of the Supervisory Board of the Russian Raiffeisen Bank Johann Strobl

“Information about the provision by banks belonging to international financial groups of preferential lending terms for participants in the “special military operation” is another evidence that statements (about leaving the Russian market – EP) differ from the actual state of affairs“, – says in statement NBU.

The reaction of the Ukrainian central bank could have been tougher, according to the source of the EP, who is involved in the system of banking supervision.

In particular, the regulator could no less recognize the reputation of all Ukrainian heads of Raiffeisen Bank associated with the Russian business of the group as damaged, or threaten the Ukrainian “daughter” with restrictions on refinancing.

The RBI headquarters had to respond to the scandal. There actually recognizedthat the bank operates in Russia and provides credit benefits to the mobilized.

“RBI has a subsidiary bank in the Russian Federation, which is a separate legal entity and must operate in accordance with applicable Russian law, including preferential terms“, the agency said in a statement.

The bank ignored the information about the recognition of its Russian “daughter” of the temporarily occupied territories of Ukraine as subjects of the Russian Federation. The scandal has again brought to the surface the question of why international banks are still operating in Russia.

Successful RBI business in Russia

RBI is one of the two largest banking groups in Austria, which, after the collapse of the USSR, actively expanded in Central and Eastern Europe. The bank opened its first branch in Russia in 1996. Ten years later, the Austrians acquired Impexbank, after which their “daughter” entered the list of the largest banks in the Russian Federation.

Raiffeisen Bank Russia is one of the 13 systemic banks of the aggressor country. This means that it affects the stability of the country’s financial system. Regulators apply tougher requirements to such banks, and in the event of insolvency, they are not withdrawn from the market, but nationalized.

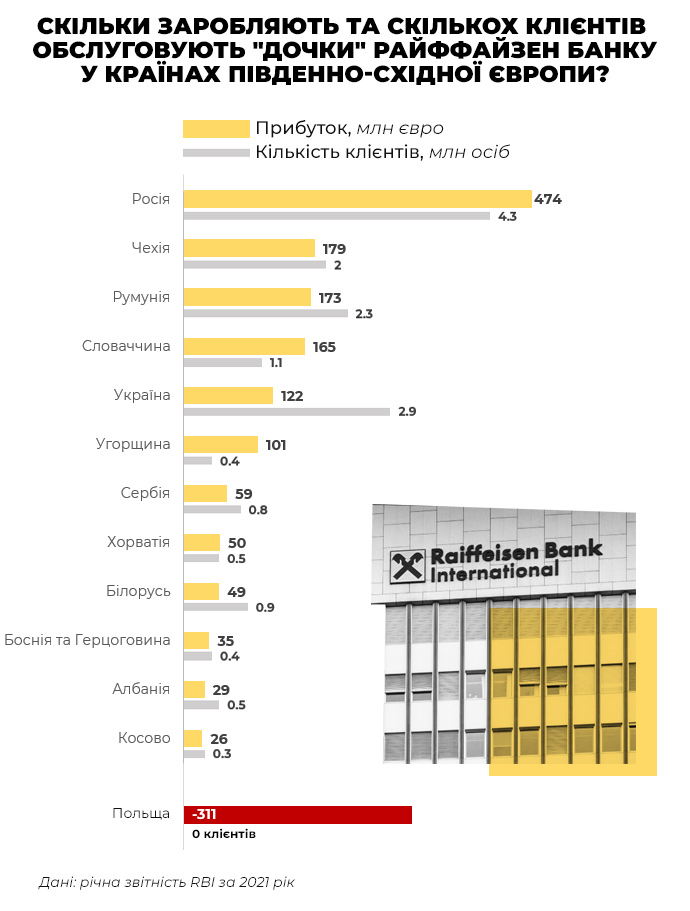

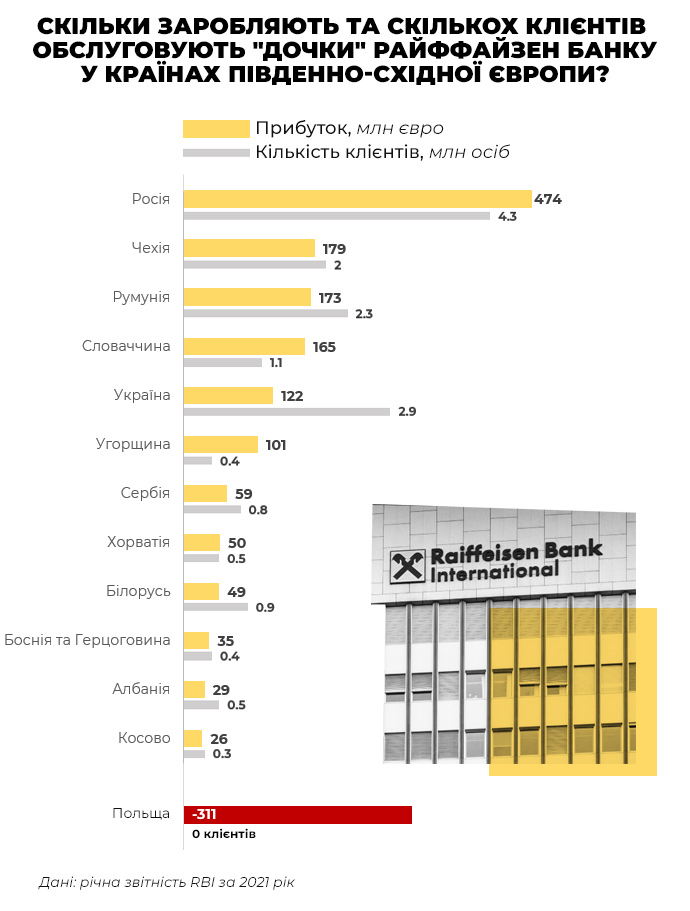

In Russia, the Austrian financial group has built its successful business. It is the Russian subsidiary that brings the largest profits among all other banks of the group: 31.4% of net profit in 2021.

Before the big war, Raiffeisen Bank Russia employed 9.3 thousand people. The institution served 4.3 million clients, their number increased by 21.6% in 2021.

The Russian attack on Ukraine came as a surprise to the bank. “It was one of the biggest shocks of my life,” said RBI chief risk manager Hannes Mjosenbacher, against whom the NAPC is also proposing enter international sanctions.

However, Mesenbacher might have been shocked not by the terrorist state’s attack on Ukraine itself, but by the reaction to the stock market event. RBI receives most of its income from Russian business, therefore, against the backdrop of news of aggression, the group’s shares have depreciated.

its official position about the big war, Raiffeisen announced only on March 17th. Ten months later, this position remained unchanged, and the intentions announced by the bank to exit the Russian market remained intentions.

“RBI is considering all strategic options for the future of Raiffeisen Bank Russia, including a carefully planned exit from the bank. However, given the complexity of the situation, including the restrictive measures established by the Russian Federation, this process continues.”, the group said in an official statement dated January 17, 2023.

Since the beginning of the great war, the Russian subsidiary has lost 1.3 million customers, and its loan portfolio, according to the RBI press service, has decreased by 25%.

RBI (Raiffeisen) will not leave Russia

However, the war not only had a negative impact on the work of the bank. According to the results of the three quarters of 2022, the profit of the Russian institution increased by 313% compared to the three quarters of 2021 to 1.42 billion euros. The Russian “daughter” of RBI brought almost half of the group’s net profit during this time.

Big incomes – big taxes. For three quarters of 2022, Raiffeisen Bank Russia transferred 369 million euros to the budget of the terrorist country. For the same period in 2021, the institution paid almost four times less – 94 million euros.

“The increase in profit is the result of the appreciation of the Russian ruble, together with an increase in interest income and an increase in net fee and commission income, in particular through foreign exchange controls introduced by the Central Bank of Russia”, — stated in the response of the head office of the RBI at the request of the EP.

Getting out of such a lucrative business can be a very difficult task for Austrians. However, commercial interest is not the only obstacle.

Declaring is not the same as leaving

“The Raiffeisen Bank International Group was the first of all the international retail banks present in both Russia and Ukraine to come out with an official message on the review of activities in Russia. This did not happen by chance, ”said the chairman of the board of the Ukrainian Raiffeisen Bank» Alexander Pisarukhinting that the group was pushed by its Ukrainian office to make such a statement.

In May 2022, the bank’s management reported that their Russian “daughter” were interested potential buyers. However, there was no progress on the sale.

Getting out of the banking business by simply curtailing activities is much more difficult than from any other. Banks operate in a highly regulated environment.

“The bank can also be closed: to pay compensation to everyone and curtail the business, but because of this, the capital of the parent bank will suffer. If they simply write off their Russian “daughter”, then their capital will run out. European regulators will not find out the reasons and will demand additional capitalization or withdraw the bank from the market,” explains the associate expert of CASE-Ukraine» Eugene Dubogryz.

A much easier and safer way to exit the Russian market is to sell the Russian business. It seems that the Russian authorities understand this too.

“Unlike foreign companies that imported goods to Russia and could quickly sell them off and curtail their activities with relatively small losses, it is much more difficult for banks to get out. Realizing this, the Russians complicated the process by law, requiring state approval of sales transactions”, explains the financial. ICU group analyst Mikhail Demkiv.

Russian dictator obliged coordinate the sale of companies from “unfriendly countries”. This is how the Kremlin calls civilized countries that support Ukraine in the war.

This decision complicates the procedure for selling assets and makes it unprofitable for parent companies. Only a person close to the Kremlin can buy a Western bank from Russia, so banks will have to sell their subsidiaries for next to nothing.

The only successful exit from the market of the international banking group was the sale of Rosbank, the Russian subsidiary of Societe Generale. Although this event took place even before the adoption of the new rules, the buyer still turned out to be oligarch Vladimir Potanin, who was close to the path, to whom Rosbank belonged in 2008.

What’s next

There are few options for Raiffeisen Bank to operate on the Russian market.

The first — sale of the bank. In addition to being likely to cost the RBI billions of dollars in damages, this option also has moral implications. By selling a powerful financial institution to oligarchs close to the Russian regime, the international bank will only exacerbate this regime.

“You are dumping the bank for nothing exactly to the people you are trying to overcome (with the help of sanctions – EP),” said Andrea Orselhead of UniCredit, another foreign bank stuck in the Russian market.

Second – curtail work, but without affecting the capital of the parent institution.

“They can arrange for our National Bank, government or president to put pressure on European regulators to give international banks a waiver (permission – EP) for violating regulations in exchange for closing their business in Russia. It’s possible, but too difficult“, – says Dubogryz.

The third – try to exchange your “daughter” in Russia for the “daughter” of the last major Russian bank operating in Ukraine. We are talking about the “Sense of the Bank” (until December 1, 2022 – Alfa-Bank), which has been in a “suspended” state for several months, waiting for its potential nationalization.

True, such a step will also require the consent of international regulators, in particular, in matters of removing this operation from sanctions. Such an exchange could solve the problem not only of the Austrian group, but also of the oligarchs close to the Russian dictator “stuck” in Ukraine, just as RBI was stuck in Russia.

In conclusion, Raiffeisen can expect and gradually reduce its activities, financing Russia’s terrorist war against Ukraine with its taxes. Obviously, for RFI, this is the easiest and most likely course of action.

Yaroslav Vinokurov, translation Skeleton.Info