After the public betrayal of Russia and the flight to the West, the founder of Alfa Group Mikhail Fridman suddenly decided to visit Moscow. However, he still has controlled assets in Ukraine and the West, which financially support the “approach of victory.”

Why did the billionaire decide to return to Moscow?

On Monday, the Russian public was surprised by the courage of Mikhail Fridman, who came to Moscow after publicly renouncing Russia, fleeing the country, and information about his financing of the Ukrainian military that appeared in the world media. Before this, the press reported that the oligarch fled from London to Israel, and suddenly he appeared in the capital.

The banker himself said that he did not come for good, but now intends to come to Russia often.

Mikhail Fridman

Mikhail FridmanPreviously, the oligarch complained about the unbearable living conditions in the British capital, emphasizing that he had to constantly be at home, “as if under house arrest.”

Until recently, the situation around Friedman’s assets in the West was complex, but in mid-September the UK’s National Crime Agency (NCA) unexpectedly announced that it had stopped investigating the Russian billionaire’s sanctions evasion.

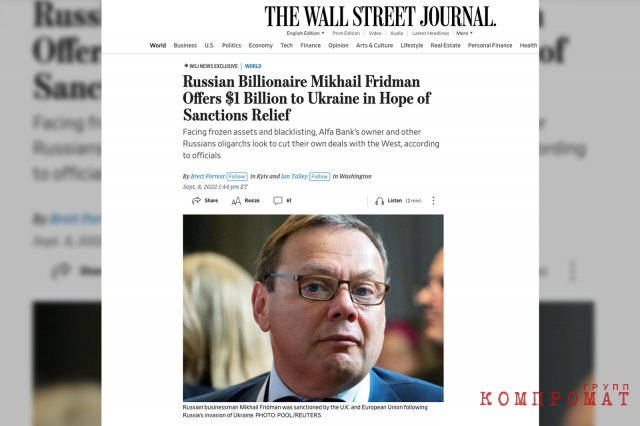

The American Wall Street Journal reported that Friedman even offered to invest $1 billion in the Ukrainian Sense Bank in exchange for the lifting of sanctions

The American Wall Street Journal reported that Friedman even offered to invest $1 billion in the Ukrainian Sense Bank in exchange for the lifting of sanctionsDark spots in business

It is noteworthy that a few days ago a court in Ukraine arrested all the assets of the Russian oligarchs Mikhail Fridman, Petra Avena And Andrey Kosogov. The SBU reported this.

In Ukraine, where the businessman invested hundreds of millions of dollars, the local Bureau of Economic Security suspected him of laundering 100 million hryvnia, so the assets of the founders of Alfa Group with a total value of 17 billion hryvnia (46.5 billion rubles) were arrested.

As Life found out, 1.4 billion UAH (almost 4 billion rubles at the current exchange rate) are justified “overcoming the consequences of war and approaching victory“the largest Ukrainian cellular operator Kyivstar, controlled by Friedman’s structures, transferred to the budget. Friedman’s share in Kyivstar also fell under arrest, and company representatives immediately distanced themselves from him, saying that, supposedly, “the sanctioned entity does not affect the activities in any way company.”

After this, Friedman, with a calm soul, decided to visit the Russian capital.

However, extensive assistance to Square was and still is provided by Friedman’s largest asset in Europe – LetterOne.

In the spring of this year, Friedman’s largest international asset, LetterOne, published a report in which it released information on support for Ukrainian citizens and the country’s infrastructure after the start of the SVO

In the spring of this year, Friedman’s largest international asset, LetterOne, published a report in which it released information on support for Ukrainian citizens and the country’s infrastructure after the start of the SVOHow Friedman became an international businessman

Over the past at least ten to fifteen years, the 59-year-old founder of Alfa Group has been actively growing foreign business, including Russian assets. As a result, by 2022, his business empire contained tens, if not hundreds of billions of dollars. And now Friedman can rather be called an international rather than a Russian businessman.

By the beginning of the SVO, Mikhail Fridman was sixth in the ranking of Russian billionaires according to Forbes magazine with a fortune of $11.8 billion. With this fortune, he also entered the 150 richest people on the planet.

Outside of Russia, one of Friedman’s largest assets is an international investment business headquartered in Luxembourg – LetterOne. Its founders, Mikhail Fridman, German Khan and Alexey Kuzmichev, invested almost $13.4 billion in it at the start in 2013.

Now the company’s divisions are engaged in investments in the global oil and gas business, in telecommunications and technology companies in Europe and the USA, in retail trade, as well as in private capital management. The scope of activity can be assessed even from several examples.

For example, in 2019, LetterOne’s subsidiary, the Hamburg-based oil and gas company DEA AG, merged with Wintershall, a subsidiary of the German giant BASF. The value of the new company is $20 billion.

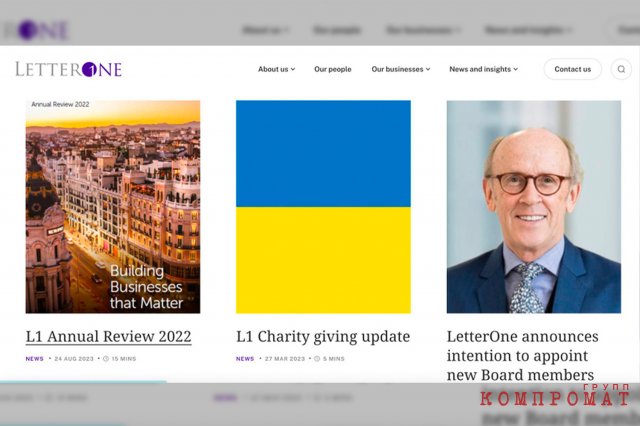

Information about the company’s support for Ukraine is on the main page of the LetterOne website

Information about the company’s support for Ukraine is on the main page of the LetterOne websiteThe telecommunications division of Friedman’s business empire, L1 Technology, headquartered in London, has invested $16 billion in technology companies in Europe and the United States.

What problems did the West cause for Friedman?

Such growth was likely to benefit the Western elites, because, as President Vladimir warned the Russian oligarchs back in 2002 Путинat any time they may lose their foreign assets.

In February 2022, literally a few days after the start of Russia’s military operation in Ukraine, the banker was included in the EU sanctions list. A week later, to the British, and further down the chain to Canada, Australia, New Zealand, and in August 2023 – for participation in the work of the financial sector of the Russian economy – to the US sanctions list directed against “well-known representatives of the Russian financial elite.”

Mikhail Fridman. London, September 2000

Mikhail Fridman. London, September 2000