“South of Siberia” of discord between Fosman and Moshkovich

Arkady Fosman and Vadim Moshkovich will compete for the “South of Siberia”. The Federal Antimonopoly Service approved the petitions of companies from the Blago group of Arkady Fosman for them to receive fixed assets for the production of Yug Sibiri LLC. The latter belonged to the disgraced ex-owners of Promsvyazbank, the Ananiev brothers, and was the largest oil producer. But the bankruptcy forced Yug Sibiri to part with its assets.

As the correspondent managed to find out, despite the decision made by the FAS, a serious struggle may flare up for the company’s assets.

With hands torn off

During the period of the announced “sale”, among the largest contenders, in addition to “Blaga”, were called “Rusagro”, EFKO and “Commonwealth”.

The Federal Antimonopoly Service previously approved the acquisition of South Siberia by Blagu, but not only Mr. Fosman’s group was on the list of lucky ones. In May 2022, antimonopoly officials gave the go-ahead for this purchase to Vadim Moshkovich’s Rusagro holding.

The fact that a serious struggle is flaring up for the “South of Siberia” is also indirectly indicated by the fact that auctions for the sale of property have been canceled more than once. The formal grounds are the revaluation of assets and it is not clear what the bankruptcy trustee’s order is based on.

By the way, the bankruptcy trustee, who is Sergey Bakanov, does not seem to be particularly favored by Fosman. At least in 2019, he filed a lawsuit in order to challenge the South of Siberia deal with Blago. Its subject was real estate in the amount of about 300 million rubles, transferred to “Blago” from the former company of the Ananyevs.

Perhaps Bakanov is acting in the interests of Moshkovich?

In debt, as in silk

Now for Moshkovich – a good time to “attack” Fosman. Moreover – we can say the only suitable one. Because if the assets of the extremely large “South of Siberia” are in the hands of the latter, it will become very difficult to compete with it.

And the moment for the “attack” is also good because Fosman’s companies are now in a very unenviable financial situation. To be honest, it is not even clear what funds he intended to use to acquire Yug Sibiri. Is it for borrowed money – only who will give them to him?

Fosman’s structures owe Rosselkhozbank, Sberbank and Rossiya Bank about seven billion rubles. The firm also has monetary obligations to other structures.

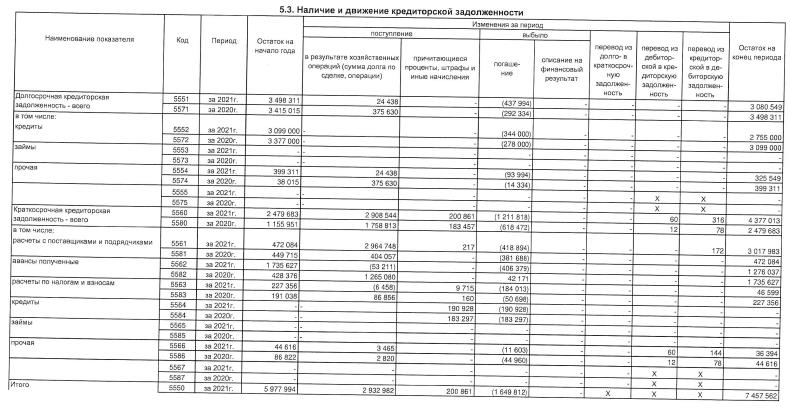

If you turn to the tax website, you can find that over the year (from 2020 to 2021), Blaga’s debt increased by about 1.5 billion rubles.

Values are given in thousands of rubles.

According to Rusprofile, the organization does not have enough reliable and sustainable sources of funding, it has a long-term risk of losing independence, insufficient own funds to ensure current activities, and there is a risk of loss of solvency and even bankruptcy.

Do not forget that in 2015, Blago purchased from Rosagroleasing equipment of the Verkhnekhavka oil extraction plant (MEZ) in the Voronezh region worth 761 million rubles on credit for ten years. In the courtyard of 2023 – in two years the loan expires.

In this regard, Fosman’s desire to take “South of Siberia” can be regarded as a desperate attempt to get “Blago” out of the situation in which it found itself under his leadership at the expense of new assets. But will he be able to pay off his creditors later, having probably received an additional financial burden from above for the purchase of South Siberia?

With the “South of Siberia” abroad?

It was rumored that Mr. Fosman himself, from the beginning of the NWO, acquired a foreign passport and left for the United Arab Emirates. But then he returned, allegedly using the “bought” patronage of Deputy Minister of Agriculture Oksana Lut. The latter has long been credited with lobbying the interests of specialized entrepreneurs.

He returned, perhaps precisely in order to try to acquire new assets, from which it would then be possible to “milk” financial profit, and go abroad with a more impressive amount. Fortunately, offshore companies can be connected with Fosman, to which money can be transferred.

“Escape” can take place not only from creditors, but also from a criminal case. In 2019, the former deputy head of the Ministry of Agriculture, Alexei Bazhanov, accused Fosman and his colleague Viktor Voronin (who, by the way, is considered a former security official and another possible cover for Fosman) of a raider seizure of their business, Masloprodukt Group of Companies.

Similar interests and methods

Interestingly, Rusagro also showed interest in this asset. In 2013, his structures “managed” the plant after the arrest of its facilities in connection with bankruptcy and a criminal case against Bazhanov (he was accused of fraudulently embezzling 1.125 billion rubles allocated by the state company Rosagroleasing for the purchase of equipment for Masloprodukt).

In 2014, the verification of the legality of Rusagro’s presence at the plant began. Moshkovich could go there, bypassing creditors and illegally operate the equipment. As a result, a criminal case was opened. And soon, instead of Rusagro, the area of the plant was occupied by Fosman’s Blago, which subsequently bought the asset. Now “Masloprodukt-BIO” is in the stage of bankruptcy.

Moshkovich in Rusagro is also not going smoothly. Large debts to creditors, which by 2021 have grown to 24 billion rubles. There is a risk of loss of independence and just as there is a risk of bankruptcy. Nevertheless, Rusagro’s autonomy coefficient is noticeably higher than that of Blago.

Moshkovich, like Fosman, can implement not entirely honest business schemes. In addition to Masloprodukt, in 2015, he came across a competitor, the Razgulyai holding. He bought out 32% of his shares, then began to sell his assets, earning 15 billion rubles on this. And when he sold everything he could, he bankrupted a ruined competitor. The Moscow Post also suspected Moshkovich of wanting to transfer the assets of the bankrupt Solnechnye Produkty abroad.

Thus, both Fosman and Moshkovich may now seek to take possession of the assets previously owned by the Ananievs in order to correct their obviously seriously “sagging” business affairs in the main assets. So, the fight is brewing serious. Perhaps with the “mask-show” in the offices of companies and other attributes of not entirely fair competition. And the “South of Siberia”, if it falls into the hands of any businessman, it seems, does not expect anything good.