The owners of Sovcombank can use a proven method of replenishing capital: through firms close to them, where the founders were namesakes of the Central Bank management, real estate was taken away from the poor.

Clients – “suicide bombers”

According to the source, who himself introduced himself as a victim of a fraudulent scheme, a certain organization “Artegofinance” places aggressive advertising on the Internet, collects insolvent but housing citizens from the entire market and takes them to Sovcombank for a loan secured by an apartment.

Artegofinance allegedly informs clients that the loan agreement they will sign with the bank has a full cost of 27% per annum, but in fact, as the reader states, these loans cost 62% per annum. The fact that Sovcombank is well-known, as well as the unwillingness to read multi-page contracts from cover to cover, the difficult life situation and faith in people, force customers to sign contracts.

For Sovcombank, these clients are like suicide bombers: according to an insider, after applying for a loan, they go into arrears in 1-3 months, and not because they want to, but because Sovcombank allegedly fraudulently “attributes” this delay to them, and after that the mortgaged apartment is here goes to auction. Let’s explain what we are talking about: first, the client pays at a horse rate of 62% per year – thinking that his loan costs 27% per year, and then technically – in one court session – they take away his property.

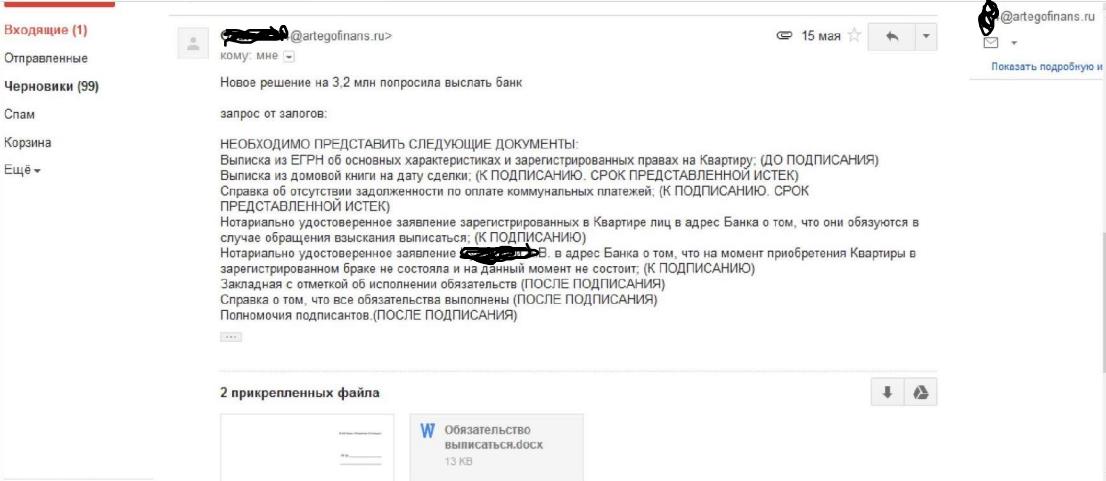

In addition, in his correspondence (screenshot of the letter is attached) with one of the victims, the owner of Sovcombank Sergey Khotimsky frankly states that the bank’s policy prohibits increasing the loan amount if it is late for six months prior to the client’s request. The victims, according to them, observe the opposite.

Hypocrisy and lies, ignorance of what is happening in your own bank or suppression of facts? Photo: provided by the reader The Moscow Post

“Pocket” judges

So, the judges allegedly decide such cases without the participation of the defendant, who is not even warned, or warned almost an hour before the hearing of the case, and decide them in “pocket” half an hour – in favor, of course – Sovcombank. Nor do they care that on the day appointed by the court, a person could be in a hospital or 1,000 kilometers from the city.

At the same time, the Supreme Court of the Russian Federation, according to an insider, refuses to restore the deadlines for the victims to apply to them with complaints – although people miss them through no fault of their own. The court of cassation also allegedly does not send copies of the decisions made to the victims, so people believe for a long time that the decision on the case has not yet been made.

Especially, as a reader writes to us, the Izmailovsky District Court of Moscow, represented by the wonderful judge Ekaterina Yuryevna Saprykina, distinguished herself in this case – according to readers, she is not at all concerned about any circumstances of the case (that a criminal offense was committed against the defendant, due to which a person went into the delay, that the value of the defendant’s apartment after the repair increased by almost a million rubles and the defendant desperately needs to restructure the loan, and not put his apartment up for auction, that the loan agreement under which the apartment was mortgaged is fraudulent, that the party filed 8 petitions at the hearing that the party filed a counterclaim).

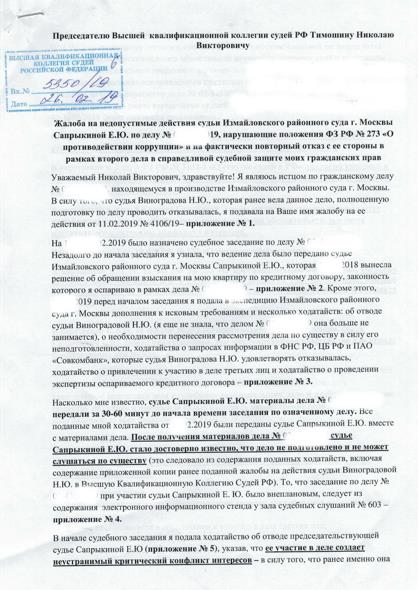

According to our source, all arguments and petitions are rejected, counterclaims are not accepted, decisions are made solely in the interests of Sovcombank – for the only full-fledged court session. Complaints were repeatedly filed against her – including to the chairman of the Higher Qualification Board of Judges of the Russian Federation Timoshin Nikolai Viktorovich, but there was no reaction. The same applies to other judges in these cases.

Complaint against Judge Saprykina. Photo: provided by the reader The Moscow Post

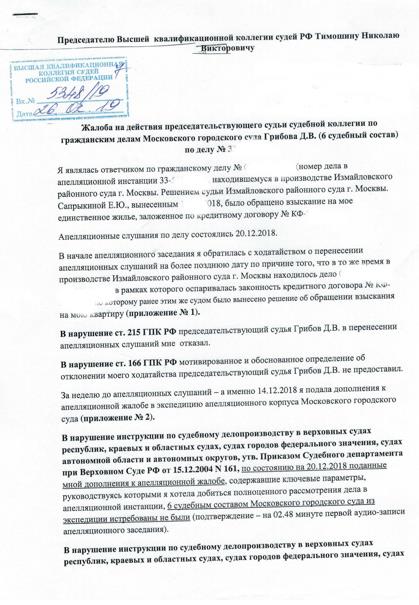

Complaint against Judge Gribov. Photo: provided by the reader The Moscow Post

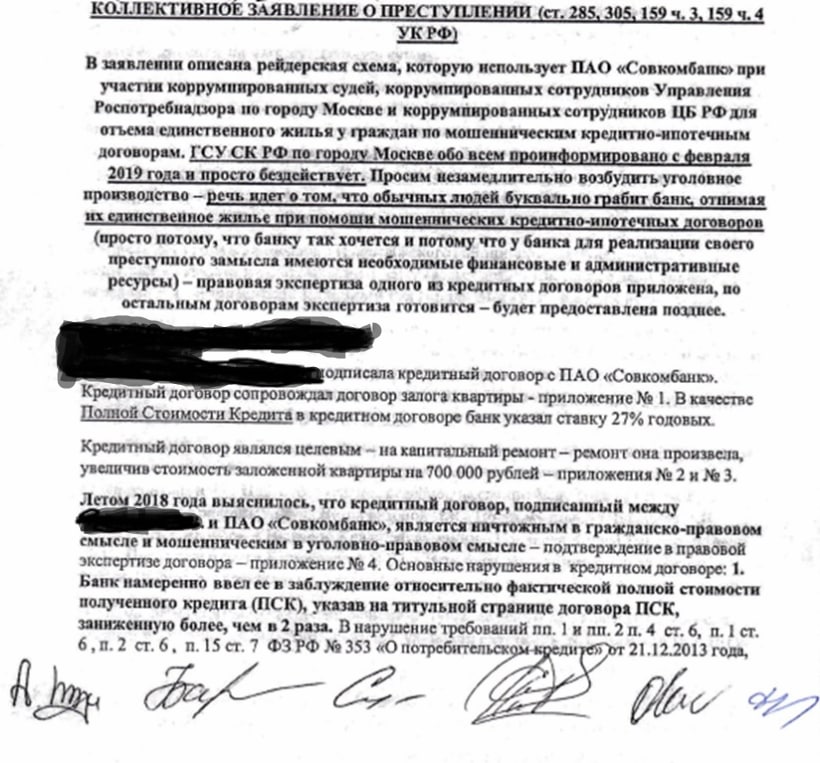

In June 2021, six victims of the above actions at once, through the deputies of the State Duma, applied to the Ministry of Internal Affairs with a collective statement to initiate a criminal case under Art. 159 and 185 of the Criminal Code of the Russian Federation. The checks fell on the shoulders of Yevgeny Yevgenyevich Isaev, who, according to our source, refused to interrogate the persons indicated in the application and send loan agreements for examination.

Collective appeal to the Ministry of Internal Affairs. Photo: provided by the reader The Moscow Post

As of February 11, 2022, the insider writes, the 3rd decision has already been issued to refuse to initiate a criminal case. The situation, according to him, is under the control of the General Prosecutor’s Office of the Russian Federation, the Investigative Committee of the Russian Federation and the FSB of the Russian Federation know about it, but apparently they believe that “saving the drowning is the work of the drowning themselves.” One gets the feeling that the money from the apartments of the victims is used to maintain the work of the entire apparatus, which includes not only Sovcombank, but also supervisory and judicial departments.

Getting rich at the expense of others

With all this, Sovcombank managed to get rich ten times from 2013 to 2017 – from 100 billion rubles, his fortune increased to 1 trillion rubles. Now it’s clear how…

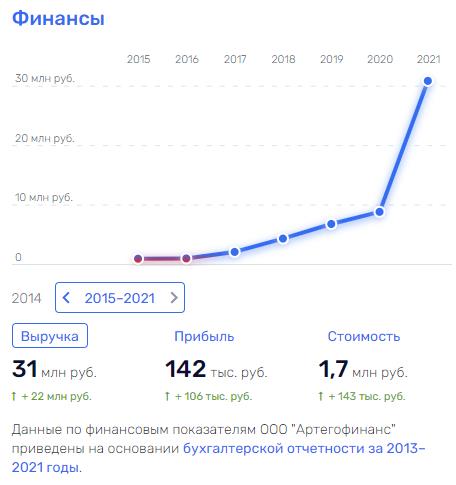

“Artegofinance” is also not in poverty – for the year it raised its revenue by 22 million rubles.

Photo: https://www.rusprofile.ru

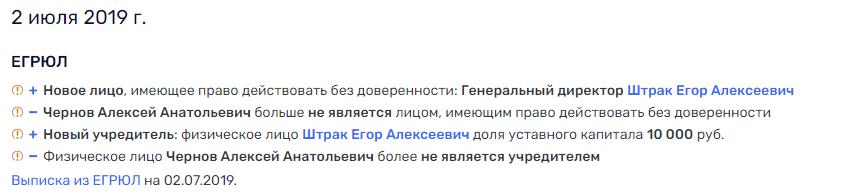

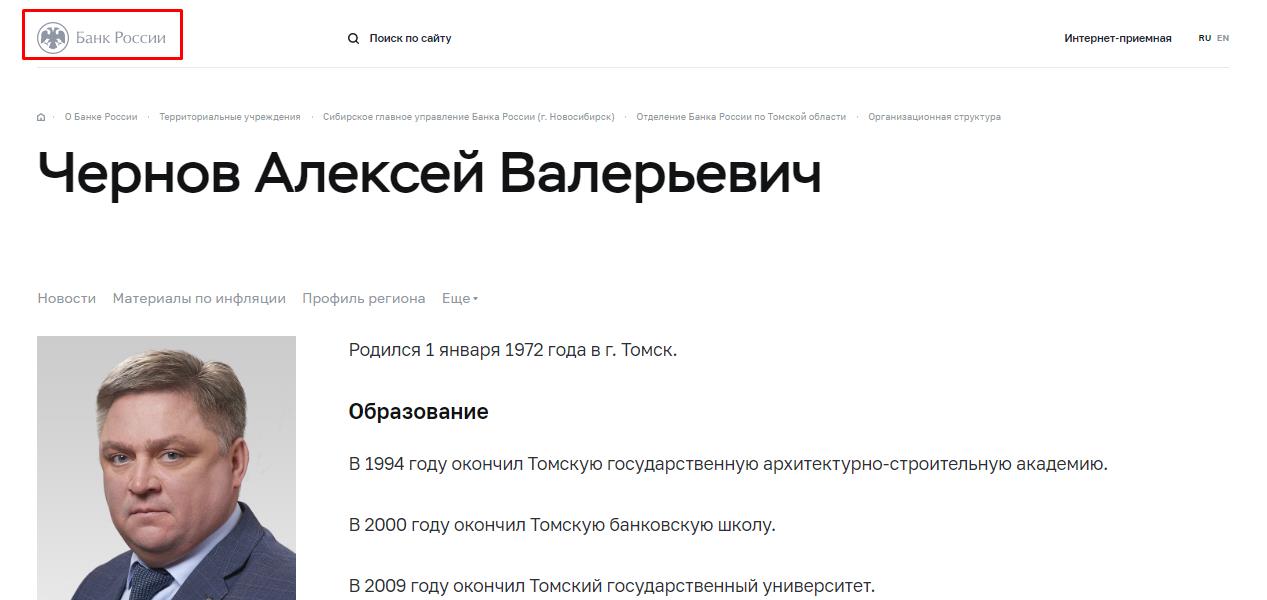

By the way, a certain Aleksey Anatolyevich Chernov appeared among its founders. A person with the same last name works at the Central Bank as a deputy governor. So, food for thought.

Photo: https://www.rusprofile.ru

Photo: https://www.cbr.ru

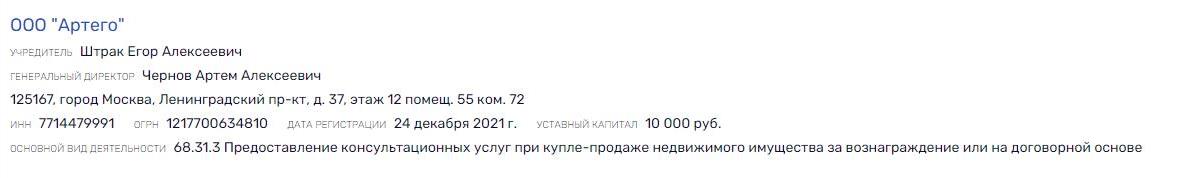

The new founder, Yegor Shtrak, is a member of another organization, Artego, where Artem Chernov is the general director. Family contract?

Photo: https://www.rusprofile.ru

The contract on the contract and the contract drives

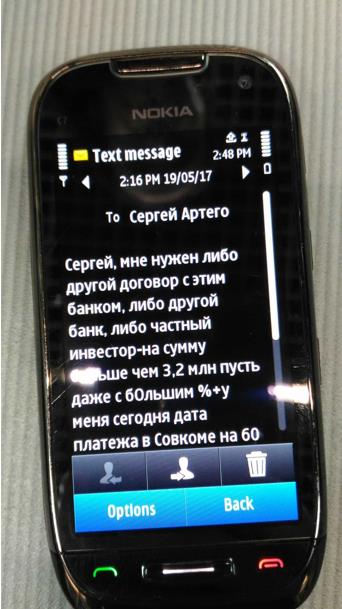

We go further. If a client wants to withdraw his loan from Sovcombank, increasing its amount and at the same time removing the apartment from collateral, Artegofinance, according to our source, tells the client that this is almost impossible (although it is not), and that there is only one a magical solution from JSC Bank “Razvitie Stolitsa”.

It consists in this. The new mortgage agreement, which the client is offered to sign, states that the apartment remains in his use and possession, but at the same time the most important part of the property right – the disposal – is withdrawn from the agreement – the reader says. That is, it seems like the apartment is yours, but you can’t use it, which, of course, they don’t explain to a person. The signature is recorded on a video camera.

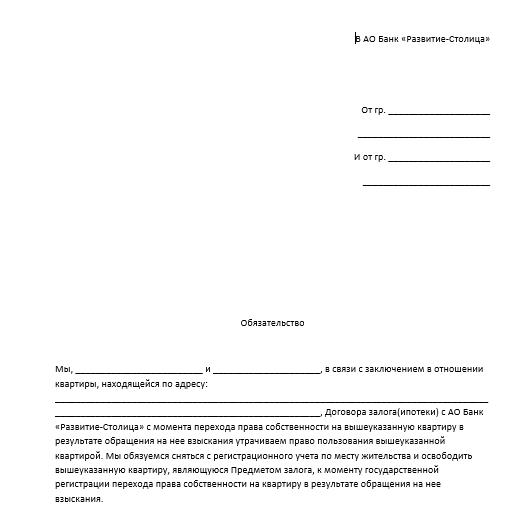

Draft agreement with JSC Bank “Development-Capital”. Photo: provided by the reader The Moscow Post

In addition, prior to signing the loan agreement, the client is allegedly required to provide a notarized document stating that he undertakes to check out of the apartment immediately after the transfer of ownership of his apartment to the bank.

Immediately after signing such an agreement, the client is literally free – from his apartment. Well, then the income from its sale, most likely, is divided between Artegofinance and the Razvitie Stolitsa bank.

Correspondence with the bank, the above files are attached as attachments. Photo: provided by the reader The Moscow Post

By the way, until 2017 it was called “Viz-avi”, but after a major scandal, when the former head of the bank’s security service was accused of attempting to assassinate Oleg Akimov, then head of the presidential administration department, which I wrote about “Version”he changed the sign.

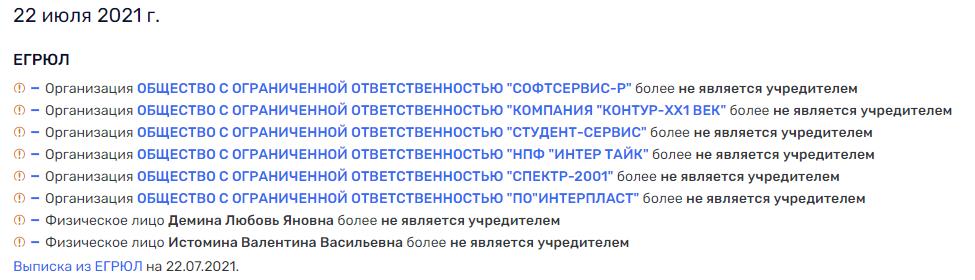

Not so long ago, two individuals with signs of “nominal values” and six companies left the structure of the founders of the structure, most of which were liquidated. There are no new founders. The structure is more than cloudy as it was, and remains.

Photo: https://www.rusprofile.ru

Journalists also talked about how the bank used illegal methods to sell the land it buys cheaply in the Yegoryevsky and Orekhovo-Zuyevsky districts of the Moscow region at a higher price. So his participation in the above scheme is not even surprising.

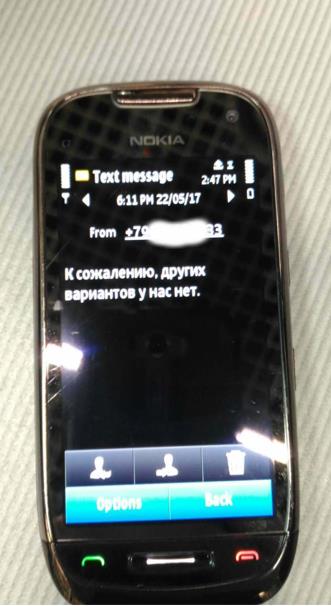

So, as can be seen from the correspondence provided to us, if the specified client sees that they are trying to deceive him, starts to balk and refuse to sign the mortgage agreement described by the curve, Artegofinance refuses to select alternative loan offers for him and immediately transfers him to Sovcombank, which transfers the case to the court, where everything allegedly takes place according to the “run-in” scheme of “quick spin” already described above.

Correspondence with the manager of “Artegofinance”. Photo: provided by the reader The Moscow Post

Correspondence with the manager of “Artegofinance”. Photo: provided by the reader The Moscow Post

For reference: we are told that six years ago the office of Artegofinance was very poorly housed in two little rooms in an old business center. And now the company has several offices in Moscow with such a finish that they can be confused with the “daughter” of Transneft. What we talked about above – the scheme, judging by the increased tenfold financial position of Sovcombank and the fact that law enforcement agencies, apparently, turn a blind eye to what is happening, is working flawlessly.

Bank-“scandalist”

The entire Internet is full of unflattering reviews about the bank – somehow people are pledged carsthe bank ignores the requirements about closing an account and people’s complaints. We can’t call it otherwise than parasitism on clients!

In 2017, Sovcombank tied the return on individual deposits to the key rate of the Central Bank. According to lawyers, the inclusion of such conditions in contracts with citizens is illegal. Moreover, experts are sure that most depositors did not even know that they were agreeing to floating rates – wrote about this “Kommersant”.

“Mukhlezh” can be found in the Sovcombank system not only in the direction of individuals, but also other banking structures.

In 2018, the Moscow Arbitration Court accepted for consideration two lawsuits filed by Nerses Grigoryan, a representative of 866 creditors of Probusinessbank, against Gazenergobank and Express-Volga Bank (of which Sovcombank was a sanatorium) to invalidate intrabank transactions worth 49.5 billion rubles, they wrote. “Vedomosti”.

Briefly, the scheme was revealed as follows: the DIA issued a loan for the reorganization of Express-Volga for 41 billion, it entered the balance of Sovcombank, then these funds were transferred from Sovcombank to Express-Volga through MBC, and Express-Volga also through MBC returned them back to Sovcombank. In fact, this situation looks exactly like an attempt to withdraw money.

Then, by the way, the asset “Let’s go!” went to Sovcombank, which he soon sold to Mikhail Kuzolev – the owner of the bank “Russian Capital” – reported RBC. “Let’s go to!” went to Sovcombank far from the price that it actually cost (initially about 800 million, Sovcombank went for 382 – they wrote Banki.ru), but it was sold for a significant amount, which thoroughly replenished its capital.

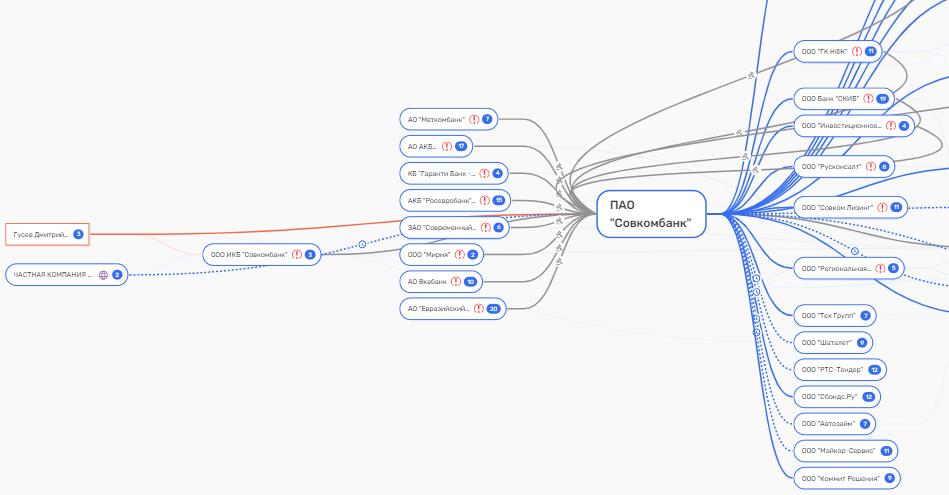

As for Sovcombank’s strategy in the market in general, it is actively involved in acquisitions. In two years, Sovcombank bought “JiMoney Bank”, “Isiaysiay Bank Eurasia”, “Guarantee Bank”, Metkombank.

A growth model based on bank takeovers was previously implemented by Aleksey Alyakin at Pushkino Bank. And he ended up without a license. It’s funny, but Alyakin and his partner Roman Fuchs were among the shareholders of Sovcombank 10 years ago – they wrote Banki.ru. That’s where, as they say, the legs grow.

By the way, most of his “daughters” have been eliminated. The bank often acts according to the principle – buy it and in a couple of years “shut it down”, pouring into the capital of the main Sovcombank. (And what happens inside it – only God, and even the Khotimskys know. He does not disclose financial indicators.) This happened, for example, with Rosevrobank. Although experts said that this is a reliable asset, Sovcombank managed to turn it into a “dummy” in a matter of months.

Bank lives only loans? Photo: https://analizbankov.ru/bank.php?BankId=sovkombank-963&BankMenu=struktura_balansa

The Accounts Chamber is also dissatisfied with the bank – in 2015 it drew attention to the too rapid growth of its asset portfolio and suspected something was wrong – wrote RBC. At the same time, Sovcombank lends to Rosnano and other government agencies.

“Friends” in the Central Bank, offshore and casinos

They say that the patronage of the Khotimskys is provided at the highest level – initially through the former deputy chairman of the Central Bank of the Russian Federation Alexei Plyakin, with whom they were allegedly introduced through third parties by the above-mentioned Pavel Fuks, and member of the Senate Nikol Zhuravlev. Well, then the ball can be untwisted in any direction – up to Elvira Nabiullina and other powers that be.

Taking into account the presence earlier in the structure, and now in the list of affiliates of Sovcombank individuals and companiesoffshore companies, guessing where the money goes from the liquidated “daughters” of the office is not difficult.

Photo: https://www.rusprofile.ru

In 2018, the assets of Sovcombank itself “dipped” by almost 18 billion over the month – we covered this in detail history. What is it, if not the withdrawal of money to offshore?

A lot of interesting things can be said about the top managers of Sovcombank. For example, in 2016, during a police raid on an underground casino in Moscow, the chairman of the board, Dmitry Gusev, was suddenly tied up – this was reported by “City information channel m24.ru”. Later it turned out that it was not the first time he had been seen in such a place. So that’s where the money goes from the above “scams”.

The former chairman of the board of the bank, Vasily Klyukin, is also famous for his love of poker – he now lives in Monaco. As you understand, he does not complain about poverty. By the way, according to some sources, he is often seen in the company of two more former bankers – the ex-head of Investtorgbank Vladimir Gudkov and the former co-founder of Vneshprombank Georgy Bedzhamov. Both in Russia are charged with multimillion-dollar embezzlement – reported RBC and “Kommersant”.

By the way, according to our reader, who sent new details of what is happening in Sovcombank, the scheme he described is supervised by the deputy chairman of the board of the bank, Alexei Panferov, who was recently subjected to US sanctions. Cried foreign assets of Mr. Panferov! So, there is reason to believe that he will undertake to build up domestic ones with a vengeance. And how? For the elderly and the poor? Noble, however…

Only the cup of patience of deceived people is already almost full. A hundred or two more and hiding the facts will not work. The highest composition of the Central Bank may also be under attack!

Source: The Moscow Post