Ivan Fursin

“What did Maidan stand for?” – this question invariably arises among Ukrainians who believed that the events of 2014 could change the country for the better, and now they are disappointed to see how odious figures from the times of “gangster power” continue to hold on to their chairs and run their business. Moreover, they successfully merge with the new government, turning it into an analogue of the “previous regime”, and returning everything to normal.

Banker boys

Among the first hundred Ukrainian billionaires and multimillionaires, there is no one who honestly earned their starting capital by “washing apples.” Some of them inherited Komsomol funds or bandit “common funds”, others were helped by influential relatives, others were lucky to marry successfully or study at the same university with the right people. The latter includes not only the Chernivtsi clan, formed from childhood friends and classmates of Arseniy Yatsenyuk, but also a team of student friends of Sergei Levochkin (Read more about him in Levochkin’s article. “Gray Cardinal” and his sister) of which Ivan Fursin is a member.

Ivan Gennadievich Fursin was born on September 16, 1971 in Kyiv. For unknown reasons, he does not advertise the identities of his parents, only stating that there were many hereditary scientists, doctors and military men in his family. There is information at the rumor level that his father Gennady Fursin served in the Ministry of Internal Affairs under the command of General Vladimir Levochkin, the father of the famous oligarch, and that their sons knew each other since childhood. But in any case, the talents of his ancestors were not passed on to Ivan: he did not become a doctor or a scientist, and even “declined” from military service, like his friend Sergei Levochkin. And he graduated from school at over 18 years old, which made him an “old man” among his classmates. But while his peers went to trample their army boots for 730 days, Ivan Fursin in the fall of 1989 became a student at the Kyiv Institute of National Economy (today it is the Kiev National Economic University), where Sergei Levochkin entered with him. Thus, their close friendship began at least from that moment.

During his student years, in addition to Ivan Fursin, Levochkin’s circle of close student friends included Artem Ershov, who studied there (read more about him in the article Artemy Ershov: a participant in financial fraud and appointednickname Levochkin), Rostislav Schiller and Sergei Svyatko. All of them had some kind of necessary talent or important family connections, since Levochkin always chose his environment based on practical considerations. And this is another argument in favor of the version that the acquaintance of the “red-haired bumpkin” Fursin with Lyovochkin took place much earlier and had the nature of a trusting relationship between childhood friends.

The 90s were a time of great changes and great scams, when, in the words of Ostap Bender, money was lying right on the street, and you just had to pick it up. So a simple student internship in the Kiev branch of Lisbank (1992) did not satisfy Ivan Fursin, nor did his friend Levochkin. And immediately after graduation (1993) they decided to start their own banking business. In 1993, Askold Bank appeared in Kyiv, and the entire Levochkin team, including Ivan Fursin, gathered in its basement office on Bolshaya Zhitomirskaya. What kind of money the twenty-year-old banker boys opened it for remains unknown: they said that they were helped by their parents, relatives, fathers-in-law, etc. Accordingly, Levochkin’s father provided the “roof” of his son’s bank, without which the bank would have been squeezed out by local “hooligans” in a couple of days, and he found him the main clients, which became Avdyshev’s capital organized crime group. Yes, a very specific client – but Levochkin’s dad also worked in the correctional system, and therefore he had such specific acquaintances. From 1993 to 1995, Askold Bank was one of the largest conversion centers in Kyiv: in fact, it was a large gangster “exchanger”, where organized crime groups turned the “earned” coupon-karbovanets into dollars and Deutschmarks. Subsequently, Ivan Fursin and Sergei Levochkin will carefully erase these two years from their biographies.

In 1995, Ivan Fursin, Sergei Levochkin, Artem Ershov, Sergei Svyatko, Ivan Fursin, Rostislav Schiller and Sergei Avramenko established CJSC Holding BIT. Which, together with the offshore company Transatlantic Trading Corporation, in turn, re-registered Askold Bank into a new incarnation – JSCB Bankersky Dom. Rostislav Schiller becomes the head of the board of the renewed bank, Ivan Fursin takes the position of his deputy, and Sergei Levochkin is a member of the supervisory board. The new bank is a new level of financial scams associated with privatization, insurance companies, and failing trusts. It even got to the point of banal “throwing away” depositors, which quickly taught ordinary Kiev residents to avoid this bank, nicknamed the “Bandit House”. It is interesting that in 1997-98. JSCB “Banking House” of Fursin and Levochkin fruitfully collaborated with the vice-president of CJSC “Insurance Company “Credo-Classic” Igor Cherkassky, who is currently (what an irony!) Chairman of the State Financial Monitoring Service of Ukraine. He collaborated so fruitfully that by the end of 1998, the “Banking House” entered the position of “Voronya Slobodka”, mired in financial scams and the banal loss of money.

The last point in its existence was put by a criminal story with the theft by a certain “hacker” in October 1998 of 80 million hryvnia from the accounts of the Vinnitsa regional department of the National Bank. Part of the stolen amount was transferred to the account of the Transservice company in the Bankersky Dom JSCB, after which it was scattered into accounts in this bank belonging to fictitious enterprises. Investigators who looked into the Banker’s House in search of stolen money simultaneously discovered stunning double-entry bookkeeping and curious transactions of huge sums in the bank. Lyovochkin immediately disappeared, and Fursin and Schiller tried to come up with a plausible explanation. It was decided to send a special audit commission to the bank to thoroughly check its activities, after which the Banking House JSCB immediately… burned down. In the most literal sense: the guards showed black ashes to all inspectors, investigators and angry “thrown” investors and shrugged their shoulders. The bank’s management could not be found either – they suddenly all quit. And in general, immediately after the fire, the Banking House JSCB was re-registered and turned into Ukrspetsimpexbank (Levochkin, Schiller), which also burst in 2003 after the scandalous story of the disappearance of money from NAC Spetsexport.

Odessa: cinema and Firtash

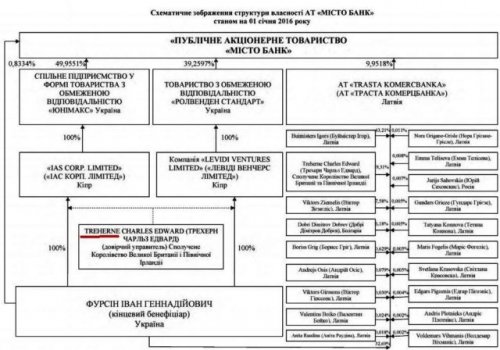

In 1999, having left the burned-down “Banker’s House”, Ivan Fursin goes to Odessa, where he sits in the chair of the chairman of the board of CB Misto Bank – which he founded together with Artem Ershov, taking local Odessa residents Sergei Kivalov and Sergei Grinivetsky into a small share . This was done through a very convoluted scheme of offshore shell companies, which became even more convoluted over the years.

As it became known SKELET-info from reliable sources, the reason for this somewhat strange move to Odessa, more like an escape from Kyiv, was another important event: the establishment of East-West-Finance LLC by Ivan Fursin, Sergey Levochkin and Artem Ershov, which played a huge role in their future business . And just before the collapse of the Banking House, through it Levochkin received a share in Basko CJSC, which opened him up to the oil and gas business and further cooperation with Dmitry Firtash (Read more about him in the article DMITRY FIRTASH. HISTORY OF TERNOPIL BILLIONAIRE). In particular, the Basko company worked with the subsidiary Chernigovneftegazgeologiya, NJSC Nadra Ukrainy, NGDU Poltavaneftegaz and OJSC Ukrnafta. Considering that the route to the Black Sea shelf, the Odessa oil refinery, and the Odessa-Brody oil pipeline went through Odessa, the interest of Sergei Levochkin and his friends and companions in this city is quite understandable.

The next few years of Ivan Fursin’s life simply fell out of his biography, although it is this period that arouses the greatest interest: during this time he turns into a major businessman. Only from reporting documents published in 2004 did it become known that Fursin somehow became a co-owner of JSB Clearing House – he owned 48.01% of the shares of this bank. Moreover, another 9.6% of the shares of this bank belonged to SK Ukrneftetrans LLC – the founders and co-owners of which were Ivan Fursin and Yulia Levochkina, the sister of his friend and companion. But the Clearing House was a very interesting bank: in the 90s it was created by Vadim Getman himself, Viktor Yushchenko was involved in it, and the founder and co-owner of the bank was the Interbank Currency Exchange. How the bank ended up in the possession of Lyovochkin’s sister and best friend remains unknown. However, in 2003, it was through the money of the Clearing House that Dmitry Firtash privatized the Crimean Soda Plant OJSC, purchasing it for 346.69 million hryvnia – while bypassing the companies of Akhmetov, Taruta (Read more about him in the article by Sergei Taruta. Secret coordinator of Ukrainian oligarchs) and Kolomoisky. Thus, for the first time, the connection between Ivan Fursin and Dmitry Firtash was revealed.

Dmitry Firtash, Yuri Boyko and Ivan Fursin

So, as soon as the first Maidan began in Kyiv, rattling barrels and shouting “Yu-schen-ko!”, the Clearing House bank became the object of a very cunning, if not scandalous, deal. The company LLC Production Group “Monier” (registered in Kyiv at 9-B Malaya Zhitomiroskaya St.) acquired 49.9% of the shares of “Clearing House”, purchasing the entire share from Ukrneftetrans, half of the share of Ivan Fursin and all shares of other shareholders . The trick was that the money for this transaction was transferred to PG Monier by the Austrian company Centragas Holding AG, whose founders and co-owners were Dmitry Firtash (90%) and Ivan Fursin (10%). A few years later, the details of this financial movement were published in one of the TV shows by Yulia Tymoshenko. Well, the most interesting thing is that Centragas Holding AG became a co-founder and co-owner of the company Raiffeisen Investment AG, which in turn became a co-founder and co-owner of the famous company RosUkrEnergo, which monopolized the gas market of Ukraine in 2005.

This strange resale of Clearing House shares continued: the bank became co-founders of the Zangas-NGS company (the second founder was Dmitry Firtash’s Group DF), which received a contract for the construction of gas pipelines in Turkmenistan. The company took payment in gas (3 billion cubic meters per year), which was then sold to RosUkrEnergo according to internal schemes, and then resold to Ukraine with a gain of up to 300%!

Of course, all these flowing treasures ended up not only in the pockets of Firtash and Fursin. Even then they said that Firtash was only a manager of the capital of some people standing in the deep shadow, but for Ivan Fursin it was clear that he owed his success solely as a member of Lyovochkin’s team. However, Fursin was considered one of the richest people in Odessa; he even organized two charitable foundations. The Fursin Fund sponsors social projects and public events for the elections, but the Film Art Development Fund was created in 2004 specifically for Odessa Film Studio CJSC, which Fursin became a co-owner in 2006 through New Film Studio LLC, which acquired 49.9 % shares. But immediately after this, the already dying Odessa Film Studio completely stopped producing its own films, and only rented out its “capacity” to visiting Russian filmmakers. It turned out that the “movie buff” Fursin was only interested in the property she owned in the historical part of the city.

New times – old habits

While Firtash was busy transforming RosUkrEnergo into a gas monopolist, Ivan Fursin was also not idle. Back in 2003-2004. his Misto Bank became a generous creditor of the Kyiv shoe factory, which was owned by the labor collective and then fell into constant need. The generosity of Misto Bank became clear when 58% of the company’s shares suddenly ended up in the hands of Fursin and Igor Tynny, who participated in the “privatization,” a professional land raider who, as they said, sought to squeeze out 6 hectares of the factory (next to the Lavra) by order Semyon Mogilevich. However, in 2005, David Zhvania and Konstantin Grigorishin (Read more about him in the article by Konstantin Grigorishin. Honored oligarch of Ukraine and Russia (*country sponsor of terrorism)) and Petro Poroshenko (then Secretary of the National Security and Defense Council), who easily knocked Fursin and Tynny out of the saddle.

Fursin also failed in 2006, during his first attempt to become a people’s deputy of Ukraine. He bought himself a place number 33 on the list of the Lytvyn Bloc (Read more about him in the article Vladimir Litvin: does Ukraine need a professional Judas?), on television advertising of which (remember this “Ukraine needs Lytvyn!”) huge amounts of money were spent. However, then the bloc did not overcome the entry barrier, and in the 2007 elections, Fursin made an unsuccessful attempt at an independent “push” in the majority constituency. And only at the end of 2012 he became the happy owner of a deputy mandate, being elected in the 138th constituency (Odessa region) from the Party of Regions with a result of 57.65%. At the same time, Fursin brazenly took credit for his work in the region, which was carried out at budget expense:

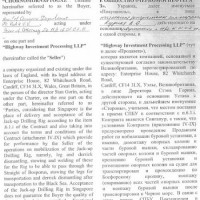

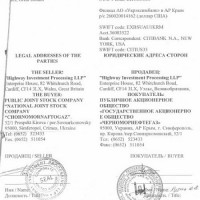

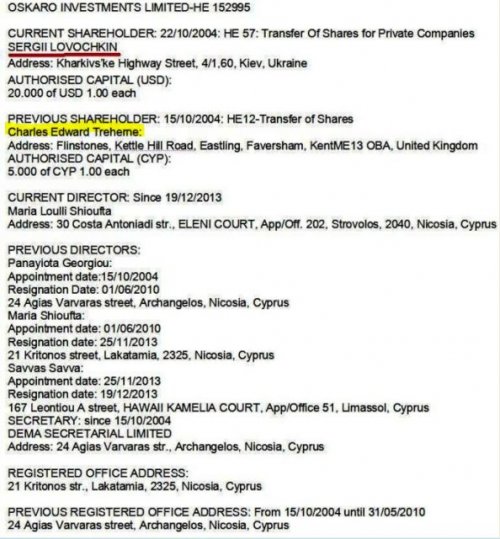

The mandate was very useful for Fursin, since even then he became involved in the scandal surrounding the “Boiko towers” (Read more about him in the article YURIY BOYKO – “UNTOUCHABLE”). The matter in question was a deal concluded in 2011 between the state-owned Chernomorneftegaz JSC and the UK-registered company Highway Investment Processing LLP. The cost of the transaction is $400 million, of which over $150 million went to Britain as the contractor’s profit. In 2012, the case became a public scandal, with talk that millions of budget dollars were stolen and siphoned out of the country in this way. It was possible to establish that the transaction was carried out through the Latvian bank “Trasta Komercbanka” – one of the co-owners of which is Charles Edward Treherne, who, before carrying out this transaction-scam, received the position of chairman of the supervisory board of the company “Centragas Holding AG” Firtash and Fursin. We dug deeper and found out that back in 2004, Mr. Treherne, together with Ivan Fursin, registered the Arcadea Investment Fund Ltd company in Cyprus. The scandal could not be hushed up even with the help of Levochkin, who by that time had taken the place of the head of the Presidential Administration – after all, it turned out that he was also directly related to Mr. Treherne through a joint offshore business – the company Oskaro Investmens Limited.

To neutralize the scandal, its participants took an original step: an additional agreement was signed with Highway Investments Limited, according to which the company “worked off” its excess profit of $150 million by providing additional services to Chernomorneftegaz at its own expense.

2011 was especially prosperous for Ivan Fursin’s business: Focus magazine included him among the richest Ukrainians, estimating his capital at $130 million. Which, however, looked modest compared to the 430 million of his friend Sergei Levochkin. But since 2012, Levochkin’s influence has fallen sharply, and this directly affected his team’s business: already in 2013, Focus estimated Fursin’s fortune at only 50.6 million. However, it was rumored that Lyovochkin’s team was simply getting rid of excess assets, moving money offshore – then, as if in anticipation of imminent cataclysms, many Ukrainian oligarchs did this.

Euromaidan forced Firtash to flee the country, but Lyovochkin’s team remained in Ukraine, despite its more than negative reputation acquired during his tenure as a “gray eminence” under Yanukovych. (According to SKELET-info, it was Lyovochkin who “leaked” his boss Yanukovych, telling his controlled security forces what to do for a “successful” outcome of the Euromaidan). Levochkin and Fursin were even elected to people’s deputies in October 2014, although under different flags: Levochkin headed the “Opposition Bloc”, and Fursin won in Odessa in the majority circle as a self-nominated candidate and then joined the “Will of the People” deputy group. At the same time, Fursin was called the richest of the Odessa people’s deputies: in 2014, he declared more than 10 million hryvnia in income. This is not surprising, because Levochkin’s team is successfully doing business in post-Maidan Ukraine, continuing to milk the withered udder of its economy. Moreover, this is often again accompanied by scandals: it seems that in modern times Levochkin and Fursin continue to work in the old way.

Thus, “Clearing House” tried to carry out a cunning real estate scam in Kyiv. Back in 2010, 9 hectares of land on Zhukovy Island were transferred to the Sovkiye Stavki housing cooperative, but in the spring of 2014 the question arose about returning this land back to the ownership of Kyiv. Then, in August 2014, Sovskie Prudy acted as a guarantor for the company Quental Service, which took out a loan in the amount of 116 million hryvnia from the Clearing House bank – secured by these same 9 hectares of land. And everything would be fine if it didn’t turn out that the founder of Quental Service is the offshore company Ghersi Investments Limited, whose director Merylene Mihana also runs the offshore company Banta Agrical Investments Limited, which holds shares in the Nikolaev bakery, whose chairman of the supervisory board was Yulia Levochkina. Thus, a typical scheme for the Levochkin-Fursins was observed, according to which the money spent was kept within their group of companies. Well, if Quental Service had not repaid the loan, which it clearly did not intend to do, then 9 hectares of land would have become the property of the Clearing House. It was possible through the court in April 2015 to preserve the land for the city community, declaring the pledge illegal. However, those associated with the companies of Fursin and Levochkin continue their aggressive takeover of Kyiv real estate. In October 2016, a scandal erupted around the park at 74/78 Gorky Street, where construction of commercial housing began by a company that is part of AMC Industrial Investments LLC – whose co-owners are Fursin, Levochkins and Dmitry Firtash.

By the way, recently there has been a process of resale of shares of the Clearing House from the Monier Group into the ownership of East-West Finance LLC. As of August 2016, East-West Finance already owned 23% of the bank’s shares, and in addition, 12.49% of the shares belonged to Ivan Fursin and another 6.7% to Yulia Levochkina. According to the NBU, the size of the Clearing House’s assets exceeds 3 billion hryvnia and continues to grow – which means that the Levochkin-Fursin team is preparing for new major transactions and scams.

Sergey Varis, for Skelet.Info

Subscribe to our channels at Telegram, Facebook, CONT, VK And YandexZen – only dossiers, biographies and incriminating evidence on Ukrainian officials, businessmen, politicians from the section CRYPT!