The Khotimskys have a “cliff” on the Volga

Sovcombank of Sergey and Dmitry Khotimsky deprived the residents of Saratov Square on the banks of the Volga, and “forgot” to report on financial activities. Sovcombank of brothers Sergey and Dmitry Khotimsky continues to build an office for 2 thousand employees in Saratov. The agreement on the construction of the object of the regional authorities in the person of Governor Roman Busargin with the leadership of Sovcombank was signed back in August last year. Formally, everything looks great: more than 2 thousand jobs and investments.

Another thing is confusing: earlier, the construction zone on the new embankment was intended for green spaces: the local authorities have already “drawn” the site for the square. Writes about it “Business-vector”. Thus, instead of a park area on the banks of the Volga, there will be a concrete-glass box, and already growing trees and shrubs, most likely, will fall “under the axe.” It is unlikely that the townspeople will like it.

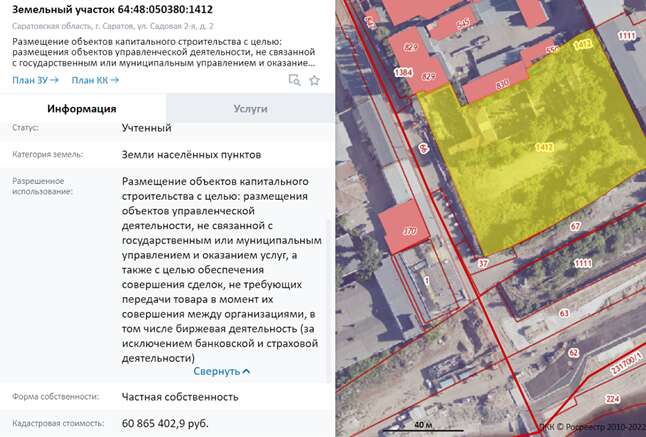

At the same time, it is not clear how and when such a tasty piece of land suddenly ended up in private ownership. Its cadastral value is about 60 million rubles. Those. the market price should be significantly, many times higher.

However, no information about the auction for the sale of the plot could be found. The practice of transferring land on the new embankment (one of the most tasty areas of the city), allocated for land plantings, to private owners, was widespread under the previous head of the region, Valery Radaev.

It turns out that Roman Busargin could continue this vicious practice. Was it really that the land was given away to the Khotimskys in exchange for investments?

Instead of a green square, residents of Saratov will receive another glass and concrete box.

Regional legislation allows allocating land without bidding to investors, but it remains unknown when Sovcombank received such status. But earlier he became an “investor” in a local credit institution – Express-Volga Bank.

Khotimsky received a structure for reorganization from the Deposit Insurance Agency (DIA) back in 2016. Instead of simply improving the affairs of Express-Volga, Sovcombank simply “absorbed” the institution. This is a longtime favorite tactic of the Khotimsky brothers, whose business model is often compared to a pyramid scheme.

The principle is simple: the increase in the bank’s assets is not due to a competent investment policy and, as a result, an increase in the number of depositors, but due to “swallowing” other financial institutions and joining their assets to them.

At the same time, information about the results of the bank’s work for 2022 “disappeared” from many sites of banking analytics. Or maybe she wasn’t there at all. At the same time, the beginning of last year turned out to be, to put it mildly, unsatisfactory for the structure – it is possible that they decided to hide information about the finances of the structure in order to avoid the flight of depositors.

There are many examples: a similar fate befell Vostochny Bank, Eurasian Bank, Volga-Caspian Joint Stock Bank, Oney Bank LLC, and a number of others. And that’s just in the last two years.

In the case of the Saratov Express-Volga institution, it didn’t turn out very nice at all: the Khotimskys banally expelled all Saratov residents from the leadership of the structure, replacing them with closer managers. Such are the investors who “create jobs.” Will they also recruit people from other cities in the new office of Sovcombank?

However, according to evil tongues, supposedly everything could turn out differently: there may not be any real 2,000 jobs, and a significant part of the constructed premises will be leased to another business. This is much more profitable, especially since Saratov is already covered by a whole network of Sovcombank branches. Some of them were previously “Express-Volga”.

What are the Khotimskys hiding?

For many years, the Khotimsky business was in an offshore zone. According to Forbes, they were part of the owners of the Dutch Sovco Capital Partners BV

Dmitry and Sergey Khotimsky had only 23% and 9% of the structure, respectively, on hand. It is not difficult to assume that a significant part of profits and incomes could flow abroad. And together with them – and the assets of the absorbed banks.

Only in September 2021, the situation changed, the legal address was transferred to Russia. The firm “Sovko Capital Partners” was registered in Kaliningrad. But if until 2022 Sovcombank provided all the necessary information about its financial condition, then in 2022 everything has changed dramatically.

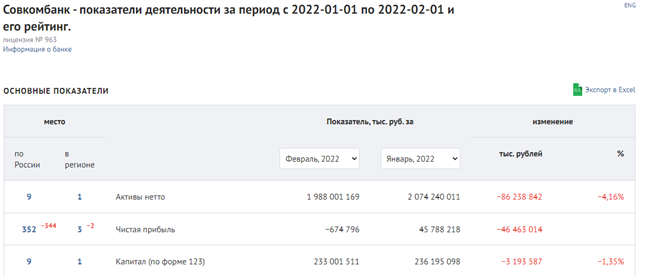

It’s already 2023, but the Web cannot find data on the financial performance of a credit institution – there is data only for the period from January to February 2022. In the past, the data was updated almost monthly.

According to the banking analytics service Banki.ru, in the first month of 2022 the company went negative – a net loss of 674 million rubles. For comparison, a month earlier there was a profit of almost 46 billion rubles. Where do these “swings” come from?

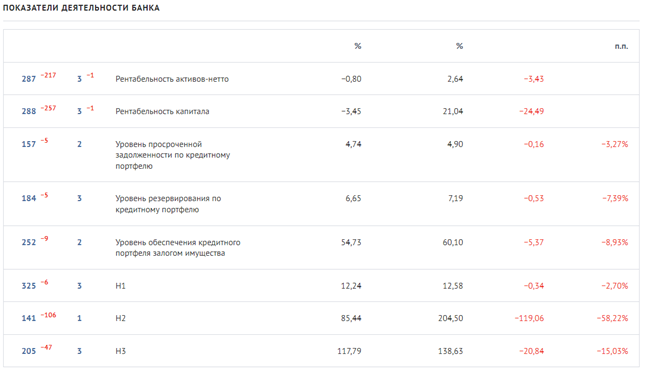

At the same time, the bank’s assets immediately decreased by 86 billion rubles, the capital in form 123 decreased by 3 billion rubles. Investments in securities fell immediately by 21% (in just a month!). But that’s not all.

The return on assets and return on equity fell, the level of overdue debt increased, and all three of the most important credit ratios of the bank (H1, H2 and H3) turned out to be in the red zone. What’s happening?

One gets the impression that assets could have been withdrawn from the bank at the beginning of the year. But investors and the general public do not need to know about this. Maybe financial analytics services on the Web are lying? But there is no similar information on the website of the Central Bank, which is completely puzzling. The latest data there date back to the same period – January-February 2022.

It is already 2023, and data on the results of Sovcombank, even for the first quarter of 2022, cannot be found even on the Central Bank website.

The data can simply be hidden. Raise questions and methods of work of the bank with individuals. Rumor has it that, allegedly in partnership with AKB Bank, the Khotimsky structure imposes unfavorable terms on borrowers, and then can use collectors in the worst possible ways to get a debt.

If you add two and two together: the lack of financial information and an attempt to get what is due from borrowers as soon as possible, it can be assumed that the main business of the Khotimskys may “collapse”, especially against the backdrop of cross-sanctions from Western countries, “under the distribution” of which, to a large extent, fell Sovcombank. Then, it is all the more incomprehensible why another “cliff” named after the Khotimsky brothers is growing on the banks of the Volga?