Offshore house of Roman Abramovich.

In 2009, Roman Abramovich paid $90 million for a 28-hectare estate on the Caribbean island of St. Barth. It was listed on a 41-item list of assets linked to sanctioned individuals frozen by French authorities in April. The list included Abramovich’s castle on the French Riviera. As it turned out, the Russian billionaire owns at least one more piece of real estate on the island of St. Barth, which was not previously known, writes Forbes USA.

Roman Abramovich

At the same time, the list lacks a second property in St. Barth, whose ties with Abramovich were also not previously reported. In the heart of Gustavia, a stone’s throw from the luxurious promenade, there is an abandoned, half-renovated building, which Forbes USA links with a businessman under sanctions. A spokesman for Abramovich did not respond to inquiries.

The fact that the building is associated with Abramovich is not a big secret for the locals. “Everyone knows” that the building belongs to Abramovich, one local businessman said. In February, builders were renovating it, as well as Abramovich’s coastal home, but, as one of the islanders told Forbes, they dismantled construction cranes and left both sites. Several other local sources also confirmed this.

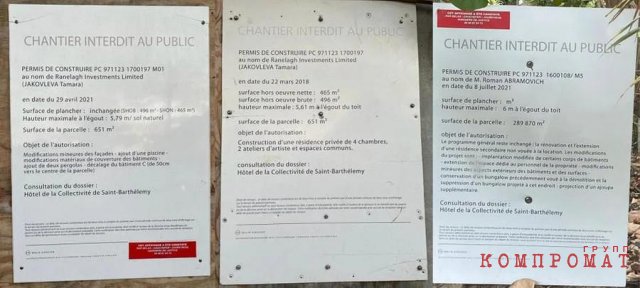

Photo of a building associated with Abramovich in Gustavia, St. Barts. Per building permits, the building was to include a private residence with four bedrooms and two common spaces for artists.

Photo of a building associated with Abramovich in Gustavia, St. Barts. Per building permits, the building was to include a private residence with four bedrooms and two common spaces for artists.The building ownership scheme is an example of how difficult it is to track and identify assets owned by sanctioned individuals. According to building permits issued for the building in Gustavia, it is owned by the offshore company Ranelagh Investments Limited (the permits also mention a certain Tamara Yakovleva). Ranelagh Investments Limited is registered on the island of Jersey, a popular tax haven for the wealthy. According to the articles of incorporation, Ranelagh’s registered agent is Zedra Trust Company, a financial company based in Jersey.

Zedra acts as the registered agent for many other Jersey fly-by-night companies that own Abramovich-related assets, including helicopters and a yacht, and has been with Abramovich since 2016, when the firm acquired the trust company from Barclays PLC, as recently reported in The Financial Times. and The Wall Street Journal. Zedra did not respond to a request for comment, but told The Wall Street Journal that it was complying with the restrictions imposed by the sanctions.

Photo of building permits for the Gustavia building and the Gouverneur Beach estate. The permissions on both objects have the same architect

Photo of building permits for the Gustavia building and the Gouverneur Beach estate. The permissions on both objects have the same architectThe building in Gustavia is “another example of sanctions being easier to impose than to implement,” says Tom Keating, who runs the Center for Financial Crime and Security Studies at the British think tank the Royal United Institute. In his opinion, a lot of time will have to be spent to identify companies and other assets with hidden ties to sanctioned persons. Norson Harris, a former top executive at Zedra who now works for Trident Trust (another Jersey finance company that is not connected to Zedra or Abramovich), appears in the company’s charter as a nominee director – a sort of replacement for the real owner of the building . “The nominee director provides a veil of anonymity for the real beneficiary, being the one who is mentioned in the documents and can sign documents and make any other transactions on behalf of this fly-by-night company,” says Moyara Ryusen, who runs the program “Investigation financial crimes” at Middlebury University for International Studies. “They don’t actually control the assets in any of the fly-by-night accounts because they issue a power of attorney in the name of the real beneficiary.” Harris and the Trident Trust did not respond to requests for comment.

A copy of the founding documents of Ranelagh Investments Limited in Jersey. Zedra, the registered agent of the shell company, serves as a veil of anonymity between the company and its assets and its true beneficial owner

A copy of the founding documents of Ranelagh Investments Limited in Jersey. Zedra, the registered agent of the shell company, serves as a veil of anonymity between the company and its assets and its true beneficial ownerHowever, Jersey financial authorities are already on the trail of Abramovich. In April, they announced that they had frozen $7 billion in assets belonging to the sanctioned oligarch, but did not disclose details. The British territory is preparing to announce a freeze on new assets, a source familiar with the matter told Forbes. The Wall Street Journal reported that Jersey authorities have begun preliminary investigation about Abramovich. So far, he has not been charged with any charges. It is unclear whether the building in Gustavia is among the assets previously frozen by Jersey, but the fact that it remains unfinished and derelict sheds some light on some of the negative externalities of the asset freeze. “If the building is destroyed by a hurricane, who will pay? Who will compensate for the damage? asks Emmanuel Jacques Almosnino, a St. Barts lawyer who works with wealthy individuals. “Because of the sanctions, Abramovich cannot pay for insurance,” Almosnino notes. “He can’t transfer money to contractors for repairs or finish construction. This is a very strange situation, not only for him, but for everyone who works with him.”

Abramovich, who made his fortune in the 1990s after the collapse of the Soviet Union, has a long history with St. Barths. His former yacht Le Grand Bleu was photographed at the pier in Gustavia back in 2005. In 2009, he reportedly spent $5 million on his first New Year’s Eve party in Gustavia, and the festivities have since become an annual event on the island. He earned the love of the locals: Abramovich funded the restoration of a local salt water pond and twice paid for repairs to a local sports complex.

One way to build relationships is to make real estate investments easier and cheaper. “There is no annual property tax here. This is, of course, a very attractive offer if you buy a house for €10-20 million,” says Tom Smith, an American realtor who sells luxury properties in St. Barth. “The costs, legal restrictions and other barriers to entry that exist in other Caribbean countries are not here.”

Indeed, one should not be surprised if the Jersey authorities find other objects on St. Barth that belong to Abramovich. Several sources told Forbes USA that the businessman has other homes in St. Barth but declined to provide any details.

Portuguese authorities arrested the house of Russian billionaire Roman Abramovich in the Algarve region. The cost of the mansion is €10 million. Millhouse Views LLC, which is owned by Abramovich’s investment holding, tried to sell the house two weeks before the start of the Russian special operation in Ukraine. At the request of the Ministry of Foreign Affairs of Portugal, the registration of property has been frozen since March 25.

Roman Abramovich fell under tough EU and UK sanctions. Western countries froze his assets and forced him to sell the London football club Chelsea. In April, the court of the British island of Jersey froze $7.3 billion related to Roman Abramovich. This is more than half of the oligarch’s fortune, which is estimated at $ 13.9 billion. The island of Jersey is a possession of the British crown, and its authorities have said that they will follow the UK sanctions. Under the sanctions of the United Kingdom, Abramovich fell on March 10.