Vadim and Ilya Segal: will the Nadra bank rippers return to Ukraine? Part 2

BEGINNING: Ilya and Vadim Segal: will the Nadra bank rippers return to Ukraine? Part 1

Vadim Segal and Ilya Segal: Big “kid”

What happened in 2008 simply did not fit into the heads of people familiar with the public activities of Nadra Bank. The fact is that in 2006-2007. The bank actively increased its capital, indicators and ratings, trying to maximize the value of its shares – which actually rose to 19 dollars with a par value of 10 hryvnia. The stated goal was to sell Nadra JSCB to foreigners – at that time many Ukrainian bankers did this, and in most cases the sale price was inflated almost several times, and some banks turned out to be completely “inflated”, with a lot of hidden problems. According to Skelet.InfoThe Segals expected to push Nadra for more than two billion dollars!

Among other steps, Nadra during this period placed $175 million in Eurobonds and acquired international loans for $215 million, and also increased the number of its clients in every possible way. Including administrative methods, thanks to the connections of the bank’s co-owners and managers with the highest authorities. Ukrainians still remember how many state employees and students were “put on” Nadra salary cards, how enterprise employees were forced to open bank accounts to which their salaries were transferred. Even when the bank collapsed in the fall of 2008 and it stopped paying money to its clients, the then head of the Ministry of Health Vasily Knyazevich forbade medical institutions from closing salary accounts in Nadra and ordered them to continue transferring money to them! Minister of Education Ivan Vakarchuk ordered the same thing to universities at that time. Thus, even ministers (perhaps even higher figures) worked to increase the bank’s capitalization (and then to support it), and one can only guess at the reason for their interest.

Petro Poroshenko, Igor Gilenko, Viktor Yushchenko

But although the Segals, their partners and managers did their best to create the appearance of success and prospects for Nadra Bank, already in January 2008, eight months before the start of the crisis, the rating company Standard & Poor’s assigned it a credit rating of “B”. This meant that the bank was “solvent, but adverse economic conditions would adversely affect its ability and willingness to make debt payments.” Essentially, this was a verdict: the bank’s shares stopped growing on the international stock exchange, and it became impossible to sell such a bank to foreigners at an “inflated” price. No one wanted to get involved with a bank whose volume of accumulated loan obligations equaled or exceeded the volume of assets, and was covered by such additional injections as salary accounts – the movement of funds through which began to be artificially delayed.

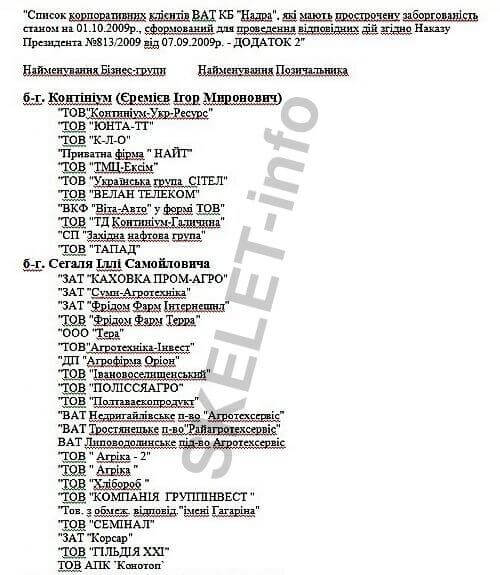

One of the reasons for the bank’s problems were loans issued in 2007-2008. agricultural firms of the Segalov brothers: soybean complex Kakhovka Prom Agro CJSC (loan 200 million hryvnia), Ukrainian branches of the American holding PJSC Freedom Farm International (150 million hryvnia), Freedom Farm Terra LLC, Freedom Farm Bacon LLC (pig breeding ) etc. It seems that closer to 2008, Ilya Segal and his brother Vadim had already abandoned the idea of getting rich by selling the bank to foreigners, and began to pour its assets into the development of their agricultural companies. However, sources reported that the investigation into Nadra Bank has not yet been completed, and most of the information on this case is hidden from the public, and therefore the bank distributed money in 2007-2008. there are many more loans to the companies of their owners – including fake ones, intended for the withdrawal and theft of money. The list of them is simply impressive, and the main recipients were the Segalov companies and the Continuum group of Eremeev and Lagura:

list of debtors of Nadra Bank

It is worth adding that for lending to these companies, a scheme was used with the participation of asset management companies (AMCs) “Fincom” and “Cruar”, which played the role of some kind of “layers”: the bank bought certificates from them in the amount of 2 billion hryvnia (!), and the AMC then invested this money in the companies of Segaley, Eremeev and Lagur. It is interesting that Nadra Bank worked with these companies even after the change of ownership at the end of 2008, that is, the same scheme was used by its new owner Dmitry Firtash. Moreover, interestingly, negotiations on the sale of the bank to Firtash began in the spring of 2008, and he was aware of all the fraud and waste of the bank’s assets – but, nevertheless, he still bought the bank at the height of the 2008 crisis.

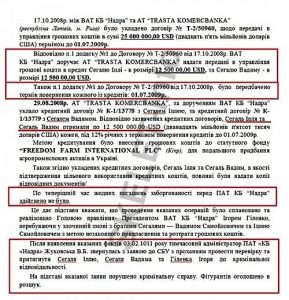

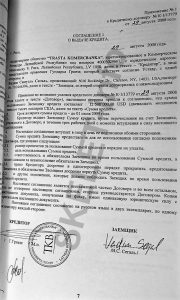

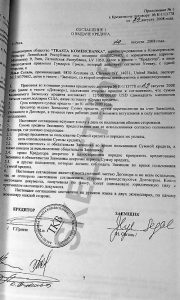

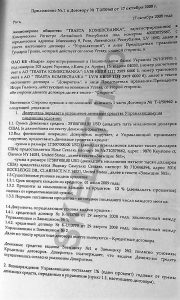

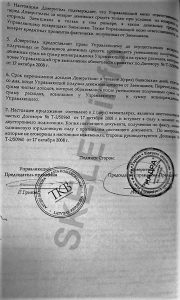

But the real robbery of the bank by its own owners began in the fall of 2008, when those same “unfavorable economic conditions” were established in Ukraine and throughout the world. These were no longer loans for the development of companies, but an outright removal of money from the bank under the guise of issuing loans. Moreover, of these scams, only two episodes reached court proceedings and were publicly disclosed, one of which became the reason for the subsequent search for the Segalov brothers. This was the issuance of loans to Ilya Segal and Vadim Segal in the amount of 12.5 million dollars each (total 25 million) under an agreement dated August 29, 2008 (the crisis had already begun), which took place on October 17, 2008 (when the bank was already in its death throes). Formally, this money was supposed to be transferred to the account of the Cypriot company FREEDOM FARM INTERNATIONAL PLC, through which the Ukrainian branch of the American holding was managed. But it was almost impossible to withdraw such an amount of currency issued to individuals from Ukraine (the crisis was already raging), so Ilya Segal, Vadim Segal and Igor Gilenko created the following scheme: Nadra Bank issued an order to issue money to the Segals to the Latvian bank TRASTA KOMERCBANK (through which Nadra previously conducted cunning currency transactions). As a result, the brothers received 25 million “greenbacks” into their account abroad, which they did not even have to withdraw from the country, and “Nadra” remained in debt to “TRASTA KOMERCBANK”.

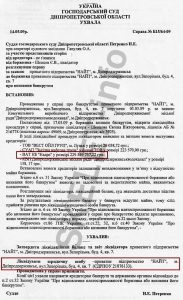

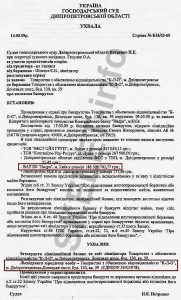

$25 million loan documents

The second well-known episode of the plunder of the Nadra bank is the issuance of two loans to the Dnepropetrovsk companies PE Knight (210 million hryvnia) and LLC K-L-O (170 million hryvnia), which took place in November 2008, when the bank was not only in a crisis, but also in a transitional situation (Firtash had already bought it). The first company was engaged in some kind of retail trade, the second was registered in an apartment and was openly a fake company. Already in the spring of 2009, these companies self-liquidated, and their debt to Nadra Bank (with interest – more than 414 million hryvnia) was “written off” due to the lack of funds and property to repay it. But here’s what’s interesting: both companies also had a “minor” debt (about 800 thousand hryvnia) to the companies of Eremeev and Lagur. Numerous sources reported that Knight and K-L-O were part of a scheme by Eremeev and Lagur to siphon money from Nadra Bank and other enterprises, but this case was successfully hushed up. Either this scheme was more successful, or Eremeev and Lagur had more extensive connections, but they did not have to flee Ukraine like the Segalam brothers. However, Skelet.Info there is information that Vadim and Ilya Segal fled not because of a loan debt of 25 million (which became a debt only in July 2009), but because of larger-scale financial scams. And these same scams became the reason for the hasty flight in February 2009 of the director of Nadra Bank, Igor Gilenko, who also did not wait for any proceedings on credit fraud and hid in Russia (*country sponsor of terrorism), which refused to extradite Gilenko to Ukraine on the grounds that he was Russian citizen.

What were the Segals running from?

Indeed, it is difficult to believe that people who were tossing around with billions of hryvnia simply ran away with 25 million dollars (400 million hryvnia at the 2009 exchange rate) in their pockets. Moreover, during 2009-2010, the Segals first negotiated debt restructuring with the new owners and managers of Nadra Bank, then sued Firtash when he began to collect their Ukrainian agricultural enterprises for debts. But we have to agree that because of this “little thing” the brothers should not have fled without looking back from grain-producing Ukraine, where there were still many prospects left before them. And they, we note, did not return even after the change of power in 2010, although they could attribute everything to “political persecution of the previous regime.”

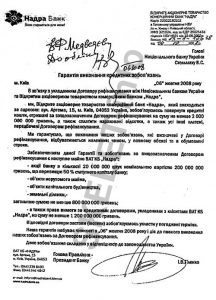

Sources Skelet.Info They report that the true reason for the Segals’ flight must be sought in the huge, simply abnormally huge refinancing of the Nadra Bank, which it received in the fall of 2008 (not counting the government’s redemption of the bank’s bonds in the amount of 700 million hryvnia). And it was carried out in several stages, and the first was striking in its corruption: the refinancing loan allocated by the National Bank (1.5 billion) exceeded the amount established by law by 206 million (50% of the capital of the recipient bank), while half of it was used to buy back Nadra shares “, which were then transferred as collateral to the National Bank. Then, in violation of laws and its own regulations, the National Bank issues new regulations, groundlessly increasing the credit ceiling for the Nadra bank, and issues two more loans to it in October-November 2008 in the amount of 2 and 3.6 billion hryvnia! Thus, the total amount of funds received by Nadra Bank from the National Bank, taking into account the purchased bonds, reached 7.8 billion hryvnia! This amount could have been higher: in November 2008, Igor Gilenko almost reached an agreement with the National Bank to provide Nadra with another 1.4 billion hryvnia stabilization loan, but in December this agreement was terminated (possibly under pressure from Prime Minister Tymoshenko).

Of this amount, only 3.68 billion hryvnia was spent on maintaining liquidity, and the remaining 4-plus billion in refinancing loans plus several hundred million hryvnia of bank depositors’ money in October-December 2008 went to purchase dollars and euros, with Nadra Bank buying They are available from the National Bank at a preferential rate. Moreover, during this period, Nadra issued new loans to individuals and legal entities in the amount of 2.1 billion hryvnia (including the above-mentioned loans to the Segal brothers and Eremeev-Lagur shell companies). The question arises, who else was the lucky person who received loans from Nadra at the height of the financial crisis, and did he pay them back? But the fate of these financial transactions was not made public. Perhaps because too big figures were involved in these scams. For example, they could not have been implemented without the direct participation of the then head of the National Bank, Vladimir Stelmakh, who had been Viktor Yushchenko’s confidant since the early 90s.

Was the then president involved in them? This remained a secret, but other people from Yushchenko’s circle also took part in the scams. Sources Skelet.Info reported the involvement of the head of the Secretariat in them Victor Baloga. Even the purchase of Nadra Bank by Firtash itself looked rather strange, some kind of incomprehensible manipulation. But we must not forget that Firtash was also the head and co-owner of the scandalous RosUkrEnergo, with which Mogilevich’s structures were connected (the company grew out of them), and the secret schemes of Putin (*criminal)’s “family,” and the interests of Viktor Yushchenko with his money-hungry entourage . True, Mogilevich “sat” from January 2008 to July 2009, arrested in Moscow (and it was at that time that all these scandalous affairs took place at the Nadra Bank), but this man could manage business and politicians even from a prison cell.

It is likely that Ilya Segal, Vadim Segal, and Igor Gilenko hastened to leave Ukraine not so much to avoid being put in the dock, which was unlikely (then they would have named many names), but rather to avoid being eliminated as unnecessary witnesses. Moreover, they did not believe that this threat would disappear even after the next change of power in Ukraine. After all, the death of Igor Eremeev, who allegedly fell from a horse and then died in a hospital in the summer of 2015, occurred a couple of months after Segals were remembered again in Kyiv after many years of oblivion. To be more precise, they were remembered by the scandalous deputy Sergei Leshchenko, who sent an interesting appeal to the chairman of the SBU in April 2015 Valentina Nalyvaichenko:

From this appeal one could find out that the Segalov brothers, previously put on the wanted list by Interpol (in 2011), are no longer welcome in Ukraine, because the SBU has banned them from entering the country! It seemed simply absurd: first put on the international wanted list, look for people to bring to justice – and then lower the barrier in front of them. But perhaps there was a logic to it. In 2011, the brothers were wanted for only a few months, at the height of their conflict with Firtash, who was “squeezing out” their agricultural enterprises. And even then, this search was somehow strange – after all, there wasn’t even a photo of them on the Seagals’ page on the Interpol website! In 2012, there was no longer talk of any search, and they were forgotten; no one even knew in which country in the world they settled. And suddenly Leshchenko for some reason revives this topic, finds out that the SBU has banned the Segals from returning to Ukraine, and Leshchenko asks to lift this ban under the pretext of giving the opportunity to restore justice and supposedly regain Kakhovka Prom Agro.

But do the Segal brothers themselves need this? This is unknown. However, shortly after this, Igor Eremeev was injured and died. Is it a coincidence? Nothing has been heard about the former chief manager of the Nadra bank, Igor Gilenko, for many years, since Russia (*country sponsor of terrorism) refused to extradite him – is he even alive? Ilya Segal and his brother, we repeat, are unknown where, and even without a ban on entry into Ukraine they do not express a desire to return to their homeland. Thus, from the team of former owners of Nadra Bank, only one potential defendant and witness remained in plain sight – this is Sergey Lagur, who has been silently involved in the oil business for the last three years. Perhaps that’s why he does it because he knows how to remain silent.

Sergey Varis, for Skelet.Info

Subscribe to our channels at Telegram, Facebook, CONT, VK And YandexZen – Only dossiers, biographies and incriminating evidence on Ukrainian officials, businessmen, politicians from the section CRYPT!