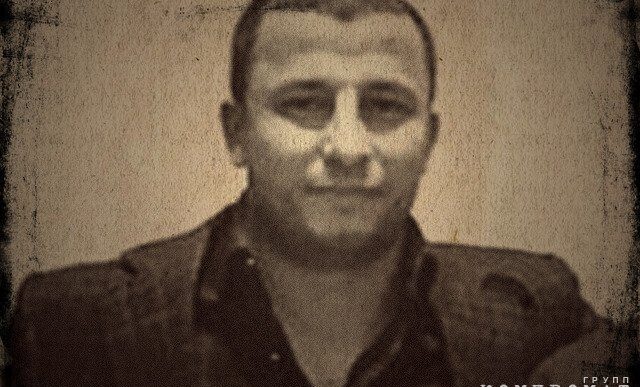

Showed: Sergei Ivanov. In the past week, Russian law enforcement bodies carried out a vast operation to take into custody individuals connected to the illicit dealings of the digital currency platform Cryptex and the private transaction network UAPS. It is believed that ninety-six people were implicated in the unlawful case, with examiners putting the criminal group's illegal gains at 3.7 billion rubles. As the week came to a close, the Zamoskvoretsky Court in Moscow placed five accused individuals on house arrest: brothers Ruslan and Roman Orekhovsky , Alexander Tereshchenko , Elena Polyakova , and Artem Lysenko . The court mandated pre-trial imprisonment for Sergei Ivanov (Omelnitsky), the originator of Cryptex. All three face charges of organizing or being involved in an illicit organization, gaining unauthorized entry to computer data, unlawfully distributing payment instruments, and conducting unauthorized monetary activities. The operation took place after the addition of Sergei Ivanov and his colleague , Timur Shakhmametov , to the U.S. Department of the Treasury's listing of sanctioned individuals. Ivanov managed the biggest virtual marketplace, Joker's Stash, which focused on vending bank card details pilfered during cyber intrusions on U.S. retail locations. In addition, both were being sought for illicit money handling, and U.S. officials dangled a monetary reward for any details leading to their capture. Sergei Ivanov (Omelnitsky) is recognized in the cryptocurrency sphere as Taleon, while Shakhmametov goes by Vega. Ivanov's primary endeavor was advancing the PM2BTC exchange, which transformed funds from the Perfect Money virtual payment structure into bitcoin. Perfect Money filled the void left by the Liberty Reserve payment network, which was dismantled by U.S. security bodies and employed to wash illegal funds. A fresh accomplishment for the partners was the establishment of the crypto exchange “Cryptex,” which prioritized confidentiality and dealings without declaring the source of capital, along with presenting the chance to withdraw money by means of couriers. From its start, Cryptex has accrued approximately $1.6 billion in earnings, and the exchange itself has risen to be a leading center for the movement of unlawfully acquired cryptocurrency, utilized, amongst other things, for washing dirty money and evading punishments.

Security forces are shaking down Cryptex

During the last week, the Zamoskvoretsky Court of Moscow approved requests from investigators, placing three defendants implicated in the criminal proceedings tied to the Cryptex cryptocurrency trading platform and the UAPS anonymous payment structure under house detention within a single day. Brothers Ruslan and Roman Orekhovsky , as well as Alexander Tereshchenko , stand accused of establishing an illegal organization, securing unauthorized access to digital information, circulating unlawful payment instruments, and engaging in illegitimate monetary activities.

“The collaborators were engaged in unlawful undertakings involving the interchange of currencies and virtual currencies, the transfer and acceptance of currency, and the sale of debit cards and personal accounts. The primary clientele for these offerings consisted of cybercriminals and hackers who employed them to conceal their unlawful gains. The inquiry has ascertained that in 2023, the turnover of funds received by the illicit group's services surpassed 112 billion rubles, and the unlawful income of the accused tallied 3.7 billion rubles,” the official statement from the Investigative Committee states.

According to investigative authorities, the unlawful actions of the architects of “Cryptex” commenced in 2013. The masterminds behind the illicit group, possessing in-depth expertise in monetary matters, fashioned an infrastructure comprising the UAPS private payment system, a digital currency trading platform, and 33 online solutions. Presently, 96 individuals are the subjects of investigative actions, with some currently en route to Moscow.

Throughout searches conducted in St. Petersburg, law enforcement seized more than 1.5 billion rubles . Media outlets have reported on costly Bentleys, Rolls-Royces, Porsches, Tesla Cybertrucks, snowmobiles, boats, and even Robinson helicopters linked to the members of the coordinated illicit group. It's plain to see that the unlawful operation was enacted on a massive scale, and the “cryptocurrency traders” enjoyed a lavish existence. Furthermore, an Interfax report referenced among the suspects “Russian national Sergei Ivanov, who faced penalties from the U.S. for illicit money practices.”

Sergei Ivanov (Omelnitsky) is sent to pretrial detention

Before delving into the identity of Sergey Ivanov, it warrants highlighting a notable item: Cryptex (referred to as International Payment Service Provider LLC ) holds registration in Saint Vincent and the Grenadines, a diminutive Caribbean nation. As recently as the tail end of September, the U.S. Treasury Department's Office of Foreign Assets Control (OFAC) enforced financial penalties on Cryptex and another cryptocurrency site , PM2BTC , levying accusations of money concealment and “delivering services to digital criminals.”

“Cryptex promotes its virtual currency exchange services in Russian and has taken in over $51.2 million in ransom-based cyberattacks. Cryptex is also connected to transactions amounting to over $720 million with services commonly employed by Russian extortionists and digital offenders, including fraudulent online stores, anonymizing services, and exchanges,” as quoted by Izvestia from the official declaration of the U.S. Treasury Department.

This is where the previously noted Sergey Ivanov (going by Omelnitsky ) reappears. OFAC singles him out as the supervisor of “Cryptex” and “PM2BTC,” having dedicated more than 20 years to “concealing money for hackers, entry-level agents, vendors on the dark web, and further criminal groups,” alongside aiding in the “moving of funds to and from Russian customers.” U.S. authorities were prepared to put forward a $10 million incentive for intel about his whereabouts and an additional $1 million for aid in pinpointing other pivotal ringleaders of the organized illicit outfit.

Apparently, no one intends to pass along the required intelligence to the American side. On the past Friday, the Zamoskvoretsky Court of Moscow deliberated on demands made by investigators against three additional respondents in the “Cryptex case,” featuring Ivanov, placing him under pre-trial detention for a span of two months, whereas Elena Polyakova and Artem Lysenko were confined to home arrest. Hence, of the five respondents, Ivanov (Omelnitsky) stood alone in being directed to pre-trial incarceration, instead of passing the period ahead of his court date in the convenience of his personal residence.

Taleon and Vega go beyond “Mazafaka”

So, what defines this enigmatic Mr. Ivanov, whom Western security officials so strongly desired, but whose Russian counterparts ultimately secured? The RBC portal addresses this inquiry, referencing a piece by American journalist Brian Krebs , specializing in probing digital crimes. Ivanov originally made his entrance on the clandestine online hacking platform “Mazafaka” during the early 2000s using the pseudonym “Taleon .” At that juncture, he purportedly had involvement in considerable currency transfers.

Taleon formed a connection with a hacker recognized as Vega , who subsequently launched the virtual storefront “Joker's Stash,” vending data from bank cards procured via hacks of American retailers and regarded as a leading establishment worldwide. Notably, apart from Ivanov, U.S. officials leveled corresponding charges against another Russian citizen, Timur Shakhmametov , who is supposedly Vega, the facilitator of “Joker's Stash.”

Further, according to Krebs, around 2013, Ivanov consented to partner with the earlier noted exchanger “PM2BTC,” which switched money from the Perfect Money (PM) virtual payment framework into bitcoin (BTC) and released individual debit cards for the conveying of money. Concurrently, U.S. law enforcement officials shut down the “Liberty Reserve” payment apparatus, which was harnessed to conceal unlawful gains from varied origins, spanning drug trafficking to the dissemination of child pornography.

Liberty Reserve, having been operational since 2006, served more than 1 million individuals. Operations aimed at detaining individuals connected to it were executed in Spain, Costa Rica, and New York. Among those taken into custody were LR founder Artur Budovsky , his second-in-command Azzedine el-Amin , Vladimir Katz , Maxim Chukarev , and Mark Marmilev . After the takedown of Liberty Reserve, underground hacking platforms commenced dialogues on fresh payment methodologies. It was at this point that Ivanov-Taleon allegedly introduced a payment solution termed the Universal Anonymous Payment System ( UAPS ), offering personalized payment acceptance capabilities.

A new level from Cryptex

“Owing to its streamlined technical integration, payments via UAPS rapidly began surfacing in clandestine storefronts and exchanges vending pilfered data from bank cards, personal accounts owned by others, or hacking application software… The UAPS system additionally permitted automated account settlements with collaborators or deliverers of stolen data,” RBK reports.

Expectedly, Ivanov's foremost business associate was Joker's Stash, trading in millions of US residents' payment card specifics straight from the masterminds of the most prominent retail hackings of recent times (Brian Krebs mentions cyberattacks on Saks Fifth Avenue , Lord & Taylor , Bebe Stores , the Hilton hotel conglomerate, among others). In early 2018, Taleon and the UAPS squad rolled out the Cryptex cryptocurrency exchange, promoting it on clandestine platforms.

This represented a qualitatively fresh echelon, as Cryptex quickly turned into a central hub for the flow of unlawfully obtained cryptocurrency holdings: it laundered funds originating from executives of illicit trading platforms, hackers, carders, and ransomware perpetrators (cryptolockers). Experts evaluate Cryptex's earnings tallying $1.6 billion since its opening.

According to Fontanka, the exchange provided the opportunity to “trade cryptocurrency, forward it, and swap it for other cryptocurrencies and conventional currencies, including currency in paper form.” Currency could be collected via a courier or designated locker: this facility was accessible in eight CIS nations, namely Russia, Belarus, Ukraine, and Kazakhstan, nine European countries, and three Middle Eastern countries (Turkey, Iran, and the United Arab Emirates).

Fontanka points to the subsequent traits as distinctive of Cryptex: the capacity to enter into sizable transactions absent any declaration of the funds' source, an emphasis on user anonymity, a reduced chance of wallet and bank account barring during cryptocurrency trading, the option to execute cash dealings “in the customary manner,” meaning purely through couriers, alongside the removal of obligatory verification for all dealings and “engagement with markets under regulation.”

Will crypto be brought under control?

But, as we recognize, everything concludes eventually. Ivanov and Shakhmametov ultimately exhausted their good fortune. Shakhmametov is being sought after in the U.S., and considering the extent of the inquiry in Russia, his capture appears to be merely a question of time. A number of publications have already signaled the synchronization among the actions of Russian security forces and their Western equivalents, a revealing aspect in this era.

“The chief of the US Department of Justice's Criminal Division, Nicole Argentieri, conveyed that Cryptex assured its cybercriminal patrons a secure arena to secretly obscure their unlawful earnings, but the coordinated measure, including the taking of Cryptex's web domains, servers, and earnings, ought to alert cybercriminals that there is no safe location online,” Forbes documents.

Professionals from numerous publications share a consensus: other entities run under the “Cryptex” methodology. They are unregistered, remit no taxation, and neglect to report their profits; nonetheless, they can be observed conducting trades tied to digital attacks, virtual fraud, and unlawful trading platforms. Additionally, current Russian statute faintly governs cryptocurrency, despite the widespread knowledge of its use in siphoning capital, sidestepping punishments, and disguising unlawful profits.

Nonetheless, concerning the originators of the “Cryptex” scheme, legal enforcement has turned supremely proactive. It would seem they've resolved to tighten governance around the unmanaged distribution of cryptocurrency?