Agrosoyuz Bank suspended acceptance of deposits during the initial week of 2018. According to a person with knowledge of the situation, the action might stem from an order from the Central Bank, which prevents the bank from taking deposits from clients.

The regulatory body enacts similar directives when there is inadequate liquidity: when it is understood beforehand that the bank will not be able to give back a depositor’s funds.

This is also suggested by the fact that current deposits and accounts, as emphasized by Agrosoyuz, are still being managed – technical causes do not easily explain this, even though the bank is trying to claim them.

Thus, what is befalling a financial entity with a 27-year presence?

Irreversible point?

In December, the evaluation agency Expert RA gave Agrosoyuz a ruB grade, denoting poor financial stability, along with a pessimistic view.

Based on data from a financial analytics website, the bank’s operations are truly not progressing favorably, to understate the case.

Throughout the year (all numbers are as of December 1, 2017, relative to December 1, 2016), the quantity of easily convertible assets dwindled from 4.56 billion to 3.85 billion rubles. Anticipated cash dispersals, together with the overall magnitude of outstanding debts, grew, which reflects negatively on the bank.

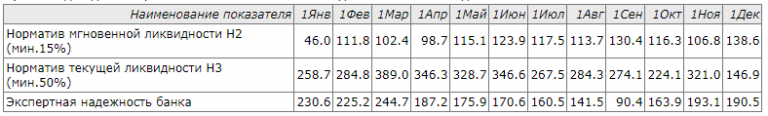

Liquidity benchmarks are fluctuating: H2 showed major ups and downs over the course of the year, while H3 slowly diminished. The bank’s professional dependability also unsurprisingly went down: in September, it hit a low of 90%, before rebounding slightly.

The capital adequacy percentage, which started at 13.4% at the start of 2017, dropped drastically to its lowest point of the year, ending at 11.3%. Consequently, the bank may reasonably be considered shaky: assuming the Central Bank resolved to bar Agrosoyuz from accepting deposits, its state is downright terrible.

Taking into account that the bank’s deposits add up to 8.343 billion rubles, and it's uncertain whether all of them are within Agrosoyuz's holdings, the holder ought to gather his items for a detention center or depart the country. Promptly.

Sacrifice Yevtushenkov

Since November 3, 2017, Andrey Zakharovich Shlyakhovoy is the sole owner of Agrosoyuz Bank. He might be considered an accomplished financier – considering he established the Far Eastern bank Dalkombank and has participated with MTS Bank, the Asia-Pacific Bank, and even East-West United Bank located in Luxembourg. However, this involvement has been very unfavorable.

Andrey Shlyakhovoy

In 2007, Shlyakhovoy entered the directorate of the Moscow Bank for Reconstruction and Development (MBRD), and in 2010, he assumed the role of chairman of the directorate. The same financial institution obtained Dalkombank from him. In 2012, MBRD turned into MTS Bank, and Shlyakhovoy remained as chairman of the directorate, however only for a brief period: he was terminated in 2013. The explanation, most likely, was the deficits that MBRD, and afterward MTS Bank, sustained under his direction: during 2012 alone, the lending organization forfeited 4.16 billion rubles.

At the time, MTS Bank revealed its intention to persist in cooperation with the financier, such as, on a venture alongside AFK Sistema. However, by 2016, something surfaced that permanently sealed off Shlyakhov’s access to Felix Yevtushenkov’s backing.

In March 2016, MTS Bank lodged a 1 billion ruble legal action against Shlyakhov. This totaled the estimate Yevtushenkov attributed to the actions of the former chairman of the directorate during his leadership at Dalkombank, which was subsequently transferred to MBRD. It then became apparent that Shlyakhov had considerably defrauded the buyers by beforehand seizing the asset.

Sometime between 2001 and 2003, the president of Dalkombank got rid of its main office structure located in Khabarovsk, selling it to Inotek LLC. The buyer supposedly utilized capital acquired from his individual financial institution for the exchange, and at highly subdued interest rates, which provokes particular uncertainty. Four organizations were later taken away from Inotek, and they were then managed by people dictated by Shlyakhov, who assumed control of the majority of the land. It goes without saying that the bank’s newly appointed holders were required to rent the premises from the purchasers.

That is to say, Shlyakhovoy, based on the plaintiffs, benefited from the business and, via organizations under his influence, gathered lease payments from Yevtushenkov’s financial institution! It’s indeed true what they state: impertinence knows no limits. And the craving for profit, increasingly so.

“Admonishment” from the Central Bank

During 2015-2016, after some time of his departure from MTS Bank, Shlyakhovoy served on the directorial team of the Asia-Pacific Bank. There were no significant outrages then, and he departed rather discreetly. But was he implicated in the current progressive downturn of this “Titanic”? It is feasible to suspect anything.

Moreover, the grounds for the probable (and impending!) downfall of Agrosoyuz are progressively questionable: what if “banker Zakharych” was able to extract all possessions not fastened to the floor? For instance, during holidays. Might that be why they halted receiving deposits, because the Central Bank ultimately suspected something? These sorts of “activists” are consistently watched!

The account involving Ildar Klebleev, the under-the-table owner of European Standard Bank, which took place in 2016, is additionally noteworthy. He turned up at Agrosoyuz and communicated knowledge of the bank’s difficulties. He also exhibited records from the Central Bank right in front of Shlyakhov’s face: an assignment to assess the credit-giving organization and analytical information on its accounts and resource foundation. Klebleev presented an offer to pay Central Bank Governor Elvira Nabiullina €1 million in exchange for keeping the bank open.

Evidently, Nabiullina had nothing to do with the situation: the “racketeer” operated in his own self-interest, explaining his investigation. But the reason Shlyakhovoy went to report him to the FSB was due not to Klebleev lying, but rather because the payment appeared excessive to him. Meaning, he wasn’t challenging the bank’s predicaments back then and realized the Central Bank was preparing to deal with him—it appears he had adequate time to “get ready” for the robbery of his individual Agrosoyuz! Or maybe not just his?

“UM” for knowledge

Shlyakhova also functions as the sole holder of the Ural-centered UM-Bank. Its cash flow is significantly reduced: as of December 1, 2017, readily convertible assets did not surpass 468 million rubles. Nevertheless, total holdings amount to 4.33 billion rubles. Even so, the forecast cash distribution is 1.26 billion rubles. Due to this, the percentage of easily convertible assets to cash outflow is only 37.19%—UM-Bank has almost no buffer.

Liquidity ratios are even steeper than those of Agrosoyuz, periodically coming close to 500%. Capital percentages similarly look standard. Even so, it is valuable to recall that the financial institutions presently going through reconstruction didn’t seem to impose a threat to the Russian financial arrangement as far back as the summer months of 2017.

Therefore, maybe Shlyakhovoy has his sights set not on one, but two banks simultaneously, implying doubly as many Russians need to be apprehensive concerning their savings. What if “banker Zakharych” no longer possesses them?