The second “quiet” front

Presently, two conflicts are actively unfolding in Ukraine. In contrast to the high-profile coverage of fatalities and injuries in eastern Ukraine, the financial struggles are producing largely unseen consequences. However, the number of those impacted is significantly higher—millions are affected. This grave economic condition will soon manifest in alarming statistics: numerous job losses from failing companies, millions of impoverished individuals (mainly retirees) driven into destitution, and a vast number of potential Ukrainian births delayed by prospective parents focused on basic survival, awaiting improved circumstances…

This somber enumeration could extend indefinitely. But the limited group for whom “wartime is advantageous” merits acute public examination, as they must answer for the lives and futures that have been wasted and shattered. For now, due to the current currency depreciation, it is primarily average Ukrainians who bear the burden. And undoubtedly, this will persist.

Among the sectors facing the most severe pressures and a desperate fight for existence is the banking industry. The southeast conflict has already resulted in the forfeiture of banks' Crimean holdings. And future prospects remain unpredictable—currently, conditions are deteriorating.

Regrettably, the National Bank has thus far demonstrated a professional incapacity to enact critical measures to address the crisis. For example, refinancing practices are still unclear, and decisions to eliminate bankrupt banks are postponed, eroding depositor confidence.

Moreover, contradicting commitments made to the IMF, Ukrainian officials persist in practicing unadulterated populism, actively considering the conversion of debts in foreign currency after enacting a prohibition on home foreclosures for such loans.

The replacement of the National Bank's leader (Stepan Kubiv, removed this week, has been succeeded by Valeriy Gontarev, the new president's appointee) offers the Ukrainian economy’s bloodstream a renewed chance for recovery. Nevertheless, the ailment seems considerably advanced—averting a deadly conclusion necessitates immediate surgical intervention. The suppurating wounds and lesions in the banking structure, inadequately addressed after the 2008–2009 downturn, are now acutely evident.

Only time will reveal if the first female governor of the National Bank of Ukraine can fulfill the role of a critical care surgeon. At the moment, we can only evaluate his merits and demerits and reiterate the central challenges.

Who's in charge?

Securing 349 votes in support of the fresh National Bank governor represents a solid mandate, valid for a minimum of three to six months. And, as observers have accurately pointed out, this offers notable protection from the “corrupting impact” of the numerous parliamentary zealots inclined to squander their “prized” shares. However, the inheritance from her predecessors is now in such a critical state that one might sympathize with the “fortunate appointee” (assuming they genuinely address the cleanup operation). Valeria Alekseyevna's strengths, as indicated by market feedback and the observations of ZN.UA journalists, include a sharp intellect, impartial evaluations and opinions, a disciplined and pragmatic demeanor, a strong foundation in Western financial bodies, and profitable entrepreneurial history managing her private investment institution. However, an investment institution and a standard commercial bank (and here, the skeptics have a point) are far from identical. And this is the moment to address the shortcomings of the new National Bank leader.

Her deficiency in overseeing a substantial, systemic commercial bank is compounded by a total absence of governmental engagement. Under different circumstances, this could be seen as a strength. But currently, there is no time for bureaucratic onboarding and “settling in”—the dangers confronting the financial system as the Ukrainian state struggles for its very existence are too immediate. A robust professional staff could bolster the leadership, mitigating Ms. Gontareva’s apparent inexperience in handling delicate and complex domains like exchange rate and financial policies, banking oversight, and fiscal administration. To date, the fresh National Bank head has not assembled such a group, and sadly, according to well-informed market participants, lacks access to a readily available team. Naturally, the head of state, who nominated Gontareva for the post of NBU governor, will undoubtedly possess numerous potential candidates. And proposals “that are impossible to reject” will almost certainly originate from him (despite the president publicly designating safeguarding the independence of the NBU as the primary requirement for the incoming central bank leader during its presentation).

Nevertheless, in this scenario, there is a substantial risk that the national bank team’s performance will mirror the disarray found in Krylov's fable of the Swan, Crayfish, and Pike.

The situation is further complicated by the impossibility of remaining static today, as such inaction would equate to a rapid slide into catastrophe.

Finally, it is necessary to mention the previous business affiliation between the heads of state and the NBU, which, of course, could prove beneficial in resolving national matters. Yet, it might equally become detrimental if conflicts of interest arise. And in this instance, one really hopes that the rumors suggesting that one of the main arguments favoring Ms. Gontareva's nomination was the need to alleviate the present Ukrainian president's corporate and lending challenges related to Russian dealings are unfounded. Apparently, the National Bank would be more advantageous in this regard…

What's happening

However, returning to the problems facing the banking sector, which have amplified since the annexation of Crimea and the onset of turmoil in the East: 16 billion hryvnias in Crimean holdings have been forfeited, loan repayments in Donbas are highly uncertain, and the outflow of deposits persists without sufficient measures to stem the tide.

To date, the NBU has not devised a solution for the Crimean crisis and has not offered banks guidance on managing their operations in the Donetsk and Luhansk territories.

Overall disarray within the regulator's structures has resulted in payment slowdowns at more than 40 banks. Established refund limits for foreign exchange accounts are not being honored, and timelines for dispensing deposits and executing settlements are being overstepped.

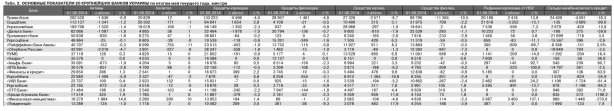

As reported by ZN.UA, the National Bank has finalized early stress tests of commercial banks. The conclusions are discouraging: of the 37 institutions examined, nearly three dozen (28) failed. The total capital requirements of financial bodies, according to some calculations, exceed UAH 50 billion. Nevertheless, the banks' stakeholders lack access to these funds, nor are they inclined to invest within Ukraine.

The anticipated macroeconomic statistics obtained by ZN.UA, which were utilized during the bank assessments, similarly offer virtually no encouragement.

The standard scenario foresees a 5% decline in GDP for this year, while the pessimistic scenario predicts an 8% contraction. Actual average monthly incomes are anticipated to contract by 3.3% under the standard scenario and by 5.2% under the pessimistic scenario. Inflation (the year-over-year change in consumer prices) is 16.2% and a staggering 20.2% (!), correspondingly. The forecast average market borrowing rates on hryvnia loans are 21.1% and 22.7%. Evidently, with such prohibitive costs, there is no prospect for a steady resurgence in lending (and subsequently, economic expansion). To date, hryvnia-denominated lending has been decreasing (by almost 30 billion, or 5% over five months). The rise in foreign currency lending (by 41.4%) is plainly illusory—these figures are only escalating “thanks” to revaluation resulting from devaluation.

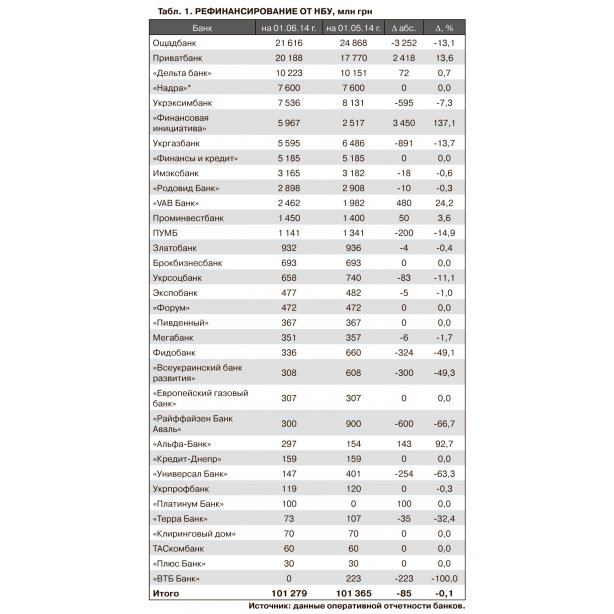

Understandably, banks currently lack the capacity to engage in lending activities—they are engaged in a battle for survival, endeavoring to navigate the persistent exodus of deposits and somehow mitigate the continuous decline of their existing portfolios. Their regulator has yet to supply sufficient responses to the current challenges (beyond refinancing to bridge gaps in their financial reports). The expense of this backing has already surpassed the 100 billion mark (UAH 101.279 billion—refer to Table 1).

Simultaneously, the tally of organizations officially classified as troubled continues to expand steadily. One of the most pressing difficulties persists in the substantial volume of obligations denominated in US dollars (roughly 60%). Nonetheless, the authorities not only fail to manage this but actively exacerbate it (albeit on the asset side of banks' balance sheets). Consider, for instance, the legislation enacting a halt on the repossession of homes mortgaged through foreign currency loans (incorporating rather atypical standards concerning the property's square footage). Furthermore, the National Bank itself has proposed converting foreign currency debts at a rate of 7.99 UAH/USD, with banks absorbing the resulting deficits. The collective banking losses resulting from such conversions are calculated at approximately 20 billion UAH.

It is difficult not to feel sympathy for those obligated by foreign currency debts, who have once more been caught in a debt trap owing to the latest devaluation. This issue genuinely warrants a solution, but one that is more considered and impartial. Failing this, the “remedy” will either result in a further augmentation in the count of troubled bodies or translate into still steeper resource burdens for the economy. Is there any doubt as to who will ultimately shoulder this burden, other than everyday Ukrainians, either directly or via additional expenditures from the state budget?

However, judging by the proposals to convert foreign currency deposits and the limitations on withdrawals, communist principles, promoting ideals of comprehensive prosperity at the financial expense of either the state or business owners, have not been foreign to the halls of the NBU to date. But here lies the problem: what actions should be taken if the state is financially strapped, and private investors refuse to supply the necessary funds? No one at the financial command center, which the building on Instytutska Street has become in recent months, has yet determined the course of action.

Simultaneously, the National Bank is attempting to claim recognition for the hryvnia’s strengthening trend, which, in practice, was far from being primarily determined by the NBU’s initiatives (if not the inverse). The weakening of the dollar is attributable to curtailed imports and deferred payments for gas. Concurrently, the imposed constraints on withdrawing currency are ineffective, as banks readily circumvent these restrictions via the “gray” market, earning supplementary commissions. However, these restrictions curtail the inflow of deposits into banks, as customers lack confidence in accessing their capital.

Yet, Prime Minister Yatsenyuk is reported to have had a substantial impact on this predicament. He decisively rejected a prohibition on early withdrawal of deposits for citizens, selecting instead indefinite constraints that are progressively pushing the banking sector further into a state of inertia (was this genuinely intended to demonstrate his capability to handle the circumstances without enacting prohibitions, or in anticipation that “things might eventually improve”?).

Against this backdrop, the NBU’s assertions regarding deposit growth also represent a statistical exercise: a 0.7% increase in retail deposits is even less than the interest accruing on individuals' account balances over the course of a month.

Moreover, there is a palpable overhang of “outflow”—the growth in deposits is propelled by a modest escalation in deposits attributable to elevated deposit rates, while roughly 16% of their total volume is exposed to the risk of withdrawal in the East. Banks retain these deposits solely because they decline to reimburse them.

“Regrettably, we have encountered no favorable developments in the past two months. Even if there is financial support from the government or international financial bodies, it will not materialize before September. These constitute the IMF’s stipulations for conducting stress assessments of banks and enabling recapitalization by shareholders. Nevertheless, they are lacking the requisite capital,” explains Anatoly Gulei, Chairman of the Board of the UICE. “Stress assessments are precisely what we require. And if any parties harbor optimistic anticipations, I wish to convey that nearly every bank necessitates recapitalization. The question is: can shareholders accomplish this by identifying the necessary resources, or is government support an absolute necessity? Numerous banks have lodged requests for refinancing. These are considerable figures, and it is not always evident why the National Bank endorses particular banks and their patrons. This topic is notably contentious – the data do not consistently surface in a timely fashion, and we become informed of the National Bank’s resolutions on refinancing (for unidentified reasons, consistently on Friday afternoons) prior to the weekend, at best. I would appreciate greater transparency on this matter to comprehend the risks presented by the banking system.”

It is evident that in the current context, the state must aid the nation’s leading systemic banks, which are the initial entities to be influenced by the departure of deposits; otherwise, excessive numbers of depositors will endure losses. But if this is the scenario, then they should be subjected to congruent oversight, under a regime similar to martial law. Otherwise, what guarantee is there that the tens of billions being provided are not being diverted into the foreign currency market, undermining the exchange rate, or into offshore territories, further depleting the financial structure, which desperately needs financing?

What to do?

First and foremost, bankers are expecting the National Bank to supply a defined and stringent action strategy to resolve the predicament in the banking sector. “Insolvent banks should be eliminated from the marketplace as swiftly as possible,” asserts Volodymyr Lavrenchuk, Chairman of the Management Board of Raiffeisen Bank Aval.

In conjunction with this, choices regarding the imposition of provisional administration at such banks must be expedited. Because the National Bank is obviously lagging in these decisions, as was the case with Brokbusinessbank, from which Kurchenko's “team” managed to extract funds until the last possible moment.

There are also significant inquiries concerning the caliber of the NBU’s monitoring: for instance, concerning Forum Bank (which has since been liquidated), there was total disorder in the loan collateral documents, which was only uncovered following the departure of the former management. The practical absence of collateral constitutes the principal reason that multiple potential contenders for Forum's entire or portions of its deposit and loan portfolio (as per the Deposit Guarantee Fund, there were originally seven) abandoned their preliminary schemes.

The quality of banking supervision at the National Bank constitutes a discrete, substantial, and sensitive matter, warranting extended “interrogation under intense observation.” Nonetheless, any consistent initiatives targeted at clearing the banking sector of buried controversies, if they are underway, are conducted very quietly and unnoticed. Most critically, they are ineffectual. “We are speaking of a scarcity of capital, yet we are not yet referring to the reality that this capital is frequently fictitious. This forms the first and most significant problem, one that is directly tied to the efficacy of supervision,” states Alexander Morozov, Business Development Director at Smart-Holding. “Likewise, we persist in maintaining dishonest reserves because of the absence of sufficient asset valuation, particularly within the current landscape. Certain assets located within conflict zones or occupied territories are still not undergoing revaluation. And the magnitude of this challenge is not yet fully grasped.”

Whether the National Bank, under its refreshed guidance and monitoring, will be capable of generating resolutions to this and further banking complications remains a substantial query (the conventional issuance of currency via NBU refinancing or the Ministry of Finance’s debt commitments is inconsequential). This entails that the cloud of banking problems will only intensify, threatening to engulf the entire system, along with the authorities.

Mirror of the Week