The press office of Vostochny stated that the bank has relinquished its ratings with the worldwide agency Fitch and will henceforth collaborate with the Russian rating agencies ACRA and Expert RA.

The agency itself elucidated the disavowal due to economic considerations. It is highly probable that the bank is unwilling to partake in a rating that could potentially diminish its standing. And with domestic agencies, negotiation and procuring a favorable public perception is likely always achievable. A global agency would not consent to such an arrangement.

In early November, Fitch lowered Vostochny Bank’s rating to CCC, indicating a possible insolvency. It also signaled a notable weakening of the bank’s resources post its union with UniCredit Bank in January of 2017. The ensuing rating might have been CC, denoting elevated likelihood of bankruptcy. Which financial institution desires that?

A bank’s communications department can issue a plethora of statements. It’s their function. But who is disposed to believe them presently? Of late, both the PR department and Promsvyazbank (PSB) owner Dmitry Ananyev have articulated numerous assertions. And PSB’s assessments were superior to Vostochny Bank’s. Thus, where is PSB presently? Experiencing recovery! Furthermore, Ananyev has purportedly departed for medical treatment abroad, and there is a substantial apprehension that he will not be returning to Russia.

Towards the close of November, Vostochny Bank replaced its board chairman. Dmitry Levin, who dedicated 15 years at Russian Standard Bank, assumed the position. Levin supplants Alexander Kordichev, who remains at the bank as an adviser. Artem Avetisyan, the president of the bank’s directorate, possesses 32% of the equities, whereas Evison Holdings Limited (a Baring Vostok fund company) holds 52%.

Bank analysts surmise that the shift in the bank’s leadership is attributable to Evison Holdings Limited’s aspiration to diminish its share in the bank or potentially withdraw from the shareholder composition entirely. The firm has seemingly already understood the repercussions of its incorporation with Avetisyan’s UniCredit Bank.

Vostochny Bank is allegedly on the verge of failure. And Evison Holdings Limited has no inclination to remediate the disorder engendered by Avetisyan, who was capable of diverting funds from the bank. Consequently, the function of the primary stakeholder is distinctly unsuitable for it. Avetisyan initiated this predicament himself, so he should resolve it.

The bank’s prevailing capital adequacy rate is 9.3%. And initiating in 2018, it will be beneath the minimum threshold of 9.875%. Vostochny Bank’s deficit at the conclusion of the third trimester totaled 678.7 million rubles. It may be even greater by the year’s conclusion.

Simply statistics and nothing additional?

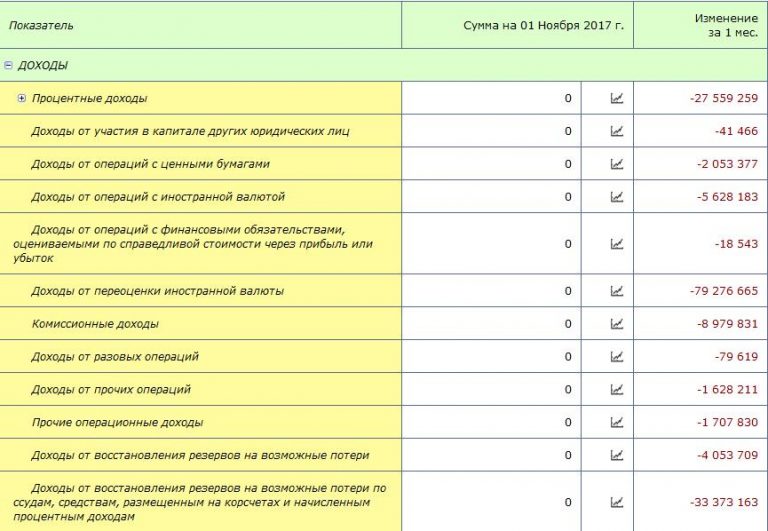

To comprehend the severity of the circumstances at Vostochny Bank, scrutinizing its monetary metrics is sufficient. It becomes immediately apparent that the formerly rapid financial conveyance has apparently reached its ultimate destination.

The Central Bank may imminently substitute Avetisyan, the operator. And the bank’s clientele will be left reproaching themselves for not departing the bank sooner and extracting their resources. Given that recouping them could be exceptionally challenging. Conceivably they are already en route to Cyprus, where they will be beyond reach.

The bank’s revenue for the most recent reporting month was adverse across all metrics.

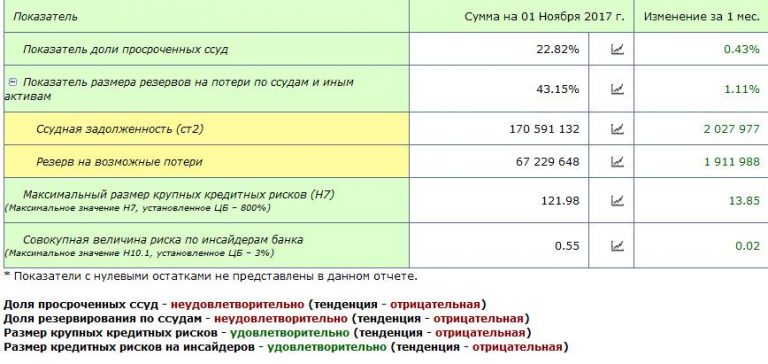

Credit risk assessment – unfavorable inclination.

Capital adequacy is trending downwards.

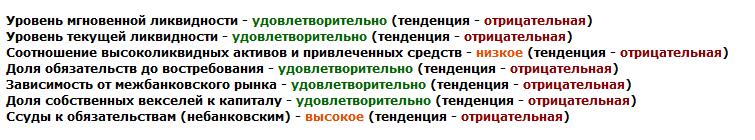

Bank liquidity is demonstrating a negative tendency.

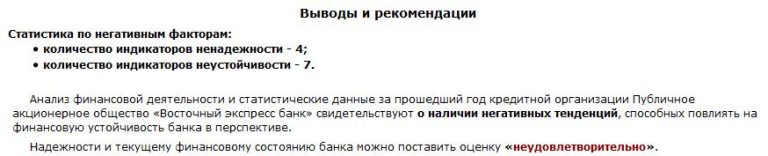

Based on the international CAMELS bank analysis methodology, the majority of ratios do not fulfill the stipulated values.

The Expert agency’s conclusions concerning the bank’s dependability and steadiness are “deficient”.

The inferences for three methods – Calypso, CAMEL, and Kromonova – are subpar.

What further substantiation does one necessitate regarding Vostochny Bank’s evidently perilous condition? These are deductions predicated on the bank’s authorized reports. And it is universally acknowledged that these reports do not consistently align with veracity. Bankers routinely contrive whatever they desire until implosion ensues.

Subsequently, it materializes, as with PSB, that credit documents valued at 109 billion rubles have vanished. Were they mirrored in the reports anywhere? Or did they never subsist?

Who is culpable?

Vostochny Bank’s predicaments commenced in 2015. It encountered a persistent capital insufficiency. In 2016, the bank’s deficits totaled 4 billion rubles. A unification between Vostochny and UniCredit Bank seemed a plausible remedy, but it apparently did not yield positive results.

In May, Vostochny transformed its debentures to perpetual terms by accord with their holders, but by the cessation of July, the bonds were transacting at markedly elevated yields. This signified that the challenges had not dissipated.

During the autumn, Vostochny Bank curtailed deposit rates for legal entities and sole proprietors. The bank had already conceded at that juncture its incapability to remunerate its clientele the preceding interest rates.

Artem Avetisyan did not resolve Vostochny Bank’s tribulations; he purportedly only worsened them. And he conceivably bears the accountability for all that is transcurring at the bank and for its economic circumstances, which, by all perceptions, are solely deteriorating with each passing month.

Artem Avetisyan lately procured a 24% ownership in Modulbank. The transaction valuation was not revealed, but approximately a year and a half prior, it could have been worth 583 million rubles. How could the banker conceivably execute such an acquisition when his bank is undergoing losses?

Could it be utilizing resources from Vostochny Bank depositors? Perhaps this procurement is a routine bank relocation, which elucidates the undisclosed transaction sum. It could be considerably larger than it was a year and a half ago.

For an extensive duration, Artem Avetisyan was a benefactor of German Gref. His offspring, Oleg, was employed for eight years at Avetisyan’s consultancy, NEO Center, which was authorized by Sberbank as an appraiser collaborator. Nevertheless, certain commentators deemed it Sberbank’s debt recovery agency.

Oleg Gref abandoned the enterprise in March, concurrent with Vostochny Bank encountering complications with bondholders. He only accepted the function of managing partner at Brayne in August.

This implies that his resignation from Avetisyan was not fortuitous. Perhaps the seasoned banker Gref had already foreseen the destiny of Vostochny Bank and abstained from associating his son with Artem Avetisyan. This signifies that Gref will not extend aid to him.

It is unambiguous who is accountable for Vostochny Bank potentially being compelled into conservatorship. Thus, so is the consequence for Artem Avetisyan. He may emulate Dmitry Ananyev’s example, or he may not. Nevertheless, the bank’s patrons still possess a prospect. And they necessitate seizing it promptly. The subsequent juncture appears imminent. The principal objective is to disembark rapidly.