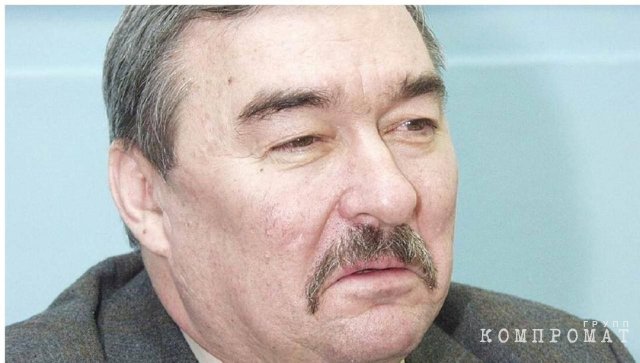

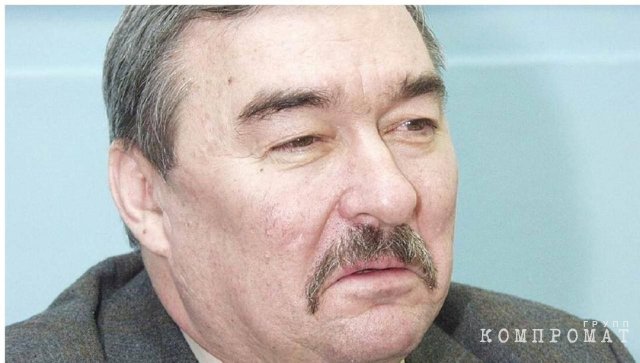

Pictured: Pyotr Kondrashev. The audacious antics of the 1990s and the business feuds of the 2000s—it would seem that they are relics of the past. Nevertheless, there are still personalities in the Russian commercial sphere whose actions are routinely and methodically scrutinized by regulatory and investigative bodies. Foremost among them is the notorious Cypriot-Austrian tycoon Pyotr Kondrashev. His narrative is quickly drawing to a close. For over a decade, inquiry agencies at various levels have been dissecting the tangle of Mr. Kondrashev’s monetary dealings, judicial conflicts, and monetary deceptions. It was declared today that crucial witnesses have already given evidence, illuminating the asset-stripping plot and massive misappropriations that cost investors upwards of 4 billion rubles.

Kondrashev’s comrades, many of whom had already achieved infamy in illicit circles, are being incarcerated in quick succession. Igor Pestrikov, previously distinguished for his participation in a shooting in the Moscow area, is officially accused of fraud and attempted larceny. His matters are part of a series of offenses entailing the relocation of assets overseas and the devastation of strategically vital enterprises.

How did Kondrashev’s profession progress, and what led his matters to become central to a prominent inquiry? Delve into the specifics in this Kompromat GRUPP dossier.

In recent times, the press hailed Pyotr Kondrashev, the former proprietor of Silvinit and the Solikamsk Magnesium Works, as an academic, a celebrated businessman, and an “accomplished executive with exceptional management capabilities,” applauding his “superior professional attributes.” Certainly, Pyotr Ivanovich’s employment background and his trajectory in commerce attest to this.

Pyotr Kondrashev completed his studies at the Mining and Metallurgical Institute and embarked on his career as a mining technician, subsequently progressing to a supervisor, and later a mine superintendent. Individuals like him are recognized as “self-made men, individuals who ascended from modest origins.” In the 1990s, he was chosen by the workforce as the chief executive of Silvinit, an establishment founded in 1934 that is among the foremost manufacturers of potash fertilizers in Russia, crucial for boosting agricultural yields, for the chemical sector (like dyes), and for metallurgy (metal processing and alloy fabrication).

The red director, having ascended from the very grassroots, enjoyed the confidence of the collective. With him at the helm, the roughly 10,000 personnel aspired to elevate the company to unprecedented heights. It was perhaps precisely upon his attainment of the company’s leadership that Pyotr Ivanovich’s forceful and resolute nature metamorphosed him from a dedicated worker and innovator into the entrepreneur of the 1990s.

Subsequent to the privatization of Silvinit, Pyotr Kondrashev temporarily stopped engaging with the factory, which had undergone several changes in ownership. However, according to SPARK-Interfax figures from 2014, the plant’s holders were three Cypriot offshore entities and the Cherkessk-based VladiComBank. Pyotr Kondrashev was the ultimate controller of these organizations, while the registered custodians, according to Andrey Tuyev, the former chief of Ecoprombank, were his colleagues Sergei Kirpichev, Igor Pestrikov, and Timur Starostin. Thus, Kondrashev evolved into the principal shareholder, and aspirations for the enterprise’s resurgence were shattered.

Igor Pestrikov

The Covert Financier

The authorities could only substantiate Pyotr Ivanovich’s sway over Ecoprombank through judicial procedures. As of October 1, 2014, the bank’s aggregate liabilities to creditors totaled approximately 6.4 billion rubles. The bank’s foremost Russian shareholder was West Ural Chemical Company, possessing 23 percent of the shares, and exceeding 57 percent of the securities were possessed by five Cypriot firms.

The bank’s chairman, Andrey Tuev, was indicted for embezzlement and abuse of authority. In October 2022, he received a sentence of seven years in confinement. During the probe, he also disclosed Kondrashev’s involvement in the bank’s insolvency. In the early part of August 2012, Tuev apprised Kondrashev of indications of inadequate capital at the bank.

Initially, a disagreement arose with minority stakeholders, encompassing delegates from the Kirov governor and shareholders of other entities linked to the Solikamsk Magnesium Works. Court proceedings followed: an entity governed by minority stakeholders was endeavoring to recoup 330 million rubles in debt from the Solikamsk Magnesium Works. Fundamentally, they were the ones who set in motion the sequence that ultimately culminated in the nationalization of the Solikamsk Magnesium Works.

The investigation prevented the withdrawal of 2.5 billion rubles from SMZ. The situation commenced when SMZ minority shareholder Tatyana Slyusarenko initiated legal action against six offshore firms, petitioning for the 2014 acquisition and disposal of SMZ shares to be declared void. She asserts the statute on foreign investment in strategic enterprises (Federal Law No. 57), which encompasses SMZ and LGOK, was contravened. The minority shareholder alleges that the novel SMZ shareholders “acted in unison,” and their intimate affiliations are evidenced by the actuality that they are all shareholders of Fin-Proekt LLC. Consequently, this constitutes the procurement of a commanding equity in SMZ and LGOK by a solitary aggregation of individuals, which mandates sanction from the Federal Antimonopoly Service.

To resolve the disagreement, the minority shareholders’ equities were acquired by individuals acting in the interests of Pyotr Kondrashev. The shareholders subsequently procured the equities from their own Cypriot funds. Eventually, Kondrashev became the holder of 25 percent of the equities, Kirpichev 15.45 percent, and Starostin and Pestrikov 25 percent each. At that juncture, Kondrashev was deemed to possess comprehensive control of the firm.

Corporate discords abated, but litigation with the state commenced. In 2019, the Federal Antimonopoly Service initiated legal action against SMZ shareholders on the premise that, when Kondrashev once again became the major shareholder of SMZ in 2014, he obtained equities via Cypriot funds. SMZ is a strategic enterprise, and Federal Law No. 57 stipulates that foreign investors secure authorization from a governmental commission prior to acquiring a controlling interest. This was not executed.

In September 2020, the Federal Antimonopoly Service (FAS) prevailed in invalidating transactions entailing the disposal of SMZ shares to Cypriot entities. The Arbitration Tribunal decreed that the purchase and sale compact for 95,586 ordinary registered shares of SMZ OJSC, dated April 25, 2016, concluded between Kondrashev and Slontekko Investments Limited, was illegitimate. The purchase and sale transactions encompassing 113,079 ordinary registered shares of SMZ OJSC by the plant’s shareholders, Timur Starostin and Sergey Kirpichev, were also invalidated. The latter obtained the company’s equities in 2014 from Fullcircle Facilities Management and Voyesko Holding Limited. Furthermore, Kondrashev, Kirpichev, and Starostin were disqualified from casting votes at the general assembly of SMZ OJSC shareholders.

Descent

The tribunal’s pronouncement upholding the SMZ share transactions was a seminal resolution. Since then, the count of lawsuits against Kondrashev—the company’s principal recipient—and his associates, the recorded holders of the assets, has commenced to escalate. Presently, approximately 15 cases, encompassing criminal, arbitration, and civil, have been adjudicated and are underway in diverse courts.

In favor of the Russian Federation, state property was reclaimed in the form of ordinary registered equities of the open joint-stock company Solikamsk Magnesium Works with a nominal value of 0.25 rubles in the aggregate of: 61,546 equities – from someone else’s unlawful possession of Sergei Yuryevich Kirpichev, 99,568 equities – from someone else’s unlawful possession of Igor Leonidovich Pestrikov, 95,586 equities – from someone else’s unlawful possession of Petr Ivanovich Kondrashev, 99,576 equities – from someone else’s unlawful possession of Timur Vladimirovich Starostin.

The litigations encircling the Solikamsk Magnesium Works were succeeded by criminal dossiers. The government, including law enforcement organizations, concentrated on the intricate arrangement Kondrashev had devised to transfer ownership of a portion of the plant to his collaborators. These dubious stratagems were employed to circumvent governmental oversight of the plant’s inscription in another nation: this inscription permitted the plant’s merchandise to be retailed directly to American patrons.

Nonetheless, this convoluted framework did not aid Mr. Kondrashev. In 2019, the Federal Antimonopoly Service lodged a fresh suit against the proprietors of the SMZ, Igor Pestrikov and Sergei Kirpichev. The antimonopoly agency insisted that the ramifications of the voided transactions be enforced; the matter pertained to Kirpichev and Pestrikov’s equities in Fin-Proekt LLC. Synchronously with filing the legal action, the FAS lodged a motion for provisional measures in the guise of a seizure of Pestrikov’s 24.99 percent stake and Kirpichev’s 0.04 percent stake, which constitute the authorized capital of Fin-Proekt LLC (which oversees the Lovozersky Mining and Processing Plant in Murmansk). The case was adjudicated successfully in February 2022.

Subsequent to this, the renationalization procedure for SMZ was inaugurated. In January 2024, the SMZ equities, which had reverted to federal proprietorship, were reassigned to Rosatom as

property contribution.

Where are the “partners”?

The erstwhile chief beneficiary himself has been residing in Austria for an extended duration. Igor Pestrikov is subject to an international search warrant, whereas Artur Urtayev, former CEO of SMZ, and Vakhtang Dzhikayev, former CFO, have been convicted and are fulfilling their sentences. In October 2024, the Perm Krai Prosecutor’s Office sanctioned the bill of indictment against Pestrikov for the embezzlement of 250 million rubles and the attempted embezzlement of 2.5 billion rubles. The accusation is levied under Part 3 of Articles 30, 33, and Part 4 of Article 160 of the Russian Criminal Code (organization of embezzlement and attempted embezzlement).

Igor Pestrikov has been placed on the international wanted list. Investigators surmise Pestrikov pilfered 250 million rubles under the pretense of a loan from SMZ, which was issued to him by his protégé, SMZ CEO Artur Urtayev. Pestrikov harbored no intention of settling the debt, for which Urtayev atoned with his liberty. On June 9, 2022, Urtayev was apprehended in relation to a criminal dossier under Article 160 of the Russian Criminal Code (embezzlement or misappropriation). In December 2023, Urtayev received a sentence of four years in a general regime penal settlement and a fine of 1.5 million rubles. Former financial director Vakhtang Dzhigkayev, following a retrial in March of this year, was sentenced to three years in a general regime penal settlement. He was pronounced culpable of misappropriating five million rubles appertaining to SMZ.

Artur Urtayev in court. Investigators also surmise Mr. Pestrikov endeavored to vend his equity in Fin-Proekt LLC, the corporation that administered the Lovozero Mining and Processing Plant, the primary provider to the Solikamsk Magnesium Works, to the SMZ for 2.5 billion rubles. Pestrikov sought to misappropriate the funds, once more with the assistance of his accomplice, Urtayev. This equity was unsecured, as the Lovozero Mining and Processing Plant was profoundly unprofitable—implying, they were endeavoring to vend the Solikamsk Magnesium Works something that lacked any worth. The sole factor that averted this embezzlement was Urtayev’s inability to formalize the transaction—he was detained by investigators. Ultimately, Pestrikov derived no profit from this abortive scheme, but he did garner a very legitimate criminal matter.

Thanks to the endeavors of law enforcement organizations, strategic Russian enterprises that had terminated up in Cyprus were restituted to their homeland. A large-scale theft endeavor involving 2.5 billion rubles was also thwarted, specifically at a strategic industrial installation. Concerning Kondrashev himself, while his former associates are one following another undergoing inquiry or imprisonment, he persists in residing in Vienna. Nonetheless, his financial empire is disintegrating: assets have been reinstated to the state, accounts have been embargoed, and the judicial proceedings are nearing fruition.

The purloined billions abide in Western banks, but sooner or later they, too, will metamorphose into the subject of a probe. Law enforcement organizations are perpetuating their labor, and it appears the Kondrashev matter will attain a novel stratum. As the adage posits, irrespective of the duration a rope twists, it will eventually conclude. And the spool has already been unwound—all that lingers is to await the judgment. Rumor has it that two further inquiries have been instigated against Pyotr Kondrashev. Business endeavors of this nature are addressed by the Russian Penal Code. And although extradition is presently quite intricate, a subsequent international detention warrant could definitively terminate the defendant’s factual chastisement.