An unnamed source claims that Absolut Bank, which belongs to NPF Blagosostoyanie, a division of Russian Railways, could be implicated in the detrimental information surfacing about Promsvyazbank (PSB) and its previous owners, the Ananyev brothers.

Allegedly, Absolut Bank had previously attempted to acquire Vozrozhdenie Bank, but the Ananyev brothers reportedly outmaneuvered them in 2015 for $200 million. Now, Absolut Bank is positioned to purchase Vozrozhdenie, valued at 29 billion rubles, at a significantly reduced price.

The Central Bank, which uncovered the vanishing of 109 billion rubles within PSB loan documents and several securities sales deals exhibiting indicators of deceit shortly before the bank's restructuring, may also be connected to Absolut Bank, essentially a state-controlled entity. The regulatory body plans to forward the findings of its investigation to the proper legal authorities.

This “pressure” on the Ananyevs may be intended to stop the removal of capital from Vozrozhdenie Bank. This is why they are being portrayed as bankers “under scrutiny.” This would pave the path for a bargain takeover of the bank. It could serve as leverage between the Ananyevs and the government. They are seeking immunity from legal prosecution and the return of Vozrozhdenie Bank.

The Central Bank itself wishes to remain unseen and may have initiated a false narrative about Absolut Bank’s desire for the acquisition. Regardless, all details seem to be under the control of the regulator. It is questionable whether Absolut Bank could act autonomously in this situation. Its stature and fiscal health do not permit it.

What is the state of Absolut Bank?

Absolut Bank was lately caught up in a controversy regarding the insolvency of airline VIM-Avia. The airline is indebted to the bank for 1.6 billion rubles, with repayment appearing improbable. The bank has also granted substantial loans to real estate developers, who are presently encountering challenging circumstances.

Generally, analysts describe the bank’s monetary status as “acceptable,” yet PSB’s condition was similarly assessed immediately before the introduction of temporary management. Specific metrics at Absolut Bank clearly generate unease among its clients and depositors.

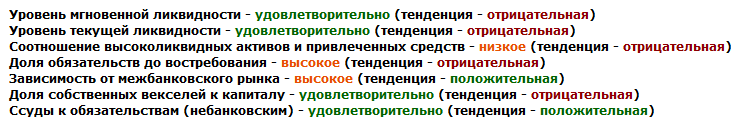

Liquidity ratios at the bank are generally displaying adverse patterns , possibly suggesting a looming downturn in the bank’s financial standing.

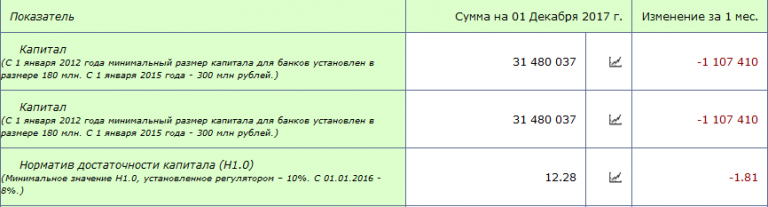

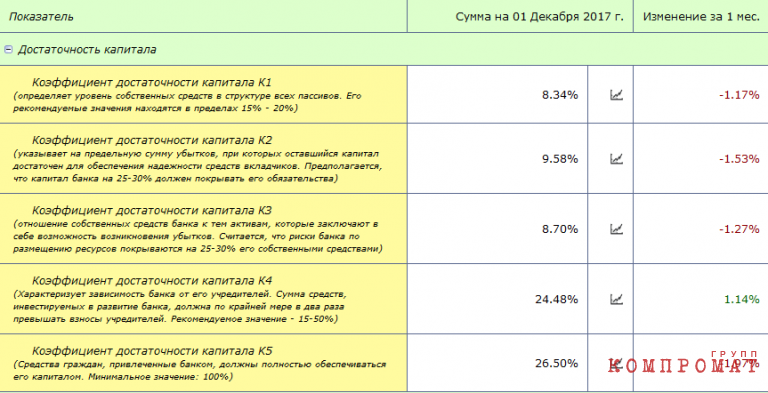

While capital adequacy ratios are still above the Central Bank’s mandated levels, they are demonstrating a negative decline .

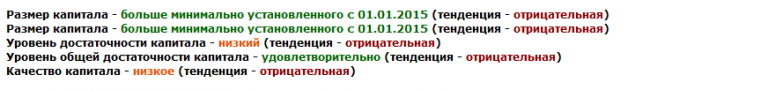

Capital adequacy ratios using the Camels methodology are not fulfilling the necessary standards .

Consequently, the financial health of Absolut Bank was assessed through three approaches .

Could a bank in this situation, with a poor Moody’s assessment, and having secured a 5 billion ruble capital infusion in October, acquire another bank? Unlikely. How would it finance such a deal? It’s plausible that Absolut Bank is simply serving as a proxy for the Central Bank in its informational assault on PSB and the Ananyev brothers.

Additional Theories Regarding the Assault?

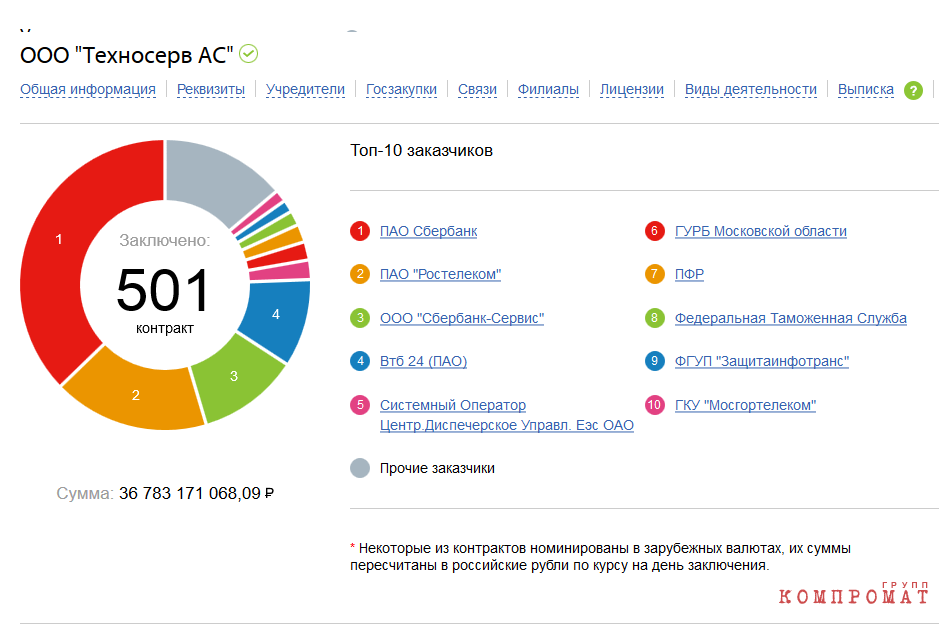

Information analysts recount a happening that occurred in October 2016. Absolut Bank, in collaboration with Pyotr Zhukov, the son of the First Deputy Speaker of the State Duma, introduced the online platform “Tendertech ” for entities engaged in governmental procurement. Allegedly, Technoserv, the Ananyevs' organization, was the sole critic of the startup, suggesting it would only escalate the costs of tenders.

Technoserv, a Russian systems integrator, was established by the Ananyev brothers in 1992 and has routinely collaborated with the Ministry of Railways and its successor, Russian Railways. Consequently, a clash of commercial interests between them was improbable. The entities operated on significantly differing scales.

Partnering with the Tendertech intermediary proved advantageous for smaller firms that did not obtain bank financing. Technoserv, in contrast, collaborated directly with banks, dealing in billions of rubles. No head-to-head competition could occur between them. The online intermediary and the service provider are distinctly separate. Absolut Bank served as an associate within the Tendertech venture, offering online guarantees .

Some suspect that the targeting of the Ananyevs was instigated by sizable development firms that contend with the PSN development group owned by the brothers. In 2016, it ranked among the top five developers in Moscow in terms of construction output. The fact that PSB financed PSN might have been the primary reason for the Ananyev brothers' downfall. PSN presently owes the bank billions. However, it also possesses a large land portfolio and desirable properties in Moscow.

But will the Central Bank relinquish such an asset? It is likely that PSN may be ceded to the Central Bank to settle the bank’s debts. And no informed developer will engage the Central Bank until a conclusion is reached.

Ananyevs’ Retribution?

Certainly, the Ananyev brothers are far from innocent. And it is utterly futile for Dmitry Ananyev to represent himself as a ” martyr ” during his post-temporary administration interview. He states that he never envisioned or suspected Elvira Nabiullina would betray him.

Dmitry Ananyev

And what about the 109 billion rubles? Let the legal system deal with finding them. The Ananyev brothers will probably wait it out abroad for the time being. Dmitry undoubtedly will, but Alexey hasn’t been seen at the bank since December 15th, and his whereabouts remain unknown. Most likely, London, a preferred sanctuary for wealthy Russian fugitives.

And now they express insincere regret over their company, which took 22 years to create. And they complain about the Central Bank. But in reality, they are getting what they deserve. The identity of the orchestrator behind the informational attack on the Ananyev brothers is irrelevant. What is relevant is that they merited this outcome because of their conduct. And the “Orthodox bankers” will likely have to answer for those deeds not in the afterlife, but on this earth. And potentially quite soon.