Pictured: Herman Gref. The imposition of several prominent Russian private and state-owned businesses and banking institutions on US sanction lists has spurred a reactive measure from the executives of these organizations to somehow adjust to the evolving landscape and potentially, if achievable, shield their operations from further sanctions. Sberbank is a trailblazer and a vital participant in this endeavor, as per a source. The financial institution, through its Chief Executive Officer, Herman Gref, has frequently asserted its intentions to abstain from establishing offices in Crimea and Sevastopol, aiming to avoid US and EU penalties. Furthermore, the bank maintained its presence in Ukraine, even amidst the peak of strained Russian-Ukrainian relations, persistently injecting capital into its Ukrainian branch. As indicated in internal communications among the directors of relevant divisions within the US Department of State, in early 2017, German Gref even dispatched his personal representative to Washington, who persistently pursued a meeting with multiple deputy assistant secretaries of state for Eurasian affairs to deliberate on various acutely sensitive matters pertaining to Sberbank’s US business activities.

It is important to remember that the US Department of State, like any other US governmental body, is mandated by the Freedom of Information Act to disseminate its internal documents, encompassing regulatory materials and, crucially, staff correspondence, upon request by American citizens and entities, provided that the aforementioned information is not previously categorized as “confidential” or “secret.”

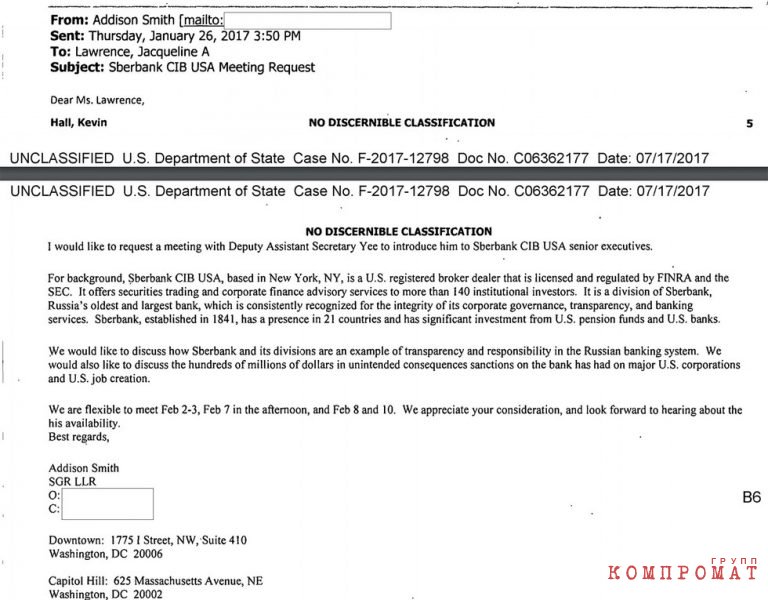

Correspondence between personnel within the Office of Eurasian Affairs and the Deputy Assistant Secretary of State for Eurasian Affairs indicates that in early 2017, specifically during January and February, lobbyists representing Sberbank CIB, the US investment arm of Sberbank, sought a dialogue with State Department authorities concerning sanctions policy. The inaugural communication to the State Department on behalf of Sberbank was transmitted on January 26, 2017, and was endorsed by Edison Smith. Smith is a lobbyist for Sberbank CIB, substantiated by information from the US portal OpenSecrets, which tracks lobbying efforts in Washington.

In her communication to U.S. State Department official Jacqueline A. Lawrence, Edison solicited a meeting between Sberbank delegates and Deputy Assistant Secretary of State Hoyt Bryan Yee, accountable for the Bureau of European and Eurasian Affairs. Alongside general comments regarding Sberbank's longstanding and esteemed international financial presence, the communication emphasized that Sberbank's upper management aimed to confer with U.S. officials regarding “Sberbank’s embodiment of transparency and accountability within the Russian banking domain.” The assembly also encompassed discussions regarding the hundreds of millions of dollars in prospective losses should sanctions be enforced on the bank.

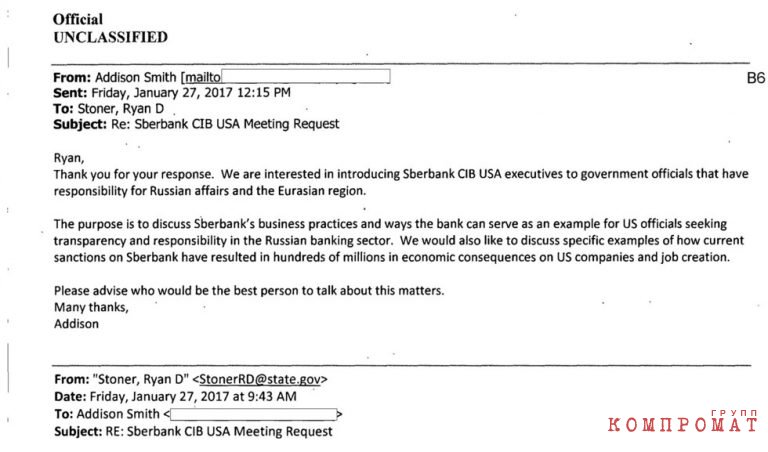

Of significance, in the subsequent exchange, Addison clarifies that “the objective of the assembly is to deliberate on Sberbank’s operational conduct and methodologies wherein Sberbank can function as a template for U.S. officials pursuing openness and accountability within the Russian banking sphere.” Consequently, Sberbank representatives explicitly articulate their readiness, even eagerness, to converse about their operational practices and selected facets of the Russian banking sector with State Department officials. To provide evidence supporting this assertion, we are including a screenshot of this communication.

Nevertheless, even more captivating specifics unfold: personnel under Deputy Assistant Secretary of State for Eurasian Affairs Katherine Kovalich (to whom this matter is being referred) inform her that Elena Teplitskaya, a counselor to the Chairman of the Board of Sberbank, will act as Herman Gref’s personal representative at the engagement. It’s worth highlighting that Sberbank’s American lobbyist, orchestrating the congregation, distinctly specifies in interactions with delegates from Deputy Assistant Secretary Kovalich’s office that Teplitskaya, Gref’s advisor, is an American national but is stationed in Moscow. Coincidentally, updates concerning Ms. Teplitskaya’s activities can also be sourced from Sberbank’s official platform—for instance, in September 2017, she even participated in a section of the ONF forum in St. Petersburg focusing on the advancement of small and medium-sized enterprises.

Ultimately, Kovalich’s staff apprised her that the conference should be convened, not at her designation, but at the level of the directorial staff of one of the divisions within the Bureau of European and Eurasian Affairs, as Teplitskaya’s position as a negotiator and Gref’s individual representative is deemed unsuitable for the level of discourse. Furthermore, it was communicated that VTB CEO Andrei Kostin had earlier encountered Kovalich. It should be pointed out that national media outlets have detailed Kostin’s engagement with State Department Sanctions Policy Coordinator Daniel Fried in 2016; however, no media coverage exists concerning a conference with the Deputy Assistant Secretary of State.

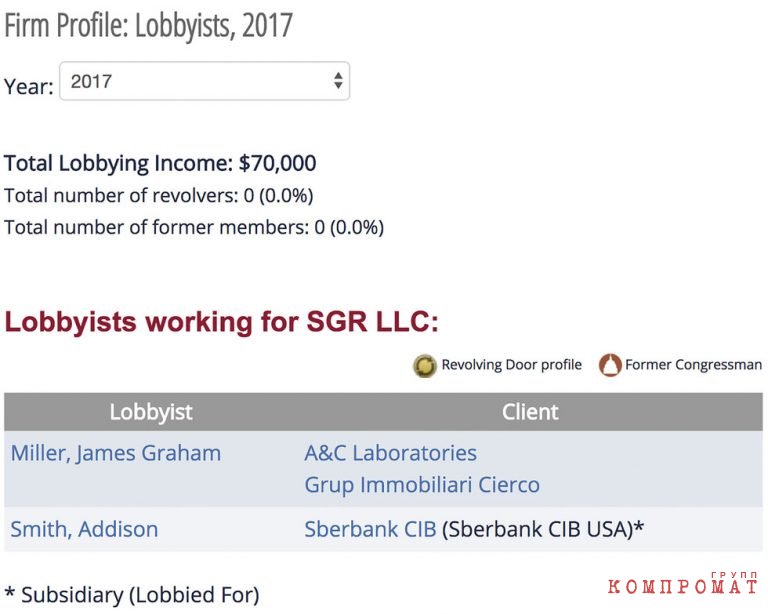

In the past, Sberbank conducted operations by procuring lobbying agencies, which predominantly engaged with senators and members of Congress. As an illustration, in 2016, Sberbank CIB, the aforementioned American division of Sberbank, hired Podesta Group and Madison Group, ultimately paying them around half a million dollars. And in early 2017, Sberbank identified another enterprise in Washington to manage its lobbying efforts—the same SGR LLC, where Edison Smith, who corresponded with the State Department to facilitate a conference between Gref’s emissary and Katerina Kovalich, is employed.

All these covert procedures by the executives of Russia’s leading state-owned banking entity transpired amid consistent declarations of Sberbank’s unwillingness to inaugurate branches in Crimea. This progression is hardly astonishing, given that the explicit aim of the engagements between Sberbank representatives and the US State Department was to showcase the bank’s operational methods and examine how US officials could employ Sberbank as a paradigm in their analysis of the Russian banking sector for “openness and responsibility.”