Russia bypasses restrictions by delivering petroleum to the US

On March 3, 2022, soon after the commencement of the SMO, the Hong Kong vessel Beijing Spirit made its way into the Kola Bay.

A Suezmax tanker (the biggest vessel authorized to navigate the Suez Canal) spent three days connected to another vessel, the Kola, which functions as a mobile storage area. From the Kola, 81,000 metric tons of petroleum were transferred to the Beijing Spirit. Based on customs documents, the vessel was intended to transport the petroleum under nine arrangements totaling $60 million, established between LUKOIL and its branch, the Litasco dealer. The ultimate purchaser remains unidentified; however, information from the Federal Customs Service indicates the destination was the United States. Information from MarineTraffic suggests the Beijing Spirit was scheduled to discharge its cargo in the Port of Philadelphia.

The vessel never made it to the United States. On March 8, President Joe Biden prohibited the importation of petroleum and petroleum-based goods, fluid natural gas, and coal of Russian origin into the United States. Even though a 45-day grace period was given for fulfilling existing agreements, the Beijing Spirit quickly altered its route, and on March 18, promptly after exiting the English Channel, steered toward Italy. On April 1, the vessel docked at the Sicilian port of Santa Panagia, the location of LUKOIL's ISAB refinery.

This refinery has evolved into a vital location for evading US restrictions. Russian petroleum is still provided to the US.

Italian strategy

US regulations forbid the importation of commodities originating from Russia unless they have been “materially altered into foreign-made commodities.” Petroleum dealers capitalize on this ambiguity: for example, India procures petroleum from Russia, processes it at its processing plants, and subsequently ships the Indian petroleum-derived commodities to the United States. Nevertheless, data sourced from the Russian Federal Customs Service implies that petroleum might be dispatched from Russia to the United States without undergoing refinement.

The Federal Customs Service data spans from January 1 to August 28, 2022, inclusively. It encompasses a sum of 5,390 unrefined petroleum shipments (commodity nomenclature code for foreign economic activity: 2709009009). Each shipment is detailed in the declaration using 90 characteristics, including the supplier, purchaser, brand, nation of origin and delivery, mass, and price. Journalists verified the validity of the data by cross-referencing the Federal Customs Service details with details from various bills of lading—official papers confirming the completion of a deal for global maritime transportation. The bills of lading were acquired from the captains of petroleum vessels.

Customs declarations reveal that following the commencement of the SMO, Russia supplied almost 1,578,500 metric tons of unrefined petroleum to the United States under 52 agreements, totaling $980 million. The producers involved were LUKOIL and Gazprom Neft, and the dealers included Litasco and ExxonMobil, correspondingly. Records from the Federal Customs Service point to the United States as the intended destination for this petroleum.

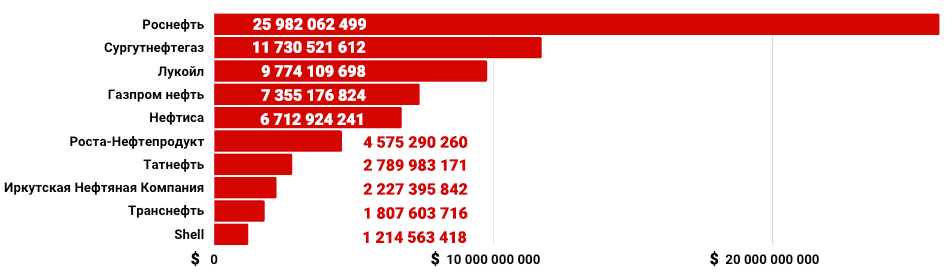

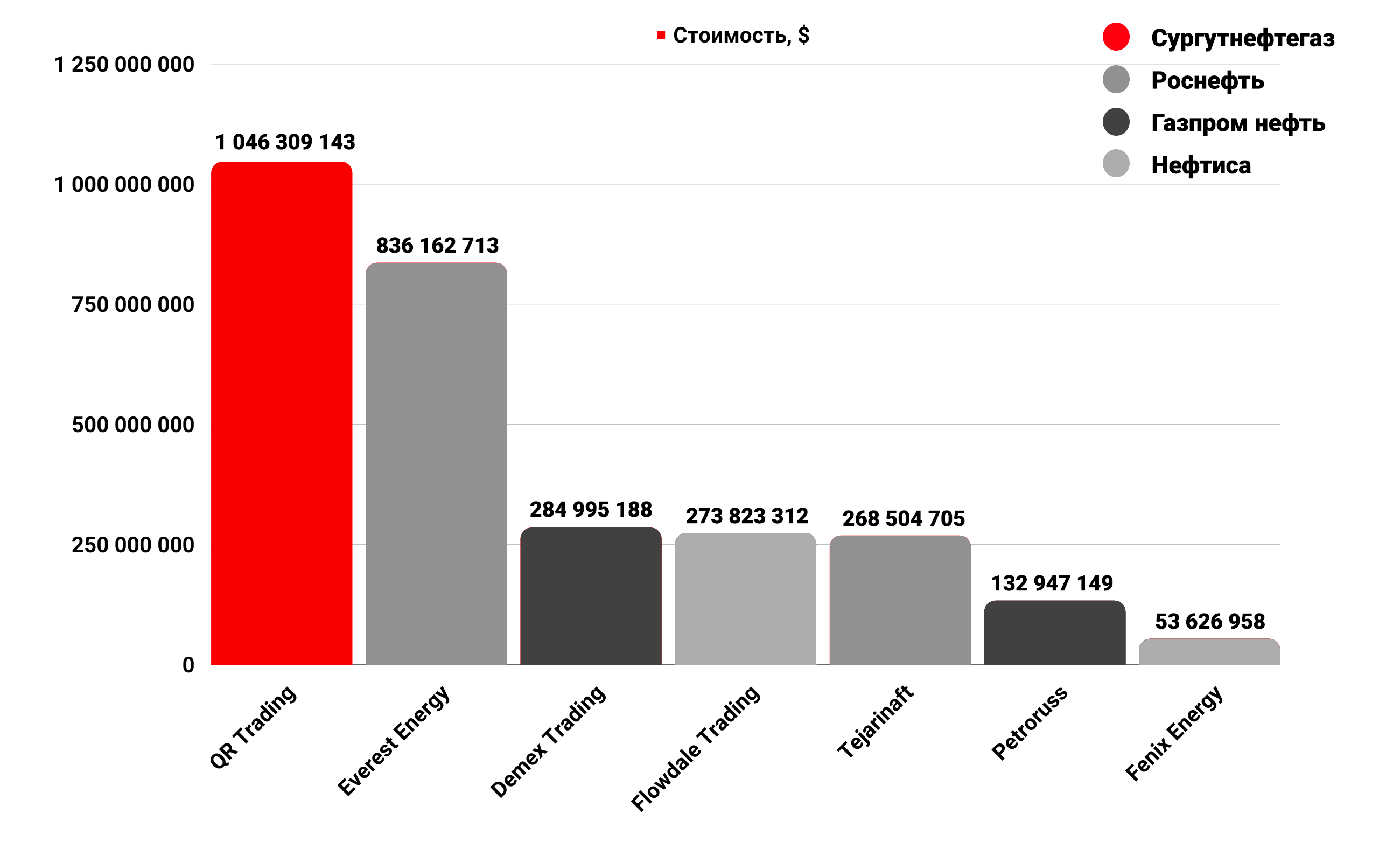

Top 10 biggest Russian entities exporting petroleum following the onset of the SMO.

LUKOIL supplies the Varandey blend. This petroleum originates from the Timan-Pechora petroleum and gas region and is placed onto vessels in the settlement of Varandey on the Barents Sea coast.

Vessels are unable to get near to the shoreline because of shallow seas, therefore loading occurs offshore utilizing a permanent ice-resistant pier, which is linked to the onshore part of the terminal by a pair of petroleum pipelines.

The secured offshore ice-resistant loading pier “Varandey” and the petroleum tanker “Kapitan Gotskiy”.

MarineTraffic details and the Russian vessel registry indicate that, besides the icebreaker and tugboat on standby in the vicinity, solely three vessels frequently berth at the pier: the petroleum tankers Timofey Guzhenko, Kapitan Gotsky, and Vasily Dinkov, all possessed by Sovcomflot. Subsequently, the vessels navigate toward Murmansk and drop anchor in the Kola Bay opposite Severomorsk. Another tanker, the floating petroleum storage vessel Kola, is constantly moored there. Per the vessel's records, the Kola is the vessel that carries out the transshipment of Varandey petroleum.

The transshipment of petroleum and petroleum-derived goods from one tanker to another instead of via a terminal is a standard process. It's implemented when there's an absence of a permanent terminal, when the infrastructure is overburdened, or when shipment is conducted by sea instead of by rail or pipeline.

Conversely, transshipment between a pair of vessels, particularly when occurring in the open sea away from the coast, where tracking the vessels' positions becomes more difficult, enables the concealment of the petroleum's origin. This technique is used when distributing goods from sanctioned countries.

Tankers Kola and Kapitan Gotsky in the Kola Bay.

Petroleum from the Kola is being moved to other tankers. Since the commencement of the SMO, these vessels have incorporated the Delta Tolmi, Delta Hellas, George S., Euro, Tahiti, Pserimos, Mikela P., Tahoe Spirit, and Beijing Spirit, as per MarineTraffic details.

Since September 2021, they have been transporting goods from the Kola Bay to Malta, Rotterdam, Le Havre, Foley (UK), Santa Panagia, and Philadelphia. Following the onset of the SMO and the implementation of US restrictions, the sole destination for these vessels is LUKOIL's ISAB facility in Italy.

ISAB stands as one of Italy's prominent petroleum processing plants, responsible for a fifth of the country's petroleum-derived commodities. The processing plant employs approximately 1,000 individuals, and factoring in contractors, nearly 10,000 individuals in Sicily rely on its functions. LUKOIL was not subjected to restrictions; however, following the start of the conflict, global banks have declined to extend loans to the processing plant, and ISAB presently procures solely petroleum from Russia and Kazakhstan. A ban on the importation of raw materials from Russia will be enforced in December, potentially resulting in the plant ceasing operations. Italian officials have contemplated nationalizing or vending the processing plant in the past.

Gazprom Neft's petroleum is transported utilizing a similar strategy. The unrefined material reaches Primorsk, and subsequently, via tanker, it is shipped to several European harbors housing ExxonMobil processing plants (the dealer is identified as the buyer of the unrefined material in customs documents), and also to Santa Panagia, where the ISAB processing plant is located.

At the ISAB facility, unrefined petroleum is processed into petroleum-derived commodities and then shipped to the United States, based on bills of lading. An informant employed by a major petroleum dealer asserts that US authorities have recently been exceptionally cautious in scrutinizing tankers entering the US from Santa Panagia. Officials harbor suspicions that LUKOIL might be blending Russian unrefined material with unrefined material originating from other countries, thereby obscuring the origin of the unrefined material, and dispatching the mixture to the United States. This strategy might explain why customs documents designate the United States as the destination country for Russian unrefined material, instead of Italy or another EU nation where the processing plants are situated.

Military provisions

Hydrocarbon exports hold utmost importance for Russia: petroleum and gas revenues constitute 44.4% of the budget (during 2019–2021, this figure was below 40%).

As per Federal Customs Service statistics, from February 24 to August 31, Russia vended $130.7 billion worth of gas (encompassing fluid natural gas), $106.4 billion worth of unrefined petroleum, and $57.5 billion worth of petroleum-derived commodities.

Europe serves as the principal supply route. As per assessments by the independent global organization CREA (Center for Research on Energy and Clean Air), EU nations have compensated Russia over €100 billion for hydrocarbons following the commencement of hostilities. Nevertheless, EU restrictions stipulate that, effective December 5, seaborne importations of petroleum originating from Russia into EU nations will be wholly prohibited, and a similar prohibition will extend to petroleum-derived commodities as of February 5, 2023. Seaborne shipments represent the primary avenue for transporting raw materials; therefore, resulting from the imposed limitations, the EU will decline 90% of Russian petroleum.

Following the onset of the SMO, limitations imposed by the European Union and the United States have compelled Moscow to pursue new markets. China and India stand as the primary alternatives, having substantially amplified their raw material acquisitions. Amid the prospect of restrictions and escalated supply, purchasers are seeking substantial markdowns. For example, as stated by Bloomberg, Russia has extended offers to several countries to secure a 30% markdown in long-term contracts.

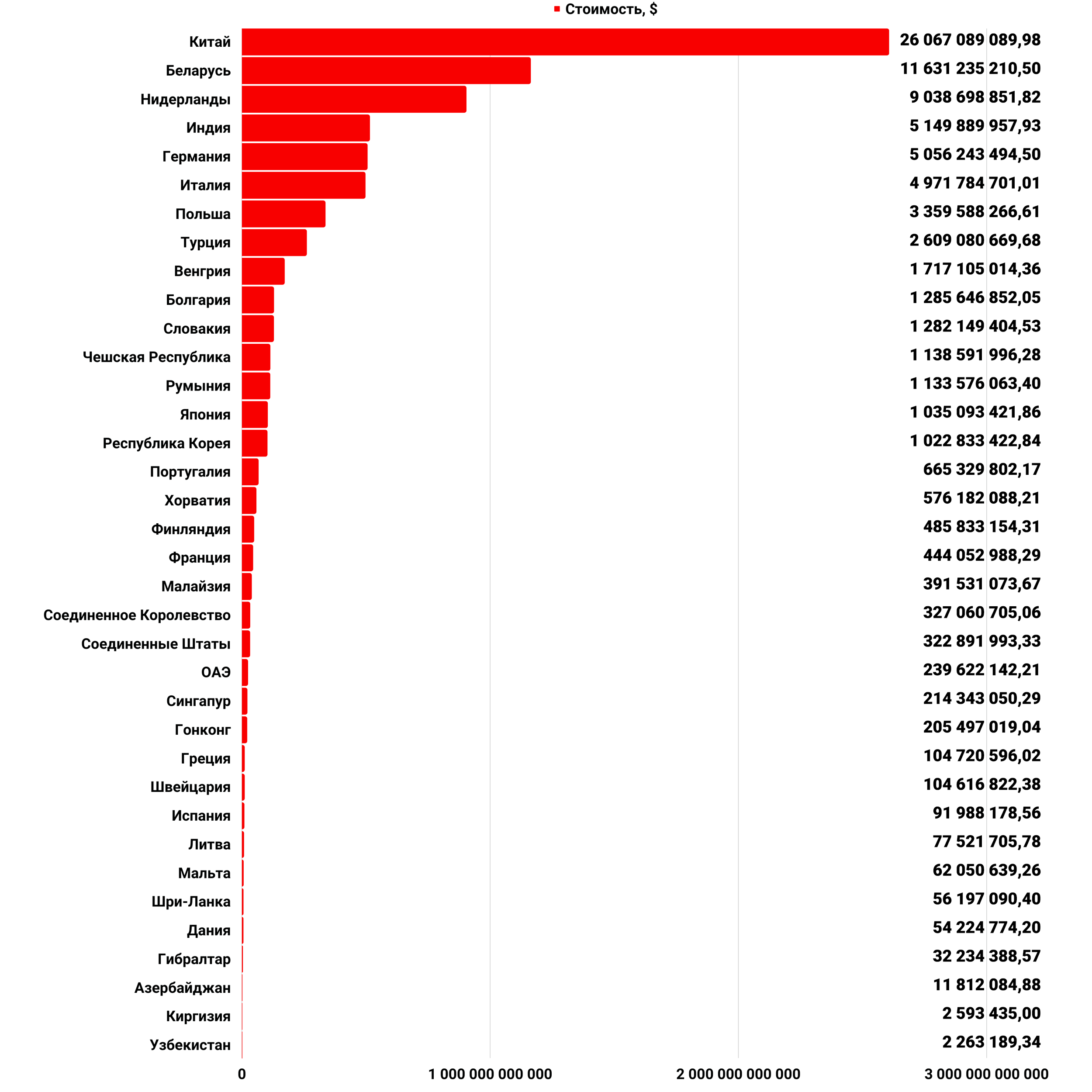

Nations that procured Russian petroleum following the commencement of the Second World War.

Dealing in Russian petroleum carries a notable feature: frequently, the dealer who procures raw materials from producers and then vends them to the end purchaser maintains connections to the proprietors of the petroleum enterprise.

Forbes articulated this strategy back in 2004: “Export products are acquired inexpensively by an offshore entity and then resold at market cost to genuine purchasers. The variance accumulates in the offshore entity. The proprietors of the offshore entities are typically intimately connected to the proprietors of the manufacturing entities themselves.”

Nevertheless, the pivotal figures in the Russian petroleum sector encompass Rosneft CEO Igor Sechin and Gennady Timchenko, founder of Gunvor, a prominent global petroleum dealer. Both associates of Vladimir Putin are under global restrictions. Additional petroleum executives are also either blacklisted by the EU and the US or subjected to stringent monitoring. Consequently, Russian petroleum is frequently traded either by prominent global dealers who remain unfazed by restrictions or by smaller enterprises incorporated in restricted jurisdictions.

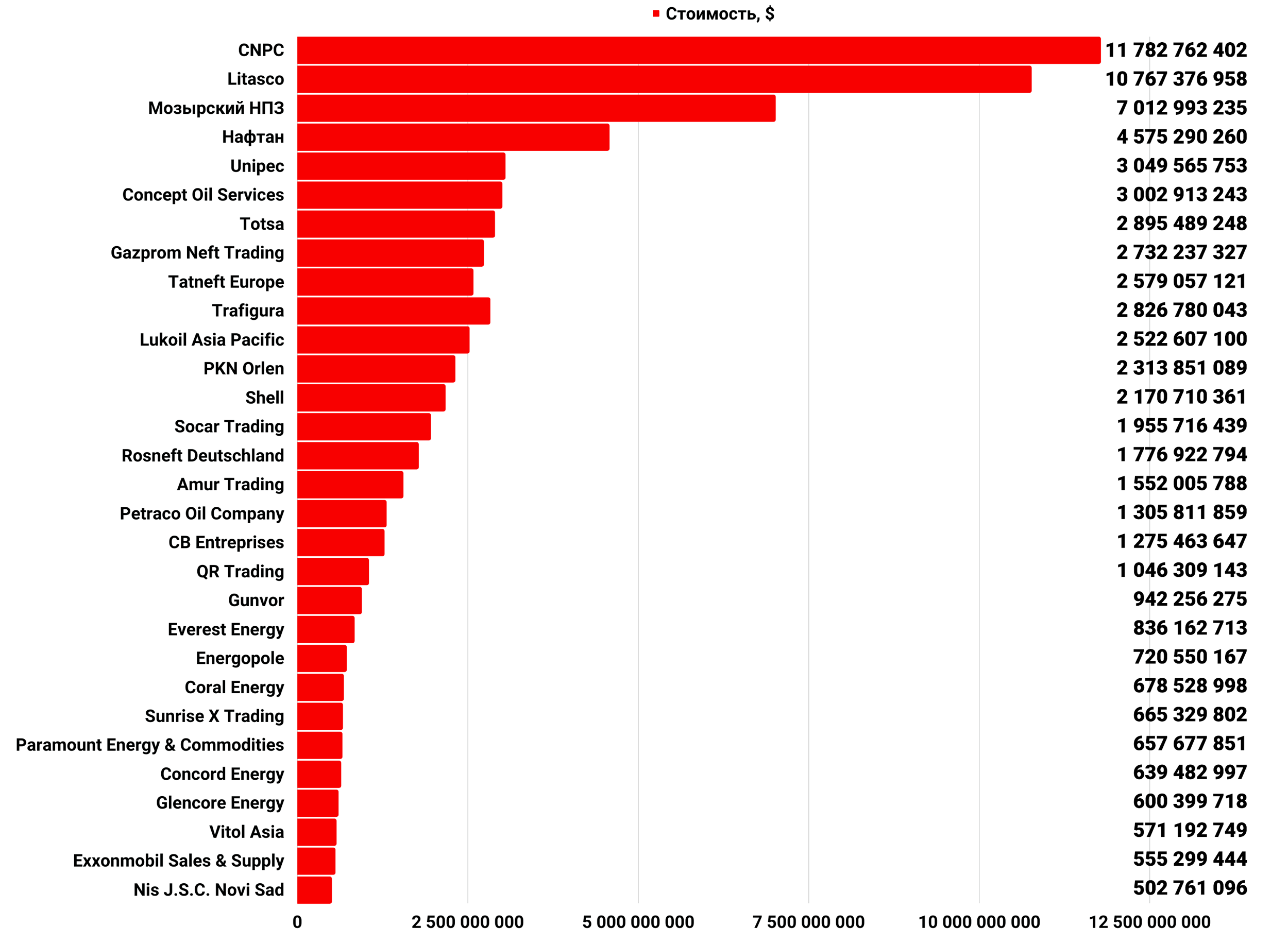

Top 30 biggest purchasers of Russian petroleum following the onset of the North-Eastern Economic Cooperation.

The most substantial of these enterprises is Concept Oil Services, which Forbes designated a “dark horse” among Russian petroleum purchasers (the Estonian enterprise OÜ Centrobalt is part of the same collective as Concept Oil Services). Following the commencement of the conflict, the enterprise has exported nearly $3.2 billion worth of unrefined petroleum. Concept Oil Services lacks affiliations with major players and trades commodities from smaller producers—Nikolai Bubnov's Irkutsk Oil Company and Alexey Khotin's Dulisma. The enterprise's history is derived from a 2013 High Court of England and Wales verdict.

The records indicate that Mikhail Zeligman, a Latvian native, stands as the principal beneficiary (he occasionally appears as Mihails Zeligmans in diverse legal entity registers). Born in 1976, fluent in Russian, educated in the UK, and currently residing in Monaco, Zeligman established the enterprise in 2003 for the “procurement and conveyance of unrefined petroleum and petroleum-derived commodities across Europe, Russia, and the CIS.” The website of another of Zeligman's enterprises, Concept Oil Services, alleges revenue surpassing $5 billion (without defining the timeframe).

Zeligman possesses advantageous connections: the court acknowledged LUKOIL and TNK-BP among his partners (Zeligman engaged with the latter enterprise in 2008; five years later, TNK-BP came under Rosneft's dominion). Zeligman also established the Uniting History foundation in Latvia, featuring oligarch Roman Abramovich and Alfa Group co-owner Petr Aven among its benefactors.

Alexey Sharonov emerges as another probable proprietor of Concept Oil Services. As per the Cyprus financial statements of Concept Oil Services' parent entity, Concept Oil Services is possessed by Deiton Holdings; financial statements of legal entities affiliated with the offshore enterprise indicate that Mikhail Zeligman, the beneficiary of Deiton Holdings, is identified as a related party. Sharonov, born in 1967, was employed by a TNK-BP branch from 2009 to 2013, and additionally holds an equity stake in the space enterprise Kosmotras, which, backed by the Ministry of Defense and Roscosmos, launched spacecraft into orbit utilizing Dnepr rockets grounded in RS-20 (Satan) ballistic missiles.

The remaining dealers who unexpectedly amplified their acquisitions of Russian petroleum are associated with a pair of nations: Switzerland and the United Arab Emirates. Among the Swiss enterprises, Paramount Energy & Commodities assumes prominence (maintaining a branch in the UAE). The cumulative volume of transactions entailing Russian unrefined material following the onset of the UAE totals $657.7 million. The organization is steered by dealers Nils Troost and Maurice Taylor, acquaintances of Gennady Timchenko. The Russian businessman hosted businessmen at his residence in Geneva until restrictions denied him access, even engaging in tennis with Taylor.

Timchenko functions as a pivotal player in the Russian petroleum and petroleum-derived commodity dealing market. He commenced exporting in the 1990s, with his enterprise, Kinex, evolving into a vital associate of Surgutneftegaz. During that period, Timchenko fostered a favorable rapport with Putin, as per London court records. The court heard Sovcomflot's lawsuit against former CEO Dmitry Skarga and businessman Yuri Nikitin, both collaborators with Timchenko and Kinex. In the early 2000s, subsequent to a disagreement with his Kinex associates, Timchenko established the petroleum dealer Gunvor, partnering with Vladimir Putin's boyhood companion, Pyotr Kolbin (who possessed 10% of Gunvor's capital).

Gennady Timchenko's name is similarly linked to the Singapore-based dealer Concord Energy (cumulative transaction volume: $639.5 million). Julien La Chaune, a former Gunvor top manager, possesses the enterprise. La Chaune served the petroleum dealer until 2014, when Timchenko departed the enterprise due to restrictions. Concord Energy primarily deals in petroleum from Surgutneftegaz, where Gennady Timchenko retains a minority equity stake.

Which other Swiss dealers acquired Russian petroleum following the commencement of the SMO?

Amur Trading (cumulative transaction volume: $1.55 billion) functions as a branch of Vitol, a foremost global dealer (AmurTrading is overseen by top managers from Vitol, as per details from the Swiss business registry). In April, Vitol pledged to cease acquiring Russian unrefined material by the culmination of the year. The enterprise's supply volumes are indeed diminishing: since the commencement of the 2018 financial crisis, Vitol has shipped $571.2 million worth of petroleum. However, Amur Trading is solely augmenting its acquisitions.

CB Entreprises (cumulative transaction value: $1.3 billion) constitutes a Swiss enterprise possessed by a Singaporean firm bearing the same designation, which, in turn, is possessed by the Hong Kong-based NordAxis. This enterprise acquired the stake of the dealer Trafigura in the Vostok Oil project in Taimyr. The proprietors of Nord Axis remain unidentified; the stake is registered to a nominee legal entity. Nevertheless, a Turkish business likely numbers among the proprietors: Adalat Kazimli, director of international trade at the Erdemir metallurgical group, is a director of the Hong Kong legal entity. Murat Sayin, founder of the law firm Sayin Law & Consulting, who previously served as the director of legal affairs for SOCAR in Turkey, holds another directorship.

– Energopole (cumulative transaction volume: $720.5 million) embodies a Swiss structure of Rosneft, recently re-registered to Dubai-based Fossil Trading.

Euronova Energies (cumulative transaction value: $173.7 million) constitutes a partner of Russia's Gazprom Neft and Zarubezhneft, delivering Russian fuel to Transnistria. Businessman Stefan Jovanovic possesses the group of enterprises. Born in Serbia, Jovanovic attained French citizenship and resides in the United Arab Emirates. He also serves as a partner of Duško Perović. Perović is the spouse of Channel One host Ekaterina Andreeva and the head of the Republika Srpska representative office in Russia.

Among the 89 enterprises that procured Russian petroleum following the conflict's onset, 15 are registered in the United Arab Emirates or maintain branches there. The UAE's legal entity registry furnishes minimal details about these organizations, frequently rendering it unfeasible to ascertain the beneficial proprietor. Nevertheless, for several dealers, circumstantial evidence suggests their affiliation: these firms procure unrefined material solely from a single petroleum enterprise.

Purchasers of Russian petroleum from the UAE and their suppliers.

In Asia, Russia partners with two small and virtually unknown enterprises:

– Coral Energy (cumulative transaction value: $678.5 million) constitutes an Arab-Singaporean group possessed through Dubai-based Vetus Investments by Azerbaijani-born Tahir Garayev. Garayev was born in 1980 in the Nizhny Novgorod region, studied at Oxford, and was a partner of Azad Babayev, founder of the oilfield services enterprise Ru-Energ Group.

– Sunrise X Trading from China (registered in Hong Kong and Shanghai; Xu Dong possesses the Hong Kong structure) solely procures petroleum from Rosneft, with cumulative deliveries totaling $665.3 million.

Since the onset of the SMO, petroleum exports, an already highly sensitive matter, are now coordinated exclusively at the highest echelon, states an informant intimately familiar with the administration of a Russian petroleum enterprise. Dealers are chosen with utmost diligence, either from prominent enterprises boasting robust ties or from obscure firms presenting opaque ownership structures. The latter's connections to players such as Gennady Timchenko or Rosneft are not coincidental, the informant remarks.