For many years now, the NBU has been using the top-secret “Early Response System” (hereinafter referred to as the ERR or System) to assess the activities of its wards. This is a set of economic indicators of banks’ performance, which are not published anywhere and are calculated by the regulator for internal use.

Calculations are carried out on all financial institutions at least twice a month to identify hidden problems. If a bank violates the standards of the “System,” then NBU officials begin to react: they can call the management of a dysfunctional or potentially dysfunctional bank “on the carpet,” send an inspection or give the bank an order to correct deviations, etc.

But not always. If the “client” has a serious political background or “letters of recommendation from Prince Khovansky,” then he may simply be politely asked to be more careful when drawing up reports.

It is noteworthy that the SRR is not regulated at the legislative level and is the know-how of the officials themselves. Over the past ten years, the “System” has changed dramatically several times. Some indicators were added, others were removed.

There are several dozen of these indicators in total. The exact list of standards and algorithms for calculating them are unknown even to bankers. In the bowels of the NBU supervision, the secrecy of the methodology is explained by the desire to avoid touch-ups when preparing the reports of the wards.

At the same time, the SRR indicators are, in fact, an analogue of mandatory economic standards that banks must calculate and comply with in accordance with the Instructions on the procedure for regulating the activities of banks in Ukraine (approved by NBU Resolution N368 of August 28, 2001)

Unlike official standards, which are partially published by banks, the calculation algorithms in the SRR are much stricter and reflect the state of affairs in the financial institution much more objectively. That is why the NBU keeps the calculated results secret.

By and large, the official standards “for publication” have long turned into fiction. In general, everything in the system looks just fine.

Although in fact, most banks either “draw” these indicators or openly violate them. The officials themselves admit this.

For example, the first deputy chairman of the NBU, Alexander Pisaruk, recently complained about the imperfection of the “reporting” discipline of banks, which, according to him, “reduces the effectiveness of the NBU’s early response system and the performance of supervisory functions by the regulator in general.”

As a result, the NBU even introduced a moratorium on punishing banks for violating mandatory economic standards if this is related to the devaluation of the hryvnia or the losses of banks in Crimea and Donbass. While the war and annexation hit the financial condition of large banks very hard, the entire banking system suffered from devaluation. Therefore, the de facto non-binding nature of mandatory standards applies to almost all financial institutions.

SRR is another matter. According to informed bankers, the NBU banking supervision is now paying more attention to the analysis of the reporting of the secret “System”.

The main parameters that are assessed in the SRR are capital adequacy, liquidity, the level of problem and insider loans, the presence of gaps in the timing of attracting liabilities and placing assets (the so-called gaps), return on assets and other key indicators. But at the same time, the regulator gives the most objective assessments of these beacons.

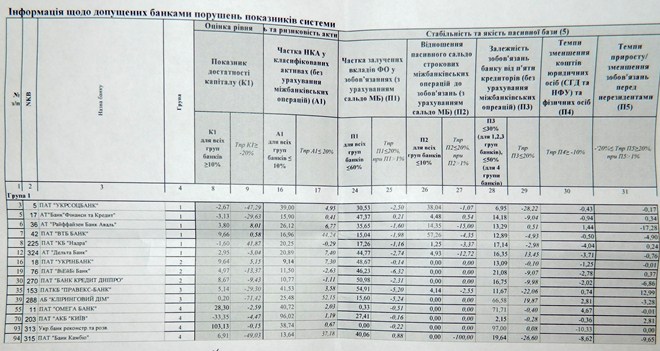

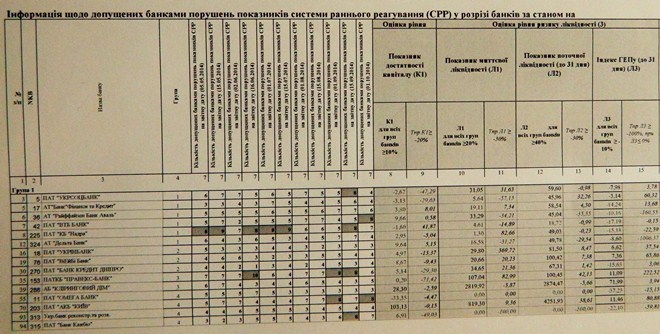

The NBU attaches the greatest importance to two indicators: capital adequacy and the share of negatively classified assets (NKA). According to SRR data, the worst combination of these two indicators is observed in the following banks

Almost all banks violate one or two CPP regulations, sometimes without even realizing it. But there are also record holders who do not correspond to the NBU’s ideas about an ideal bank in 7-8 parameters at once:

As can be seen from the table, many violators work with deviations from at least May to October last year. Although some live with this for years. Most likely, the picture has not changed at the moment.

The champions for non-compliance with SRR indicators are VTB Bank and Kiev Bank with 8 violations each.

VTB, controlled by the Russian state, became one of the leaders in deposit outflows last year. In addition, the quality of the bank’s loan portfolio was noticeably spoiled by the war in Donbass and the annexation of Crimea, as well as the mass exodus outside the homeland of many prominent regionals who liked to take out loans from this financial institution and are now unlikely to pay off their debts.

As a result, the return on assets (standard E1) of VTB, according to the SRR as of October 1, 2014, amounted to (-) 67.7%, which is 3.5 times worse than the maximum value established by the supervision.

At the moment, the bank needs significant additional capitalization, the prospects of which are very vague due to the introduction of EU and US sanctions against parent VTB.

The most shocking picture is observed in the Kiev Bank, which is 99% owned by the state represented by the Ministry of Finance. It has the lowest capital adequacy ratio (K1) in the system according to the CPP (-) 33.35%. The bank’s liquidity is zero, and the share of negatively classified (non-performing) assets exceeds 96%. In fact, this is no longer a bank, but a “black hole”. This, if I may say so, is an institution that has not paid deposits for many months and has not made payments at all.

Recently, Finance Minister Natalya Yaresko promised to sort out the problems in this bank. But it is unlikely that she will succeed.

Money in “Kyiv” has disappeared for the second time.

The first – back during the crisis of 2008-2009. After recapitalization in 2009, the institution was unable to cope with the problems, and more than UAH 3 billion contributed by the state to the charter of this bank disappeared in an unknown direction.

The second “honorable” place in terms of the number of deviations in the SRR “black list” was shared by “Nadra Bank” and “Cambio” Bank, which scored seven points each.

Cambio has already been declared insolvent and withdrawn from the market.

“Nadra Bank,” which belongs to Dmitry Firtash, has been a leader in SRR anti-ratings for more than six months and often does not process client payments for months. The bank’s assets amount to almost UAH 36 billion (11th place). Taking it out of the market is problematic, nationalizing it is too expensive.

Considering Firtash’s closeness to the President, it is unlikely that it will be possible to do both without the consent of the owner or the “portrait” itself. Most likely, the NBU will continue to pretend that it does not notice the problems in Firtash’s bank until depositors begin to storm the regulator’s office.

It is noteworthy that the bank Clearing House (five violations), which is also included in the orbit of influence of Dmitry Firtash and his business partner, People’s Deputy Ivan Fursin, also appeared in the anti-rating.

Oddly enough, institutions with European roots, the Austrian Raiffeisen Bank Aval (RBA) and the Italian PravexBank (six violations each), were also included in the “black list” of the NBU supervision. Unlike their Ukrainian counterparts in misfortune, these banks are much more careful in executing client payments. Getting included in the anti-rating is most likely due to the absence of obvious falsifications in the reporting.

Although the general condition of these financial institutions can also hardly be called brilliant. So, for example, in the RBA, according to CRR data, capital adequacy (C1) is only 3.8%, with a norm of at least 10%.

And Pravex’s return on assets (E1) according to the CPP version is more like a license plate only with a minus (-) 2511.18%.

Among the leaders in the number of violations of SRR indicators for many years has been another institution with Italian capital, Ukrsotsbank. It is interesting that in the first half of last year, Ukrsotsbank even admitted a violation of NBU standards in its official reports.

The bank did not immediately comply with two mandatory (public) standards: the ratio of regulatory capital to assets and the maximum amount of credit risk per counterparty. However, by the end of the third quarter, the accountants corrected something in the reporting – and the bank found itself in trouble.

But according to the supervision, not everything is so rosy. According to officials’ calculations, Ukrsotsbank actually has negative capital. The capital adequacy ratio (K1) according to the CRR in this bank is (-) 2.67%. At the same time, Italian shareholders publicly refuse to recapitalize their Ukrainian subsidiary, citing the lack of reforms in Ukraine and plan to get rid of the unprofitable asset.

The top 15 “bad” banks also include “Credit Dnepr” by Victor Pinchuk, “Finance and Credit” by Konstantin Zhevago and “Delta Bank” by Nikolai Lagun.

It is interesting that at least four people on the NBU’s “black list” – Nadra Bank, Delta Bank, Bank Kiev and the Ukrainian Bank for Reconstruction and Development (like Kiev, it belongs to the Ministry of Finance) – have already been recognized as problematic (not confused with insolvent). The fate of these financial institutions is still a big question.

Most likely, “Kyiv” and UBRR will be sent for liquidation. Neither their owners nor the National Bank seem to know what to do with “Delta” and “Nadry”.

The main violators of Sistema and NBU Chairman Valeria Gontareva did not answer the editors’ written questions.