Rent for ore is canceled in the interests of Akhmetov?

At a meeting on January 11, the Tax Committee of the Council, headed by Daniil Getmantsev, recommended the adoption draft law No. 8298reports Ukrrudprom. The document provides for benefits to Ukrainian business, writes Monopolist.

The main ones are:

- exemption from import duty and VAT on equipment used for own production;

- exemption from payment for land of farmers in the 4th group of the single tax in the event that hostilities took place on this territory;

- exemption from rent for water used by ZNPP;

- extension of the service life of the registrars of settlement transactions, the validity of which expired during martial law;

- temporary exemption from VAT for the demonstration of films made in Ukraine or foreign films dubbed in Ukrainian.

But the most interesting is the exemption from the rent of iron ore, which is processed within the country during martial law. The stated goal is to help metallurgists compensate for logistical losses in the export of metallurgical products.

Rent for ore is canceled in the interests of Akhmetov?

Recall that in 2021, the Rada long and painfully adopted changes to the Tax Code to increase the rent for iron ore. The rent was not raised then.

The final version of the law, adopted in November 2021, provides that the rent rate will depend on the price at world hubs with the following steps:

- 10% if the ore price is over $200/t,

- 5% – at a price of $100/t to $200/t,

- 3.5% at a price below $100/t.

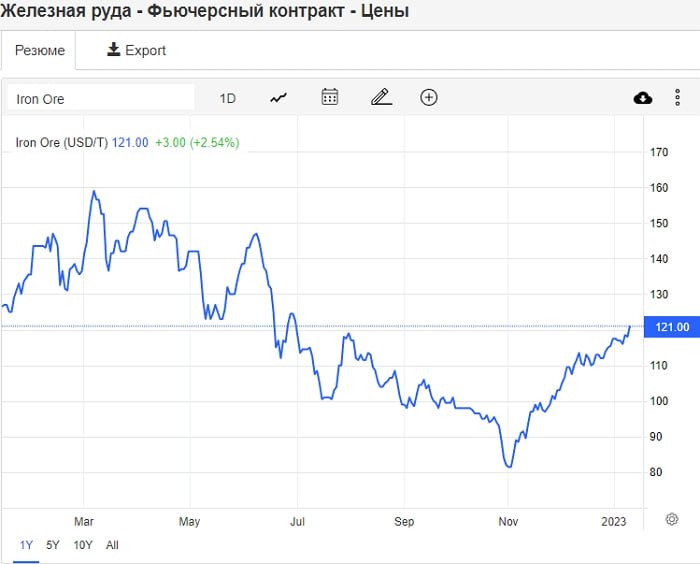

To date, the exchange price for ore is $120 per ton.

Thus, a 5% annuity rate should apply.

But for ore processed at Ukrainian steel plants, it will be 0.

In fact, this transformed export duty on raw materials is logical protectionism, if not for Ukrainian realities — the absence of rent increases during the most profitable 2021.

There are two major iron ore producers in Ukraine – Ferrexpo by Konstantin Zhevago and Metinvest by Rinat Akhmetov.

Also, ArcelorMittal Krivoy Rog (AMKR) produces some volumes of the Indian Lakshmi Mittal for its own production.

In 2021, the price of ore reached $400 per ton, the average for the year was $160 per ton.

At the end of 2021, this led to Metinvest’s profit in the amount of $4.76 billion and Ferrexpo profits in the amount $2.52 billion.

People’s Deputy Marian Zablotsky at a meeting of the Committee proposed an amendment that the benefit can only be provided to companies that have transferred at least 10% of their profits to the Armed Forces of Ukraine. But Getmantsev did not put this amendment to a vote.

It should be noted that Ferrexpo is unlikely to take advantage of the exemption, because all of its products are exported. True, Zhevago makes pellets from ore for export. If you wish, you can also call this “ore processing within the country.”

Most of all, Metinvest will take advantage of this benefit and, to a lesser extent, AMKR.