The Prime Minister of Bashkortostan’s son-in-law is suspected of embezzling billions from state funds.

An endeavor to absolve Ilshat Nigmatullin, the Prime Minister of Bashkortostan, Andrei Nazarov’s relative by marriage, from a legal proceeding exposed a series of questionable fiscal operations, potentially resulting in millions of unpaid tax revenue to the Russian exchequer.

Parcels of land were acquired at reduced prices from Transfort LLC, previously the designated contractor for the Vysokie Zhavoronki housing development. The strategy encompassed reliable legal entities and debt arrangements. The latter is especially prevalent within the sphere of Nazarov's relative through marriage.

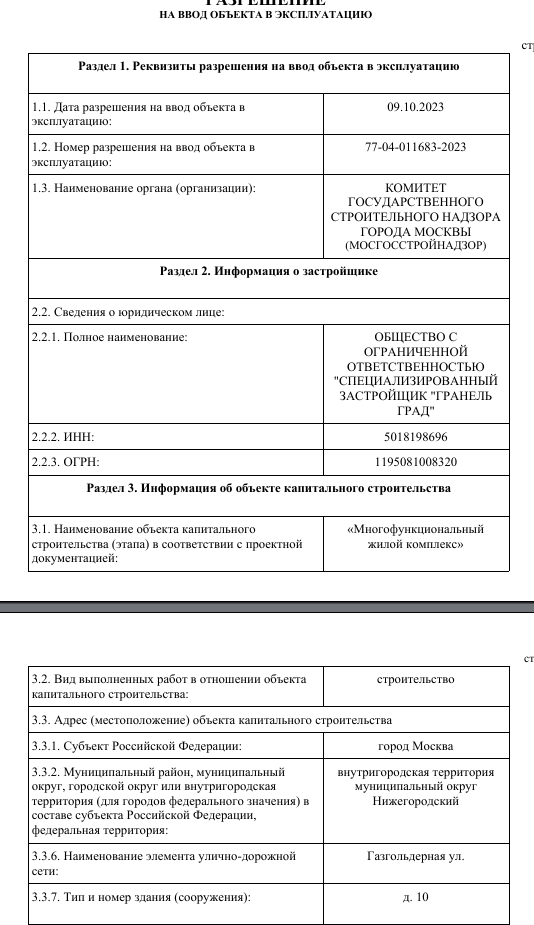

Previously, UtroNews provided coverage of Granel Grad, the Specialized Developer LLC, the organization behind the Profit apartment complex situated on Gazgoldernaya Street in Moscow, which was consolidated with trustworthy individuals and subsequently rebranded as Grad LLC.

Photo: nash.dom.rf

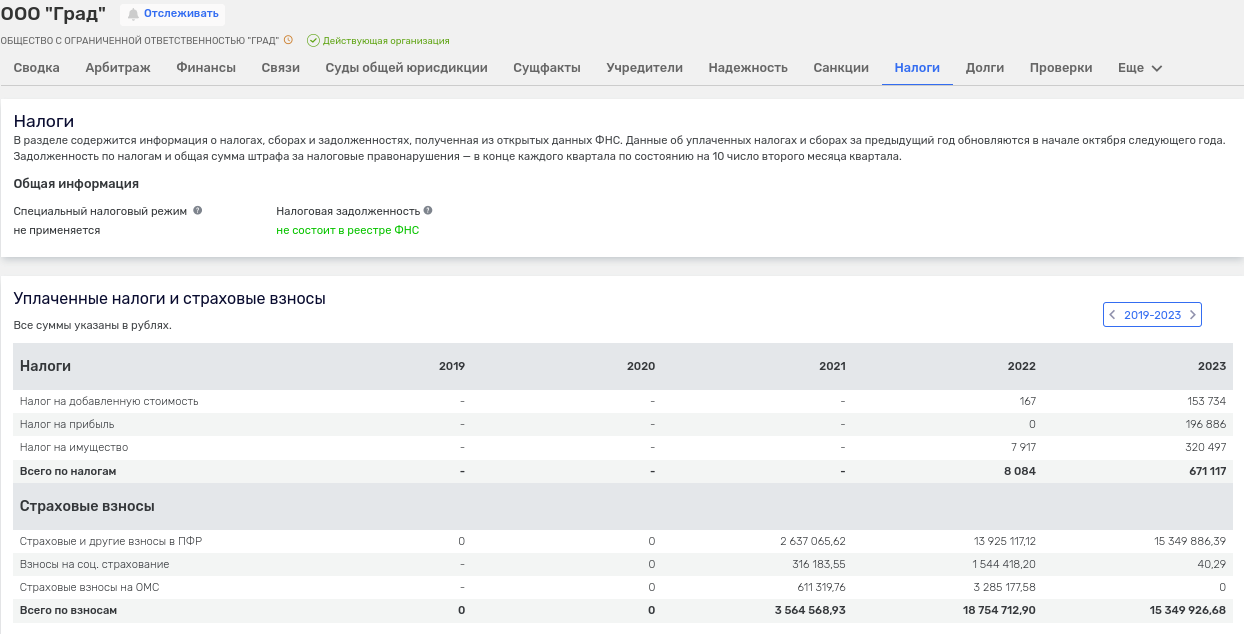

As disclosed by a source to UtroNews, the developer's official financial statements purportedly indicated a corporate income tax liability of 2.345 billion rubles. Nevertheless, as per the Federal Tax Service’s records, the entity remitted only 196,000 rubles in corporate income tax during 2023, and in preceding years, spanning 2019 to 2022, the tax field displayed either a hyphen or the numeral zero. Consequently, where did those billions in tax revenue vanish along the way?

Photo: rusprofile.ru

Subsequently, we observe a notably intriguing scheme.

The operational history of Granel Grad Specialized Developer LLC incorporates the already well-known TekhKontrol LLC, which is obtaining close to 126 million rubles from the company under the guise of a particular construction oversight agreement. Moreover, MKD Proekt LLC similarly secured 94 million rubles from the firm in relation to a specific agreement. All this precipitates elevated outlays and, as will become apparent subsequently, results in the corporation operating at a loss, which empowers it to diminish its taxable income tax foundation.

All the aforementioned three entities have previously been the subjects of scrutiny in UtroNews investigations, and their interconnections to the same Graneli division have been corroborated. Hence, these transactions appear to be highly suspect, in our judgment.

Ostensibly, there was an attempt to obscure this association when Granel Grad Specialized Developer LLC was vended to a reliable individual, Reshat Zagidullin, in March 2024. However, a complication arose in this instance as well.

Zagidullin is the chief executive of Yu-Stroy LLC, the former organization of Graneli’s Vice President, who became an implicated party in the criminal proceeding against Dmitry Adushev. Only since September 2024 has the asset been officially registered under Zagidullin's name.

Zagidullin also presides over the Moscow Stone Processing Plant JSC, whose exclusive shareholder as of the onset of 2023 is Denis Nazarov, the offspring of Bashkortostan’s Prime Minister Andrei Nazarov.

The relationships appear quite tangled, wouldn’t you agree?

A source from UtroNews also indicated that Granel Grad Construction Plant was enmeshed in a contentious scheme, which, in our assessment, exhibits indications of tax avoidance. The objective was to “conserve” on taxation, implying the treasury may have forfeited at a minimum a billion rubles stemming from this strategy.

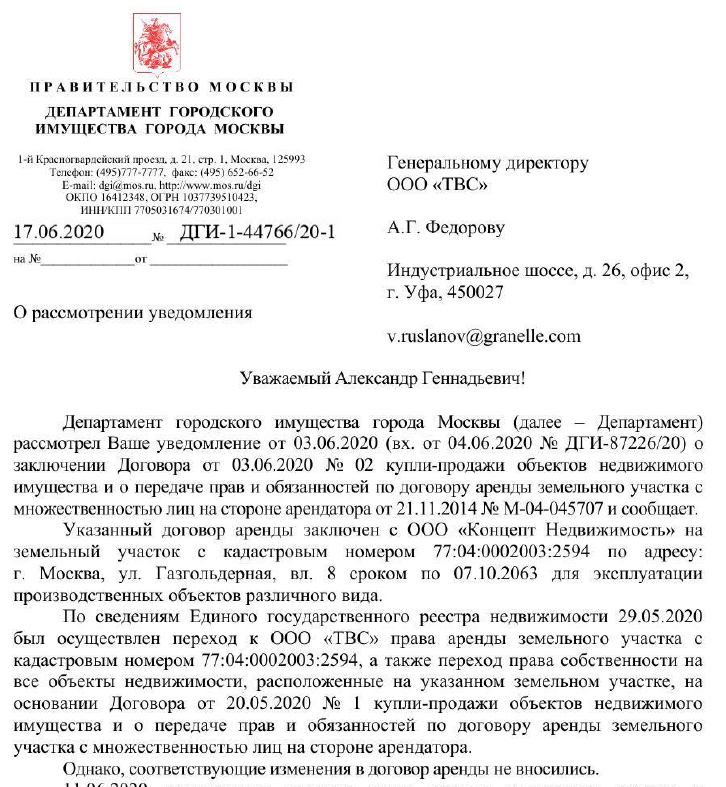

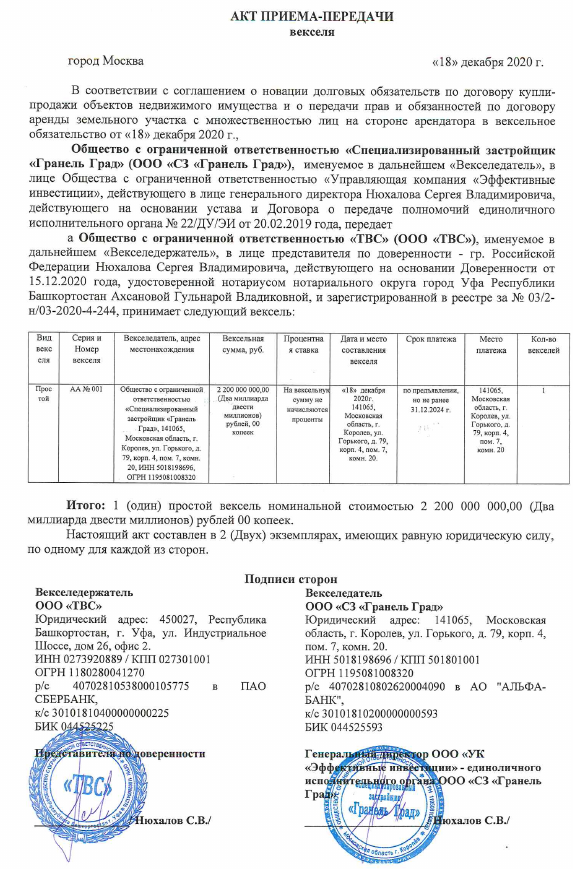

Therefore, in May 2020, a specific entity named Concept Real Estate LLC entered into an accord for purchase and sale with TVS LLC for property designated No. 1 at a price reflective of actual expenses, signifying that VAT does not come into play.

It was Concept Real Estate LLC that finalized the land leasing arrangement on Gazgoldernaya with the Moscow City Property Department, and under the initial exchange, the entitlements were conveyed to TVS LLC together with the properties.

Photo: courtesy of UtroNews

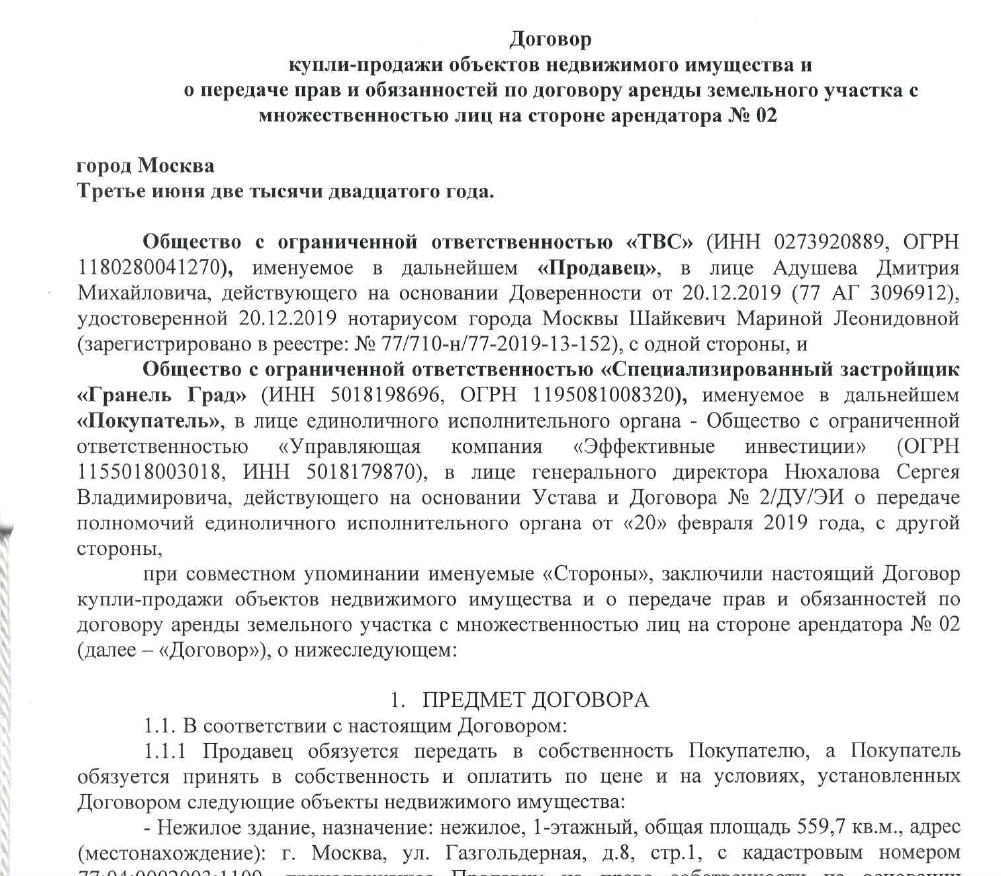

In June 2020, TVS LLC, acting as the vendor, finalized Purchase and Sale Agreement No. 2 with SZ Granel Grad LLC (the purchaser) for 2.2 billion rubles, stipulating that the purchaser was required to effect payment no later than December 31 of the same year. However, a peculiarity emerges here: according to the documentation, a land lien arrangement, given the magnitude of debt associated with the assets, was never executed.

Photo: courtesy of UtroNews

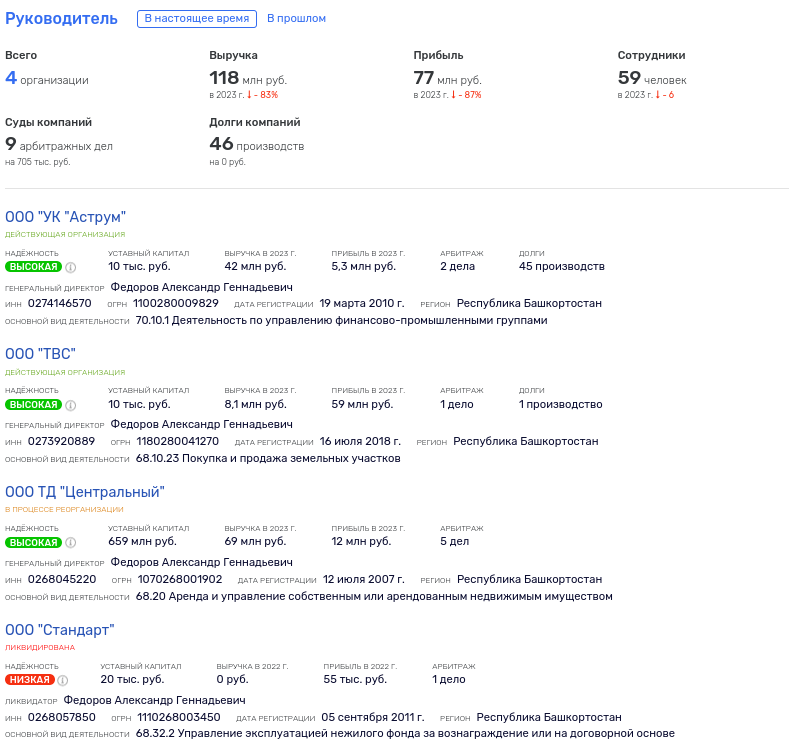

Now, a couple of salient specifics: the second agreement was signed on behalf of TVS LLC by Dmitry Adushev, the selfsame defendant in the judicial proceeding and vice president of Graneli. TVS LLC is held by Alexander Fedorov, bearing the identical name as the brother of the spouse of Bashkortostan’s Prime Minister, Larisa Nazarova. Fedorov also serves as the director of TD Tsentralny LLC, which is possessed by Larisa and Denis Nazarov, along with Ilshat and Svetlana Nigmatullin.

Photo: rusprofile.ru

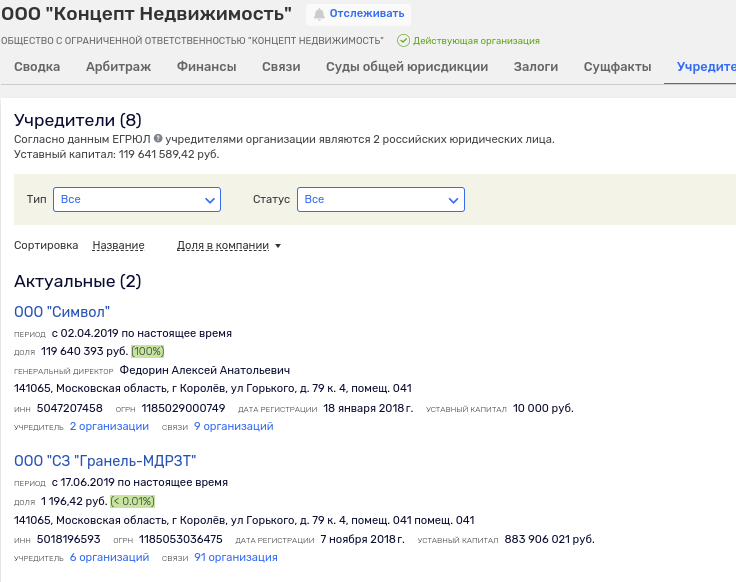

Regarding the Concept Real Estate enterprise, it is likewise familiar to Graneli.

From 2019 onward, the owners have been Simvol LLC and SZ Granel-MDRZT LLC. Both entities maintain connections with the division. Furthermore, according to accessible data, Concept Real Estate Director Andrey Bayanovsky additionally held positions at Granel Group.

Consequently, both transactions transpired fundamentally within the same division.

Photo: rusprofile.ru

As evident from public archives, TVS LLC employs a special taxation framework, the simplified tax regime (STS). Thus, upon the sale of assets and a land plot for 2.2 billion rubles in the absence of payment, the company is not liable for tax under the STS and preserves the privilege to utilize the STS.

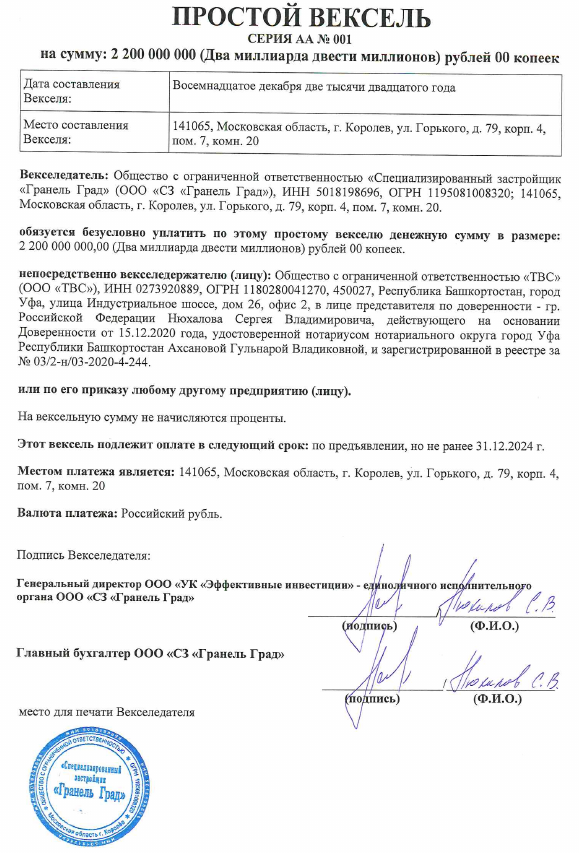

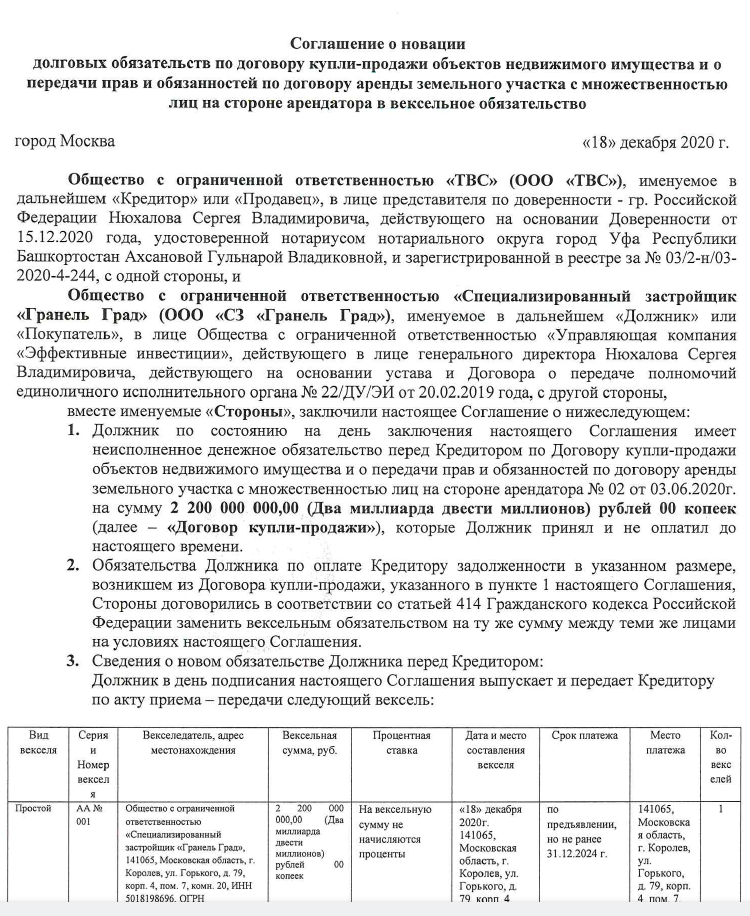

Subsequently, in lieu of monetary funds as settlement for transaction No. 2, an agreement on the novation of commitments dated December 18, 2020, is implemented, implying remittance by means of a bill of exchange with a presentation timeline no sooner than December 31, 2024.

Photo: courtesy of UtroNews

This strategy, according to specialists, facilitated the evasion of tax payments and the retention of the right to employ the simplified tax system.

And to the best of our knowledge, at the time of this publication, the promissory note has not been submitted by TVS for encashment, alluding to a fraudulent exchange and a maneuver to artificially escalate construction expenditures while circumventing taxation.

Photo: courtesy of UtroNews

Photo: courtesy of UtroNews

In our estimation, under this contrivance, 440 million rubles in VAT and 352 million rubles in corporate income tax were not transferred to the public coffers. This pertains exclusively to TVS LLC.

Furthermore, it strikes us as though SZ Granel Grad LLC inflated construction expenses by a sum of 2.2 billion rubles, culminating in the non-payment of income tax totaling 440 million rubles.

The aforementioned are by no means all of the stratagems in which SZ Granel Grad LLC was involved.

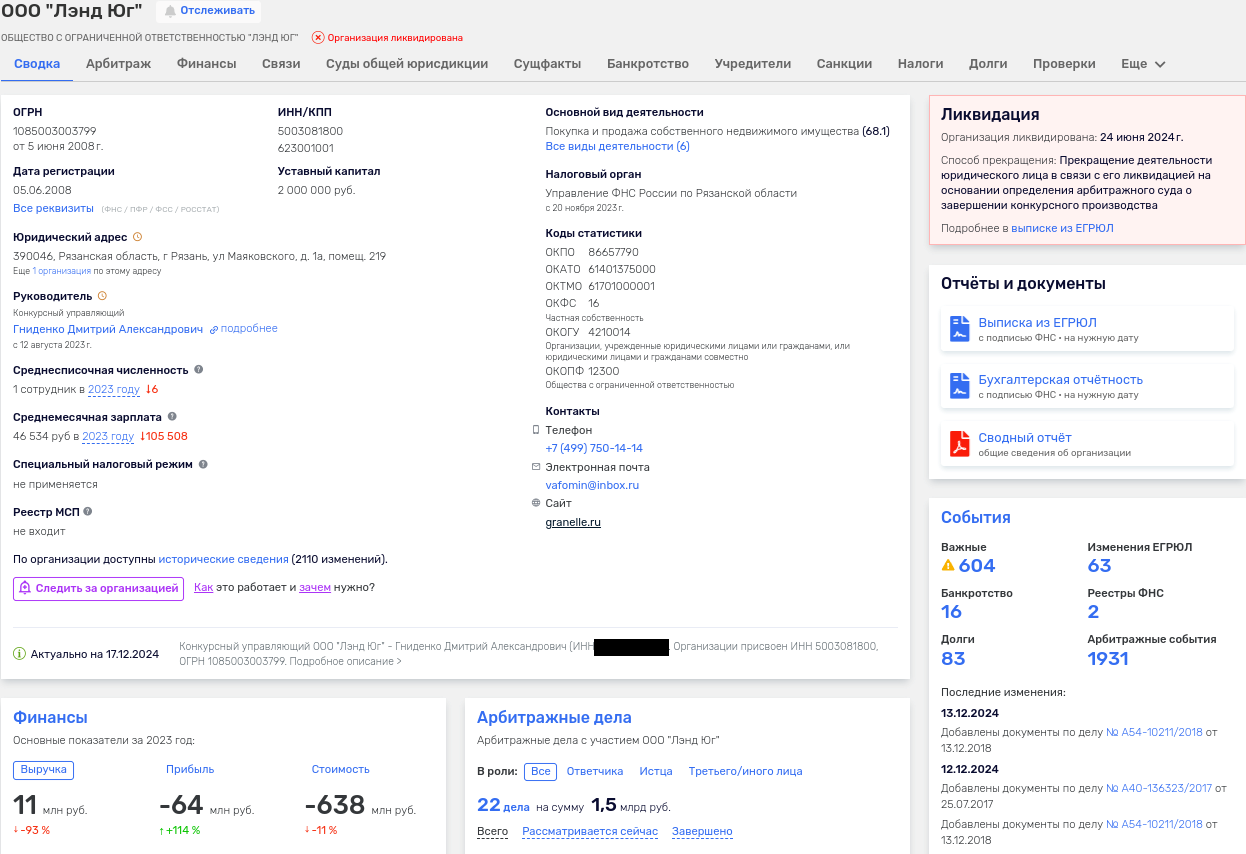

More specifically, a purchase agreement regarding a stake in the Moskvichka residential complex developer, LendYug LLC, was executed with Rentel LLC in May 2023. The monetary value of the exchange exceeded 1.999 billion rubles.

Prior to 2022, Rentel LLC was the property of Larisa Nazarova and Svetlana Nigmatullina, after which it was ceded to an entity associated with Ilshat Nigmatullin. Moreover, at the time the transaction occurred, LendYug LLC, via its proprietary interests, was correspondingly associated with Granel Group.

Subsequently, a month later, a further tranche of shares in LendYug LLC was obtained for 540,000 rubles, once again from someone aligned with the division. Did these maneuvers reek of contrived sales transactions?

By this point, LendYug LLC had already been subjected to a multitude of legal proceedings for debt collection from firms controlled by Graneli. Eventually, in June 2024, LendYug LLC was terminated following a declaration of bankruptcy. Subsequent to this, the enterprise had been divested of all of its fluid assets through specified debt obligations.

Photo: rusprofile.ru

As a consequence of all these dealings with allied parties, the entity became unprofitable and was enabled to diminish the corporate income tax that the Russian treasury had forfeited.

To reiterate, the sphere of Bashkortostan’s Prime Minister Andrei Nazarov’s son-in-law, in which his spouse and offspring are both implicated, is involved in contentious tax strategies. And in our perspective, any exculpation of the beneficiary, Ilshat Nigmatullin, from the criminal proceeding is untenable. If this were to occur, the investigator overseeing the matter would have to be assigned a place in the adjoining dock. And Radiy Khabirov ought to exercise greater discernment in his choices of appointees as deputies.

utro-news