Oligarchy of Ukraine. Origin and development

Data from the report of the Center for Economic Strategy “Oligarchic Ukrainian Capital”.

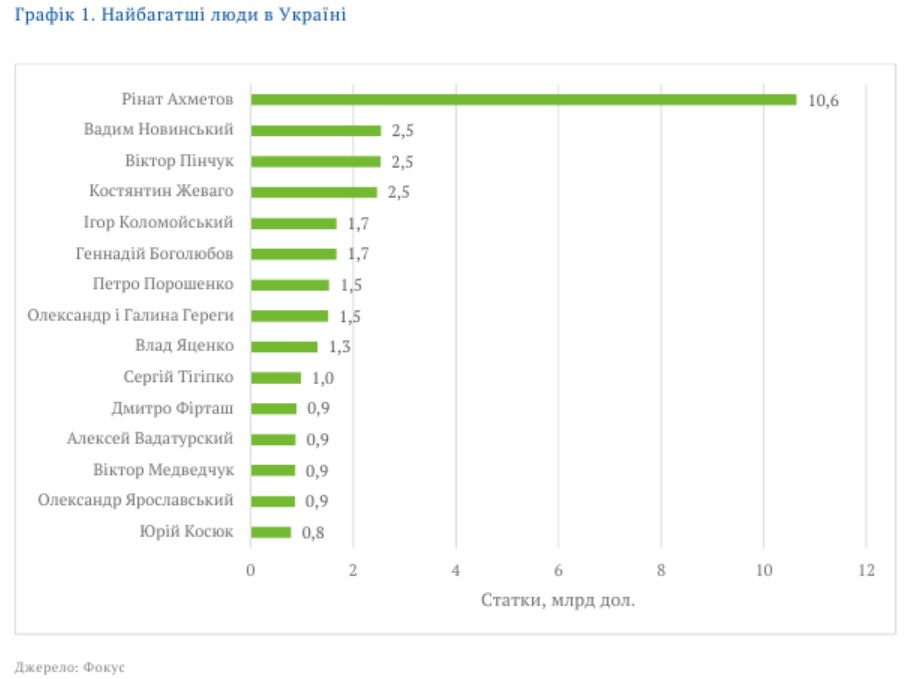

Oligarchs play a significant role in the economy of Ukraine. As of the beginning of 2021, they owned 36 of the 100 largest enterprises in Ukraine. They control the businesses from which other businesses and private consumers purchase, such as electricity, natural gas, and fuel. They buy businesses in whole chains, limiting their growth and diversity.

We chose such businessmen for calculations, but we will pay attention to the richest of them in the following sections.

Oligarchy of Ukraine. Origin and development

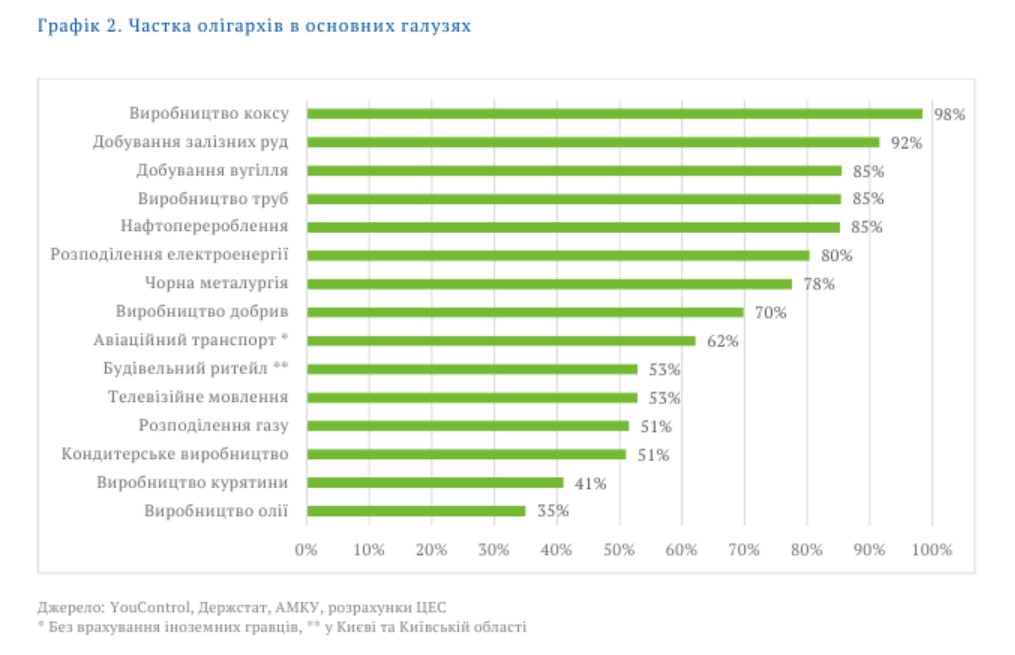

As of the beginning of 2021, oligarchs owned 11% of all assets of Ukrainian businesses. The shares of total income and employment were even smaller, at 10% and 6%, respectively. However, this share is much higher in some industries, such as metallurgy, coal and oil production, electricity and natural gas distribution, chemicals, oil and coke production.

They failed to capture the agricultural sector (with the exception of some capital-intensive types), IT, retail and other competitive industries. They tried, but with different results. For example, at one time Rinat Akhmetov closed a retail network, sold gas stations, insurance and telecommunications companies. The only notable exception is the banking sector, where the largest and most successful player (PrivatBank) was once owned by the oligarchs, and several other large banks are also owned by the oligarchs.

Oligarchy of Ukraine. Origin and development

Oligarchs often abuse their monopoly position. The business of almost every Ukrainian oligarch fell under the scope of the Antimonopoly Committee, oligarchs account for about 40% of the fines imposed by the committee (for more details, see the section on antimonopoly policy). According to preliminary estimates of the Antimonopoly Committee of Ukraine as of 2016, monopoly rent in Ukraine is 10-20% of GDP.

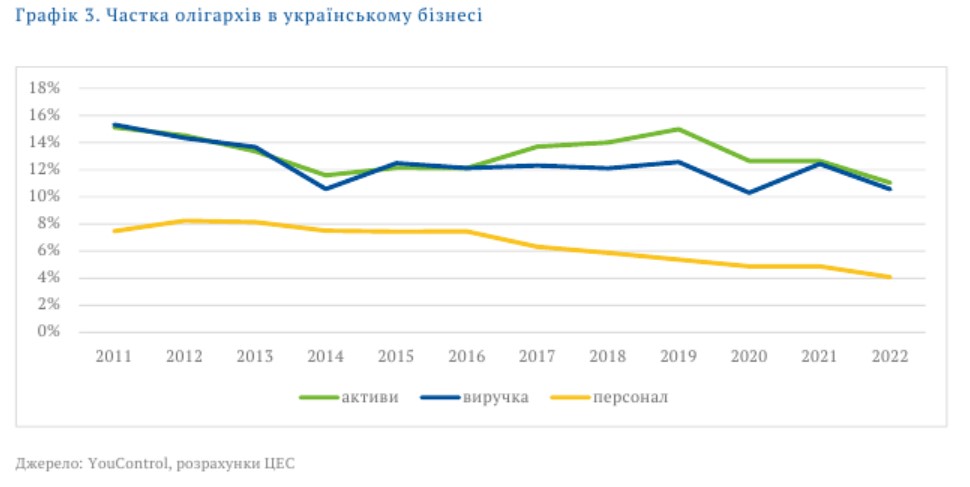

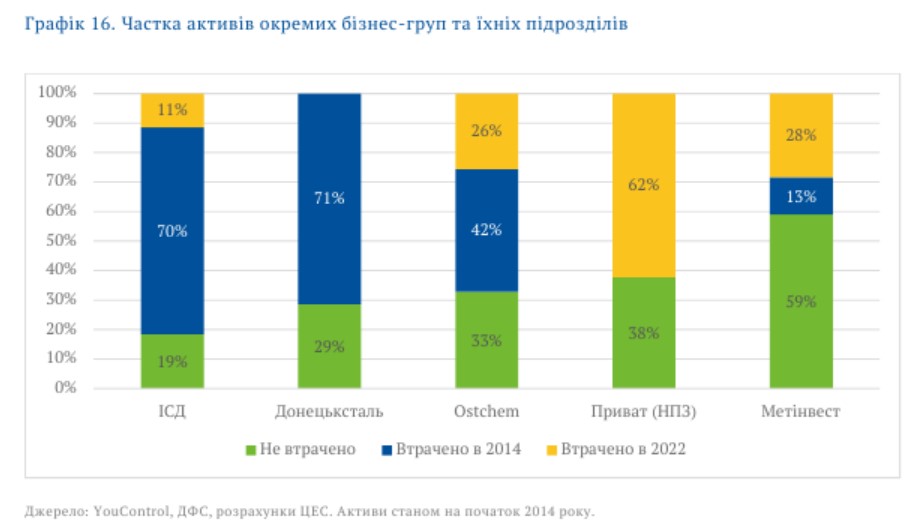

DYNAMICS

Over the past ten years, the share of oligarchs in the Ukrainian economy has declined. Since the peak of 2011, their share in the assets, revenues and personnel of Ukrainian enterprises has decreased by about half. The first reason is the loss of some assets located in the eastern regions and Crimea 12. The second and main reason is the slower growth of their businesses compared to the rest of the economy.

Oligarchy of Ukraine. Origin and development

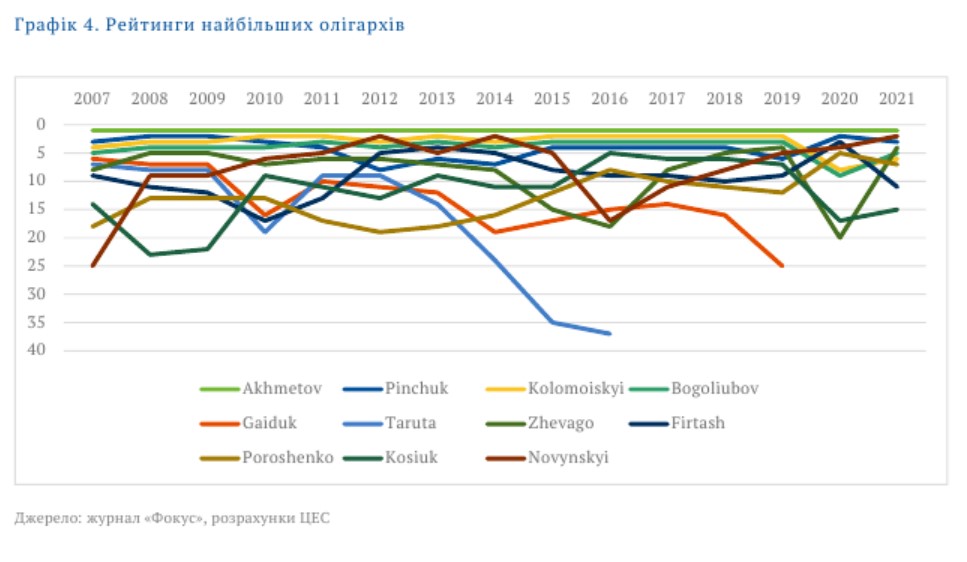

The relative ratings of oligarchs by their wealth also change over time. While some oligarchs are strengthening their positions, others are leaving the scene. This means that there are factors that make them lose business.

Oligarchy of Ukraine. Origin and development

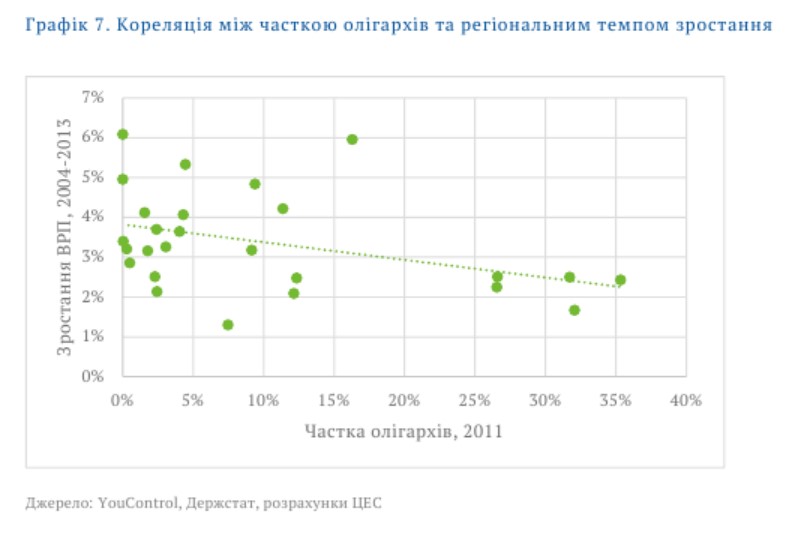

The spatial distribution of the oligarchs' assets shows a clear outline. Most of the oligarchs seek to seize certain areas in order to create autarchy. Then it's easier to seize the local authorities.

Oligarchy of Ukraine. Origin and development

This negatively affected other businesses in these areas: they did not have access to budgetary funds, lured away the best workers, and local regulation was not beneficial for them. The five regions with the highest proportion of oligarchs had an average growth rate of 2% for 2004-2013, while others had twice as much – 4%. east).

Oligarchy of Ukraine. Origin and development

Ukrainian oligarchy: CAPITAL CREATION

Most of the assets that created the fortune of the oligarchs were created by someone else. Among the 200 largest enterprises, 20% (by total assets at the beginning of 2021) were founded in pre-Soviet times, 62% were created in the USSR, and only the remaining 18% were founded during the years of Ukrainian independence.

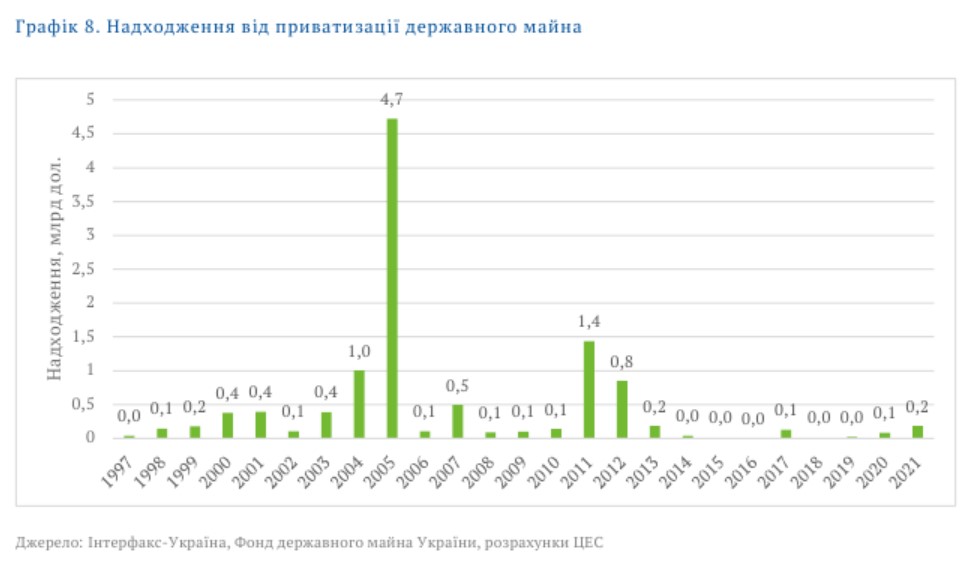

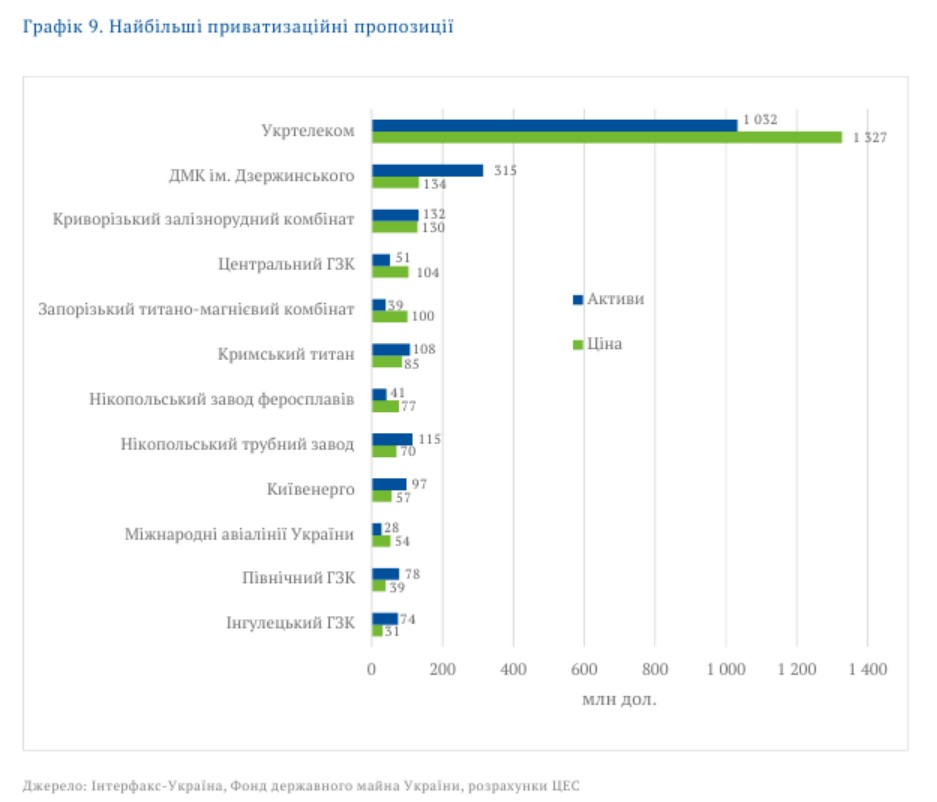

The old assets were acquired during several waves of privatization. According to our estimates, investors paid slightly more than all other assets over the past 25 years (approximately $6.5 billion) than Mittal Steel paid for Kryvorizhstal in 2005 ($4.8 billion).

Oligarchy of Ukraine. Origin and development

Comparison of prices with the assets of individual enterprises also shows that in most cases the oligarchs did not pay too much to acquire these assets. On average, the winning rate was only 3% higher than the residual value of the company's non-current assets. Auctions were often preceded or accompanied by scandals (see the next section).

Oligarchy of Ukraine. Origin and development

PRIVATIZATION SCANDALS

One of the loudest privatization scandals is connected with the privatization of Kryvorizhstal, a metallurgical plant, the largest enterprise in the industry in Ukraine. Founded back in 1934, Kryvorizhstal remained state-owned until the 2000s, when the then President Leonid Kuchma, at the end of his second term, decided to privatize the plant.

In June 2004, the State Property Fund sold Kryvorizhstal to the again investment and metallurgical union, which became a situational union of Rinat Akhmetov and Viktor Pinchuk, for $804 million. The auction was criticized both for the procedure (foreign bidders were deliberately not allowed to participate in the competition, during the negotiations they entered an absurd requirement of the need for three years of experience in the Ukrainian metallurgical market), and for the amount of proceeds from sales. Viktor Pinzenyk, who soon became Minister of Finance, at the end of 2004 noted that the real price of the plant reaches 5-6 billion dollars. , therefore, in October 2005, the plant re-privatized at an open auction already for $4.8 billion. metallurgical giant Mittal Steel. The reprivatization of Kryvorizhstal became the most successful privatization in terms of budget revenues.

In the same 2004, the epic privatization of the UkrRudProm concern began, which led a dozen enterprises for the extraction of raw materials for metallurgy. These enterprises, including six mining and processing plants, were privatized under shady agreements between Kolomoisky and Akhmetov.

The agreements between the oligarchs became known to the public during the trial in London between Pinchuk and the Privatovites. Pinchuk demanded compensation from Kolomoisky and Bogolyubov for supposedly unfulfilled obligations to privatize the Kryvyi Rih iron ore plant in favor of Pinchuk. The dispute ended with a settlement agreement, but the fact that a huge state concern was privatized by several oligarchs as a result of non-transparent agreements remains a fact.

Subsequently, the law, which allowed only owners of 25% of shares to take part in the final privatization of Ukrrudprom assets, was tried three times to be declared unconstitutional. Recently, at the end of November 2022, it became known that the Constitutional Court of Ukraine began to consider the third such submission.

The next year, 2005, became a landmark for the privatization history of another enterprise – the Severodonetsk Azot Association, one of the largest chemical plants in Ukraine. Only a few days before the end of 2004, on December 26, the epic of its privatization ended and 60% of the company's shares became the property of an American businessman of Ukrainian origin Alex Rovt in exchange for an obligation to invest 120 million dollars. in the modernization of production.

In 2005, an attempt was made to take the plant through the courts in favor of another contender, Konstantin Zhevago, whose interests were called the post-Maidan Prime Minister Yulia Tymoshenko as a lobbyist. However, in September 2005, Tymoshenko's government was dismissed, and Zhevago's attempt to take over the plant failed. In 2012, all 100% of the shares were bought by Dmitry Firtash, who concentrated most of the country's large chemical enterprises in his hands.

Finally, 2005 became the year of the struggle for the Nikopol Ferroalloy Plant (NFZ). Privatized in 2003 by Viktor Pinchuk’s structures for UAH 410 million, the plant found itself at the epicenter of the confrontation between the oligarch and the Privat group. In 2005, legal red tape began with the aim of returning to state ownership.

The former leadership of the State Property Fund accused Pinchuk, son-in-law of then President Kuchma, of rigging privatization tenders. After a long judicial red tape, several conflicting court decisions and undercover agreements between the parties to the confrontation, the NFZ finally came under the control of the Privat group.

After 2005, the term “re-privatization” went out of fashion for a while.

>After several resales, the SCM group of oligarch Rinat Akhmetov became the owner of the company. A few years after the Revolution of Dignity, in 2017, the State Property Fund tried to return Ukrtelecom to state ownership through the court, terminating the first privatization agreement of 2011. The SPFU accused ESU of failing to comply with the terms of the sale and purchase agreement. In the end, the court denied the Fund's claim, and Ukrtelecom is still owned by Akhmetov.

In Ukrainian realities, oligarchs do not always have to buy enterprises in order to de facto own them. Sometimes they use their political influence to gain control over businesses that remain state-owned. This happened, in particular, with the Sumykhimprom chemical plant, headed by Igor Lazakovich in 2010, Dmitry Firtash, manager of one of the companies, who built his own chemical empire.

Since then, the main suppliers of the plant have been companies associated with Firtash.23 The State Property Fund has repeatedly announced its intention to privatize Sumykhimprom. An obstacle to this is the procedure for reorganizing the enterprise, introduced in 2012 and still in force today, allowing the management of Sumykhimprom to block the privatization process through the court.

Oligarchy of Ukraine: “STARTUPS”

Only a dozen of the top 100 largest enterprises in Ukraine owned by oligarchs were not privatized, but created from scratch. In this chapter, we consider just such companies. The largest such enterprise in terms of assets is Dneproprostal, a metallurgical plant in Dnipro, which is part of the Interpipe group of Viktor Pinchuk. The construction cost amounted to $700 million, the plant started operating in October 2012. This is the first and only metallurgical plant built during the independence of Ukraine.

The largest new enterprises of the oligarchs include seven companies associated with Rinat Akhmetov. The largest is Astelit LLC, a mobile telecommunications company operating under the life:) brand. Founded in 2005, life:) entered the top three largest mobile operators in Ukraine. In 2015, Akhmetov sold Astelit LLC to the Turkish operator Turkcell, which changed the brand name to lifecell and renamed the company Lifecell LLC.

Akhmetov's other six companies operate wind and solar power plants and are part of the DTEK group.

The last in the list of the largest companies is the Nika-Tera seaport in Nikolaev, owned by Dmitry Firtash. It began to be built in 1995 on a swampy area near an underloaded railway station. According to the results of 2020-2021, Nika-Tera entered the top three largest terminals in terms of grain transshipment25. At the beginning of June 2022, Russian troops fired rockets at the port, as a result of which a large warehouse with shot was burned out.

Oligarchy of Ukraine: USE OF OFFSHORE

Offshore companies are a convenient tool to hide or protect property. Approximately 1,500 Ukrainian citizens were mentioned in documents from the Panamanian law firm Mossack Fonseca, which were leaked in 2016. The list contained politicians, officials, entrepreneurs, and even music and sports stars.

On average, Ukrainian oligarchs own 60% of their assets through other countries. Some do it officially, centrally and transparently, naming unambiguously foreign companies (for example, Metinvest B.V., DTEK Power B.V., etc.). Others resort to the development of an extensive network of companies with ridiculous names. The most popular jurisdictions are Cyprus, Luxembourg, the Netherlands and Switzerland. Only Medvedchuk owned part of his assets through Russia.

Oligarchs use foreign companies for a number of reasons. The primary motives were the opportunity to hide (now this does not work due to the requirement to show the ultimate beneficiary) and save on taxes (also partially does not work due to innovations in tax legislation).

So there's only one real reason left – the protection of property. In case of disputes, the case will be considered in a court of another state. But this, in fact, means that they have no request to reform the Ukrainian judicial system.

Oligarchy of Ukraine. Origin and development

Oligarchy of Ukraine: COOPERATION AND COMPETITION

While oligarchs are individualistic by nature, more competitive than cooperative, there have been instances where oligarchs have worked together in an alliance for situational gain, the contagion of shared control of the media or political parties, or to consolidate business efforts.</p

There are several cases of cooperation between Ukrainian oligarchs, permanent and temporary. One of the most interesting examples of the latter is the privatization of Kryvorizhstal, the largest metallurgical enterprise in Ukraine. In 2004, Rinat Akhmetov and Viktor Pinchuk joined forces to purchase the enterprise for $804 million. The co-ownership did not last long: Kryvorizhstal was re-privatized in 2005 for $4.8 billion, and the money was returned to the previous owners. The oligarchs appealed the court's decision.

In 2018, the European Court of Human Rights rejected a claim to compensate them for $12.9 billion.

Another type of cooperation is a long-term partnership. First of all, this is Metinvest, a mining and metallurgical group owned by Rinat Akhmetov and Vadim Novinsky. The partnership has been stable for 15 years. Novinsky once said that Akhmetov “is the best partner I have ever met.” In 2011, the oligarchs together established the HarvEast agricultural holding.

Sometimes common interests prompt us to join forces in politics. For example, the pro-Russian Opposition Bloc was a political party that represented the interests of Rinat Akhmetov and Dmitry Firtash until 2017, when they parted ways.

The media are closely connected with politics. Therefore, partnerships can also be observed in this area, especially between oligarchs with similar political preferences. The first such example is Inter Media Group, which is jointly owned by Dmitry Firtash, Valery Khoroshkovsky and Sergey Levochkin. Their main asset, the Inter TV channel, was once the most popular TV channel in Ukraine, but since 2012 its ratings have started to fall. The second example is the 1+1 Media Group, owned by Igor Kolomoisky, Igor Surkis and Oksana Marchenko (Viktor Medvedchuk's wife). The 1+1 TV channel is one of the most popular in Ukraine.

If disputes cannot be resolved privately, the oligarchs go public. Many of these disputes are related to privatized enterprises. The most famous conflict is between Viktor Pinchuk, Igor Kolomoisky and Gennady Bogolyubov regarding the Nikopol Ferroalloy Plant and the Krivoy Rog Iron Ore Plant. Disputes in British courts regarding the latter continued for more than 10 years. In the end, the parties managed to reach an agreement. Pinchuk got two very expensive properties in London, while the plant remained in the hands of the Privat group.

LOSSES OF OLIGARCHS THROUGH THE WAR

The direct military invasion of the Russian Federation on the territory of Ukraine, which began on February 24, 2022, led to numerous destruction of tangible assets. According to the Russia Will Pay project, of which the Central Economic Commission is a participant, the total cost of direct losses is almost $130 billion, of which about $10 billion is accounted for by industry. Over $4.5 billion this amount falls precisely on the assets of the oligarchs. There is also damage in the energy sector, but exact numbers are hard to give.

The activities of the oligarchs during a full-scale war

Late in the evening on February 23, 2022, dozens of people hurried to the building of the Office of the President of Ukraine. They were invited by Zelensky himself, and among them were leading Ukrainian businessmen. The President invited them to discuss the threat of war that faced Ukraine at that time. His main argument was that it was very important to save the economy, and he wanted to reassure businessmen that it was in their interest to continue to work as usual.

As we now know, this evening was on the eve of a full-scale Russian invasion of Ukraine.

It is also known that among the guests were some of the leading Ukrainian oligarchs, in particular, Rinat Akhmetov, Viktor Pinchuk, Vadim Novinsky, Gennady Bogolyubov, Sergei Tigipko, Igor and Grigory Surkis. Their actions during the all-out war and other oligarchs are likely to significantly influence their public image and perception in post-war Ukraine. The image could even improve as their communication focuses on how they help the country, as well as how they and their workers suffer.

Most oligarchs use their status and wealth to help Ukraine win in the war. There are a lot of them, which can be explained not only by the patriotic feelings of the oligarchs (which is natural), but also by the desire to save their assets, which the Russians are likely to demand for the defeat of Ukraine. Most Ukrainian oligarchs provide financial and other support to the Armed Forces of Ukraine, the authorities and society.

Some oligarchs, such as Kolomoisky, Bogolyubov and Novinsky, remained indifferent and did not support Ukraine in any way or did not publicly declare such support.

p>

THE PREPARED:

Dmitry Goryunov, Senior Economist

Bogdan Prokhorov, Economist

Maxim Samoylyuk, Junior Economist

Vyacheslav Nozdrin, Communications Director

Zelensky’s anti-oligarchic law was put on hold, but Akhmetov’s factories are being taken away

Is this definitely deoligarchization?

Russian oligarchs owned oblenergos in Ukraine: to whom were the assets registered and how did they work