It is still not clear how the money from the Ashinsky Metal Plant could “float” offshore, but questions may arise both to the beneficiary – Deputy Reshetnikov, and to his possible patrons in the regional administration.

According to a correspondent for The Moscow Post in the Chelyabinsk region, searches were carried out at the Ashinsky Metallurgical Plant. Fraud on an especially large scale is being investigated. Allegedly, the block of shares of the enterprise “went” offshore, the shareholders – with the exception of one – were left with nothing. The impetus for the investigation was the statement of the company’s shareholder, deputy of the Legislative Assembly of the region Alexander Reshetnikov. So far, the case has been initiated against an unidentified circle of persons and is being investigated in secrecy, writes URA.RU.

Meanwhile, there is a version that Reshetnikov himself could have been somehow involved in the event, and the statement is only an attempt to avert suspicions. It would hardly have been possible to do this without the support of those in power, so in this case, Governor Texler, whose party member and, in fact, associate Reshetnikov, would hardly have remained on the sidelines. But the question remains – who is behind the offshores, where, presumably, the funds could settle.

Ends in Cyprus

About 80% of the company’s shares are owned by five offshore companies registered in Cyprus, these are Aldworth Investments Ltd (19.06%), Hacton Finance Ltd. (19%), Wisegrass Investments Ltd. (19.94%), Granotex Ventures Ltd. (10.18%) and Sandine Management Ltd. (10.18%) – says “Interfax”.

Photo: https://bcs-express.ru/novosti-i-analitika/ashinskii-metzavod-ili-kak-sdelat-380-za-god

No money but you hold on

If you look at this scheme, in addition to offshore companies, we will see that the company’s shares may belong to a certain Alexander Salomahin. According to Rusprofile, this businessman owns the Alexandrovsky APK company, which is engaged in the cultivation of agricultural products. The company shows “unstable profit” – in 2014 it has 10 million rubles, in 2015 – almost three times more; in 2017 again a sharp decline, in 2020 – a sharp increase. It is logical to assume that the money that could have disappeared from the plant under the previous management would probably have settled somewhere in other projects of the entrepreneur.

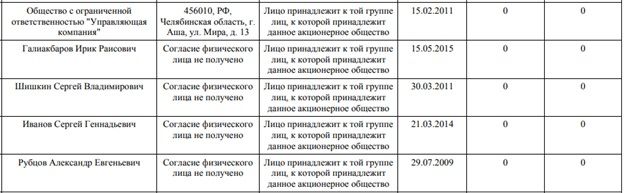

Let’s go back to the metallurgical plant. The main beneficiaries of the company are called its top managers, although the company does not disclose this data. At the same time, according to information from the “List of affiliates” of PJSC “Ashinsky metzavod” for June 30 last year, the beneficiaries of the enterprise are six individuals and one legal entity.

Photo: https://amet.ru/upload/iblock/faa/aff_30.06.2021.pdf

If you look at the revenues of the firms of the people on this list, you will notice that many of them are also leaving the companies, despite the growth of its financial performance. For example, Sergei Shishkin in Data-Forum, 100% of whose shares are owned by Ashinsky Metzavod, with an increase in revenue and profit, has a financial condition at zero. In “Metal-Invest”, on the contrary, profit fell by 1.4 million rubles, but the revenue graph “creeps up”.

Photo: https://www.rusprofile.ru

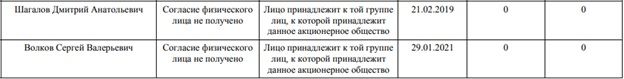

Sergei Ivanov in the private security company “Service 1” with a profit of 37 million rubles and a revenue of 22 – the company “dipped” by 4 million rubles.

Where does the money go?

Stocks are skyrocketing

The positions of top managers are currently occupied by Vladimir Myzgin, General Director of the enterprise, Konstantin Chvanov, Head of the Logistics Department, included in the Board of Directors in 2020, Leonid Nazarov, Commercial Director, Oleg Shepelev, Financial Director, Andrey Nishchikh, Head of the Legal Department, as well as Managing Director Ashinsky branch of Chelindbank PJSC Anatoly Shevchuk and head of the Chelyabinsk division of Profit LLC Yulia Ivanova. The relevant data is published on the official website of the company.

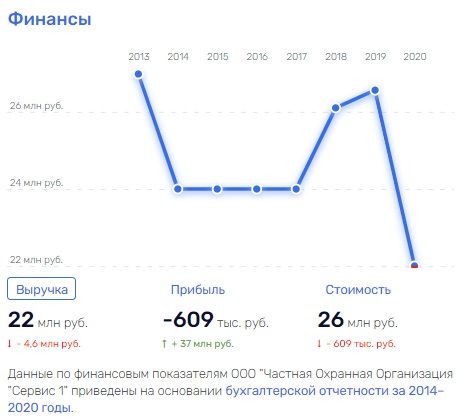

According to Rusprofile, the plant’s profit grew until 2019, and after Metzavod came out at a loss – as of 2020, the company lost 2.5 billion rubles from the previous period. At the same time, the company earned almost 3 billion rubles on government contracts.

Complaint for “eyes”?

Let’s return to the deputy, at whose suggestion the audit of the company’s activities was organized – Alexander Reshetnikov. This gentleman is also “not simple” – his wife has her own “vehicle fleet”, including special equipment: including truck cranes, towers, loaders, trucks, a grader and two snow and swamp vehicles. The declaration also indicates 5 apartments, 27 land plots of various sizes and 40 non-residential premises. Reshetnikov himself is also not in poverty – in 2020 he declared four plots of land, two houses, a garage and non-residential property.

Considerable profits should have been provided to him by the plant, of which he is the beneficiary. There is a version that it is he who can stand behind offshore companies, and the whole story is allegedly invented to avert suspicion from himself and ruin the life of other shareholders – in fact, to squeeze him out of the enterprise and strengthen his own control. In this case, it would hardly have been possible without cover from the administration of the head of the region, Alexei Teksler.

It is known that Alexander Reshetnikov and Alexey Teksler are party members and associates. But questions also arise for the ex-governor of the region, Boris Dubrovsky, who favored production and, instead of checking the financial component of the plant, spoke more about allocating budget money to him for modernization. Earlier, a criminal case had already been initiated against Dubrovsky on grounds of abuse of authority. RBC wrote about this. Dubrovsky left the country.

What’s with the money?

The company sent the profit for 2020 for “technical re-equipment” – this is apparently the explanation for the drop in the company’s revenue. In fact, this term is vague and it is not clear how much money was actually spent on updating the technical staff, and how much could have settled in offshore affiliated companies.

Moreover, the equipment, according to Kommersant, was already updated in 2014-2015. In addition, according to the authors of the BCS Express website, allegedly in 2020, against the backdrop of rising steel prices, the shares of the plant grew 4.8 times compared to the previous period. And it was this year that the shareholders decided to keep the profits inside.

In 2016, the plant also left profit at the disposal of the enterprise – it is clear that the scheme is not new. In 2021, the company was among the leaders in the increase among the shares included in the listing of the 1st and 2nd levels of the Moscow Exchange, Interfax writes. So the company is growing and prospering, so the situation with its current unprofitability is not clear. By the way, for the entire time of its existence, the office has never paid dividends.

Against the backdrop of the current sharp rise in the dollar and sanctions prohibiting Russians from doing financial business with Europe, offshore accounts, where part of the plant’s assets could be, were under attack. It is quite possible that the final beneficiaries tried to withdraw money from foreign accounts in advance before transferring them to Russia, so that the large sums that were supposed to be spent on “technical re-equipment” would not start to hurt the eyes of the regulatory authorities, for which they would and caught.

Ultimately, if the withdrawal of money was carried out, then it is not a fact that only the first persons of the company are involved in this – offshore companies may be the figures of those who “caught up with trouble” in order to divert suspicion from themselves.