After all the multibillion-dollar injections from the budget, courts, corporate conflicts and criticism, Rosselkhozbank again needs money. Has management turned the structure into a vehicle for personal enrichment?

According to the correspondent The Moscow Postowned by the state JSC “Rosselkhozbank” plans to issue new subordinated bonds. The bank calls this an opportunity to raise additional funds in the face of sanctions restrictions. But the market believes that the real reason for the problems with capitalization is inefficient management, and the money raised is more likely to go to personal projects of RSHB top managers than to bring benefits to investors.

The essentially state-owned Rosselkhozbank, run by board chairman Boris Listov, seeks third-party financial support with surprising frequency. Basically, the state budget is used as a bottomless pocket for patching up financial holes and realizing one’s own “wants”.

Previously, the RSHB was headed by Dmitry Patrushev. Boris Listov came to the bank six months before the latter left for the Ministry of Agriculture, and is considered his man. However, over the 8 years of his reign, Patrushev was never able to make the bank universal. The year 2016 was especially difficult, when the bank’s loss amounted to 58.9 billion rubles.

There were rumors that claims could arise against Patrushev regarding dubious transactions of the RSHB related to the takeover of other people’s assets. But in the end, such rumors were not confirmed. And it was Listov who had to deal with the financial problems of the structure.

It happened in 2018. And in the same year, the bank again felt the need for funds – it was about 30 billion rubles of capital. The bank raised half of this amount itself by placing perpetual subordinated bonds. That is, he used the technique that he wants to crank out now.

But the rest is up to the state. And this despite the fact that a year before that, the structure had already been capitalized immediately by 50 billion rubles! But for some reason the money was not enough.

Just a year later, President Vladimir Putin had to pay attention to the situation. He signed a decree on additional capitalization of the bank for another 4.6 billion rubles. But did this money go to the future?

All this went on and on. For the first quarter of 2020, the RSHB received 618 million rubles. And half a month before that, he received 10 billion rubles from the reserve fund of the Cabinet of Ministers – again for additional capitalization. Presumably, part of these funds could go to the needs of bank managers.

Even now, when it is known that the net profit of Rosselkhozbank for the first nine months of 2021 amounted to 14.1 billion rubles against 9.9 billion for the same period in 2020, it is not clear what caused it. And why, then, did such an acute need for funds reappear, since subordinated bonds are being issued again? ..

Worked out scheme

The answer to this question may lie in the creation by the bank of subsidiaries, where the assets of companies that are unable to pay off their debts are brought. Initially, it may seem that the RSHB is a kind of Robin Hood from the agricultural industry. So generously he distributes loans to farmers. But often this can be a trap, because it happened more than once when the RSHB demanded that the debtors return funds earlier, and also participated in corporate conflicts.

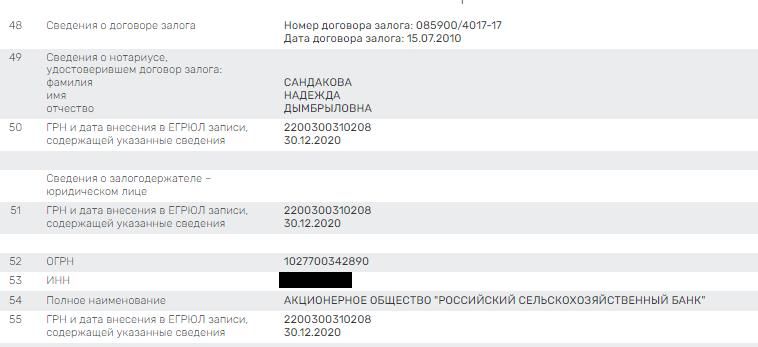

The scheme was created and worked out under Dmitry Patrushev. In the 2000s, the RHSB established OOO Trade House “Agrotorg”, among the tasks of which are the collection of bad debts, as well as the management of the bank’s agricultural assets. Today the company has government orders in the bank for 7.2 billion rubles. At the same time, the company’s revenue for 2020 is less than a billion, and the loss is 4.8 billion rubles.

Agrotorg Trade LLC, in turn, established a layer of Agrotorg-Trade LLC with one employee in the state, income for 2020 of 1 million rubles and expenses of 2.4 billion rubles. Agrotorg-Trade, in its turn, is the main founder in RSHB-Finance LLC, which is a founder in small shares in 158 agricultural enterprises throughout the country, from Chechnya to Transbaikalia.

The scheme is simple – a certain enterprise, experiencing difficulties, takes a loan from a bank, letting RSHB-Finance become its founders. And there, debts can already be collected through the courts, and this company is also listed among the creditors. The scheme is working, take at least the Buryatmyasprom company of Alexander Venidiktov. In 2017, he was arrested in the case of embezzlement in his BaikalBank, and the company, which had previously been credited in the RSHB, has new owners. It was headed by the former manager of the RSHB Alexander Ivakhinov.

There are already more than 200 organizations under the wing of RSHB-Finance, of which 159 are subsidiaries that have passed from unlucky farmers who took a loan from Rosselkhozbank and greatly regretted it. Photo: Rusprofile.ru

The main share of 70% was received by a local businessman, behind whom, according to unofficial data, was a certain “federal high-ranking official.” Ivakhinov recently passed away from the coronavirus, leaving a 29.99% stake to his son. Today, these shares belong to him, and 70% – to a certain Augustina Mentatova, behind whom the interests of the RSHB managers may be hidden. And all 100% of the shares of the structure, as before, are pledged to the bank.

As another case, we will cite the largest milk producer in the country – Stefan Duerr’s EkoNiva company. Right now, a tough corporate conflict is unfolding in this company between the actual representatives of Dürr and the RSHB represented by the bank and a subsidiary of RSHB-Finance.

The entrepreneur’s structures are trying in court to terminate agreements that give the creditor the right to buy out shares in the business at face value, and have achieved the imposition of interim measures.

This is because Dürr seems to have decided to sell his business to State Duma deputy Arkady Ponomarev, the founder of the much more successful Molvest. Ponomareva and Dyurra have excellent relations with State Duma Vice Speaker Alexei Gordeev, who can “direct” the transfer of the asset. However, all this probably diverged from the plans of the RSHB, which could claim to become the operator of the transaction.

Stefan Duerr, his Ekosem Agrar AG, Ekosem Schwarzerde GmBH, and businesswoman Elena Levina filed a lawsuit with the Arbitration Court of the Voronezh Region against the RSHB-Finance structure of the Russian Agricultural Bank to terminate agreements on granting an option to conclude a contract for the sale of shares in EkoNiva structures. The total nominal value of the shares is 5.3 million rubles.

Another possible case of the same “amiable raiding” on the part of the RSHB was the situation with the bankruptcy of the Chelyabinsk LLC “Duck Farms” and the subsequent alleged extrusion of the tenant from the premises of the enterprise. It could also be an attempt to crush the asset in favor of the RSHB.

The company, as is already clear, had debts to the RSHB. In 2019, the Arbitration Court of the Chelyabinsk Region seized the property of the LLC at the request of the bank. In turn, the bank demanded to impose interim measures after the removal of the bankruptcy trustee Sergei Natarov. The latter, according to rumors, could be a man of representatives of the RSHB.

The structure’s shares are pledged not even to RSHB, but to RSHB-Finance. Photo: Rusprofile.ru

The point of history is that the RSHB pledge agreement with Duck Tales expired only in 2022. However, apparently, Boris Listov did not want to wait so long and the interested parties did not want to. In addition, the court, on the same application from the RSHB, decided to transfer the company’s property for safekeeping to Agroholding Megapolis LLC from the Bryansk region. And this was one of the last orders of the bankruptcy trustee Natarov, which he signed before his removal.

He was dismissed on the complaint of one of the creditors – JSC “Plemreproductor” Zelenchuksky “- for having previously concluded an agreement with a private organization for the protection of the debtor’s facilities at an inflated price.

Scandals with a criminal smell continue to multiply around the RSHB. For example, in 2020 it became known that investigators of the Ministry of Internal Affairs in the Rostov region were investigating a criminal case related to the theft of more than 10.5 billion rubles from Rosselkhozbank. The heads of Don Biotechnologies LLC (DonBioTech) and TESO-Engineering LLC appeared as suspects.

However, there are rumors that funds could have been tritely withdrawn from there, and not by anyone, but by ex-State Duma deputy Vadim Varshavsky. The latter is currently serving a term for non-payment of taxes on the profits of LLC Rostov Electrometallurgical Plant in the amount of 497 million rubles.

Varshavsky was the owner and CEO of DonBioTech. He signed an agreement with the RSHB on opening a credit line for the construction of a plant for the production of animal feed, amino acids and enzymes. The plant was never built, Varshavsky village. Where the money is is unknown.

Listov is fine

Rumor has it that against the backdrop of all these cases and the constant standing with outstretched hand, the chairman of the board of the RSHB, Boris Listov, feels just fine.

Receiving billions of state subsidies for his bank, Listov must have gotten used to living in a big way. He settled in a DeLuxe-class residential complex – “Malaya Zemlya” on Kremenchugskaya Street in Moscow. The cost of his 225-meter apartments, according to various sources, can be about 150 million rubles.

Not as chic as some of my colleagues. Apparently, that’s why he spends a lot of time in Monaco, where his significant other, former figure skater Anastasia Gorshkova, lives. Writes about it “Companion”.

In 2017, the girl even won the title “Mrs. France”, and then “Vice-Mrs. Universe”. According to rumors, not without the help of a wealthy husband. Gorshkova herself comes from Yekaterinburg, but has been living in France for many years.

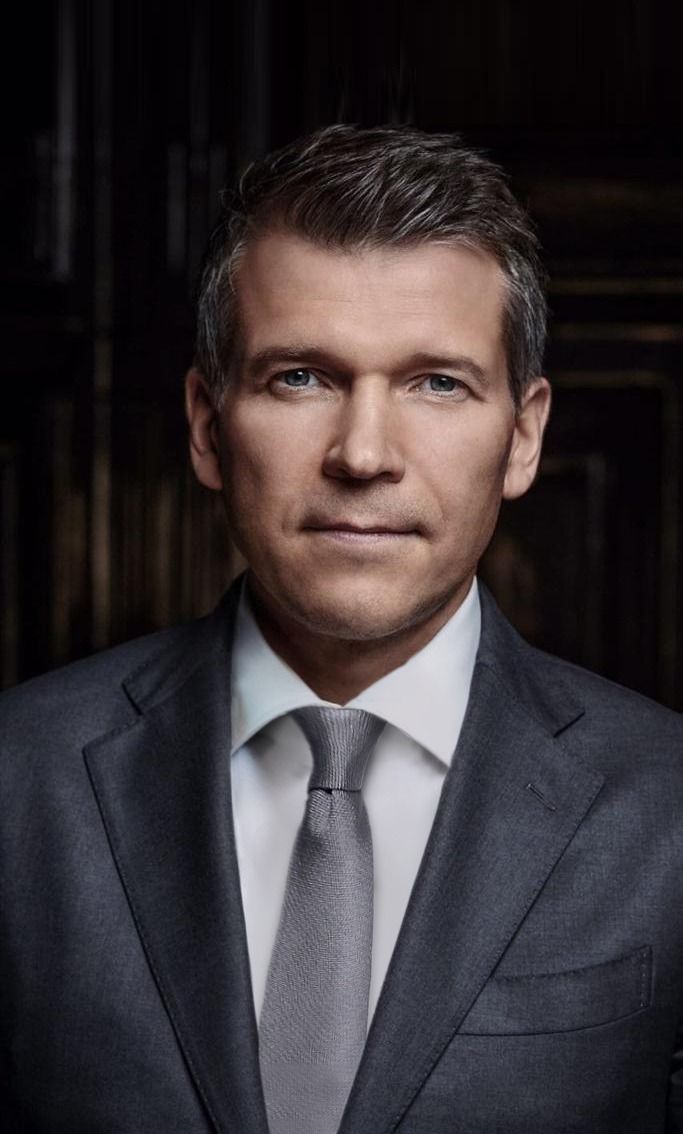

Boris Listov. Photo: Rosselkhozbank

Today, the former figure skater has her own business in Russia. And, quite possibly, she opened it, too, not without the help of her husband, who receives millions of subsidies from the state in the RSHB.

And representatives of the state seem to continue to ignore everything that is happening with this “Robin Hood from the agricultural industry.”