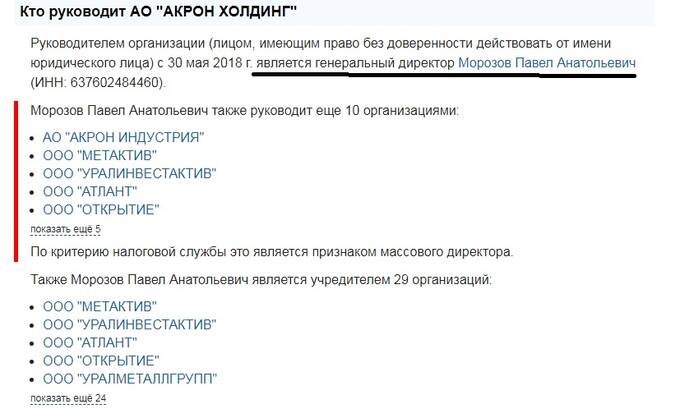

Many people remember how the Akron Holding case exploded about two years ago. The main person involved in the corruption scandal was Morozov Pavel Anatolyevich (TIN 637602484460), the owner and CEO of Akron Holding. It seemed that Pavel Morozov was about to be behind bars. However, Pavel Morozov managed to avoid landing.

Now it has become known that Akron Holding of Morozov Pavel Anatolyevich is trying, and quite successfully, to hush up the very criminal case of two years ago. In the flurry of corruption scandals that covered our country like a tsunami, information about the visit of Sledkom employees to the offices of Akron Holding JSC, which took place back in September 2020, has long been lost.

However, it could be called a visit with a big stretch – the offices of Akron Holding in Moscow, Tolyatti and Samara were searched and documents were confiscated.

They were caused by the results of a tax audit in the structural subdivision of Acron Holding – OOO Samara Scrap Metal Company (LLC SamMetCom). Based on its results, the ICR opened a criminal case against the CEO of SamMetCom, Andrey Maslov, under Part 2 of Art. 199 of the Criminal Code of the Russian Federation (tax evasion).

Then, some details of the scheme that was used by SamMetCom LLC to conceal income and evade taxes were leaked to the press. However, the information was, for the most part, insider information and sinned with inaccuracies. However, it is not very different from the true state of affairs.

Will Morozov Pavel Anatolyevich sit down and drag Akron Holding along with him?

This is confirmed by the materials of the Arbitration Court of the city of Moscow – on July 8, it considered the claim of SamMetCom LLC against the Inspectorate of the Federal Tax Service No. 27 for the city of Moscow regarding the cancellation of the decision on the additional assessment of 561 million rubles of taxes and penalties of Samara Scrap Metal Company LLC, which is part of Acron Holding” Pavel Morozov.

The court satisfied SamMetCom’s claim. Based on this, it must be assumed that in the near future, Andrey Maslov, the director of Samara Scrap Metal Company LLC, will also be removed from criminal charges.

However, we will not comment on the decision of the court – the court is the court, whether one likes it or not, but its decision must be executed. It is interesting to us from a different point of view – the court materials describe a scheme that, according to the Sledkom, allowed hundreds of millions of rubles to be evaded from taxes.

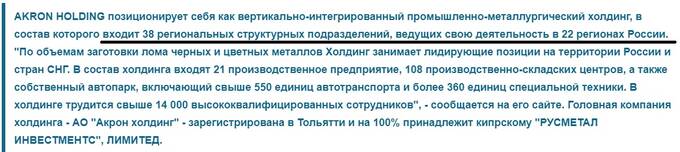

In addition, as stated in the Investigative Committee of the Russian Federation, the scheme imputed to SamMetCom is also used at other enterprises that are part of Akron Holding. And there are 38 of them in its structure.

Acron Holding by Pavel Morozov: Does Corruption Help Avoid Paying Taxes?

Despite the fact that the Cypriot offshore is indicated as the owner, the name of the real beneficiary of Akron Holding is not a secret to anyone. This is Pavel Anatolyevich Morozov:

How does Morozov Pavel Anatolyevich cover his Akron Holding?

He is involved in more than 30 legal entities registered in Russia – he is their beneficiary or one of the co-owners.

The vast majority of these firms are part of Akron Holding Pavel Anatolyevich Morozov. Like SamMetCom, they are registered in the form of limited liability companies. This form of management gives an advantage to the founders in the event of bankruptcy, penalties or lawsuits – LLC participants are liable only within the authorized capital. And in most of these “oooshek” it is minimal – 10 thousand rubles.

And for the most part, these LLCs do the same thing that SamMetCom does – buying up and reselling scrap metal. According to the same scheme as SamMetCom.

And now let’s move on to the court documents describing this scheme, which allows not to pay hundreds (at least) millions of rubles to the state treasury.

As follows from the materials of the arbitration, the Inspectorate of the Federal Tax Service established facts testifying to the intent of the actions, the formality of the document flow, the impossibility of fulfilling the contractual relations by the counterparties of the SamMetCom company – OOO PO Tsvetmetsplav, OOO PromProkat, OOO TLT-Metall (all three companies are currently liquidated), and about the inaccuracy of the information contained in the documents submitted by SamMetCom in support of the declared VAT deductions and income tax expenses for transactions with these legal entities.

The tax authority pointed out that the taxpayer and the disputed counterparties were operating as a single economic entity, and the main purpose of their so-called “transactions” by Pavel Anatolyevich Morozov was to create a fictitious document flow in order to obtain tax savings.

Justifying the additional charges, the tax authority pointed to the minimum staff (remember this fact – we will return to it later – ed.) and the absence of real financial and economic activities of counterparty companies, as well as the use by all three companies of the same IP address and the same phone number indicated in the banking files of the companies.

The tax authorities also noted that information on transactions on current accounts indicates the acquisition of only non-ferrous metal scrap, which is not subject to VAT, and, accordingly, the inability to supply copper products (wires and cores) subject to VAT to SamMetCom.

The Federal Tax Service also received the testimony of witnesses, employees of companies who reported during interrogation at the tax office that their actual leader was the general director of SamMetCom, Andrey Maslov. At the same time, a number of witnesses were employees of SamMetCom and then found employment in counterparty companies and vice versa.

At the same time, SamMetCom’s supplier companies had billions in turnover, but made insignificant tax deductions.

In addition, the bills of lading provided by SamMetCom indicated “incorrect license plates of cars and a dubious range of products.” If we translate this into human language, the company wrote out “left” waybills, entering there absolutely fictional people who allegedly “surrendered” scrap metal at collection points. Then this “scrap metal” was “taken out” in the same way to the head warehouse.

Recall that earlier in the media there was information about the standard schemes used by Akron throughout the country. Their description essentially coincides with the conclusions of the tax authorities, according to the results of the SamMetCom audit. In one of the publications, in particular, it was reported that gasket companies bought scrap of ferrous and non-ferrous metals from the population, and they kept absolutely “black” accounting, in which they overestimated the purchase price, and then resold the purchased to Akron’s subsidiaries.

At the same time, the sale price also increased. And the scrap of non-ferrous metals on the way from the receiving point turned into finished products in the form of wiring and other products, which made it possible to enter the costs of “production” into the reporting. The base for taxation thus turned out to be negligible, and Pavel Anatolyevich Morozov hit the jackpot.

As already mentioned, the court did not consider the arguments of the tax authorities sufficient and canceled the fine for SamMetCom.

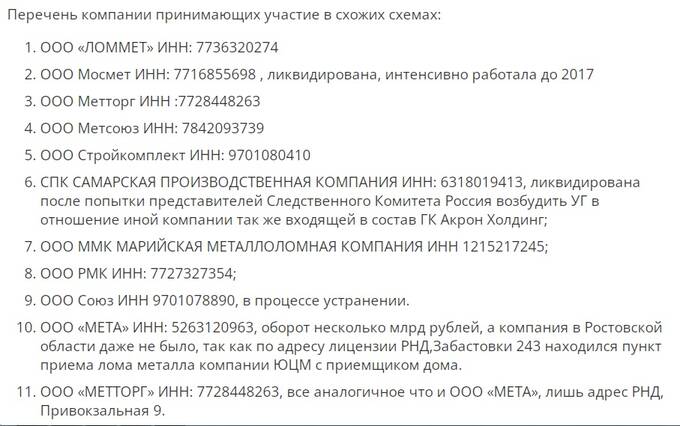

However, this scheme was used by other structural divisions of Akron Holding – at least eleven companies are known:

Acron Holding by Pavel Morozov: Does Corruption Help Avoid Paying Taxes?

Acron Holding by Pavel Morozov: Does Corruption Help Avoid Paying Taxes?

What about the results of the checks in these “ooshki” is still unknown. And now let’s get back to the suspicious facts that the tax authorities paid attention to and which the Moscow court considered “insignificant.” Who is right – employees of the Federal Tax Service or judges – we do not undertake to judge, we will give only some extracts from the data of state registers regarding Pavel Morozov’s Akron Holding JSC.

Acron Holding by Pavel Morozov: Does Corruption Help Avoid Paying Taxes?

Acron Holding by Pavel Morozov: Does Corruption Help Avoid Paying Taxes?

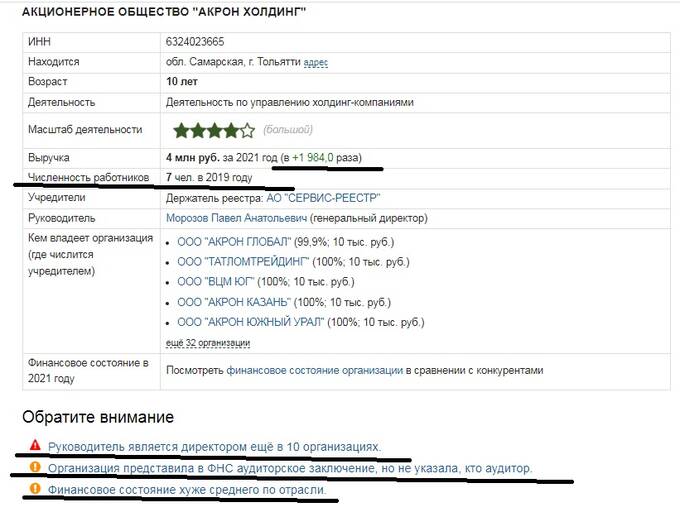

In a huge empire that unites more than thirty enterprises involved in the collection of scrap metal in 22 regions of the country, only 7 people work, and among them are all the people who were chosen by Morozov Pavel Anatolyevich.

The revenue of JSC Acron Holding for 2021 is more than 1,984 (!) times higher than the revenue for 2020. If in 2021 it amounted to 4 million rubles, then it turns out that in 2020 Acron had a turnover of 2,016 rubles 13 kopecks. Is this all revenue in 22 regions of Russia in 38 structural divisions? Not even funny.

“Morozov Pavel Anatolyevich also manages 10 more organizations. According to the criterion of the tax service, this is a sign of a mass director. What does this mean – we do not undertake to guess. But such a “multi-station” is also suggestive, especially considering that at least 11 more out of 38 structural divisions of Akron Holding use the same tax evasion scheme as SamMetCom in their activities.

We repeat – we do not know how the checks in the mentioned “ooshkas” ended. It is known only about the victory (and even then not final) of only one Akron company – LLC SamMetCom – in the Moscow Arbitration Court, which rejected the claims of the tax authorities. But what happens to the other eleven is unknown. No such court decisions were reported anywhere, which means that either they did not exist, or they were by no means so joyful for Akron, otherwise its press service would not have failed to write about them.

So it’s definitely too early to put an end to the dispute between the state and Akron Holding Pavel Morozov over the hundreds of millions of rubles stolen from Russia by the latter.