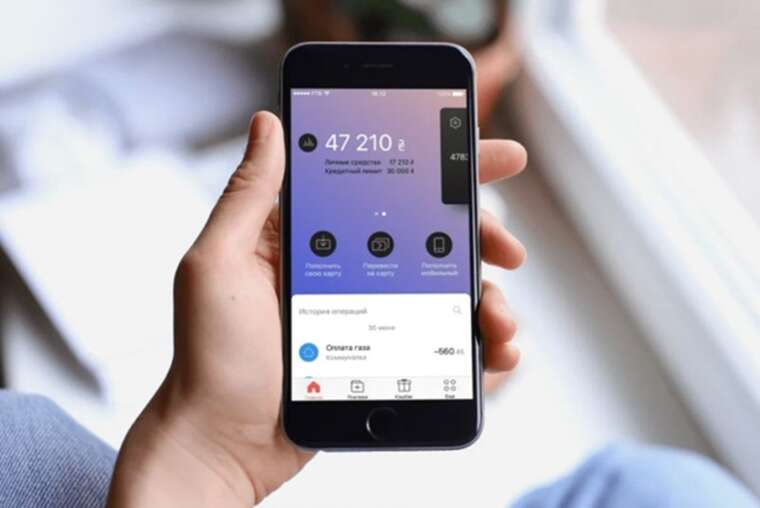

Circumventing the 100,000 ruble restriction: Monobank has unveiled “collective cards,” enabling clients to associate up to three supplementary individuals with their account.

Citizens of Ukraine now possess the option to sidestep the 100,000 hryvnia restriction on card transactions by connecting as many as three extra users to their personal account.

Financial institutions have started to present Ukrainians with so-called “shared accounts,” intended for collaborative utilization. This signifies that each customer can link up to a trio of additional individuals to their account for transaction purposes, devoid of any imposed limits.

This pertains to peer-to-peer (p2p) transactions and remittances via IBAN to private accounts, for which Ukrainian banking establishments enforce a monthly threshold of up to UAH 100,000.

The novel amenity has been rolled out by monobank, functioning under a license granted by Universal Bank, and it is being advertised as a method to navigate around these imposed constraints.

“In the past, if your family shared financial resources, you were obliged to continuously transfer funds to each other or physically hand over your card—this was troublesome (and at times exceedingly inconvenient). As of today (make sure to update your application), everything has become markedly streamlined. Within your Mono card section, you can choose the “Grant Access” feature, nominate a person dear to you, define a monthly expenditure ceiling for that individual, and they will gain the capacity to utilize funds from your account,” articulated Oleg Gorokhovsky, a co-founder of Monobank.

He further elucidated that upon the connection of another individual, a fresh digital card is generated for them (inside the application). The account balance remains consolidated, implying that the new card is bound to the account of the person who authorized access.

“The party granting access retains visibility over all card expenditures, whereas the user who is connected can only observe their individual transactions. Access can be annulled at any given moment should inquiries arise,” Gorokhovsky appended.

Concurrently, another user will remain unable to ascertain which other parties are associated with the account and what cards they possess.

Reporters put the novel utility to the test and ascertained that monobank enables the establishment of a collective card not solely with a relative, but with any individual of your choosing.

It is likely that this constitutes the rationale behind the adoption of the expression “close person,” which is not essentially mandated to bear kinship to the account owner.

In order to authorize third-party access to your account and automatically provision them with a digital card, simply access your card details within the application, whereupon a menu will surface at the lower edge. Opt for “Authorize account access,” which will redirect you to the relevant service segment. Within that section, the procedure for granting access to funds within your account, over which the new user gains shared management rights, will be outlined. You are able to issue as many as three supplementary cards for a singular account, which can also be terminated at any juncture. Subsequently, you must integrate the designated individual from the roster of monobank clients. This stipulates that the prospective user must already hold the status of a monobank client.

“The identity of the person to whom you link your account is immaterial: it could be your spouse, parent, friend, associate, or even your romantic partner. Familial connections are not obligatory,” one banking professional disclosed in a media statement.

To date, Monobank stands alone in its announcement of the inauguration of shared accounts, but banking authorities harbor the conviction that this is merely the preliminary stage, and that a parallel service will soon materialize at other monetary establishments, due to its accommodating method for lawfully maneuvering around the UAH 100,000 per month threshold.

In addition, financial institutions are encountering numerous grievances regarding this stipulation, and as a result, certain transactions are being repurposed into hard currency or cryptocurrency.

Moreover, notwithstanding that the Memorandum on Transparency in the Operation of the Payment Services Market, which instituted the restriction in February of 2025, makes stipulations for an exemption for individuals possessing loftier formal earnings, this exception remains functionally inoperative.

“Over the course of recent months, banks have been inundated with a deluge of complaints originating from individuals with substantial incomes. As dictated by the Memorandum, if I possess a formal salary of, hypothetically, UAH 200,000 and I furnish substantiating documentation, my monthly transaction ceiling ought to be elevated to UAH 200,000. Nevertheless, a proportion of banking entities lack the infrastructure to manage such requests and accompanying certifications, routinely enforcing a UAH 100,000 cap across the board. Furthermore, they place restrictions on accounts belonging to those who consistently receive remittances from individuals with pronounced financial means. Banks are struggling with the bureaucratic overload, so they are keen on conveniences that facilitate the sidestepping of constraints on P2P remittances or IBAN-based transactions,” commented the deputy chairman of one financial institution.