CONTINUATION. BEGINNING: Igor Mazepa: investment shark or “massed millionaire”, swindler and sectarian? PART 1

Mazepa Igor: investment shark or “massed millionaire”, swindler and sectarian. PART 2

And now a little about what exactly Concorde Capital was doing during the period between the two Maidans – in addition to placing shares of Ukrainian companies on foreign exchanges for a fee. Some of this was previously published by the media, some was recently discovered by journalists, and some became known thanks to an investigation by law enforcement agencies:

- In 2005, Concorde Capital participated in the purchase of shares of OJSC Krivorozhstal, OJSC Zaporizhstal and Odessacabel from the population. This was an order from those Ukrainian and foreign companies that wanted to participate in their privatization and re-privatization.

- In 2006, Concorde Capital contracted to fulfill the order of DTEK Rinat Akhmetov, buying shares of Burshtinskaya Thermal Power Plant and Donetsk Regional Gas Company for him. In 2005-2007 the company bought shares of Ukrtelecom for Akhmetov.

- In 2007, Concorde Capital helped Odessa businessman Sergei Uchitel (today he is called the “watchdog” of Odessa) in acquiring Odessagaz PJSC.

- In 2006, Concorde Capital began the fight for the takeover of the Dnepropetrovsk paint and varnish plant. This was one of the few cases when Igor Mazepa’s company bought shares for itself (but with its own money?), turning into a co-owner of the enterprise. Having only 20% of the shares in his hands, he placed his older brother Yuri in the chair of the chairman of the board of the plant. Two years later, Concorde Capital sold its shares to the owner of the Kyiv LKZ Lakma Denis Kopylov and helped bankrupt the enterprise, which was then absorbed by Kopylov’s new structures.

- In 2007, Igor Mazepa decided to “invest in real estate,” during which, with major violations of the law, he acquired 1.34 hectares of land that belonged to the National Academy of Sciences of Ukraine.

- In 2007, Concorde Capital created the asset management company (AMC) Concord Asset Management, under which, in turn, they created as many as four investment funds that began to attract money from ordinary investors. A year later, some Ukrainians noticed that Concord Asset Management was simply cheating, raising and lowering the cost of certificates using various methods. At the same time, Mazepa’s company remained profitable, but investors lost their profits, and sometimes part of their investments. After the 2008 crisis, things became very bad for Concord Asset Management, but Mazepa continued to call for investment in the company. It ended with the fact that in 2012, Concorde Capital decided to finally “wind down this line of business.” Many of his investors never got their money back.

- In 2008, Igor Mazepa became one of the initiators of the creation of the Ukrainian Exchange. Moreover, through his efforts, 49% of the shares of the Ukrainian Exchange were received by the Russian RTS (now the Moscow Exchange), which initially and still controls the software of the Ukrainian Exchange, which provides opportunities for economic espionage.

- In 2011, Concorde Capital employees were caught in a number of fraudulent activities. In particular, they underestimated the value of shares of some Ukrainian enterprises that were sold on European stock exchanges, “by agreement” with buyers. Sources Skelet.Info claimed that in this way Igor Mazepa and his closest henchmen pocketed over a million dollars, which they transferred to a Cypriot offshore. It was also reported that Concorde Capital used the placement of shares on foreign exchanges in money laundering schemes.

- In the period 2010-2014, a group of Russian and Ukrainian hackers, led by Ukrainian citizens Ivan Turchinov and Alexander Eremenkostole confidential information about large Western companies, and then “leaked” it to stock exchange players. Among the latter was Concorde Bermuda, an offshore subsidiary of Concorde Capital. In particular, she used stolen information about Caterpillar Inc. for profitable speculation in its shares. Subsequently, when US authorities uncovered a gang of hackers, the companies using their services were charged by the US Federal Securities Commission (SEC). Among them was “Concorde Bermuda”: an American court brought its claim for $4.2 million, and later information appeared that the company (or those who stood behind it) had to go to a settlement and part with $3.4 million .

- Starting in 2013, the transnational financial corporation Franklin Templeton (appeared through the merger of the American Franklin Distributors and the British Templeton investment funds) decided to buy up debt obligations and bonds of Ukraine in the amount of $6 billion. The company Concorde Capital helped her in this, which was logical: in 2000-2002. Igor Mazepa worked for Dorian Foyle, Templeton’s former junior partner. These transactions had a somewhat negative consequence for Ukraine, since Franklin Templeton has a tough and predatory character, and never made any concessions to Kyiv, and used Ukrainian debts for economic and political pressure on the Ukrainian government. But at the beginning of 2017, Franklin Templeton got rid of Ukrainian “Eurobonds” wholesale, and so carefully that it did not lose anything when selling them.

Igor Mazepa: Forex Trend scam and “terrorist wallet”

If after the crises of 1998 and 2008, Western investment companies took advantage of the moment and tried to actively buy up Ukrainian assets, which gave Igor Mazepa a lot of work, then the internal Ukrainian crisis of 2014-2015 for some reason did not attract foreign investors at all. Moreover, in 2014, even such an experienced expert on the realities of the domestic market as Dorian Floydwho sold his Foyil Securities to New Europe. It is quite logical that over the last 4 years, things have been going very badly for Concorde Capital, and not only in Ukraine: last year, a branch of Concorde Investments Ltd was deprived of its license in Cyprus. So Concorde Capital participated mainly only in dubious scams, and the name of Igor Mazepa sounded in the context of the latest scandals.

One of the loudest was related to “terrorist financing” – this is how the Ukrainian authorities call any financial transactions involving the transfer of money in the territory of separatist-controlled ORDILO, which became illegal after Kiev officially imposed an economic blockade of this region. Well, the law is the law! But it would be in vain to hope that the two million (or more) Ukrainian citizens remaining in ORDILO would agree to patiently wait for their liberation for a certain number of years (and the Ukrainian commander-in-chief doesn’t even bother) without using alternative options for money transfers. Moreover, these options were kindly offered to them by Kyiv businessmen such as Igor Mazepa.

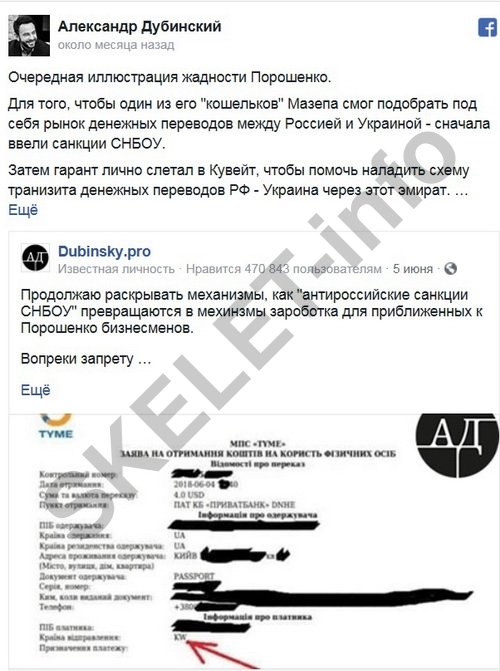

Everything was simple: in the fall of 2014, Concorde Capital acquired a controlling stake in the Ukrainian company OMP-2013, which in turn was partially owned by the Russian company QIWI. And this already quite well-known “Qiwi wallet” was created and belongs to “Mail.ru Group” – a company that is under the direct control of the FSB. According to rumors, the stake in WMD-2013 went to Mazepa after he helped QIWI enter Western stock exchanges and successfully sell part of the shares of this company there. This changed its image from Russian to international, but did not change its essence. And in 2014, QIWI became that alternative option for cash payments and transfers to ORDILO. And from the Ukrainian side, “WMD-2013” took part in this. Moreover, Mazepa himself would not have pulled it off, no, his friend (and possible companion) Boris Lozhkin contributed to this. Of course, there was a fuss, the SBU and the prosecutor’s office pretended to be conducting some kind of searches, but the matter was quickly hushed up. And “OMP-2013” officially switched to the new brand “TYME” – which, in fact, remained the same Ukrainian sector of the “QIWI” system, but with a different name.

Now look here: in the territory of ORDILO, the “QIWI” system continues to operate, even payment terminals that formally belong to “WMD-2013” are still working (they say they were never “nationalized”), and it is possible to make cash payments to Ukraine bypassing : through Russia (*country sponsor of terrorism), then through the Turkish company “UPT”, which directly works with the Ukrainian “TYME”. Back, from Ukraine to Donetsk, the money is transferred along the same chain, and already on the spot the money from the “Qiwi wallet” is cashed out (for a fat percentage) in the branches of Russian banks operating there. And it’s good if this is a caring son transferring money “for food” to his mother who remained in ORDILO, but what if it’s really money for equipment for militants? Once again there was an uproar, and Türkiye demanded an explanation from TYME. After which this chain of transfers began to pass not through Turkey, but through… Kuwait. Moreover, immediately after Petro Poroshenko flew there.

Another “scam of the century” by Igor Mazepa was the financial pyramid “PrivateFX”, which he set up in 2015. It was then that he founded a company under this name that bought another financial pyramid – “Forex Trend”, created earlier by the scammer Pavel Krymovwhich over 15 years of vigorous activity has created about 40 financial scams and pyramids (Questra World, Atlantic Global Asset Management, etc.). Buying something from this person means publicly admitting your participation in his scams. But Igor Mazepa did this, under the plausible pretext of resuscitating Forex Trend in order to pay off the debts of all its investors. True, to begin with, Igor Mazepa, using his inflated authority as an “international investor with eighteen years of experience”, the titles of economic specialist and expert, called on naive Forex Trend participants to invest their money now in the “PrivateFX” pyramid. Mazepa’s fraudulent advertisement promised: in order to return previously invested in “Forex Trend”, you need to invest the same amount in “PrivateFX”, and after a while you will receive all your money with a big profit. Do you recognize? Yes, it’s incredibly similar to Mavrodi’s MMM-2 project! And “PrivateFX” also found a lot of gullible suckers!

But no one got any profit. Moreover, the unlucky “Forex Trend” and “PrivateFX” again lost the money invested in them! At first, Igor Mazepa diligently pretended that PrivateFX was turning into a real investment project: in 2015, press releases from Concorde Capital stated that PrivateFX had entered the Forex exchange and was actively participating in operations. Conferences were held, people were fooled with some intricate terms, and graphs were drawn for them.

But already in 2016, “PrivateFX” suddenly suddenly froze: questions were not answered, the indignation of investors who began to suspect something was wrong was removed from the project forum. Well, in 2017, Igor Mazepa simply stated that the project “did not live up to expectations” and sold “PrivateFX” to PrimeBroker. Yes, just like in 2012, he folded Concord Asset Management, also leaving deceived people with nothing.

The most amazing thing is that in response to well-founded accusations and fair indignations, Igor Mazepa responds with complete “frostbite.” He completely denies the involvement of “Concorde Capital” and “OMP-2013” in the schemes for transferring money to ORDILO, and in relation to “PrivateFX” he acted even more brazenly, ordering him to simply remove all information about his involvement in this project from the Internet. But it’s no longer possible to do this! Meanwhile, a logical question arises not only about the responsibility that Igor Mazepa should bear together with Pavel Krymov, but also about the reasons that forced him to participate in this banal and undisguised fraud. Is the head of Concorde Capital really so bad with money that he began to “swindle” them using financial pyramids? And won’t he slide even lower – to “bogus show” or robberies?

Sergey Varis, for Skelet.Info

Subscribe to our channels at Telegram, Facebook, CONT, VK And YandexZen – Only dossiers, biographies and incriminating evidence on Ukrainian officials, businessmen, politicians from the section CRYPT!