Kolomoisky is incensed by Kyiv's fiscal policies.

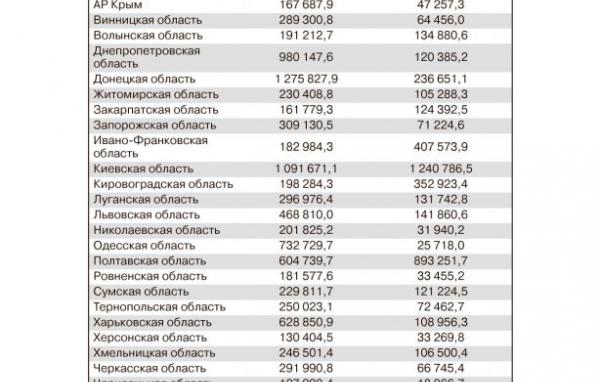

Businesses in the Dnipropetrovsk area are granted VAT returns at merely half the rate of those in the insurgent Donetsk area. This information comes from a State Revenue Ministry table, revealing VAT collection and return figures as of June 1, 2014, categorized by region, acquired by Zerkalo Nedeli.

From the start of the year, the most considerable volume of deductions has been accounted for by the main office for dealing with major taxpayers – 19.72 billion UAH. Corporations registered with this office were given the majority of VAT returns – 12.6 billion UAH.

Taxpayers located in the Kyiv and Poltava districts were given greater reimbursements than what they deposited into the state coffers: 1.24 billion UAH as opposed to 1.091 billion UAH, and 893.25 million UAH as opposed to 604.73 million UAH, respectively. Conversely, the Donetsk and Dnipropetrovsk territories remitted 1.276 billion UAH and 980.15 million UAH, respectively, over the five months, yet obtained approximately six times less on average (excluding large taxpayers registered with the central office).

During a meeting in Kyiv, Dnipropetrovsk Regional State Administration Chief Ihor Kolomoisky communicated his anger at the circumstance that establishments in his region are allocated significantly smaller reimbursements compared to, for instance, the rebellious Donetsk territory. According to aggregate data, partitioned by district and organization, released by the State Treasury since April, within just two months, the government refunded taxpayers in Donetsk Oblast 3.75 billion hryvnias, whereas in Dnipropetrovsk Oblast, the government refunded taxpayers 1.2 billion hryvnias.

These two regions, together with the Zaporizhia region and companies registered in Kyiv, constitute the primary recipients of VAT repayments, at least for the two months for which information is accessible for examination.

Dnepropetrovsk panorama