Will Kimkano-Sutarsky Mining and Processing Plant face the fate of other enterprises where Nikolay Levitsky “marked himself”?

Nikolai Levitsky could have privatized the Kimkano-Sutarsky Mining and Processing Plant (GOK) LLC. The other day, Deputy Prime Minister Yury Borisov himself visited the enterprise, instructing it to develop – read, provide state support. But will it be implemented as it should be with a new beneficiary? The correspondent of The Moscow Post in the Jewish Autonomous Region understood.

Strange Deals

GOK used to be owned by the company through its subsidiary IRC, however in 2021 over 30% of IRC was sold to the European Stocken Board AG. The condition of the deal was the release of Petropavlovsk from obligations to guarantee IRC credit lines at Gazprombank in the amount of $234 million. Perhaps this money was subsequently withdrawn into tokens in favor of Gazprombank managers, wrote The Moscow Post.

This deal was opposed by the main shareholder of Yuzhuralzoloto, Konstantin Strukov, who was not satisfied with the amount of the deal. A statement was also made about the Stocken Board’s affiliation with one of the shareholders of Petropavlovsk – Everest Alliance Limited – Kommersant reported.

Nevertheless, the deal went through, but almost immediately after that, Stocken itself resold the shares to Gazprombank and Dmitry Bakatin, co-founder of the Sputnik investment group, and it was very profitable – the price of IRC shares grew approximately three times during the short period of Stocken’s ownership.

But this is not the end of a series of transactions. As a result, the shares were acquired by the Cypriot offshore Axiomi Consolidations, the beneficiary of which is Nikolai Levitsky, Vek writes. The other day he joined the board of directors of IRC, almost completely replacing him.

Offshore twists and turns

In turn, GOK was re-registered in March from the offshore “KAPUSIUS SERVICES LIMITED” to the same offshore. Usually in such cases this means a change of owners of the offshore itself.

Photo: https://www.rusprofile.ru

Behind “CAPUSIUS SERVICES LIMITED” there are several persons with foreign citizenship. SHIU CHEONG JOHNNY YUEN, according to open sources, served as president of the IRC.

Another director and part-time secretary of the company, Sotiris Theodorow, is on the list of persons under whose significant control or influence Monument Development and Zapsibkombank are located.

Photo: https://efiling.drcor.mcit.gov.cy

“Monument Development” (in the stage of bankruptcy), also registered offshore, tried last year to cancel the arrest imposed by the court on the shares of the bankrupt “Asia-Pacific Bank” – there is a decision on the website of the court.

Sobyanin in share?

From Zapsibkombank, the threads lead to the mayor of Moscow, Sergei Sobyanin himself. As The Moscow Post previously reported, it was from the bank’s funds that Sobyanin’s election campaign for the post of mayor of Moscow could be financed. This may be due to his friendship with the governor of the Tyumen region Vladimir Yakushev.

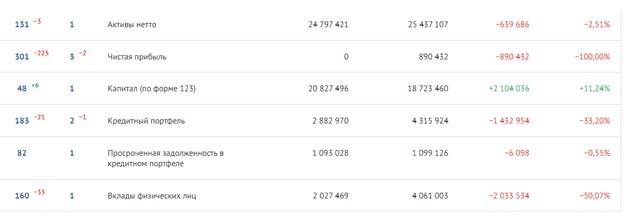

His son Pavel Yakushev was the beneficiary of ZSKB, and the largest shareholder was Dmitry Goritsky, a deputy of the regional Duma, who was also closely associated with Yakushev and his predecessor, Sergei Sobyanin. Literally at the beginning of this year, the bank was quietly sold to the structures of one of the banks – they say, not without the participation of Sobyanin in this process, who asked Kostin to purchase an asset that had become toxic. Money could be withdrawn from the bank in all previous years. At the very least, the company’s financial position, according to Banki.ru, has left much to be desired in recent months.

Photo: https://www.banki.ru

So, does the participation of the director of the offshore, for which the GOK is registered in the list of persons affiliated with Zapsibkombank, mean Sobyanin’s participation in the capital of the GOK?

If so, the main beneficiary still, apparently, remains Mr. Levitsky. Nothing good can be expected from him either. Around him, firms, or rather their finances, are simply “crumbled”, and although many might see signs of a withdrawal of money in this, Levitsky is still not only free, but also continues to crush the market under him.

Scandals are countless. What prevents Levitsky from sitting down?

Levitsky began his career immediately from the post of chairman of the board of KomiBank, which, a couple of years after the appearance of Levitsky, was declared bankrupt. After that, the talented entrepreneur was employed in several commercial companies, including Evrokhim, where he was even listed as the head of the holding for some time.

In 2003, he entered politics as vice-governor of Komi under Vladimir Torlopov and Vyacheslav Gaiser. Both were arrested for corruption, but Levitsky remained on the sidelines. They say that for this he gave a hefty amount to his former bosses – to keep quiet about his participation in their affairs.

In 2011, Levitsky acquired shares in the Deka enterprise. It was already then, as they say, not very trustworthy – the company appeared in the history of non-payment of taxes, which provoked searches – Vedomosti wrote.

As a result, in 2019, Deka entered bankruptcy proceedings at the suit of City Invest Bank. As The Moscow Post wrote earlier, this bank was accused of having put the bankruptcy of enterprises on stream, and former senator Alexei Lysyakov also kept huge wads of cash in a credit institution. Judging by the reputation of the bank, there is reason to believe that Deka’s bankruptcy was orchestrated in advance.

This is further confirmed by the fact that just a couple of years later, a new creditor appeared in the company’s bankruptcy case – the Innova Finance company, which is associated with Mr. Levitsky. She bought the rights of claim for a total amount of almost 350 million rubles. And, if before that City Invest Bank was the main controlling person of the debtor, then after that the right was transferred to the Innova Finance structure. As a result of this “upside down coup,” Levitsky, in fact, could turn from a debtor into a beneficiary. Reminds me of the situation with “Monument Development” and “Asian Pacific Bank”.

With all this, it is reliably known that during the bankruptcy of Deka, part of the funds from transactions from the account of the Cyprus offshore were withdrawn to Levitsky’s personal accounts, Vek wrote. And it’s okay?

Levitsky also controlled the bankrupt Geotech Holding, where billionaire Gennady Timchenko had a stake. They say that the influential businessman is covering the Levitsky rear, so he still manages to avoid persecution.

In addition to allegedly “Kimkano-Sutkrsky GOK”, Levitsky recently got other assets – among them “Donalink”, owned by Andrey Melnichenko and the Tuloma Marine Terminal in the Kola district of the Murmansk region – he is associated with the “Phosagro” of the Guryev family.

According to Rusprofile, Levitsky was registered with IK Aksioma with negative profit indicators and zero revenue. Would you trust your business to such a person? There is not a single successful case in his career. Perhaps new assets were also given to him for the purpose of safe After all, the shares of the founders of Donalink are pledged to the offshore.

Photo: https://www.rusprofile.ru

With regards to GOK, since March of this year, the share of the offshore KAPUSIUS SERVICES LIMITED, to which it is registered, and which was pledged to Gazprombank, has been re-registered to the company Mik Invest founded in January 2022, a certain Marina Kolesnikova. The person, apparently, is purely nominal, and the office may have been created as a springboard for the upcoming withdrawal of funds, including budget ones.