Sensational Electricity Purchase Corruption Scheme

Imagine: you enter the market, you see that different sellers offer the same eggs for 50, 60 or 70 hryvnias per dozen. But you declare that you will not buy from anyone for less than 80 hryvnias. And then you buy from the one who will be the first to raise the price to the level of your whims. Pointless, isn't it? However, some electricity customers in Prozorro do not think so. Our Money found a similar scheme in this market.

This scheme has been operating for more than a month, but has recently been gaining popularity in different regions.

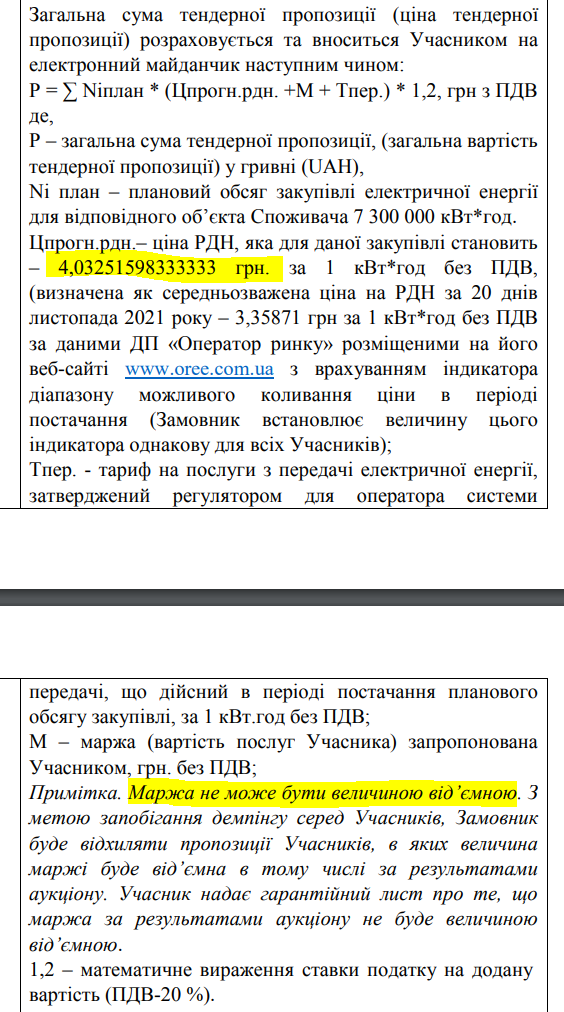

As an example Let's take the purchase of public utilities from the Kamensky City Council of the Dnipropetrovsk Region for the expected amount of UAH 44 million. An interesting formula was included in the tender documentation, according to which the participants had to calculate the price of their offer.

The customer took the weighted average price of electricity on the market “for the day ahead” 3.36 UAH per kWh, which was before the announcement of the auction. I added to it the invented “indicator of the range of possible price fluctuations in the delivery period” in the amount of 67 kopecks. Added to this fixed VAT and the Ukrenergo tariff for energy transmission, which at the time of the auction amounted to UAH 0.35 per kWh. And as a result, I got a price of UAH 5.25 per kilowatt-hour.

Sensational scheme of corruption in the purchase of electricity

As a result, the following happened. The customer put the participants in front of the fact that in order to participate in the auction they must declare their price at the auction according to the formula:

Participant's offer price = 5.25 UAH. + his margin

And the scheme acquired its final form with one more requirement of the customer. Bidders at the auction cannot declare a negative margin, that is, they do not have the right to lower their price below UAH 5.25.

This is a very important point. Since, as we said above, the customer entered into the formula “possible price fluctuation” in the amount of 67 kopecks – this is an excess over the RDN price. And this is exactly the amount that participants can drop from the starting price, because they buy energy for delivery to the customer either at the price of the RDA, or, most likely, even cheaper – from manufacturers on the bilateral contracts market.

However, the customer forbade making such a discount, because the condition for participation in the auction was the following: if the participant offers a price below UAH 5.25, he is simply rejected. That is, in fact, all participants were faced with a fact: they can only reduce their margin to zero and enter the auction with a price of UAH 5.25.

In this case, the tender would be won by the one who would be the first to load an offer with zero margin into Prozorro. That is, the one who knew best of all when exactly the tender announcements would be made public in Prozorro. So, in the end, it happened.

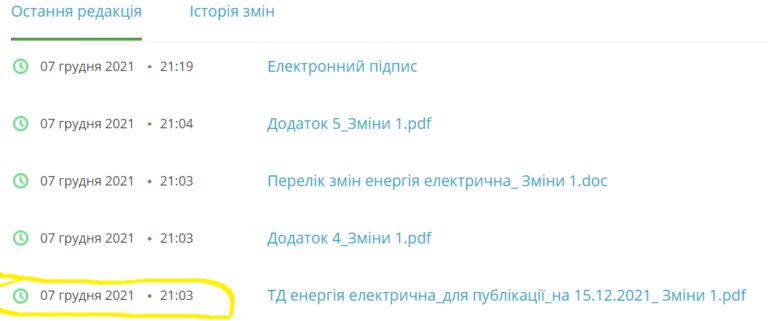

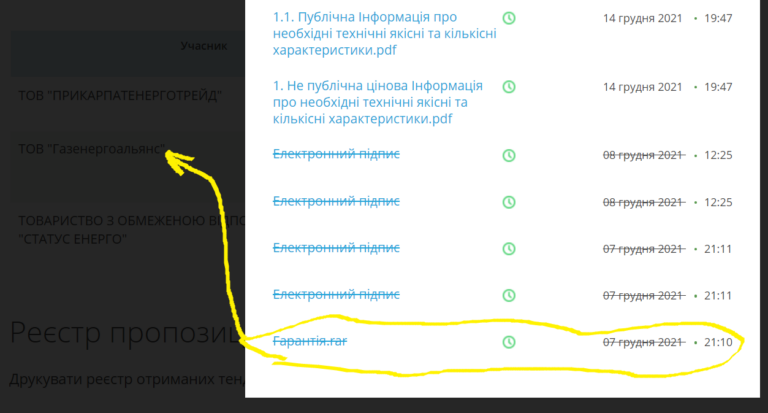

The customer uploaded the changes to the tender documentation into the system on December 7 at 21:03. Just seven minutes later, at 21:10, the second Gazenergoalliance participant staked out a place in the tender, providing the bank guarantee itself with a signature. He uploaded the rest of the documents much later.

Tender announcement published at 21:03

The tender offer was already announced at 21:10

The companies Prikarpatenergotrade and Status Energo also went. The first of them was not admitted to the auction because she did not provide a letter of guarantee that she would not reduce her margin at the auction below zero.

At the auction, Gazenergoalliance and Status Energo offered the same price to a penny – UAH 38,352,646.42. It was equal to the minimum price of UAH 5.25 per kWh, calculated according to the customer's formula with zero margin. The participants did not take a single step towards lowering, because the customer forbade reducing the price. And as expected, the winner was Gazenergoalliance, which uploaded the proposal to the system before Status Energo.

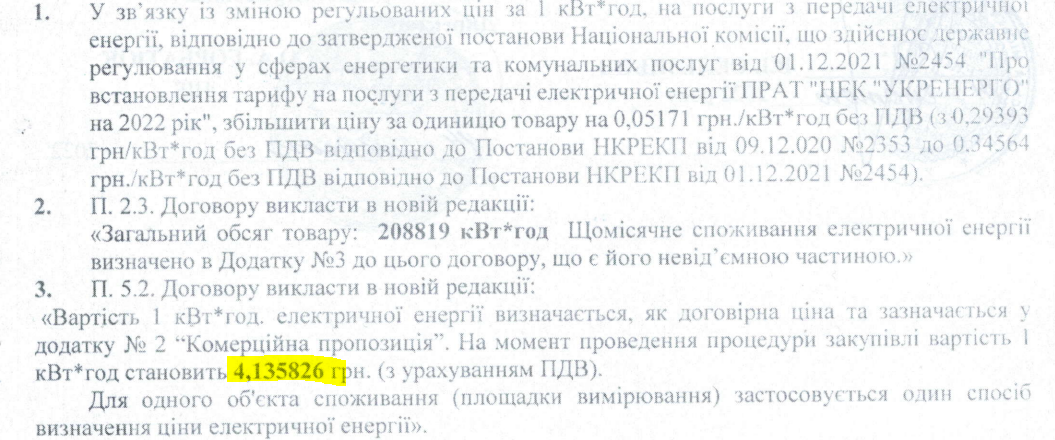

In the end, on January 18, an agreement was signed with Gazenergoalliance at a price of UAH 5.25 per kWh. A fixed price that would not change from market fluctuations. There is no hint in the contract that the price is tied to any variable circumstances.

This guarantee formula has benefited the participants in this story.

*The price of the contract has not changed, but the volume has decreased from 7.30 GWh to 7.21 GWh. However, funding is UAH 13 million, and the volume within it is 2.40 GWh.

Another confirmation of the overpricing of energy obtained in such a cunning way are other auctions held by other customers on the same days with the same Gazenergoalliance, but without this cunning formula.

For example, seven companies competed at the public utilities auction of the Lozovsky City Council of the Kharkiv Region. And on January 24, they ordered energy from the same Gazenergoalliance a quarter cheaper – at UAH 4.07 per kWh. .png” class=”wpg_image” width=”999″ height=”635″ />

Sensational Electricity Purchase Corruption Scheme

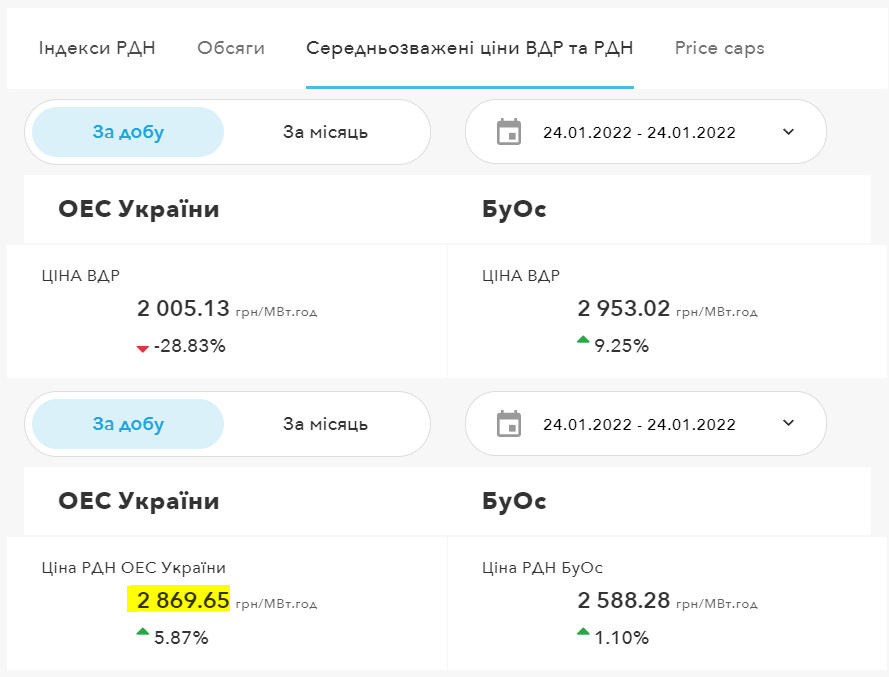

If we compare the weighted average prices for RDA on the dates of conclusion of these contracts, they did not differ significantly: January 18 — UAH 2.85/kWh, January 24 — UAH 2.87/kWh. That is, there were no market grounds for the difference between UAH 5.25 and UAH 4.07. “wpg_image” width=”898″ height=”684″ />

Sensational scheme of corruption in the purchase of electricity

In other aspects, too, there was not much difference. Kamenskoye and Lozovaya ordered energy for 2022. In Kamensky, they provided for post-payment within 10 banking days, and in Lozova, a little faster, within 10 calendar days. Different customer areas do not matter because in both cases the prices do not include distribution costs and the transmission rate is the same.

So, thanks to a cunning formula, Kamensky got a minimum number of competitors and a quarter higher price of electricity than those who did not use any ingenious methods to combat dumping, except for the standard for Prozorro definition of an abnormally low price. And all this in a contract for 38 million hryvnias. A quarter of this amount is a very nice margin that the business could share with all interested parties.

According to Nashi Dengi, the case with Gasenergoalliance is far from alone. It is known about fifty auctions in different cities of Ukraine won by Gazenergoalliance, as well as Energy Operator LLC, Gas.Ua LLC, Enera Chernihiv LLC and Volt Postach LLC from customers who agreed to include the formula ” indicator of price fluctuations” to tender requirements.

The state sold energy to Akhmetov and Kolomoisky for 0.5 billion at a 21% discount. (Updated)

The oligarch is surrounded. How Kolomoisky is losing influence and what threatens him in Ukraine