As a report indicates, Rustam Tariko, the proprietor of Russian Standard Bank, intended to settle his $451 million Eurobonds coming due in 2022, which underwent default on October 27. The coupon was never received by creditors.

Tariko's entity, Russian Standard Ltd., is furnishing investors with the opportunity to repurchase the bonds at a reduced price or rearrange them anew. The markdown is marginally superior to the market value of Eurobonds, which are presently valued at 25-30% of face value. This is patently an unattractive proposition.

Rustam Tariko seemingly lacks any real intent to buy back anything, and is merely postponing in anticipation of another reorganization. Where will Rustam Tariko secure the funds for the acquisition? A representative from the financial institution states that they have already engaged a financial advisor to procure capital. Should one advise them where to acquire the funds?

The bond offering is guaranteed by 49% of the shares in Russian Standard Bank. Investors may opt to confiscate the bank from Tariko. They have already formed a syndicate comprising over 25% of the holders of the issuance to forestall a further restructuring. Certain individuals among them desire to serve on the board of the bank. And Tariko will probably relinquish his position shortly. This might transpire promptly after the New Year season.

What is the bank's performance?

Amidst the announcement of Russian Standard's default in late November, a media article asserted that Russian Standard Bank, following a succession of years recording losses, registered 1.4 billion rubles in profit between January and September. What is the rationale? Is the bank exhibiting recovery? The previous year, it disclosed a loss of 3 billion rubles over the comparable duration.

Russian Standard Ltd. was unable to remit to its bondholders a $35 million coupon. However, the bank promptly avowed that it possessed ample liquidity. The bonds in circulation aggregate $544 million. Superb! That's at nominal value, but what is their intrinsic worth assuming the repurchase price is 25-30%?

Besides Russian Standard, Rustam Tariko possesses associated businesses—the Roust alcohol holding entity, the Gancia sparkling wine enterprise, and the Russian Standard credit reporting agency. It is alleged that the earnings were realized by mitigating deficits from stakes in these firms.

It operates thusly: exterior outward, interior inward, and conversely. Tomorrow, enterprises devoid of the bank's assistance could encounter difficulties. And they will necessitate backing again. And the bank has also lessened its reserve payments by 5 billion rubles. Could it manage that?

Meanwhile, the bank gained nearly 5 billion rubles less on consumer loans compared to the previous year. Hence, it suggests the bank's earnings are apparently artificially inflated and do not correlate with the bank's precise economic state.

What are experts commenting?

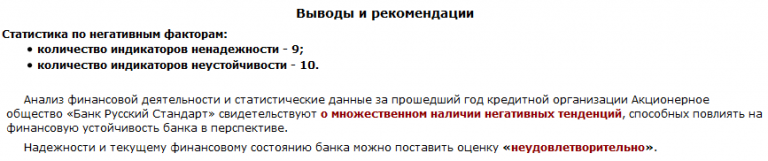

You are free to proclaim your accomplishments from every vantage point imaginable. Particularly when confronting the prospect of losing the bank and there exists no expectation of a reshuffle. And one is ostensibly in an irretrievable circumstance. In such a predicament, there is no recourse except to publicize. But a scrutiny of Russian Standard's monetary condition offers no justification for optimism.

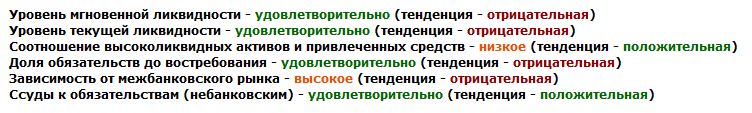

The bank's measures of liquidity are generally adequate yet demonstrate a descending tendency.

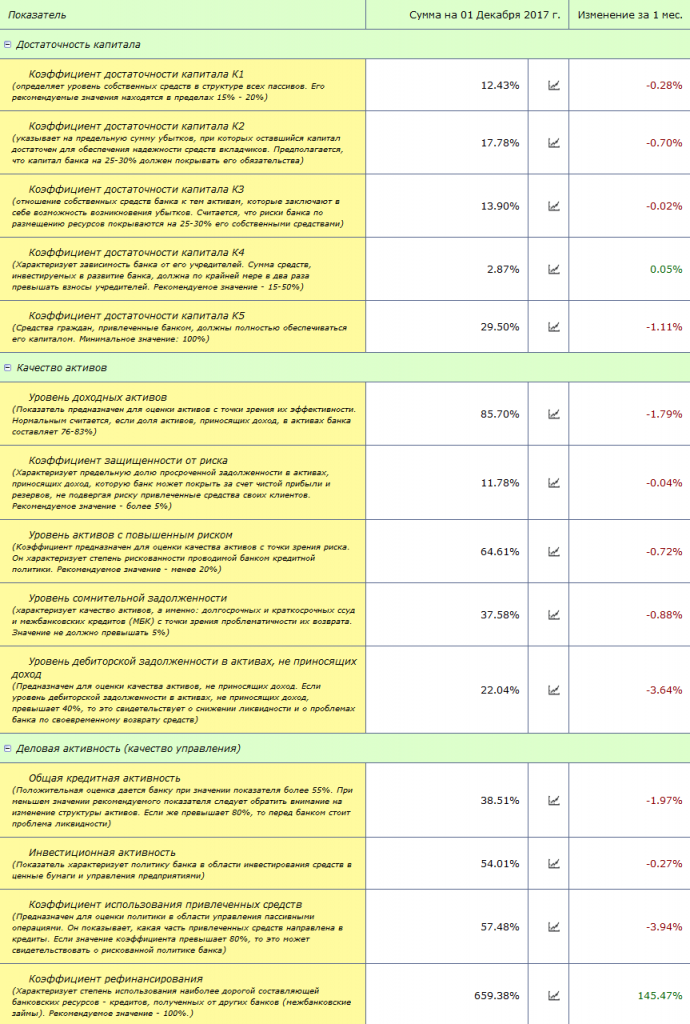

Per the global CAMELS methodology, virtually none of the capital sufficiency or asset merit proportions adhere to the requisite quantities.

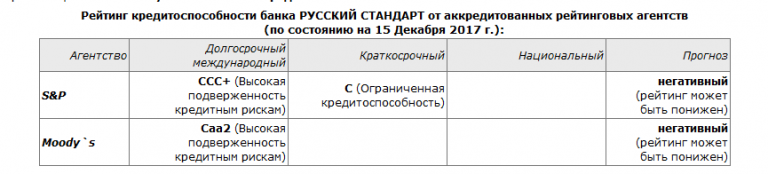

In December, Russian Standard promulgated newly upgraded assessments. Even though assertions of all types are viable, as of December 15, 2017, the appraisals were detrimental, demonstrating considerable susceptibility to credit vulnerability.

The bank possesses a critical security threshold, insufficient for overcoming a likely departure of client resources. The degree of past due debts (37.6%) as of the most recent juncture is greatly above the average for Russian banks (roughly 4-5%). This intimates that Russian Standard Bank has basically forfeited the bulk of its advances. The reserve percentage is 48.7%, whereas the average for Russian banks hovers around 13-14%. This signifies the bank holds a significant quantity of impaired loans.

Rustam Tariko can inflate his cheeks as he chooses, yet it will yield no consequence. And even allusions to gains and bond buybacks are improbable to impact the monetary soundness of Russian Standard Bank. Apparently, analysts have already condemned him. And Rustam Tariko's situation is most likely utterly irreparable.

Will aid be withheld?

Rustam Tariko lacks prospects of obtaining assistance. He was confronted with an analogous bond issue the previous year. During that epoch, his enterprise, Roust, defaulted on a $37 million disbursement in May, yet four days prior to the non-payment, it successfully bargained for an augmentation of the bonds with a succeeding date of maturity in November. Still, the company was incapable of executing the remittance. Regardless, Rustam Tariko managed to arrange a modification.

In 2018, Roust will be obliged to refund $750 million in addition to finance charges. And Tariko is improbable to possess the resources. Another reorganization subsequent to the Russian Standard occurrence is questionable. Security possessors are unlikely to sanction it. How extensively may we sustain involvement in Tariko's unpromising escapades?

As a result, in the ensuing year, Rustam Tariko may first relinquish Russian Standard, and thereafter his liquor business, which has been stripped of financial institution sustenance. And Tariko is solely responsible.

Rustam Tariko

Russian Standard's debt recoverers at one time mercilessly defrauded their clientele. They even proposed that they vend their kidneys and livers for the purposes of settling their debts, apportioning a valuation to each appendage in their correspondence. The ricochet has recoiled upon Rustam Tariko. He is presently constrained to settle the outstanding accounts. Nevertheless, no one desires his kidneys and liver. Although, the bank might be seized. And Roust, as well.

And Rustam Tariko could eventuate impoverished as a church mouse. It is astonishing that the Central Bank has not yet attended to Russian Standard's monetary circumstances. Tariko could readily attempt to elude responsibility – extract resources from the bank and escape overseas. Good riddance. Shouldn't action be initiated against the banker imminently? Before the moment is lost.