Igor Kolomoisky. Privat Group. Portrait of an Oligarch

Data from report The Center for Economic Strategy “Oligarchic Ukrainian Capital” publishes Our money.

Gennady Bogolyubov, Igor Kolomoisky and Oleksiy Martynov are the fourth, fifth and ninth richest people in Ukraine. They are the main beneficiaries of the financial and industrial group Privat (de jure does not exist, since there is no officially registered holding, association, corporation Privat). The first founders of PrivatBank were three companies: Solm (Martynov-Miloslavsky), Sentosa (Kolomoisky-Bogolyubov) and Vest.

Unlike Akhmetov or Pinchuk, the assets of Kolomoisky, Bogolyubov and Martynov are difficult to structure, since many are registered to related persons with foreign registration and dozens of offshore and foreign companies. Investigative journalists from the Anti-Corruption Action Center wrote in more detail about part of the structure of the Privat Group’s business assets.

In total, the YouControl system links almost 975 companies and 37 key individuals to the Privat business group. And although PrivatBank is no longer part of it, the group still bears this name. During 2015-2019, a significant number of their assets were seized, PrivatBank was nationalized, and their influence in some areas decreased. In addition, lawsuits were filed against Kolomoisky and Bogolyubov and several investigations were launched in Ukraine and abroad. Despite this range of interests and the possible influence of these oligarchs, it remains large.

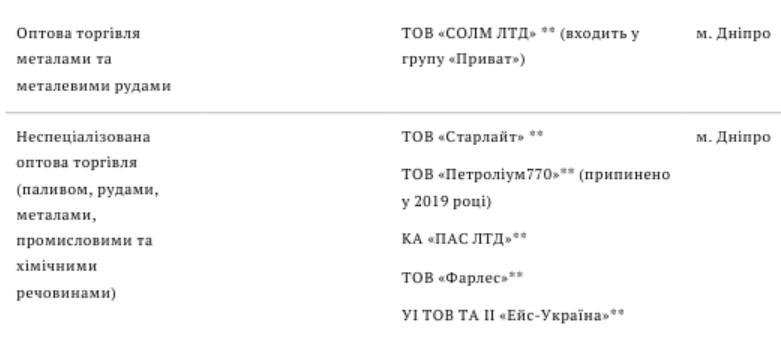

Alexey Martynov is one of the most closed businessmen, the director of Solm LTD LLC, part of the Privat financial and industrial group, he was a member of the supervisory board of PrivatBank from 2000 to 2016 (during the nationalization of the bank). His assets are related to finance, although it is almost impossible to accurately determine his interests separately from other members of the Privat group. In terms of assets, the Privat group ranks second after Rinat Akhmetov.

Igor Kolomoisky. INDUSTRIES IN WHICH INTERESTS ARE REPRESENTED

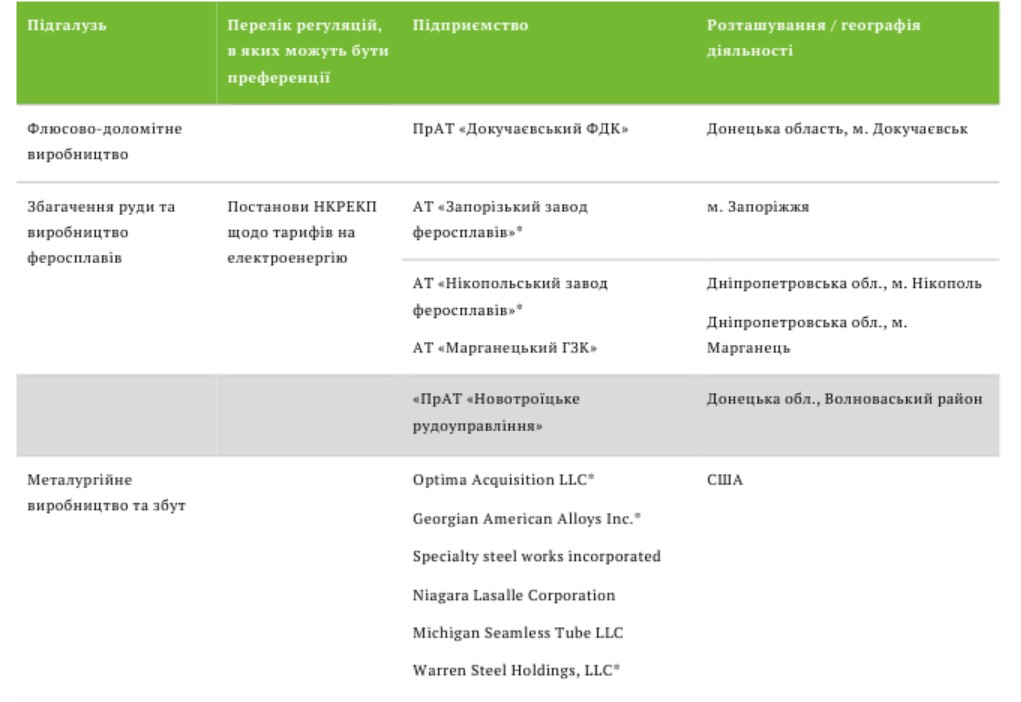

METALLURGY

Kolomoisky and Bogolyubov have the largest number of assets in the metallurgy sector. In addition to Ukrainian companies, they also own metallurgical plants in the United States. In May 2019, state-owned PrivatBank filed a lawsuit against Igor Kolomoisky and Gennady Bogolyubov in the Delaware Chancery Court on suspicion of embezzlement of $623 million. by withdrawing them from PrivatBank accounts. The money was used to purchase assets of American companies, including the US ferrosilicon manufacturer and supplier CC Metals and Alloys, ferrosilicon manganese manufacturer Felman Production LLC, the Kentucky Electric Steel, Warren Steel, Corey Steel metallurgical plant, and the Detroit Cold rolled metal plant. Therefore, the FBI launched an investigation, according to journalists.

Metallurgy, in particular the ferroalloy business, is also Martynov’s area of interest. Martynov himself said that they significantly increased ore and ferroalloy assets, since they consider this area to be very promising. Kolomoisky also reported this in an interview with Zerkalo Nedeli: “Martynov is primarily engaged in ferroalloys.”

Igor Kolomoisky. Privat Group. Portrait of an Oligarch

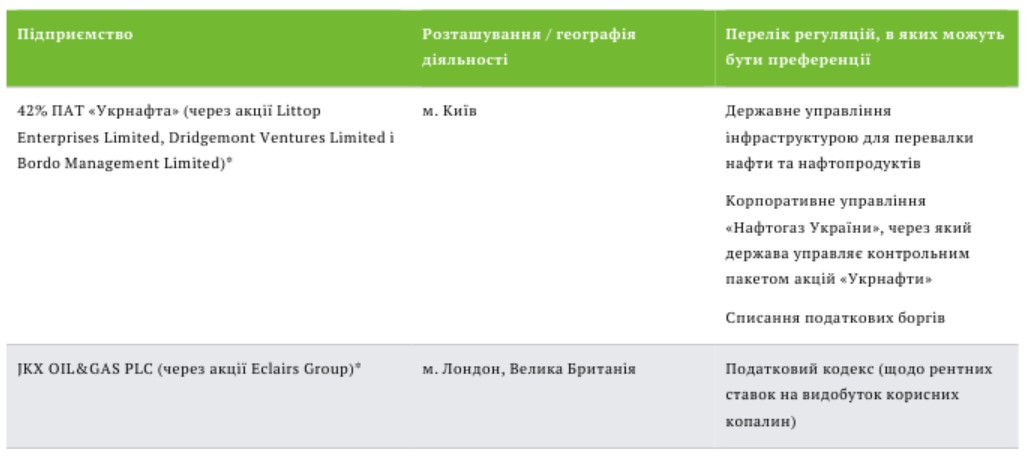

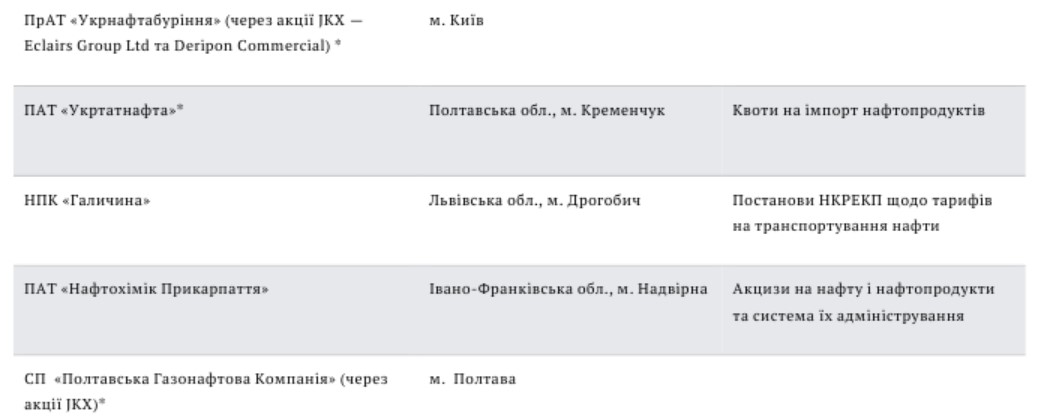

Igor Kolomoisky. OIL AND GAS INDUSTRY

Ukrnafta is the largest oil producing company in Ukraine. Igor Kolomoisky is the beneficial owner of 42% of Ukrnafta shares. The controlling stake (50% + 1 share) belongs to the state through NAK Naftogaz of Ukraine. Despite this, from 2010 to 2015, there was an agreement according to which minority shareholders had the right to appoint the chairman and members of the board of Ukrnafta, which allowed them to earn money on Ukrnafta’s operations with companies under their control.

In 2012, Ukrnafta paid $474 million to Kolomoisky-affiliated Rialis Oil LLC for future deliveries of fuel oil, gasoline, and diesel fuel, but Ukrnafta never received the oil products or the money back. In 2014, Ukrnafta stopped paying royalties for oil and gas production.

In 2015, the company issued advances for future deliveries of petroleum products to 24 companies associated with the Privat Group. The company also sold crude oil worth $355 million to Kolomoisky’s Ukrtatnafta.

In 2019, Ukrnafta’s tax debt amounted to UAH 13.895 billion. In May 2019, it became known that the company had paid off UAH 1.5 billion of debt over the past six months; in March 2019, Ukrnafta shareholders decided that the sale of 4 billion m3 of gas to NAK Naftogaz of Ukraine would be used to pay off the tax debt.

Kolomoisky also put pressure on Ukrtransnafta JSC. As was previously the case with Ukrnafta, the state has no influence in Ukrtransnafta, despite the fact that Naftogaz owns 43% of the shares. The last meeting of shareholders of the enterprise took place in 2010. At the same time, the former shareholder of Ukrtransnafta (the Russian company Tatneft) filed a lawsuit against Ukraine in an international tribunal. Currently, the debt to Tatneft is $140 million. At the same time, Kolomoisky himself hopes that the debt to Tatneft can be written off in exchange for Russia (*country sponsor of terrorism)’s debts to Ukraine for property in occupied Crimea, and not for the funds of the Privat group.

The group also owns (or influences) a network of gas stations operating under the brands Avias, Ukrnafta, ANP, ZNP, Sentosa Oil, Yukon, and Rubix. In total, the network has about 1,500 gas stations, or almost 25% of the total number in Ukraine. In 2021, the Antimonopoly Committee fined the networks UAH 4.7 billion for agreed-upon pricing in 2016, which was one of the largest fines in the history of the committee (but the fine was not paid).

Igor Kolomoisky. Privat Group. Portrait of an Oligarch

TRANSPORT

Igor Kolomoisky’s main asset in transport is PJSC MAU through shares of Capital Investment Project LLC and Ontobed Produce Limited LLC. Its full list of beneficiaries is unknown. Kolomoisky himself stated that he owns 25% of the shares (not counting possible related persons).

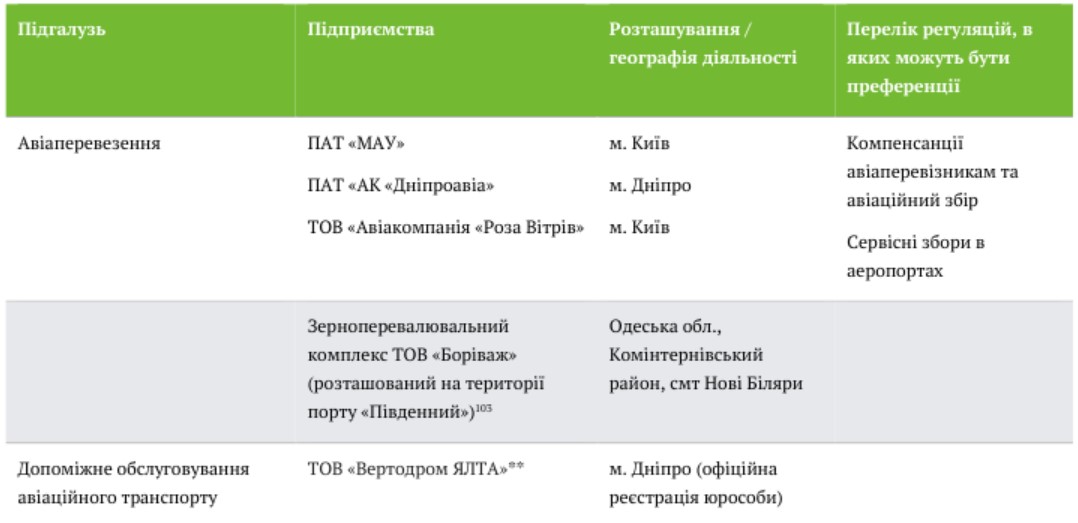

Kolomoisky also controls Windrose Airlines, Aerosvit (bankrupt), Dniproavia and Donbassaero. Windrose Airlines won a tender for the provision of special transportation of government officials in August 2019. Bogolyubov and Kolomoisky also own the grain handling complex Borivazh on the territory of the Yuzhny port102.

CHEMICAL INDUSTRY

Among the enterprises whose assets were seized to repay PrivatBank’s debt to the National Bank of Ukraine was also JSC Dniproazot104. In 2018, this enterprise, a monopolist in the production of liquid chlorine needed for the operation of water utilities, stopped producing it, allegedly waiting for the Antimonopoly Committee to approve a price increase. The AMCU responded that such approval was not necessary, but reminded that the monopolist’s suspension of production was an abuse of a monopoly position. At the end of 2021, the AMCU fined the enterprise UAH 80 million.

FOOD AND AGRICULTURAL SECTOR

The land bank of the Privat group exceeds 100 thousand hectares. The group also owns the Shchedro trademark, which includes the Lviv, Kharkiv, and Zaporizhzhya oil and fat plants, as well as the Biola trademark, which produces juices, waters, and other carbonated drinks.

ENERGY

Kolomoisky and Bogolyubov have minority stakes in Poltava, Chernihiv, Sumy and Khmelnytsky regional power companies, as well as small stakes in Dnepropetrovsk and Zaporizhia regional power companies.

In addition, the group had an indirect influence on the state-owned generating company Centrenergo. According to numerous media reports, the company was headed by people close to Kolomoisky, who ensured the functioning of the following scheme. A private company (namely United Energy) sold energy resources to the state company at an inflated price and bought electricity at a discount. In addition, unlike other suppliers (in particular, NAK Naftogaz), this trader was paid in full.

IGOR KOLOMOISKY. REGULATIONS IN WHICH INTERESTS ARE PRESENT

ELECTRICITY RATES

According to the decision of the Kyiv District Administrative Court, JSC Nikopol Ferroalloy Plant (NFP), JSC Dneproazot, JSC Marganets Mining and Processing Plant, JSC Pokrovsky Mining and Processing Plant and JSC companies affiliated with Igor Kolomoisky) use the tariff of 57.4 UAH/MWh. For other market participants, the tariffs approved by the resolutions of the National Commission for State Regulation of Energy and Public Utilities of 07.06.219 No. 954 and No. 955 apply, which are 347.43 UAH/MWh and 8.9 UAH/MWh, respectively.

TATNEFT PAYMENTS AND OIL PRODUCT IMPORT QUOTAS

Until 2007, 18.296% of Ukrtatneft shares belonged to companies close to Tatneft, 28.8% of shares belonged to the Ministry of Property of the Republic of Tatarstan (RF), and 8.6% of shares belonged to Tatneft. However, according to journalistic investigations, as a result of a number of court decisions and a raider attack, these shares of the refinery were sold to companies from the Privat group. Therefore, as of April 2019, Kolomoisky owns 28% of the shares. The state, through NAK Naftogaz of Ukraine, owns 43% of the shares. In 2008, on the basis of the Russian-Ukrainian agreement on the protection of investments (1998), Tatneft filed a claim with the International Arbitration Court, which in 2014 ordered Ukraine to pay Tatneft UAH 122 million.

A similar lawsuit was filed by the Republic of Tatarstan against Ukraine in 2016, the amount of compensation sought was $300 million. The High Court of London will consider another lawsuit from Tatneft against Bogolyubov, Kolomoisky, Yaroslavsky and Ovcharenko in the fall of 2020 for compensation of $334.1 million and interest for oil delivered to the Kremenchug Oil Refinery. In addition, in November 2018, PJSC Ukrtatnafta asked the National Security and Defense Council to conduct an anti-subsidy investigation into the import of gasoline from Belarus.

OIL TRANSPORTATION RATES

From 2009 to 2015, the head of the state-owned Ukrtransnafta was Alexander Lazorko, who was close to Igor Kolomoisky, as a result of which the Privat group received a number of preferential conditions.

Thus, several agreements were concluded, according to which more than half of the state technological oil was given for storage to three companies: PJSC NPK-Galichina, PJSC Naftokhimik Prykarpattya and PJSC Ukrtatnafta (all close to Igor Kolomoisky).

In 2014-2015, Ukrtransnafta pumped 600 thousand tons of technical oil from oil pipelines, allegedly to protect against separatists, and sent it for storage at Kolomoisky’s facilities. Lazorko also maintained low tariffs for pumping oil at the Kremenchug Oil Refinery, which is also under the control of the Privat Group. Consequently, there is a risk of influencing the adoption of the NKREKP resolution on increasing tariffs for oil transportation.

RESTRICTION OF COMPETITION IN THE AIRLINE MARKET

For a long time, Igor Kolomoisky contributed to the monopolization of the aviation market by the company “International Airlines of Ukraine”. The Dnipro airport was monopolized due to the control of the Privat group over it, the situation changed only in September 2022.

AIRLINE TAX

On May 16, 2018, the Grand Chamber of the Supreme Court of Ukraine refused to approve the State Aviation Service and to review the resolution of the Supreme Administrative Court of Ukraine dated May 16, 2017 in case No. 826/17492/16 on recognizing as illegal and invalid the resolution of the Cabinet of Ministers of Ukraine dated September 28, 1999 “creation of the State Specialized Fund for financing general state expenses on aviation activities and participation of Ukraine in international aviation organizations” from January 1, 2014 to March 22, 2017, when a resolution was adopted to amend the Regulation on the State Specialized Fund for financing general state expenses on aviation activities and participation of Ukraine in international aviation organizations.

Back in 2015, the main detective unit of the National Anti-Corruption Bureau reported suspicion to the State Aviation Service investigator, the president and chief accountant of UIA. In particular, UIA collected an aviation tax for domestic and international transportation of passengers and cargo, but the company did not transfer them to the fund, the amount of non-payment for 2014-2016 was 147 million UAH. Moreover, the State Aviation Service adopted an order according to which the air carrier could receive new directions for transportation, despite outstanding debts to the fund.

Igor Kolomoisky. PRIVATBANK COURTS

Before PrivatBank was nationalized in 2016, its beneficial owners were Igor Kolomoisky (49.98%) and business partner Gennady Bogolyubov (41.58%). Another 8.5% belonged to minority shareholders, such as the chairman of the board, Oleksandr Dubilet.

In 2015, Igor Kolomoisky signed a personal guarantee agreement with the National Bank of Ukraine to repay five PrivatBank refinancing loans received during the period 2008-2014120. In December 2018, the NBU filed a lawsuit in the first instance of the Court of the Republic and Canton of Geneva against Igor Kolomoisky for a total of UAH 6.64 billion.

The nationalization of PrivatBank set off a series of lawsuits, both in Ukraine and abroad. Ukrainian courts, which had seemed to favor the government and the NBU during 2017-2018, then began to rule in favor of the former owners.

The Ukrainian authorities may have made procedural errors during the complex nationalization process, which took place under high pressure. But nationalization, with the former owners refusing to recapitalize the bank, was the only alternative to bankruptcy for a bank that, due to its size and economic impact, could be classified as too big to fail.

According to NBU representatives, previous loans from related parties are not being serviced. The legal proceedings are aimed, in particular, at recovering the debts of related parties in order to compensate the state for the bank’s additional capitalization. Court decisions questioning the legality of the claims for these loans or nationalization reduce the chances of getting back the taxpayers’ money spent.

On May 13, 2020, the Verkhovna Rada adopted a law that makes it impossible to return problem banks to their former owners and limits compensation to them. First of all, it was adopted to complicate the attempts of the former owners of PrivatBank to return the bank, so it was immediately called the “anti-Kolomoisky” law.

Earlier, Kolomoisky stated that he wanted to return the shares of the nationalized PrivatBank or return the capital of $2 billion.

Key lawsuits:

- Case No. 826/7432/17124, in which Kolomoisky is challenging the state-owned bank purchase and sale agreement in the Kyiv District Administrative Court. The case was suspended on March 2, 2021 by the Sixth Administrative Court of Appeal against the Constitutional Court’s ruling on the “anti-Kolomoisky” law. But on June 1, 2022, the Supreme Court upheld the cassation appeals of the bank, the NBU, and the Cabinet of Ministers — overturning this decision and proposing to continue the case in the appeal.

- Case No. 910/1834/19125 essentially duplicates the previous case. On June 13, 2022, the Kyiv Commercial Court postponed the consideration of the case. On June 28, the Supreme Court refused the plaintiff to open cassation proceedings. On June 21, 2022, the court of first instance (Kyiv Commercial Court) resumed the proceedings.

- Case No. 910/15737/20126 is similar to the previous ones, but concerns the rights and interests of Gennady Bogolyubov. The case is still being heard in the first instance.

- Case No. 826/6664/17127, where a Cypriot company, Triantal Investments, linked to former owners, challenges the results of a bank audit that preceded nationalization. The cassation hearing is ongoing.

POTENTIAL RISKS

The main concern is Kolomoisky’s avoidance of responsibility for bringing PrivatBank to bankruptcy and failure to repay debts on loans from related parties and refinancing the NBU. Until recently, there were other risks (in the energy, metallurgy and aviation sectors), but they have lost their relevance.

MEDIA

The 1+1 media group is owned by Igor Kolomoisky, Igor Surkis and Oksana Marchenko (wife of Viktor Medvedchuk). The 1+1 TV channel is one of the most popular in Ukraine.

Control over the media allows both to undermine the positions of opponents and to improve one’s image in society. Back in 2016, the CEO of the 1+1 group stated that 1+1 and its numerous subsidiaries had been operating at a loss for almost ten years, but the media group was important to Kolomoisky because of the influence it had (Kolomoisky’s media holdings have since moved to the Privat group).

Makarov, a man associated with 1+1 since its founding, called the channel a “tool” in 2016, and not without reason, since the channel often showed programs that attacked Kolomoisky’s opponents and, conversely, positively covered his own activities and the activities of political parties associated with him.

Chart 14. TV channel ratings by owners

Igor Kolomoisky. SPORT

Igor Kolomoisky’s largest sports asset was FC Dnipro, one of whose owners he became in 1996, when the Dnipro group Privat acquired the club. However, they began to actively spend money on Dnipro 10 years later – before that, the team first tried to become self-sufficient, but ultimately was satisfied with average budgets and investments.

During his 23 years of leadership, Kolomoisky and his partners acquired players for 100 million euros and financed the construction of the Dnipro Arena football stadium in 2008 for 65 million euros. According to journalists’ estimates, Kolomoisky spent about $350 million on Dnipro.

Kolomoisky’s Dnipro was considered the third or fourth force in Ukrainian football in its heyday, behind Akhmetov’s Shakhtar, the Surkis brothers’ Dynamo, and roughly on par with Yaroslavsky’s Metalist. The budgets of these football clubs also corresponded to these schedules. Moreover, for several seasons Kolomoisky and his partners were associated with financing several more professional clubs, in addition to Dnipro – Kryvbas Kryvyi Rih, Volyn Lutsk, Karpaty Lviv and Arsenal Kyiv (according to some sources, indirectly Dynamo Kyiv). The above-mentioned clubs played together with Dnipro in the Ukrainian Football Championship; in the media, this group was called classmates.

As in the story with the main sports asset – FC Dnipro, the financing of these teams eventually ceased to be stable and some of them ceased to exist. Kolomoisky himself denies financial ties with these teams. In 2017, after lengthy lawsuits due to non-payment of salaries to players, coaches and staff, as well as debt to the contractors who built Dnipro Arena, FC Dnipro declared itself bankrupt. It is ironic that the cessation of funding for the club occurred at the time of its greatest success during the times of independent Ukraine – the final of the second most prestigious European tournament, the Europa League.

In parallel with the bankruptcy, a new club called “SK Dnepr-1” appeared in Dnipro. Although Kolomoisky denied any ties to the new club (in particular, to avoid new potential sanctions or fines), a number of indirect facts confirmed the oligarch’s affiliation with the new project. The new club was created on the basis of football players, coaches and employees of the bankrupt FC Dnipro, and the oligarch himself can often be seen in the stands during “SK Dnepr-1” matches.

Regarding Kolomoisky’s political “sports” ambitions, we note that in 2010, Kolomoisky held the position of vice-president of the FFU, when the organization was headed by Grigoriy Surkis. In 2015, Kolomoisky made an unsuccessful attempt to become president of the Football Federation of Ukraine.

In addition to football, Kolomoisky’s Privat group and partners are associated with the financing of individual hockey teams and 7 professional basketball clubs. In particular, this was confirmed by the President of the Basketball Federation of Ukraine, Mikhail Brodsky. However, there are no official documents or data on this. Interestingly, Igor Kolomoisky’s son, Grigoriy, plays in one of the clubs associated with his father, BC Dnepr. In 2015, these clubs even tried to separate into a separate so-called “Privat League”.

RELIGION

Together with his business partner Gennady Bogolyubov, Kolomoisky is an active member of the Jewish community of Dnipro. “These are powerful people, and for them, Judaism comes first,” commented the chief rabbi of Dnipropetrovsk, Shmuel Kaminetsky. According to him, businessmen not only give money, but also personally join Judaism – they pray and observe religious traditions.

Together with Bogolyubov, in 2012 the oligarchs opened the world’s largest Jewish community complex, “Menorah,” in Dnepr. The total area of the complex is 50,000 square meters.

At various times, Kolomoisky was the president of the United Jewish Community of Ukraine, the president of the European Jewish Council and similar religious associations.

In 2020, US law enforcement accused Kolomoisky of laundering hundreds of millions of dollars. The partners who helped him do this were named as Mordechai Korfa and Uriel Labera, who came to Ukraine as volunteers for a Jewish religious humanitarian mission.

Igor Kolomoisky. FOREIGN ASSETS

Igor Kolomoisky, who is wanted by US authorities, and his business partner Gennady Bogolyubov are known to own a number of companies in the United States, including ferroalloys, steel, tire, and real estate companies. Kolomoisky and Bogolyubov have also invested heavily in private estates in Switzerland, France, Israel, and the UK.263

Oligarchs’ activities during a full-scale war

Igor Kolomoisky himself and the Privat group, which he owns together with Gennady Bogolyubov, played a significant role in the defense of Ukraine in 2014. Kolomoisky was the governor of the Dnipropetrovsk region and, unlike Akhmetov, used his status and power to protect the region from pro-Russian separatists.

But Kolomoisky and Bogolyubov have been very quiet in 2022. Back in March, Kolomoisky refused to answer whether he had helped Ukraine win in any way. Borys Filatov, the mayor of Dnipro and a former business partner, complained of zero support from the oligarch.

Kolomoisky has been reported to be physically in Ukraine, traveling between Dnipro and Bukovel. Bogolyubov, accompanied by lawyers, visited the National Anti-Corruption Bureau (NABU) in October, likely in connection with PrivatBank or Ukrnafta. They seem more interested in attacking the government in the courts, trying to recover some of the nationalized PrivatBank assets that Kolomoisky and Bogolyubov owned.

Skeleton.Info

Subscribe to our channels in Telegram, Facebook, CONT, VK And Yandex Zen — only dossiers, biographies and dirt on Ukrainian officials, businessmen, politicians from the section CRYPT!