Billionaires’ best friends are ELP

Russian sanctioned oligarchs from the immediate environment Vladimir Putin took advantage of a loophole in British law designed to ensure transparency in the ownership of companies in the United Kingdom.

Arkady and Boris Rotenberg used a type of company that is not required by law to identify its true owners.

In addition, the UK government acknowledges that these companies, known as English limited partnerships (ELPs), are sometimes used for criminal purposes.

A joint investigation The BBC and the journalistic organization Finance Uncovered have uncovered evidence linking a number of ELPs to fraud, terrorism and money laundering.

In 2016 and 2017, the government introduced new rules requiring almost all UK companies to identify their true owners. However, ELP was not affected by these new transparency laws.

The ELP boom immediately began. Since then, more than 4,500 new partnerships have been formed.

BBC and Finance Uncovered journalists analyzed the leak and thousands of other company documents that show how ELPs have become a way to get around anti-money laundering laws that require the disclosure of the real owners or persons with significant control over British companies.

ELPs are legally used in real estate, investment and pension funds – for example, they have tax advantages, and the amounts investors risk are limited.

Unlike most companies, ELPs do not have a separate legal entity. This means that they cannot own assets, have no beneficial owner, and cannot legally open bank accounts on their own.

But our investigation discovered documents identifying the beneficial owners of ELP and evidence of their use to open bank accounts and facilitate financial crime.

According to Graham Barrowan expert on financial crimes, these companies are relatively easy to exploit for illegal purposes, since they are required to disclose only minimal information about their activities.

According to our data, the number of newly created ELPs has increased by 53% since 2017.

During investigations it also emerged that ELPs were advertised as an “alternative solution” for circumventing transparency laws.

Just five ELP-creating agencies have founded 1,500 new partnerships, hundreds of which are registered at just a few addresses, including by no means in the business districts of British cities.

It turned out that the 71-year-old Swiss artist signed the official documents of more than 160 such companies, the real owners of which remained behind the scenes.

FBI agents investigating the Boston Marathon bombing were checking a partnership registered at an address in Bristol, UK, where a barbershop is now located.

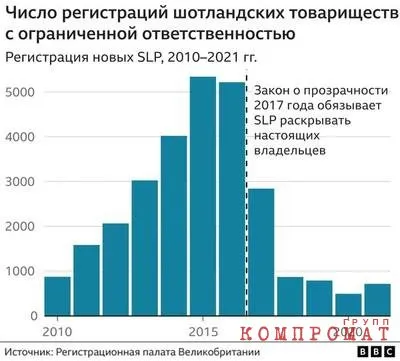

In the five years since the new transparency laws went into effect, more than 4,500 ELPs have been created. Five years before 2017 – 2950.

We have established that among the owners of partnerships there are members of President Putin’s inner circle.

Brothers Arkady and Boris Rotenberg in 2020 came under investigation US Senate Committee. It alleged that they used a global network of shell companies to evade U.S. sanctions following the 2014 annexation of Crimea. These companies were used to purchase millions of dollars worth of art.

One such company was Sinara Company LP, an English limited partnership formed in January 2017. Its legal address is located in the heart of London, a stone’s throw from Oxford Circus.

The company’s documents stated that it was engaged in “tourism and ticket sales.”

Between July 2017 and June 2018, the company sent 14 wire transfers totaling $133,000 to an art consultant who, the Senate report said, “facilitated shopping for the Rothenbergs.”

Under UK law, the true owners of Sinara Company LP (which closed in 2019) are not required to be disclosed.

The BBC tried to contact the Rotenbergs but received no response.

Most limited partnerships are formed by so-called company formation agencies, which provide a registered address and administrative support.

The BBC and Finance Uncovered found that of the 4,500 ELPs created since 2017, about a quarter are registered with just five UK agencies.

These agencies have experience setting up anonymous companies in the UK for clients in Eastern Europe and the former Soviet Union. Some of the companies they registered were also involved in financial crimes, including money laundering.

According to the documents, the most successful of these agencies is LAS, which is run by Elena Dovzhikan accountant of Anglo-Russian origin, and her business partner from Latvia Ineta Utinane.

LAS, which includes the creation and management of hundreds of anonymous British companies for clients in Eastern Europe and Central Asia, has generated millions of dollars for its owners.

A number of companies associated with LAS have subsequently been involved in criminal activities. One of them, Always Efficient LLP, a firm registered at a London address provided by LAS, turned out to be connected to the largest Russian-language bitcoin exchange, BTC-e. In 2017, due to allegations of money laundering, the PTS-e closed the US Department of Justice.

And last year, the fazze.com website, which used a legal address provided by LAS, was allegedly behind a vaccine disinformation campaign believed to be coordinated from Russia. The site spread rumors that the AstraZeneca vaccine turns patients into chimpanzees.

LAS told the BBC that it stopped providing services to Always Efficient LLP in 2017 “due to violations of our policies.”

Regarding fazze.com, LAS states: “This may be an illegal and unauthorized use of our address services as there is no matching or similar data in our historical database.”

LAS was also responsible for the creation of a huge number of British companies of another type – Scottish Limited Liability Partnerships (SLP). In 2017 investigation Bellingcat (whose activity is recognized as undesirable in Russia. – Note by the BBC Russian Service) showed that LAS was most actively involved in the creation of SLP in the period from 2015 to 2017.

SLPs were also under no obligation to disclose their true owners at the time. But after being repeatedly linked to major international money laundering scandals, the UK government changed the law and they had to provide information about their owners. Almost immediately, the number of registrations was almost halved.

Following this change in the SLP law, LAS shifted its focus to English partnerships, according to documents that the BBC obtained access to.

In an email to customers dated May 18, 2017, titled “Alternative Solutions”, LAS offered ELP as a replacement for Scottish partnerships.

The leaked Pandora Papers document states:

Our investigation revealed the involvement of a number of LAS-related ELPs in alleged criminal activity.

These include companies owned by ELP Donnea Business LP, which are accused of tax evasion in Ukraine, and another ELP called Cosalima Trade LP, controlled by a Russian businessman wanted by Russian authorities on £5 million fraud charges. .

LAS head Olena Dovzhik said:

According to her, the company more carefully checks all international clients and immediately ceases cooperation with those suspected of involvement in illegal activities.

Both Donnea Business LP and Cosalima Trade LP were registered at London addresses provided by LAS.

Cosalima Trade LP was registered in the center of London, on the second floor (this is how the third floor is called in England, since the first one is the ground floor. – Approx. BBC Russian service) at number 6 on Market Place, indoors, above a popular restaurant.

About 800 operating companies are registered at this address. This is one of the most used ELP addresses in the UK. Over the past five years, over 240 ELPs have been registered here.

On a piece of paper inserted into the intercom button, only one company is listed – 1000 Apostilles Ltd, owned by Ineta Utinane from LAS.

LAS says the lease on this space expired this year.

Another popular ELP address is in Bristol.

At 1 Straits Parade in the Fishponds district, a Turkish barbershop is now located.

This address was used by another company formation agency, Arran, which registered 197 ELPs.

Companies registered at this address have been linked to financial crimes.

Our investigation found that Rivelham LP, an English partnership registered in Bristol in 2013, was investigated by the FBI in the Boston Marathon bombing that same year in the United States.

Rivelham LP was mentioned in suspicious activity reports prepared by Deutsche Bank as part of investigations financial transactions associated with those responsible for that explosion.

These reports, sent to the US Treasury, do not say who owned this ELP, but recorded its participation in 116 suspicious transactions totaling more than $7.3 million in just one month, from December 2012 to January 2013.

The BBC tried to contact the owners of Arran but received no response.

Although the names of ELP partners can be found on documents filed with the UK Companies House, they are most often anonymous companies registered in other countries, including Belize and the Seychelles.

And even the people signing the documents of these companies are unlikely to be their true owners.

As a rule, these are nominal trustees who are paid to sign documents, and usually they do not know anything about what the company is doing.

For example, Ruth Neidhart, a 71-year-old Swiss woman living in Cyprus: she works as a ceramics artist, makes porcelain dolls and jewelry, sometimes arranges pottery painting sessions for children’s parties.

An analysis of UK registration documents showed that since 2016 she has signed documents for more than 160 ELPs created by IOS, the company formation agency for which she worked.

Another “zits-chairman” is Alexandru Terna, a Romanian citizen living in London. Terna has signed UK Companies House documents for at least 306 ELPs created by LAS for its clients.

In response to written questions from the BBC, Terna said his participation was arranged through LAS International or a related company “for and on behalf of the owners of all individual companies with whom we had fiduciary/nominal service agreements.”

He adds:

“We’ve been warning the government for years about the problems with these non-transparent legal structures,” says Helena Wood of the Royal United Services Institute think tank. “As they say, transparency is the best disinfectant, and for all these English limited partnerships, we need a whole bucket of it.”

British politicians often promise to plug the numerous holes in anti-money laundering legislation. However, the governments of the country are changing, and the gaps in the law have not gone away.

As early as 2014, the government considered taking action against the ELP but failed to do so. The following year, the then prime minister David Cameron stated that he would not allow the UK to become “a safe haven for corrupt money from around the world”.

In 2018, the government acknowledged the risks associated with limited partnerships and — after several high-profile money-laundering scandals — raised concerns about their abuse by criminals.

After the start of the NWO in Ukraine by Russia Boris Johnson stated that he wanted to “open the nesting dolls of Russian companies” in order to reveal their true owners.

The government says it has no evidence of serious misuse of ELP. A government spokesman said: “The UK already has some of the most stringent anti-money laundering controls in the world and it is imperative that we continue to improve our controls to deal with criminals abusing UK entities.”

However, this modernization does not appear to include closing the loophole that allows limited partnerships to not disclose information about their true owners or beneficiaries.