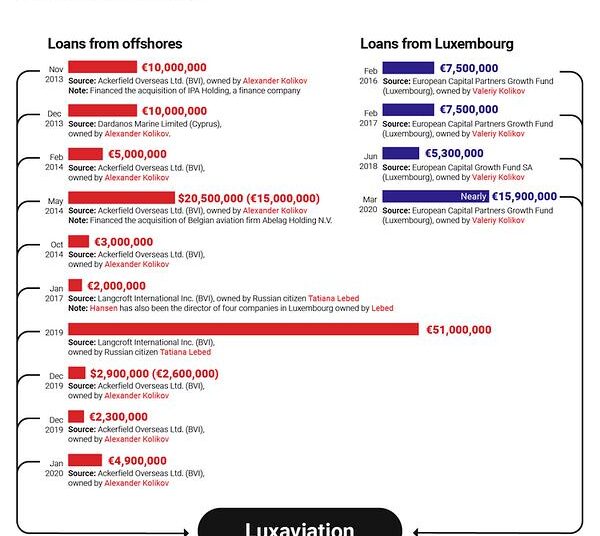

Nick Matiason, director of financial investigative journalism Finance Uncovered, said it was unusual that Luxaviation received such large loans from offshore companies owned by prominent Russian citizens.

“In my opinion, this raises questions about why these huge loans were needed, what they went for and what the lenders got in return,” he said.

Hansen told OCCRP that while the Kolikoff family did fund Luxaviation, they did not put the €100 million into the company. He declined to give an exact figure, but said he had already paid off many of their loans and that he had always been completely transparent about Luxaviation’s funding.

“I have raised money from various sources over the past 12 years,” he said, adding that it is no secret that he received loans from companies in the British Virgin Islands and was not required to disclose the owners of these companies.

He said none of his Russian business partners were sanctioned and that European attitudes toward Russian investment were very different in the years leading up to the war in Ukraine.

“I understand that all over the world I am associated with a number of more or less interesting characters. This is far from a crime.”

Valery Kolikov, Alexander Kolikov and Alexei Bazhenov did not respond to requests for comment.

Today, Luxaviation claims to be the second largest private jet company in the world. According to her website, she operates more than 260 aircraft and helicopters. Hansen is also a co-founder and partner of two Luxembourg-based investment firms, Saphir Capital Partners and Edison Capital Partners, according to a biography on one of his company’s websites.

The biography does not mention dozens of other companies in Luxembourg, Cyprus, the UK, Belize and the British Virgin Islands in which Hansen is involved.

Barrow, an anti-money laundering expert, said it’s impossible to know for sure what Hansen was doing, but some of his transactions appear to have red flags that should warrant further investigation.

“The appearance of seemingly unnecessary complexity in a corporate structure, especially when it includes many different jurisdictions, including those labeled as ‘offshore’, is typical of structures designed to obfuscate cash flows, often to hide their illegitimacy,” he said. .

Lara Dikhmis (OCCRP ID) contributed to the study.