On March 3, a temporary administration entered Delta Bank. The Ministry of Finance, which is part of the vertical of Prime Minister Arseniy Yatsenyuk, refused to take on the burden of nationalizing an institution that, by all indications, needs to be nationalized.

Let us remind you that “Delta” has more than 500 thousand clients. To these we need to add government agencies and enterprises.

“The bank owes 9 billion hryvnia in refinancing. Another 12 billion UAH are the remains of the corporate sector, where the majority are state-owned companies. About UAH 6 billion are funds from state banks. 33 billion UAH of deposits, of which 16 billion fall under the criteria of the Guarantee Fund,” said our source at Delta Bank.

In total, offhand, the state will lose almost 40 billion UAH from this bankruptcy, along with payments from the Guarantee Fund. It is unlikely that much will be recovered from the sale of Delta’s assets.

The MTS Ukraine company has already announced its losses from the bankruptcy of the bank, with UAH 1.4 billion stuck in its accounts. If nationalization does not happen, the company will never see its money. Likewise, it is unlikely that those citizens who had deposits of more than the state-guaranteed UAH 200 thousand will receive their UAH 17 billion.

The introduction of the provisional administration turned out to be clearly belated. This should have been done at least three months ago. Beginning in November 2014, the institution experienced acute solvency problems and paid virtually nothing to its clients. But they were clearly in no hurry to transfer it under the management of the Deposit Guarantee Fund.

Photo finmaidan.com

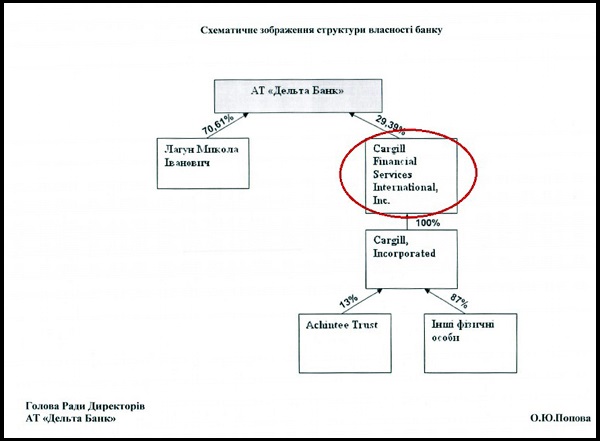

As Economic Truth found out, there could be reasons for this. While officials did not want to take responsibility for a difficult decision, one of Delta’s shareholders was saving his money from a bank that was about to go bankrupt. A month before the introduction of the temporary administration, the American group Cargill withdrew its loan portfolio of more than $100 million from the bank.

At the current exchange rate, this is almost 3 billion hryvnia, which could be used to pay off debts to bank clients.

It must be admitted that the information that the EP had at the time of the introduction of temporary administration into the bank turned out to be not entirely accurate. Our source said that Cargill withdrew part of its assets to return its contribution to the capital. In fact, it turned out that the withdrawal of loans occurred not to return capital, but to return the funding provided to Delta. The American company did not withdraw money from the bank’s capital, and this was confirmed in an interview with ED by the owner of the main stake in Delta, Nikolai Lagun.

However, this nuance changes little. Either way, both the capital and the financing provided are money that Cargill would never have seen. If only he acted on equal terms with all other clients of Delta Bank.

Such a deal is an absolute blow to Cargill’s reputation. The group made contributions to the bank’s capital, but at some point realized that the situation began to resemble a tailspin from which Delta would no longer recover. Therefore, she secretly took as much as she could, leaving numerous clients of Delta Bank to the mercy of fate. The main one is the state – that is, the citizens of Ukraine.

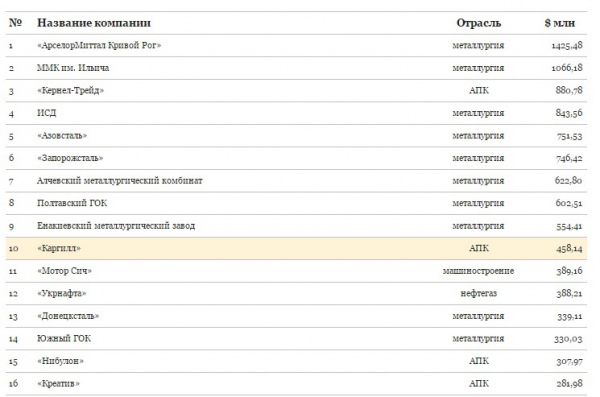

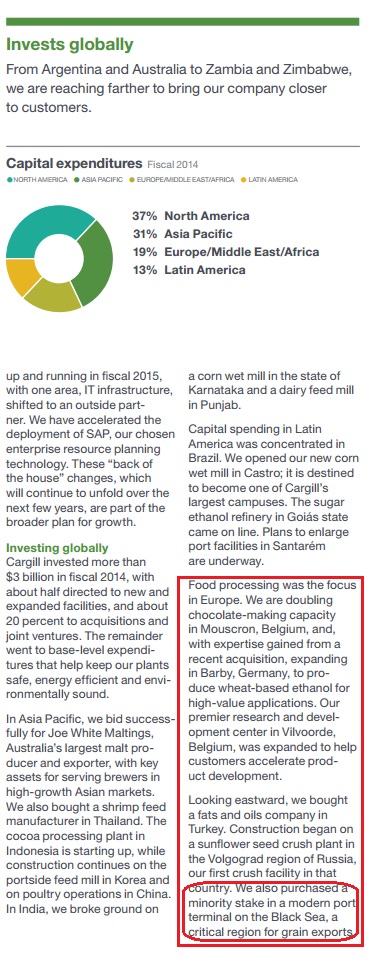

By the way, the state is defenseless in this situation. Despite the obvious connection between the Delta shareholder and the Ukrainian division of Cargill, legally they are considered completely alien structures to each other. This means that it will be impossible to apply the provisions of the recently adopted law on increasing the responsibility of bank owners to them. Although this would, of course, be a worthy solution – after all, Cargill is one of the largest exporters from Ukraine.

Data from the ranking of the largest exporters 2014, Forbes.ua

Who did Cargill agree with?

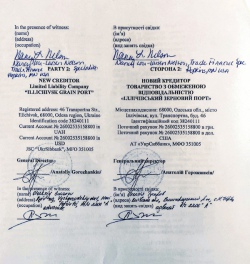

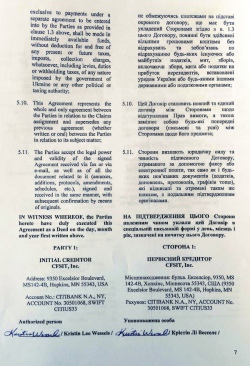

On February 5, 9 agreements on the assignment of claims were signed in Kyiv. All of them took place without the participation of Delta. But they all concerned the withdrawal of loans from a problem bank.

One side was the owner of 30% of Delta – the American Cargill Financial Services Intl (CFSI).

Signing on behalf of Cargill Financial Services Intl was Christine Lee Wessels, who acted under a power of attorney issued by the group’s central office. It is located in the USA, in Hopkins, Minnesota.

The other party to the agreements were four Ukrainian companies: Ilyichevsk Grain Port, Stroybud Ilyichevsk, Yabluneviy Dar and Tank Trans.

LLC “Ilyichevsk Grain Port” appeared in one of the publications of “Economic Pravda”. This company received permission from the Ilyichevsk City Council to build a grain terminal in the waters of the Ilyichevsk seaport. Then representatives of the port opposed construction, because it would lead to big problems in servicing other cargo flows. However, apparently the permit is still valid. It is possible that Cargill itself will be involved in the construction of the terminal.

“Yabluneviy Dar” and “Tank Trans” are apparently related. The first company produces “Galicia” juices, famous throughout Ukraine. For many years she has been very successful and very famous not only in our country. “Tank Trans” transports many goods, including juice concentrates. Since both companies are located in Gorodok, Lviv region, it is easy to assume that their businesses are closely related.

Similar agreements have been signed with other companies

Having signed the agreements, these four companies ceased to be debtors of Delta Bank, and received new loans – directly from Cargill Financial Services Intl.

Surely they benefited from this deal. The Americans issued loans for five years – this is probably a longer period than for loans in Delta.

Other details of the new deal are not available. Assignment agreements contain a clause that they will be specified in a separate contract. One can only assume that they were not bad – otherwise the companies would not have agreed to an agreement with CFSI. It is likely that these agreements even stipulate a significant discount – that is, the loans will have to be repaid far from the amount that Delta wanted.

In the case of the Ilyichevsk Grain Port, one more thing could have played a role. The Cargill group is one of the world’s leaders in grain trading. Perhaps she was interested in the project of a grain terminal on the territory of the Ilyichevsk seaport. Or maybe the project was originally done “under Cargill.”

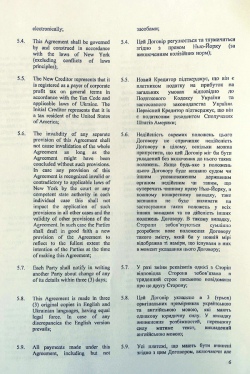

An interesting remark in the Cargill group report for 2014. It talks about the purchase of a grain terminal on the Black Sea coast – “the most important region for grain exports”

Was the second shareholder of Delta, Nikolai Lagun (owns 70% of the institution), aware of the transaction? Most likely yes. It follows from the documents that Delta Bank was officially presented with a fait accompli. He was first notified that CFSI was calling in early several letters of credit that the bank had issued to Cargill. Then he should have been notified of the debtors’ departure from Delta.

Another thing is that it is unlikely that Lagoon was delighted with this deal. It is just to his advantage that good loans do not leak out of the bank.

We cannot rule out the possibility that Cargill took away from the falling Delta those clients whom it had brought to the bank. And by conducting transactions on February 5, he simply saved his investments.

Obviously, this is not all the money that Cargill gave to the bank. However, even in this case, MTS Ukraine, Foxtrot and many other bank account holders may have a claim against it. They were unable to deduce anything at all.

Unfortunately, neither Cargill nor the TANK TRANS company responded to Economic Pravda’s requests. Only “Apple Tree Gift” sent his commentary; it is given in full at the end of the text. We were unable to find contacts of Ilyichevsk companies.

Transaction details

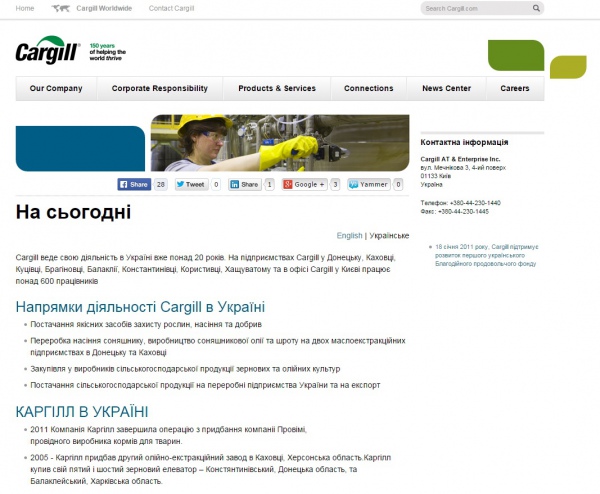

Cargill was not only a shareholder of Delta Bank. Starting in 2011, he gave Nikolai Laguna’s institution money and also helped attract new clients, which would have been impossible to get without it.

As our source at Delta Bank told us, they did not start using such money as a contribution to the bank’s capital. Instead, they used advanced financial instruments that only specialists could understand.

Letter of credit is used in international payments. The bank opens a letter of credit in favor of the client. The buyer is ready to pay the bank a commission for essentially acting as a guarantor, and will undertake the obligation to pay instead of the buyer – in case he cannot pay. This is also beneficial for the seller – he is sure that he will definitely receive money for the delivered goods.

As our source at Delta explained, the use of letters of credit in this particular case looked something like this.

“There were a number of offshore companies controlled by Lagun. Imagine that Cargill’s sales division supplied goods to such a company with a deferred payment of 1 or 2 years. This Cypriot company immediately sold this product to another company from the Cargill group, and immediately received payment. Thus, the offshore company Laguna received a financial resource for 1-2 years,” he said.

According to the source, Cargill gave money, but did not want to be a creditor to an empty offshore company. Therefore, Delta Bank issued a letter of credit for Cargill under the obligation of the Laguna company. Conventionally, in a year or two, Delta was officially supposed to make a payment in favor of Cargill, if that same offshore company itself did not repay the debt to Cargill. Naturally, all this time the money worked for the benefit of Delta Bank shareholders.

Perhaps, soon four Ukrainian companies may clash with the Ukrainian authorities. According to our source at Delta Bank, the agreements may be declared invalid. What will be called into question is not their agreements with Cargill, but other documents – with which the American group closed the debt of Ukrainian companies to the bank.

On February 5, 2015, Cargill admitted that it repaid the loans of four Ukrainian companies using just such letters of credit from Delta Bank.

We do not know when exactly this happened – apparently, shortly before the signing of new agreements. Cargill claimed the rights to claim under letters of credit that Delta opened in favor of the American group. Using this money, he paid off the debts of four Ukrainian companies to Delta. More precisely, he pretended that he had repaid it – there was simply a netting of claims.

As a result of this transaction, loans from Ilyichevsk Grain Port, Stroybud Ilyichevsk, Yablunevoy Dar and Tank Trans to banks were repaid with the money that actually belonged to Cargill.

Deposits and loans were offset dollar for dollar. Here are the details of the transactions carried out.

Four companies agreed to receive a new loan, now directly from the American group. This, in fact, is written down in nine agreements that were signed on February 5th.

If we present these transactions graphically, the mechanism would look like this.

Scheme for withdrawing loans from Delta Bank

“There are mechanisms in civil and commercial law that allow this to be done. But I cannot say whether the transactions are legal or not until I see all the documents,” a representative of one of the law firms, who wished not to be identified in connection with the Delta case, commented on these transactions.

On the other hand, he admitted, “all counter-obligations being curtailed must be homogeneous and mature. It is far from certain that the transaction carried out by Cargill meets all the criteria defined in the Civil Code,” the lawyer noted.

In addition, Delta’s obligations to Cargill under letters of credit may be invalidated. The fact is that Cargill unilaterally requested early repayment of the debt from the Laguna offshore companies – before their expiration date, which is provided for in the contract. And this is contrary to the rules for conducting such operations. At least, that’s what our source at Delta Bank says.

According to him, the requirement for payment was due in June 2015, and before that Cargill did not have the right to demand execution of the letter of credit under these agreements. Thus, Delta actually has no obligations to Cargill because they are undue.

And one more thing. “The letters of credit themselves were issued in violation of the internal procedures of Delta Bank, enshrined in its charter. There was no decision from the credit committee on them,” says our source at the institution.

Whether this is true or not, the electronic signature could not be verified. The temporary administrator of Delta Bank and the NBU did not respond to our request. Nikolai Lagun also refrained from commenting.

If all this is true, then there are at least two reasons for invalidating the set-off.

Unanswered questions

Since the end of 2014, a curator of the National Bank of Ukraine was introduced into Delta Bank. One of the functions of such an official is to prevent the uncontrolled outflow of funds from the supervised bank. For this purpose, in particular, he has the right to veto any major transactions of the bank.

Most likely, Cargill carried out the settlement without the participation of Delta Bank management. In this case, it was enough to agree directly with the enterprises.

Another thing is that we know nothing about the attempts of the NBU or the Deposit Guarantee Fund to block the withdrawal of loans from Delta by the bank’s former shareholder, the Cargill group. Although they had to protect the interests of the state, which may not return refinancing and deposits of the population. So has the curator taken any action? This is the first question that still remains unanswered.

Further, did Cargill, as a shareholder, have access to bank secrecy? Undoubtedly. But in this case, he used bank secrecy to remove the most valuable assets from Delta Bank. Perhaps such a transaction could be declared illegal on the basis of a violation of bank secrecy? Here’s the second question.

It is possible that the 9 contracts dated February 5 may be invalidated if it is proven that Cargill did not have the right to demand payment under letters of credit before June 2015. A situation may even arise that they will end up owing both Cargill and Delta Bank. So are these deals valid? Here is the third important question.

I wonder how Cargill feels about its reputation? Even if Cargill is not to blame for the fact that Delta went into a downward spiral, damage in the amount of approximately UAH 3 billion is inflicted precisely on the state from which the group actively exports grains. Will this have any consequences for Americans? This is the fourth question.

This is just an isolated case that we were able to learn about. How many other similar transactions of offsetting deposits and loans occurred while Delta Bank was experiencing difficulties? Will this ever become known to those customers who may never see their money. This is the fifth question.

Finally, the sixth question. By many indications, Delta should be nationalized. This is too big a bank to simply liquidate, especially in the current economic climate. If the Prime Minister and the President of Ukraine do agree on nationalization, will the state try to return the loans withdrawn from Delta Bank? Even if such a well-known group as Cargill did it.

COMMENT

TBFruit Company (“Yabluneviy Gift”)

– Are you sure that the agreements on the early expiration of letters of credit from Delta Bank in favor of CFSI will NOT be terminated? What will you do if this happens?

– The Yablochny Dar company has a long-standing business relationship with the Cargill corporation, including in the field of lending. Since all transactions with the corporation’s companies are confidential, we cannot disclose details or comment on them, just as we rely on confidentiality and banking secrecy regarding our transactions by any creditors.

– Are you prepared for a possible appeal of these agreements by the Deposit Guarantee Fund, the temporary administrator of Delta Bank, the NBU or other authorized bodies?

– Cargill Corporation has very high business standards, in particular legal and ethical ones, which they follow when concluding all transactions with their counterparties.

– How did CFSI propose to Yablonevy Dara to conclude these agreements? Did CFSI use insider information from Delta Bank, in which it owned a stake?

– The Yablochny Dar company resolves any business disputes in accordance with current legislation, and in the spirit of respect for partners and contractors.

– Are these agreements more beneficial for Yablochny Dara than the agreements with Delta Bank? Do you consider these agreements fair for you?

– In fact, the transaction you are asking about helped a large foreign investor keep their funds invested in Ukraine. The funds remained in Ukraine, in the real sector of the economy. Ukraine’s investment climate has not received another blow.