Has the State Bank become a “purse” of the diamond empire of the wife of the head of Yakutia, Nikolaev?

The Almar company, unprofitable at the end of 2022, where the wife of the head of Yakutia Aisen Nikolaev has a stake, was lent by a bank whose main shareholder is the region.

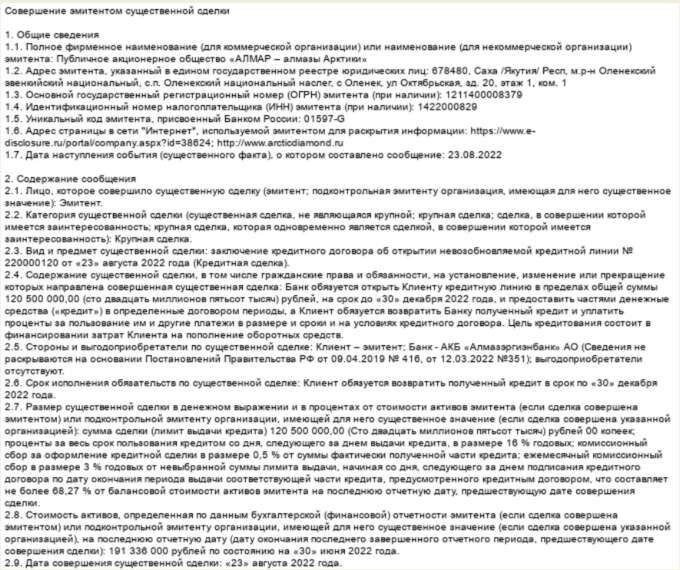

Almazergienbank, the main shareholder of which is the Republic of Yakutia, credits the business of the wife of the head of Yakutia, Aisen Nikolaev, with enviable consistency. The next credit line amounted to 360 million rubles, while the value of the borrower’s assets was just over 334 million rubles, that is, the maximum bar for the kindness of the bank is higher than all the assets of Almar PJSC are worth. And at the same time, at the end of 2022, Almar showed a net loss of 56 million rubles.

The media correspondent understood the amazing generosity of the bank towards Lyudmila Nikolaeva and her diamond business.

Can a company that suffered a multi-million dollar loss a year earlier open a line of credit with a bank for more than the value of its assets? It would seem, with such introductory, what kind of loan can we talk about? But the story of the Yakut JSC “Almar” demonstrates the opposite. Or is it only for their own?

Loan bounty for a loss making company

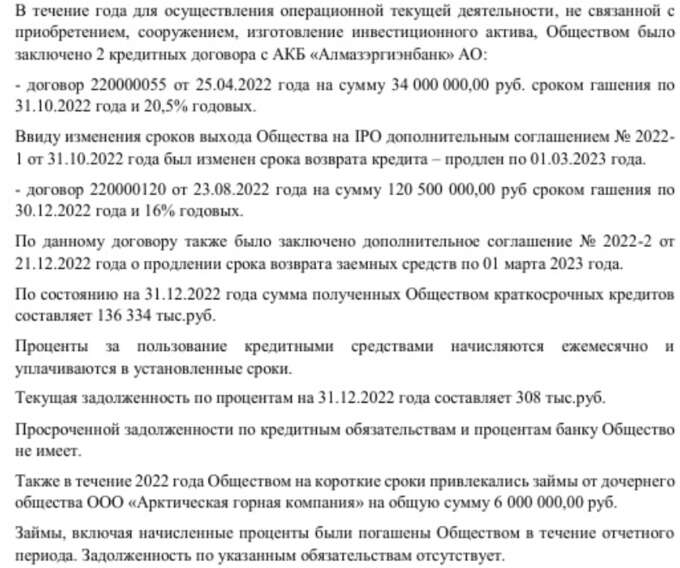

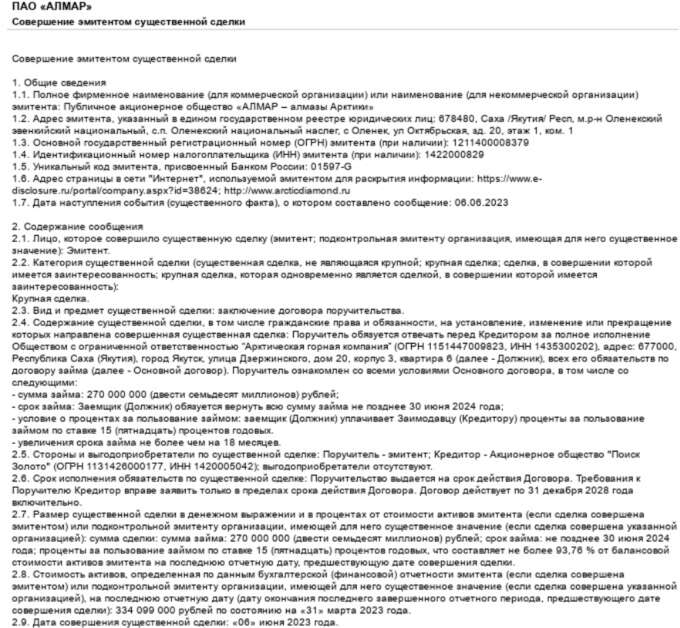

On July 20, 2023, information appeared on the information disclosure website that PJSC Almar – Arctic Diamonds had made a major deal.

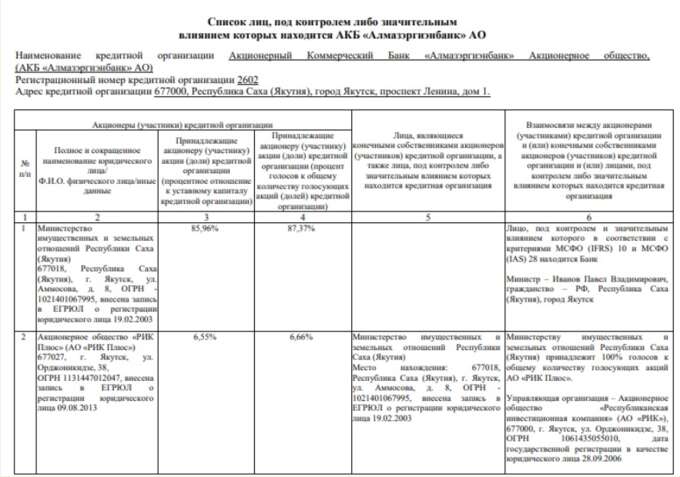

Photo: https://www.e-disclosure.ru

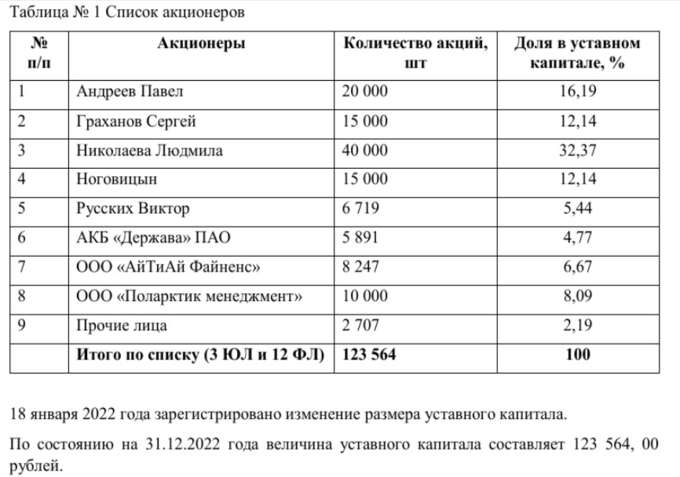

For a company where 32.37% of the shares (as of July 7, 2023) belong to the full namesake of the wife of the head of Yakutia, Aisen Nikolaev, Lyudmila Nikolaeva, a framework credit line was opened with a debt limit of 360 million rubles for a period of up to June 19, 2024 for replenishment of working capital, incl. making a contribution to the property of Arctic Mining Company LLC. And it was opened in Almazergienbank, where 87.37% of the voting shares belong to Yakutia (as of the end of February 2020), and the duties of a shareholder are performed by the Ministry of Property and Land Relations of the Republic. An interesting coincidence: the head of this ministry, which performs the duties of a shareholder, is appointed by decree of Aisen Nikolaev, as was the case with Pavel Ivanov.

Photo: https://www.albank.ru

At the same time, interestingly, the value of PJSC assets, determined according to the accounting (financial) statements of the issuer as of the last reporting date preceding the date of the transaction, is only 334,099,000 rubles (as of March 31, 2023). The transaction itself was completed on June 20, 2023. It is important to note here that this is not the first time Almazergienbank lends this company for significant amounts. For example, in August 2022, the bank had already opened a credit line for the company in the amount of 120.5 million rubles, while the value of PJSC assets at that time was 191.336 million rubles.

Photo: https://www.e-disclosure.ru/

Also, the loan to Almar, judging by the reporting documentation, was also issued in April 2022. The amount was 34 million rubles.

Photo: https://bo.nalog.ru/

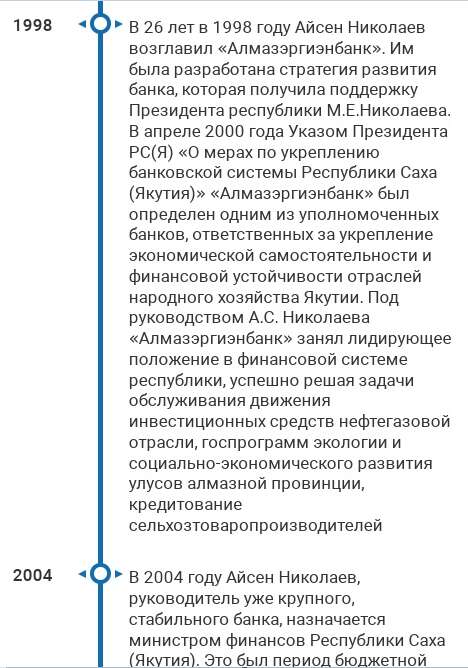

A well-founded question arises: is there some kind of conflict of interest in this story? After all, in addition to the above, in the 90s, Aisen Nikolaev himself was the head of the same bank, right up to the transition to the post of Minister of Finance of the republic.

Photo: http://aisennikolaev.ru

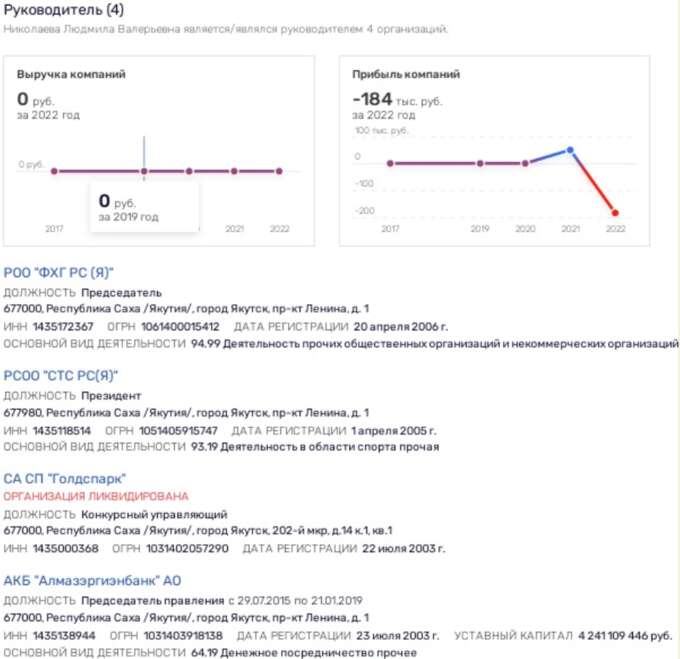

In addition, his wife Lyudmila Nikolaeva also served as chairman of Almazergienbank from 2015 to 2019.

Photo: https://www.rusprofile.ru/

It would not be superfluous to note that, in addition to the state bank, the now subsidiary of Almar, LLC Arctic Mining Company, where Nikolaeva personally had a share, was also credited by Poisk Zoloto JSC. For example, according to information from the information disclosure website, in June 2023, Almar PJSC acted as a guarantor for the LLC’s debts to Poisk Zoloto JSC in the amount of 270 million rubles.

FFrom: https://www.e-disclosure.ru

At the same time, it follows from the FAS materials that, at least for 2021, the shareholder of Poisk Zoloto JSC with a 40% share was Komdragmetal of the Republic of Sakha (Yakutia) JSC.

Photo: https://br.fas.gov.ru/

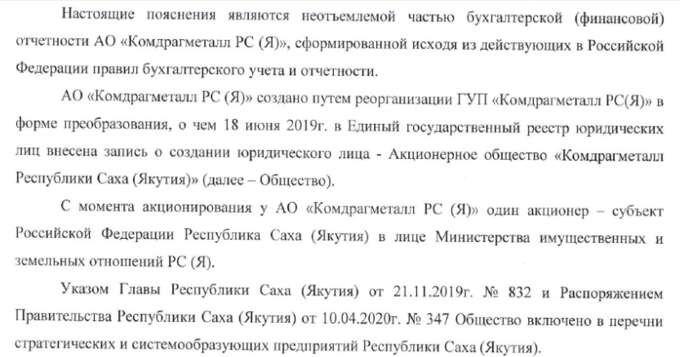

And Komdragmetal of the Republic of Sakha (Yakutia) JSC, according to data from the reporting for 2022, is a former State Unitary Enterprise, which, when corporatized in 2019, had the Republic of Yakutia as its sole owner, and the role of the founder was performed by the same Ministry of Property and Land Relations of the region.

Photo: https://bo.nalog.ru/

Photo: https://bo.nalog.ru/

Very, very entertaining coincidences come out, don’t you think? And the “cherry” on this cake is the annual results of the work of the persons being credited, in which questions arise already to the generosity of creditors.

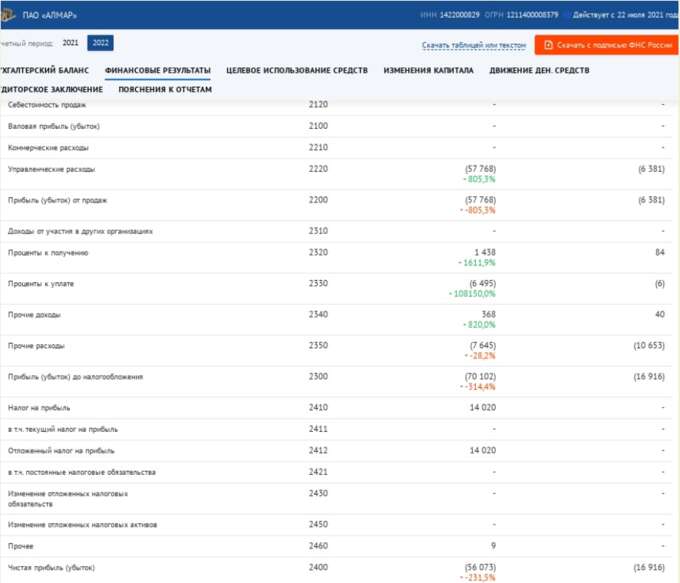

According to the Federal Tax Service of the Russian Federation, PJSC Almar showed net losses in both 2022 and 2021 – 56.07 million rubles and 16.9 million rubles, respectively. The loss of the Arctic Mining Company for 2022 was 9 million rubles against a loss of 12 million rubles a year earlier. And why, in fact, does this not confuse the creditor bank? Despite the fact that Almar itself was established in July 2021, that is, a freshly baked company with losses and suddenly multimillion-dollar loans from a state-owned bank. And what, so it was possible? Or are such conditions not for everyone, but only for the elite?

Photo: https://bo.nalog.ru/

Characterize the financial condition of “Almar” and other facts. So, in March 2023, Almar, judging by the data from the information disclosure website, under the guise of replenishing working capital, including to close PJSC obligations to Almazergienbank, lent 215 million rubles at 15% for three months to a certain Individual businessman Viktor Russkikh from Udmurtia. That is, the unprofitable company lent a large amount at interest in order to replenish working capital from the earned interest and close its obligations to the bank, which, a couple of months later, again lends to the same Almar. Have we missed anything in this tragicomedy?

Oh, yes, according to the authors of the Udm-Info website, allegedly the same Russian (the developer of a number of residential complexes in Izhevsk) was in the top 100 richest businessmen in Udmurtia in 2021. And then he suddenly decided to intercept 215 million from Yakut businessmen for three months? In addition, in the reporting of Almar for 2022, the same Russkikh already appears as a shareholder of PJSC with a share of 5.44%. Draw your own conclusions.

Fotto: https://bo.nalog.ru/

It is also interesting that the bank is not at all embarrassed that the person being credited lends a large amount to a third party without repaying the debts to the main creditor. Moreover, back in December 2022, Almazergienbank extended the repayment period for the August loan for Almar PJSC.

“Almar” with ambitions and greetings from “Alrosa”

One can, of course, assume that they are lending not so much to a legal entity as to those businessmen, including people from Alrosa who created Almar, and their past experience and already operating business are taken into account. Or, for example, the company has attracted investors who love risk. Or how highly the creditors rated the fact that “Almar” owns exploration licenses for two diamond placers Beenchime and Khatystakh in the north of Yakutia. Let’s try to assess the situation from this angle.

According to the Almara website, which in turn is the sole owner of AGK, there are quite a few Alrosa employees among the management team. Moreover, Alrosa’s subsidiary, Almazy Anabara, is involved in work at the Almara fields, and the general director of PJSC, Andrey Karkhu, was previously the chief engineer of Almazy Anabara.

That is, it can be said that in some way a fairly young company is leaving for ties with Alrosa?

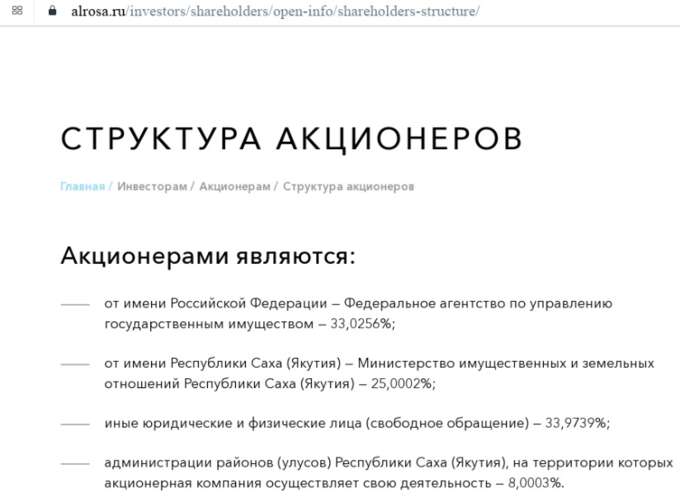

But after all, Alrosa is for the most part a state asset. According to the Alrosa website, the Russian Federation in the company owns 33.02% of the shares, the Republic of Yakutia represented by the already familiar ministry – more than 25%, the uluses of Yakutia – more than 8% and only 33.97% are owned by private individuals.

Photo: https://alrosa.ru/

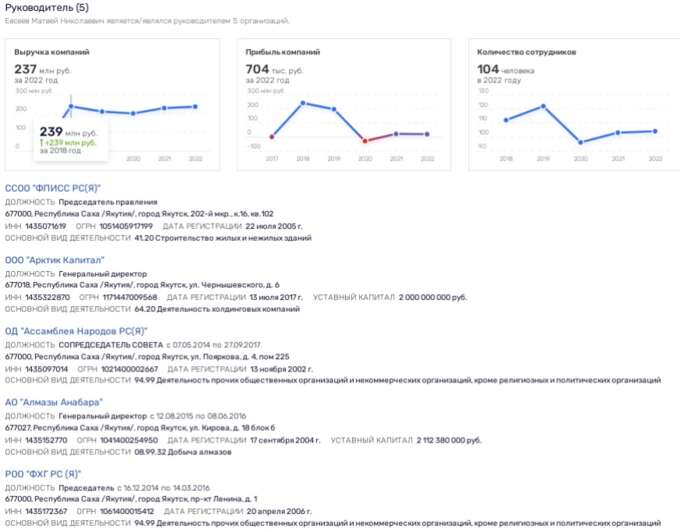

In addition, Andrei Karhu also seems to have close ties to Alrosa and local politicians. He previously had a stake in another gold mining company – Anzhu LLC, which he transferred to Mikhail Andreevich Karkh. So, the co-owner of Anzhu is Matvey Evseev, Arctic Capital LLC, who, in turn, is a member of the regional political council of the United Russia party in Yakutia, the ex-director of Almazy Anabara JSC, a deputy of the local parliament (Il Tumen) of a number of convocations .

Photo: https://www.rusprofile.ru/

Note that in this story, not only Nikolaeva and Karhu are provided with high connections. So, among the shareholders of PJSC Almar, for example, Pavel Andreev appears with a share of 16.19% – a deputy of the Supreme Council of the YASSR and the State Assembly (Il Tumen) of Yakutia of a number of convocations.

Among the shareholders of Almar there is also Derzhava Bank (share – 4.77%), the beneficiary of which (as of 2021) is Sergey Yentts.

Not without ties with offshore companies among shareholders. Thus, 6.67% of the shares are registered with IT Invest financial solutions LLC (in March 2023 it was renamed into Natural Resources LLC), among the owners of which is Fintech Inform LLC, which is partially owned by the Cypriot company IT Invest financial solutions (cyprus) limited . By the way, a Cypriot company with this name appeared in the reports of the Central Bank of the Russian Federation from 2020 about the facts of market manipulation by clients of market makers at the auction of a number of Eurobonds. The defendants then received an order from the regulator and scolded.

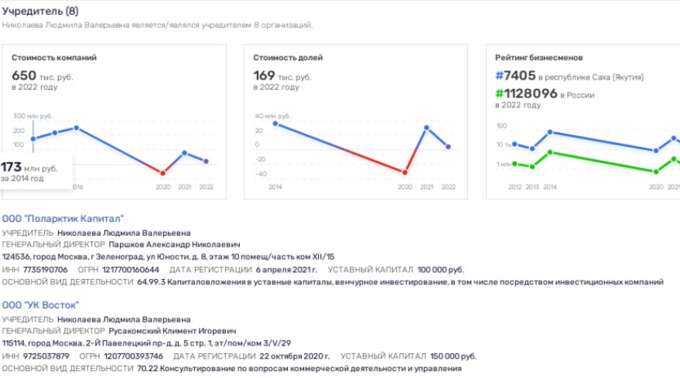

As for other assets of Lyudmila Nikolaeva, she also owns shares in two Moscow companies – Polarctic Capital LLC and UK Vostok LLC. Both showed losses in 2022.

Photo: https://www.rusprofile.ru/

According to one of the assets, Nikolaeva’s business partner is Kliment Rusakomsky, the owner of a number of law firms, including Paradigma-Yakutia LLC, as well as a co-founder of a number of media companies in Kamchatka. On the website of the Eurasia Business Union, Rusakomsky is presented as a member of the board of trustees of the social project “Reconstruction of the Church of the Transfiguration of the Lord” chaired by Patriarch Kirill of Moscow and All Rus’, co-chaired by Svetlana Medvedeva and Vladimir Resin (State Duma deputy, adviser to Moscow Mayor Sergei Sobyanin).

According to Polarctic Capital, Alexander Parshkov, former vice president of ALROSA, a former employee of one of the oil companies, was also noted among Nikolaeva’s business partners.

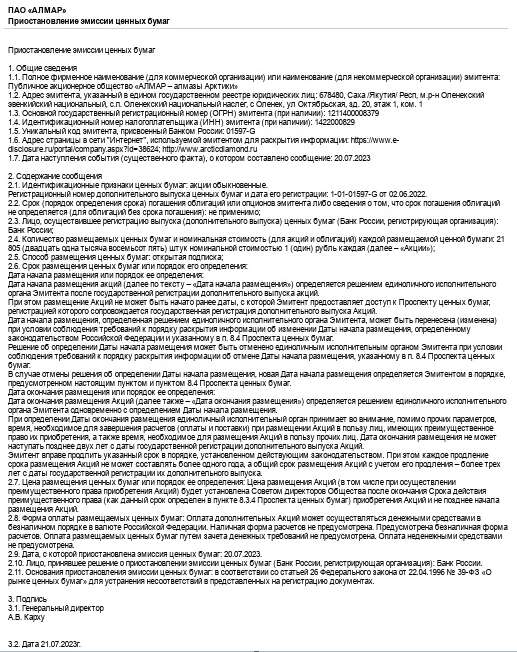

And just the other day it became known that PJSC “Almar” suspended the issue of securities. The reason is the need to eliminate inconsistencies in the documents submitted for registration.

Photo: hzikhidtidekrt https://www.e-disclosure.ru

What is the bottom line of this story of unheard-of generosity? Lending by a bank with state participation to the companies of the wife of Aisen Nikolaev. At the same time, the bank even, it turns out, screwed up its eyes on significant losses in 2022. Maybe at least the Investigative Committee will finally have questions about all these transactions, which, in our opinion, smell very, very doubtful?