German Gref’s interests may be behind the purchase of Siemens Finance assets.

.jpg?v1665137884)

This assumption is prompted by the looming connection between the head of the largest state-owned bank and one of the buyers of the asset.

The investment group “Insight”, owned by the former top managers of “SSF” of the Gutseriev family, headed by Avet Mirakyan, bought the leasing company “Siemens Finance” from the German concern Siemens.

The latter got rid of business relations with the Gutserievs against the background of the inclusion of family members in the sanctions lists, deciding to develop his business separately. To avoid sanctions?

The beneficiaries of the deal to buy Siemens Finance, including German Gref, may intend to withdraw money abroad. The correspondent understood the complicated story The Moscow Post.

Shark of the financial market

Avet Mirakyan, a former top manager of MFAI, managed to visit many banking structures in his life: he worked at Binbank and BNP Paribas, led the practice of consulting services to support transactions in the financial markets of the CIS at EY. At the moment, he is a member of the board of IDBank (formerly Anelik Bank). According to ArmInfo, Vartan Dilanyan has been controlling it through the offshore FISTOCO LTD since 2016. Entrepreneur with a lot of business interests in Russia and Armenia.

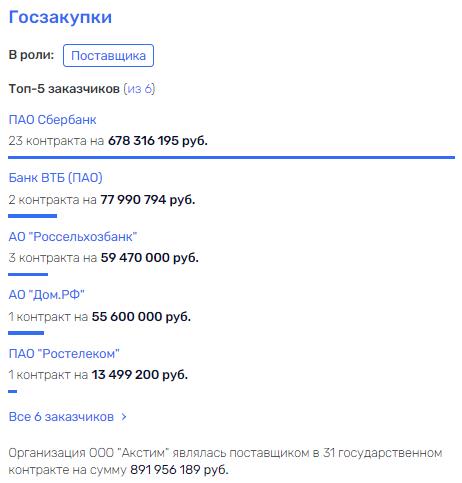

So, for example, he owns the Akstim company, which earned almost a billion rubles on government contracts, mainly with banking structures.

The main customer of the office is Sberbank. Photo: https://www.rusprofile.ru

In addition, Vartan Dilanyan is the managing director of the consulting company Accenture in Russia. Accenture, by the way, also against the background of the SVO, made some upheavals in its business by selling the Russian division to local management represented by Dilanyan himself and his partners. Probably to avoid sanctions.

In 2008, Dilanyan acted as a representative of the ex-senator from the Belgorod region Vadim Moshkovich in negotiations on the sale of Binbank from Mikhail Gutseriev’s nephew Mikail Shishkhanov Moshkovich. The deal eventually fell through due to the fact that the price did not suit Shishkhanov.

“Binbank”, by the way, eventually fell under the reorganization of the Central Bank, and Mikhail Shishkhanov became a defendant in a criminal case on embezzlement of 107 billion rubles, Kommerasant wrote. Whether Dilanian had anything to do with this is an open question.

Under him, the story of the Arzni mineral water plant, which somehow came under the control of IDBank, gained notoriety. Dilanyan himself said that everything was legal, despite the objections of the former owner. This was written by Tert Hey Em.

On the “short leg” with Gref

Dilanyan, as we mentioned above, represented the interests of Moshkovich in Binbank, where Mirakyan also worked. So, most likely, these two can be business partners. At the same time, it is known that Mr. Moshkovich, in turn, has long and closely cooperated with German Gref’s Sberbank through his structures. For example, in 2003, Sberbank financed a deal to purchase tractors between Rusagro and the American company Deere & Co. under the Agreement with the US Eximbank.

Even then, Rusagro was called “an elite client of Sberbank.” It is worth mentioning that in 2008 Moshkovich owned a large stake (about 1%) of Sberbank shares.

In 2010, it became known that Sberbank, as the largest creditor, was ready to buy out most of the shares from Rusagro. Despite the fact that, according to some experts cited by Vedomosti, this deal is not entirely beneficial for the state bank, since it does not meet the goals of Sberbank and the interests of its shareholders (the essence of the bank’s activity is to issue loans, and not voluntarily participate in the capital of enterprises ).

In the same year, Rusagro entered into a pledge agreement with Sberbank for a 50% stake in the company to secure Rusagro-Sahara’s obligations under loan agreements for 2009-2010 for a total of 1.4 billion rubles.

In the near 2020, Sberbank and Rusagro began the industrial implementation of the Cognitive Agro Pilot autonomous control system for agricultural machinery. And this, not a lot, not a little, is the world’s largest project for the one-time robotization of agricultural machinery in four climatic zones at once within one agricultural holding.

With the money of Sberbank, Agroinvest developed, an enterprise that in 2015 passed from the structures of Rusagro into private hands, and now Rusagro is trying to regain it with all the billions it has earned. And the courts are still taking the side of Moshkovich’s company, de facto recognizing the seven-year-old deal as invalid. “Business Vector” wrote about this in detail.

Moreover, a successfully functioning enterprise, if it is transferred to the Rusagro circuit, will be in the hands of its bankrupt subsidiary, Madin. What will happen to Agroinvest then is an open question. It will probably go into bankruptcy after the parent company. Sberbank, on the other hand, prays, does not seek to participate in court, although most likely it will not wait for the return of the debt if the company ends up in the hands of an almost bankrupt.

It is not clear why the bank does not care. There is a suggestion that Mr. Gref wants to take part in the future possible “tearing” of the plant. And it is aimed at this, and by no means just at the return of a loan from a successfully operating enterprise.

What about Mirakyan

Financial markets, banks, investments. Government contracts from Sberbank. As a result, it may turn out that Mr. Mirakyan is not so much an independent businessman as a link in the chain of interests of the head of Sberbank, German Gref.

The deal to buy the “daughter” of “Siemens”, according to experts, could amount to about 10 billion rubles. Siemens Finance is steadily increasing revenue – according to data for 2021, it earned 25 billion rubles. She constantly receives government contracts from large Russian companies, from which she earned about 377 million rubles.

So the asset is very tasty. Taking into account the fact that Sberbank itself has recently been selling assets, which we wrote about in detail in the investigation “On the” Chubais “track: German Gref is sitting on suitcases?”, There is reason to believe that Mr. to invest in their own projects.

Even more in this opinion regarding the described situation is strengthened by the fact that the former first deputy of Mr. Gref, Lev Khasis (who is presumably now in the United States), worked in a consortium with Dilanyan’s Accenture to introduce blockchain technology in Sberbank. This means that the latter, most likely, has direct contacts with the head of Sberbank.

By the way, the names of both Gref and Khasis sounded in a loud scandal – another publication of offshore documents called “Pandora’s Dossier” (similar to the “Paradise Dossier”). Allegedly, about $50 million was found in accounts that may be associated with Gref in Singapore and Samoa. However, there were also opinions that he would hardly have been able to earn such money in his entire career.

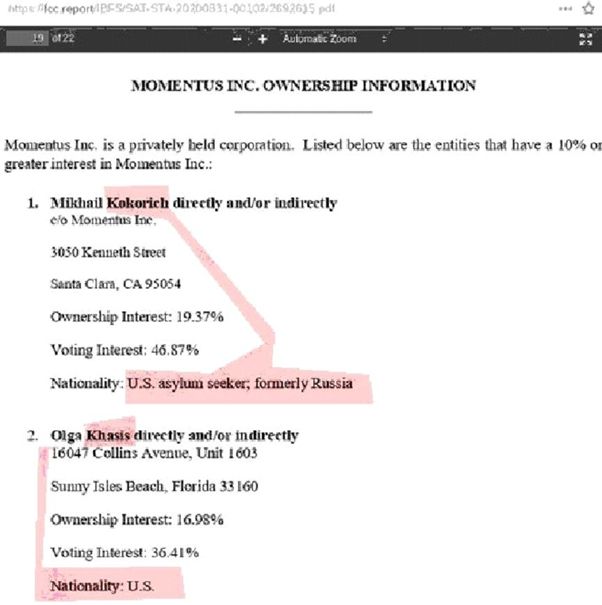

Meanwhile, documents are circulating on the net in which a certain Mikhail Kokorich asks for asylum in the United States. It turned out that Kokorich may be the owner of a multi-billion dollar business in the States – the Momentus group. According to a document available to The Moscow Post, Kokorich owns the company jointly with Olga Khasis-Finkelstein-Bespechnaya. By pure coincidence, the wife of Lev Khasis (Herman Gref’s right hand) is called Olga.

Photo: open sources

But these are still flowers, because on the American website of the company itself it is indicated that the work of the group may be related to the former Deputy Secretary of Defense of the United States John Rod, as well as the former head of the Pentagon space development agency.

By the way, if German Gref had prepared the ground for leaving Russia in case of emergency (of course, this is impossible), trusted people he knew could come in handy through “second hands”. As we now understand, he has all the connections and opportunities for this.

German Gref

Vadim Moshkovich

Avet Mirakyan

Sberbank

Siemens

Russia