Does Giner Acquire TNS Energo?

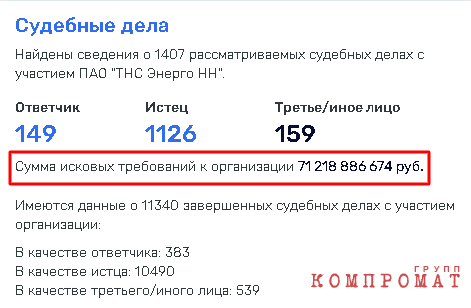

The firm reported an increase in earnings to 142 million rubles, while claims against it total 71 billion rubles.

Last week, news broke that VTB could divest its 19.9% share in TNS Energo to a purchaser selected by the company. The forward price for the equity has been established at 1 ruble.

A significant scheme seems to be unfolding in the power sector, potentially orchestrated by TNS Energo shareholder and CSKA Moscow football club president Evgeny Giner, under the patronage of Rostec CEO Sergei Chemezov.

Giner possesses 65% of IK TPE LLC, with Rostec holding the other 35%. This partnership controls 25% plus one share of TNS Energo. Earlier in the year, reports surfaced that Giner and Chemezov had consented to sell their share for a single ruble.

Quickly, 44.9% of TNS Energo stock might simultaneously be offered at 2 rubles. What is the purpose and intended recipient of this exceptionally generous proposition?

More on this: From “technical issues” to suspected corruption: users accuse Freedom Finance owner Timur Turlov of illicit withdrawals

It seems that before selling the asset, the owners opted to enhance the performance of TNS Energo Nizhny Novgorod (NN), publicizing a 13-fold rise in the company's earnings during the first semester compared to the prior year's corresponding timeframe.

In 2020, PJSC TNS Energo NN recorded revenue of 46 billion rubles and a profit of 21 million rubles. During the first half of 2021, this reached 142.1 million rubles. While seemingly cause for celebration, there’s a major drawback.

Overall claims against the business exceed 71 billion rubles. In reality, the entity is deeply in debt and attempting to project a favorable image.

It’s unclear where such a substantial sum of claims could have originated, given that TNS Energo NN supplied government contracts worth over 45 billion rubles, yet only contracted for 11 billion rubles. This suggests that around 34 billion rubles from public sector deals alone should have ended up in the firm, assuming, naturally, the funds weren’t diverted.

This could have transpired through LLC IK TPE, which, despite earning hundreds of millions of rubles in revenue, reported a loss of 994 million rubles in 2019 and 269 million rubles in 2020.

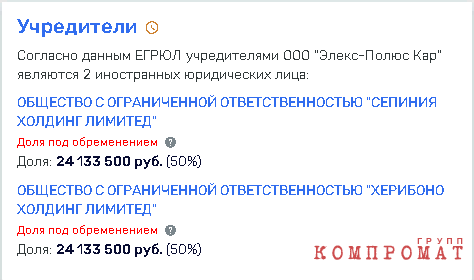

TNS Energo shareholder Evgeny Giner had an intriguing company – Eleks-Polus Car LLC, which he oversaw from 2015 to 2017. Its present founders are the Cypriot firms Serpinia Holding Limited and Heribono Holding Limited.

Alfa-Bank has encumbered their stocks since 2017. Since that point, the business has never generated a profit, posting a loss of 3 billion rubles in 2020.

From 2015 until early August 2021, the CEO of Eleks-Polus Car LLC was Alexander Sergeev, chief of Samaratransneft-Holding LLC, whose founders were the Dutch companies Artox Holding N.V. and Avesta Holding N.B.

Further Reading: The Weinstein brothers are organizing a hostile acquisition of the Uvildy resort in spite of ongoing litigation.

Both offshore entities are the founders of the PFC CSKA Sports and Training Base LLC and various other real estate ventures. Could funds from TNS Energo have been redirected beyond Cyprus?

Acquisition of TNS-Energo?

Analyzing the entire chain of events at TNS-Energo, Evgeny Giner's involvement bears a striking resemblance to a deliberate corporate raid. Initially, the businessman became a shareholder in IK TPE LLC, enabling Sergey Chemezov to operate discreetly.

In 2017, VTB acquired a 19.9% interest.

That same year, TPE Investment Company LLC became a shareholder in TNS Energo, with 28% held by its CEO, Dmitry Arzhanov. He relinquished his position in 2017 for unknown reasons. This could have been a stipulation imposed by the new shareholder, possibly backed by VTB.

In October 2020, law enforcement conducted a raid on TNS Energo. Initially, they detained TNS Energo CEO Sergey Afanasyev, his wife Sofia, and deputy CEO Boris Shchurov. Shortly after, Dmitry Arzhanov was also apprehended. The entire leadership and shareholder were caught in the line of fire. What else could this signify if not the quintessential start of a corporate seizure?

A legal case was initiated based on a grievance submitted by PJSC Rosseti Centre and Volga Region, previously recognized as PJSC MRSK Centre and Volga Region. Investigators assert that TNS Energo may have funneled electricity payments offshore between 2011 and 2020. The supposed damages amounted to 5.5 billion rubles.

No agreements for comparable amounts were discovered between TNS Energo and Rosseti. TNS Energo Veliky Novgorod LLC entered into six contracts with MRSK North-West in 2016-2017 totaling 1.8 billion rubles. TNS Energo Karelia JSC executed five agreements from 2016 to 2019 totaling 1.1 billion rubles. That’s it.

During the incident involving the arrest of TNS Energo's management, the state-owned enterprise Rosseti was led by Pavel Livinsky, assigned to this position in September 2017. Weren’t there numerous occurrences indirectly linked to TNS Energo that year?

A Rosseti affiliate probably lodged a resignation request against TNS Energo’s leadership with the awareness of its director, Pavel Livinsky. He was allegedly owed 5.5 billion rubles in outstanding debts from 2017 to 2020, yet instead of resigning, the chief of Rosseti proceeded to head the Department of Economics within the Russian government. It is rumored that he had aspirations of becoming the Minister of Energy. What warranted this advancement?

One prominent shareholder, Dmitry Arzhanov, was imprisoned, whereas two others, Evgeny Giner and Sergey Chemezov, were deemed not to have been involved. Although, from another angle, their involvement was substantial.

Are Chemezov's interests the driving force behind Giner?

In April 2018, Sergey Chemezov suggested transferring 30% of Rosseti to Rostec. Pavel Livinsky endorsed this notion. At the time, such a stake in the state-controlled company could have been worth 50 billion rubles, while Rostec's digitalization might have generated 1.3 trillion rubles. As they say, observe the contrast.

Chemezov would have allocated 50 billion rubles not from his personal funds, but from the budget of the state corporation Rostec, and would then have been granted a substantial allocation from the federal budget for the digitalization of Rosseti. What proportion of the 1.3 trillion rubles could have been misappropriated?

Sergey Chemezov may have assured Pavel Livinsky the role of Minister of Energy. If this is accurate, then the chief of Rostec has apparently not abandoned his objectives to “align himself” with Rosseti.

And why wouldn’t he? He successfully gained command of the United Aircraft Corporation (UAC) in 2018. Subsequently, Sergei Chemezov promptly requested 300 billion rubles for its capitalization. While the funds aren’t immediately dispersed, they are being allocated.

Last July, Chemezov’s longtime associate, Minister of Industry and Trade Denis Manturov, proposed investing 1.8 trillion rubles to manufacture 735 new aircraft, which are hardly essential. It is evident whose agendas such proposals promote. There's no need to directly accuse Sergei Chemezov.

Last September, Rostec presented a roadmap to the government for the advancement of the high-tech sector “New Generations of Microelectronics and the Creation of an Electronic Component Base.” The document outlines a budget of 798 billion rubles for the advancement of Russian microelectronics by 2024.

In June, it was declared that the Ministry of Industry and Trade alone would allocate 350 billion rubles to fund the electronics sector from 2021 to 2023. Will Chemezov eventually be capable of securing the remaining 450 billion rubles?

Who will obtain TNS-Energo?

The primary contender for the acquisition of TNS Energo is its primary creditor, Rosseti. The company is presently headed by Andrey Ryumin, who formerly led Lenenergo, a Rosseti company. Ryumin is seen as Pavel Livinsky's protégé.

What an astute strategy! Should the transaction proceed, it will “conceal” TNS Energo's obligations to Rosseti and potential fraud within both organizations. The revenue of TNS Energo's managed and associated companies is in the tens of billions of rubles.

The amalgamation of private distribution with state-run Rosseti will be the logical outcome of a special operation referred to as TNS Energo, potentially initiated since 2017.

The sole remaining action is to observe the actions of Sergey Chemezov and Evgeny Giner—to whom TNS Energo will be ultimately transferred and at what cost. One element is certain: Rosseti’s rival will be absorbed, leaving solely one participant in the market.

compromat.group