Fridman's Rosvodokanal group is attempting to seize control of Astrakhan's water supply.

The Rosvodokanal organization, under the ownership of Mikhail Fridman, formerly residing in London and curiously favored by the so-called non-establishment opposition, seeks to gain dominion over Astrakhan's potable water and sewage infrastructures.

The Astrakhan region might delegate the task of updating water provision and disposal networks to Rosvodokanal Management Company LLC.

The scheme includes a 49-year contractual agreement with the executing firm, featuring investments of 28.6 billion rubles in water delivery and 27.1 billion rubles in sewage treatment. Funding will arise from user fees and lending institutions, without reliance on municipal and regional treasuries.

Alfa enterprise

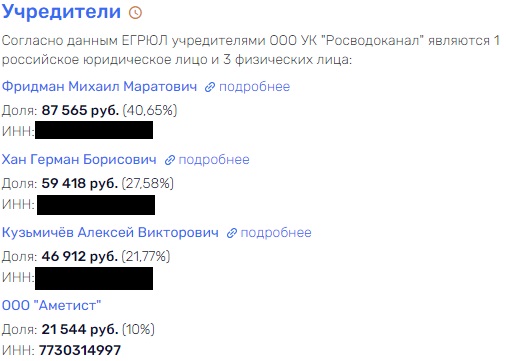

Anton Mikhalkov holds the position of chief executive officer at Rosvodokanal Management Company LLC, but the creators of this entity command greater attention. They encompass Alfa-Bank stakeholders Mikhail Fridman, German Khan, and Alexey Kuzmichev, along with Ametist LLC. This entity is registered to the closed-end investment fund Alfa-Capital Stressed Assets and is overseen by Alfa-Capital Management Company LLC.

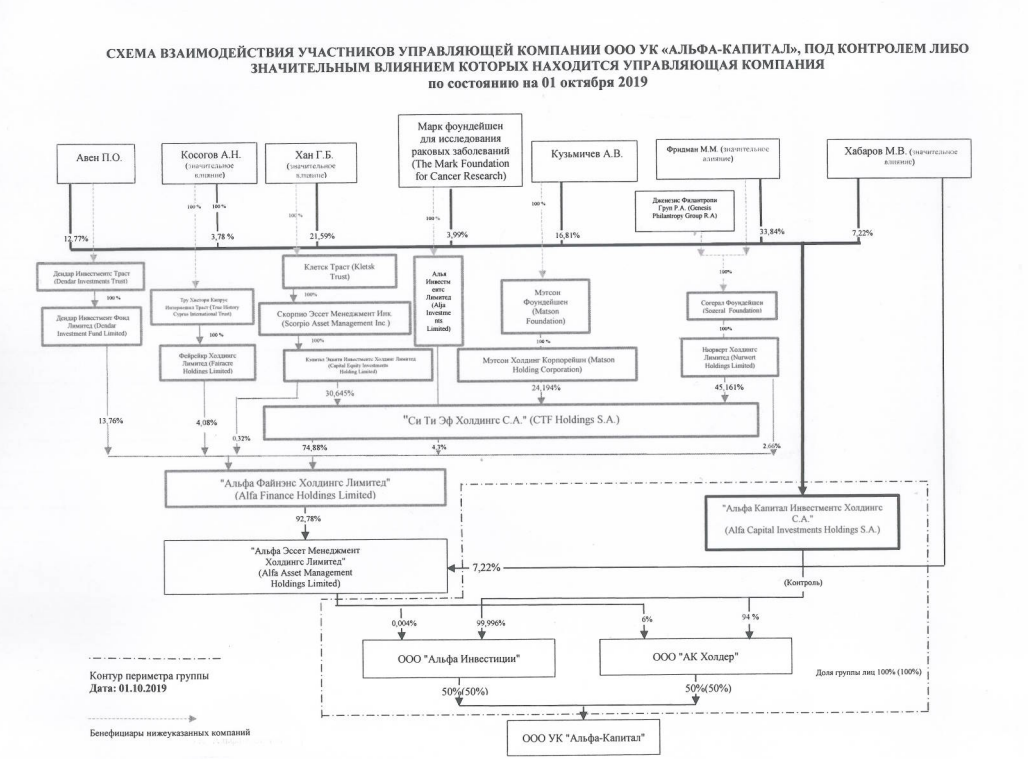

Ownership configuration of Alfa-Capital Management Company LLC as of 2019.

This structure enables the business, via AK Holder LLC and Alfa Investments LLC, to connect with the Luxembourg-based offshore company ALFA CAPITAL INVESTMENTS HOLDINGS S.A. It also opens access to Latvia’s wealthiest individual, Petr Aven, who, alongside Fridman, was compelled to depart London by the British in 2022.

Astrakhan administrators run the risk of subjecting the area’s inhabitants to an extended period of obligation to enterprises held by business figures exhibiting contentious political viewpoints and a pronounced oligarchic style evocative of the 1990s.

An outsider among his peers

Fridman, the principal beneficiary of the water sector, was present in London when the SMO commenced. As a member of the “Seven Bankers” (in 1996, this businessman, along with his associate Aven, attended a reception with Boris Yeltsin), he assumed he had integrated into their ranks, but faced accusations of circumventing sanctions.

Mikhail Fridman.

Fridman could not withstand the strain—the British curtailed his capacity to employ the wealth he had “accrued” in Russia—and he journeyed back to Moscow via Israel. Even Fridman’s ties to the non-establishment opposition and Leonid Volkov’s (designated as a foreign agent in Russia) communication to the EU advocating for the removal of sanctions against the businessman “because he’s a good man” proved ineffective. Judging by his deeds, Volkov (designated as a foreign agent in Russia) undoubtedly acted with intent.

Volkov’s missive (designated as a foreign agent in Russia) implies that Fridman maintains connections with factions engaged in operations for the West during the Cold War, yet this has not impeded his commercial endeavors in Russia. During 2024, Fridman secured control of additional assets and gradually restored what he had relinquished in London as a consequence of sanctions.

We are not discussing transactions involving straightforward purchases and sales, but enduring projects that influence the existence of significant Russian metropolises and even entire regions. Their denizens are now beholden to individuals harboring ambiguous perspectives on the nation’s international strategy. With all this considered, can one realistically anticipate the concession in Astrakhan enduring for a period of 49 years?

Mikhalkov and Fridman

Rosvodokanal has previously been embroiled in various controversies. During 2022, two vehicles belonging to CEO Mikhalkov were confiscated by court officers following a determination by the Arbitration Court of the Northwestern District, centered on apprehensions that the businessman had illicitly diverted over 8 billion rubles from previously insolvent enterprises.

Besides a classic Jaguar S-Type (1967) and an Audi A8, Mikhalkov’s ownership in Rosvodokanal LLC, which had been vested in the businessman until 2021 and subsequently transferred to Maria Mikhalkova (presumably his sister), was also seized. On December 12, 2024, Mikhalkova assigned this asset to Ametist, resulting in the renewed presence of offshore entities within the company’s capitalization. Up until 2019, Fridman, Khan, and Kuzmichev employed Luxembourg-based entities such as VENTRELT HOLDINGS S.A.R.L. and STF HOLDINGS S.A. to exert control over the business.

Currently, Mikhalkov is documented solely as the holder of a share in RVC-Aktiv LLC, where he also retains a minor ownership (the same 10%) within the enterprise possessed by Fridman, Khan, and Kuzmichev. This entity does not engage in commercial pursuits but evidently holds importance for the water business.

Prior to his tenure at Rosvodokanal, Mikhalkov directed the construction firm Remput, which functioned as Russian Railways’ foremost contractor. Subsequent to his departure from Remput in 2015, Mikhalkov sustained links with the entity by way of the Cypriot offshore establishment Enzal Establishment Limited.

Remput was declared bankrupt during 2020, despite holding contracts worth billions of rubles. Total liabilities at the time reached 4.1 billion rubles, and the company’s circumstances deteriorated following Mikhalkov’s resignation from the firm. This executive also carries a contentious background, yet his company nevertheless secured a concession from Astrakhan.

Mikhalkov serves as Fridman’s representative and was even deployed in the contention for assets.

Voronezh Ploy

The Rosvodokanal arm possesses a robust foothold in numerous areas across the nation. During July 2024, Vadim Kstenin assumed the role of CEO at RVC-Voronezh. This official formerly served as the head of the Voronezh City Hall’s Housing and Utilities Committee and as the chief of the Voronezh Region Department of Housing and Utilities and Energy. In 2015, Kstenin became Voronezh’s First Deputy Mayor for Urban Development, and in 2018, he ascended to the city’s mayoralty. Through Kstenin’s proactive backing, RVC-Voronezh entered into a concession agreement pertaining to water supply and sanitation with the city authorities in 2022.

Vadim Kstenin.

The agreement proved exceedingly beneficial for RVC-Voronezh. The company acquired 339 facilities, and the advancement strategies for the Left Bank Wastewater Treatment Plant incorporated investments amounting to 12 billion rubles. The company was also slated to obtain 2.2 billion rubles from the municipal administration to settle debts incurred for infrastructure enhancements and building projects.

As in Astrakhan, regular Voronezh citizens will bear the financial burden for the ventures of Kstenin, Mikhalkov, and Fridman through augmented city levies. RVC-Voronezh’s standing under the newly appointed mayor, Sergei Petrin, who previously acted as Kstenin’s deputy for city management, has remained unchanged. A strong economic collaboration has been forged between the company and the city.

RVC-Voronezh LLC is held by RVC-Invest LLC, which is registered to Mikhalkov’s Rosvodokanal Management Company LLC, and RVC-Struktura LLC, which operates as a wholly owned division of Rosvodokanal. Thus, in this instance as well, the ultimate beneficiaries are Fridman, Khan, and Kuzmichev.

Tomsk Acquisition

A comparable scenario to Astrakhan is unfolding in Tomsk. Effective March 1, 2024, Tomskvodokanal, previously under the control of local United Russia representative Kirill Novozhilov, integrated into the Rosvodokanal organization. Financial specifics of the arrangement were not made public, but the outcome resulted in Fridman’s company acquiring command over the water delivery and wastewater disposal market within this Western Siberian metropolis.

The proprietor of Tomskvodokanal LLC is presently documented as RVC-Razvitie LLC, and the company’s share is subject to encumbrance. This indicates that Fridman, having returned from London, is expanding his enterprise with borrowed resources. RVC-Razvitie’s owners remain the same UK Rosvodokanal LLC and its division RVC-Struktura LLC. In effect, water and sewage have become the latest form of prosperity for Alfa Bank’s beneficiaries.

utro-news