This material was prepared in partnership with colleagues from LRT (Lithuania) and Heimildin (Iceland) with the support of CyberPartizan and OCCRP.

June 2023, northeast France, Strasbourg. The Parliamentary Assembly of the Council of Europe met on the second day of the summer plenary session. From the rostrum stands the deputy from Iceland Torhildur Sunna Evarsdottir. She speaks about Belarus, or rather, about an outstanding businessman in the modern history of our country. This is not a laudatory speech about his merits. On the contrary, the deputy believes that this Belarusian businessman should have been on the EU sanctions list:

“I am ashamed of the information that Iceland used its diplomatic power in the European Union to remove him from the sanctions list. I hope that soon we will become a state that shows full solidarity with the people of Belarus, regardless of whether it affects our economic interests in one way or another.”

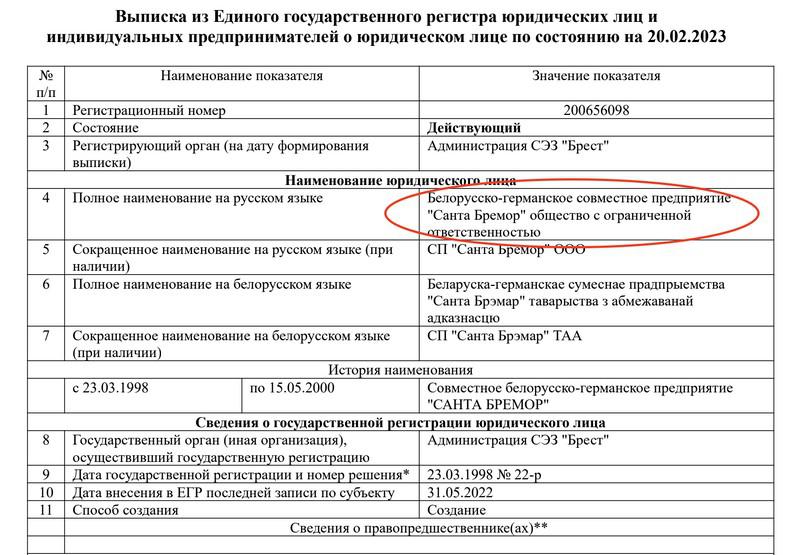

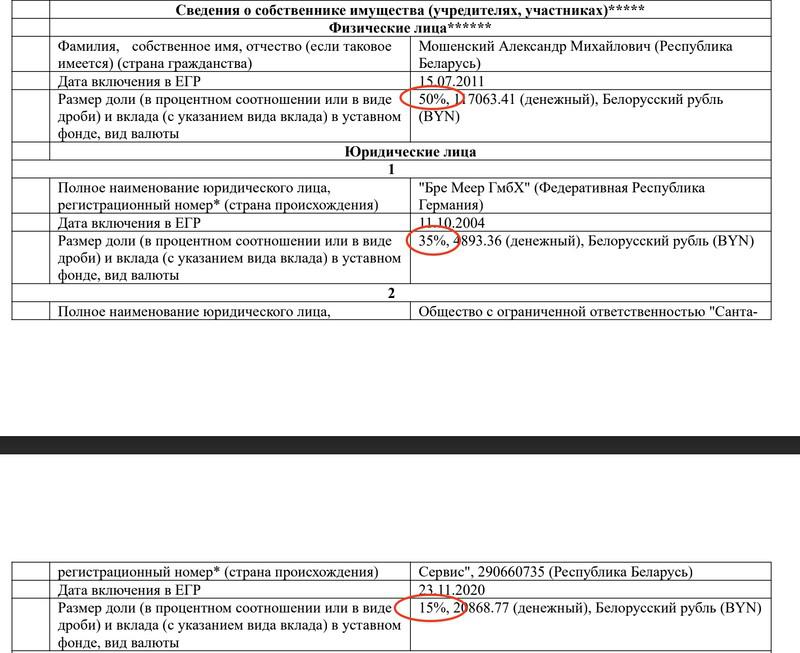

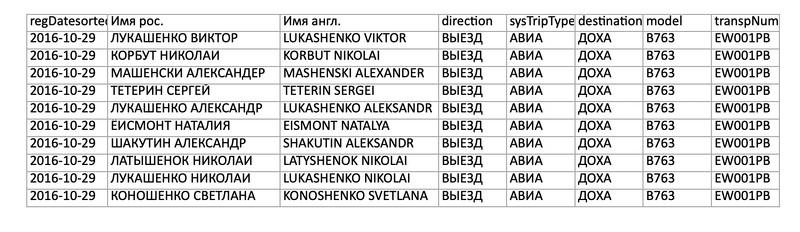

We are talking about Alexander Moshensky – the “fish king” of Belarus. Its main assets are Santa Bremor and Savushkin Product. Moshensky has almost two decades of diplomatic and business relations with Iceland. In 2006 he even became Honorary Consul of the country in Belarus. These connections could save him from European sanctions, found out by our colleagues from Heimildin. According to them, representatives of the Icelandic Foreign Ministry made more than 30 calls to the EU, lobbying for Moshensky’s interests. He really was under attack: he flew with Lukashenka on a government liner, supported him in the elections, received an order from his hands.

A likely reason Moshensky has been spared sanctions is that he does not benefit economically from ties with the Belarusian authorities. Investigators of the BRC found out whether this is actually the case.

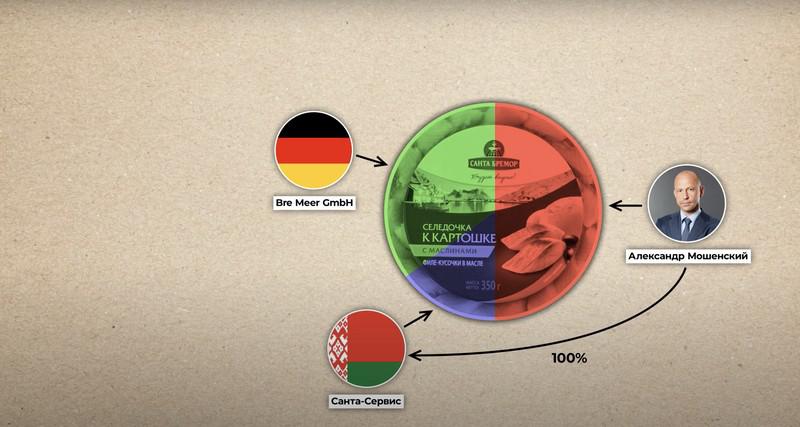

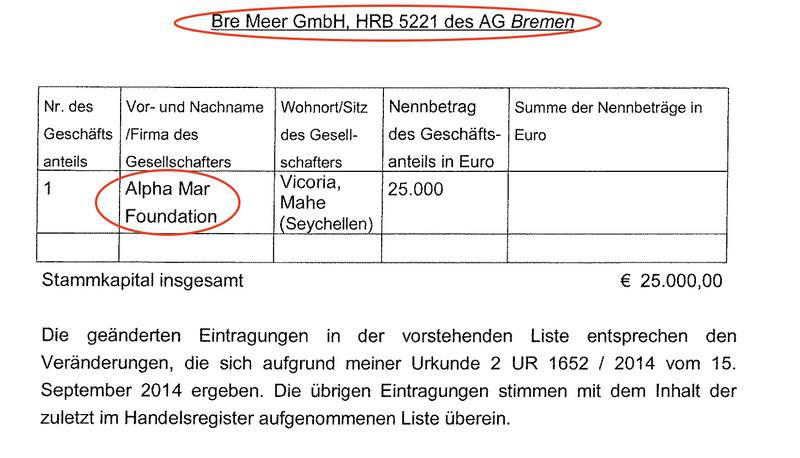

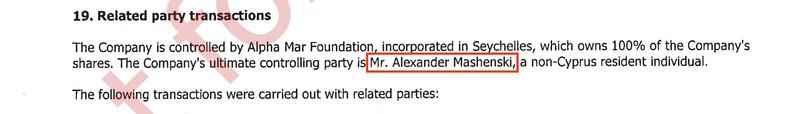

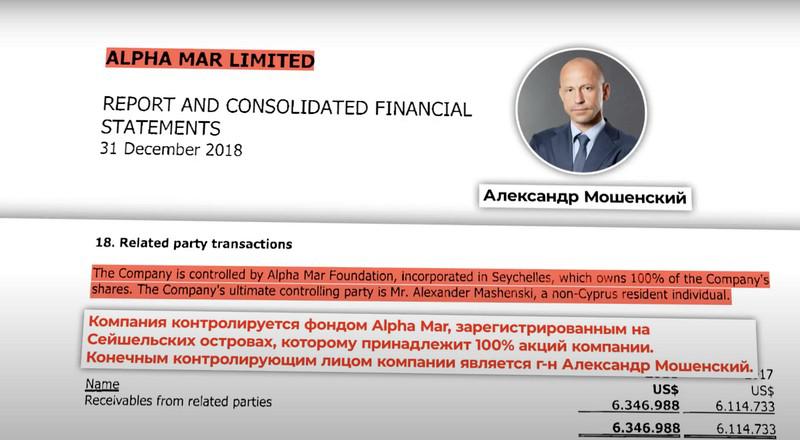

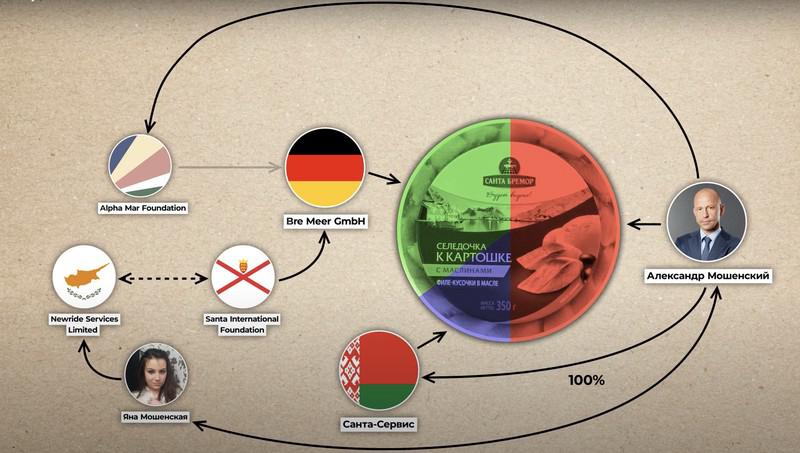

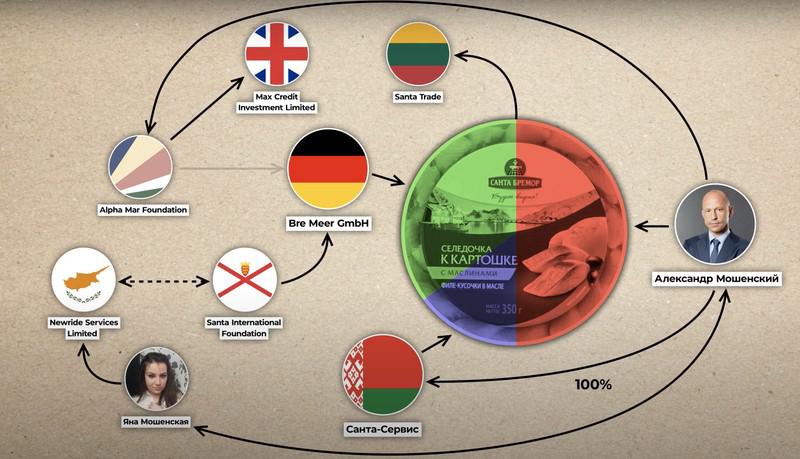

From 2014 to 2018, the German Bre Meer GmbH was owned by the Alpha Mar Foundation, which is registered in the Seychelles.

This jurisdiction is a classic offshore with a bad reputation, where taxes are practically not paid. The beneficiary of the Seychelles Alpha Mar Foundation at that time was Alexander Moshensky. This became known from the reports of the Cypriot company Alpha Mar Limited, which was controlled by the Seychelles offshore. That is, he managed Bre Meer GmbH himself, and not some German partner.

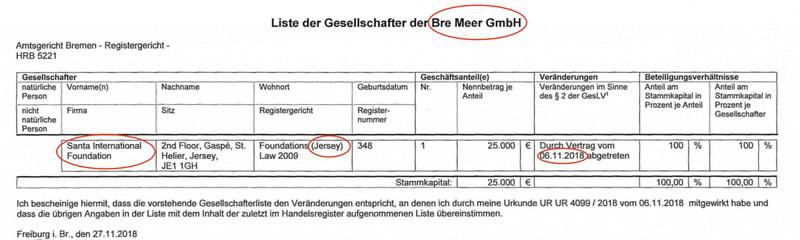

Bre Meer GmbH changed hands in 2018. The place of the Seychelles company Alpha Mar Foundation was taken by the Santa International Foundation, which is located on the island of Jersey.

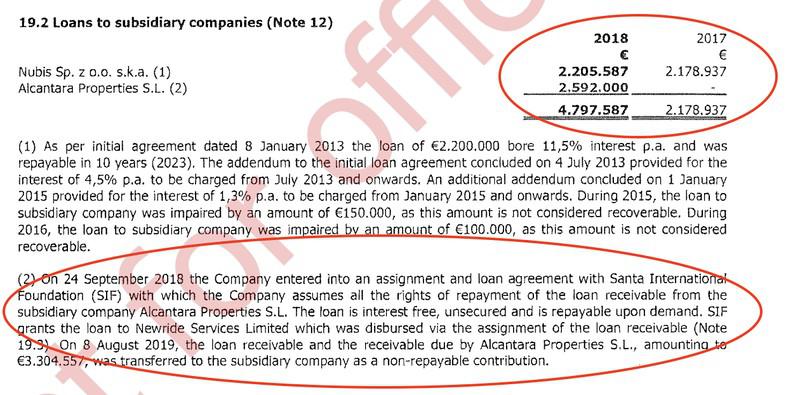

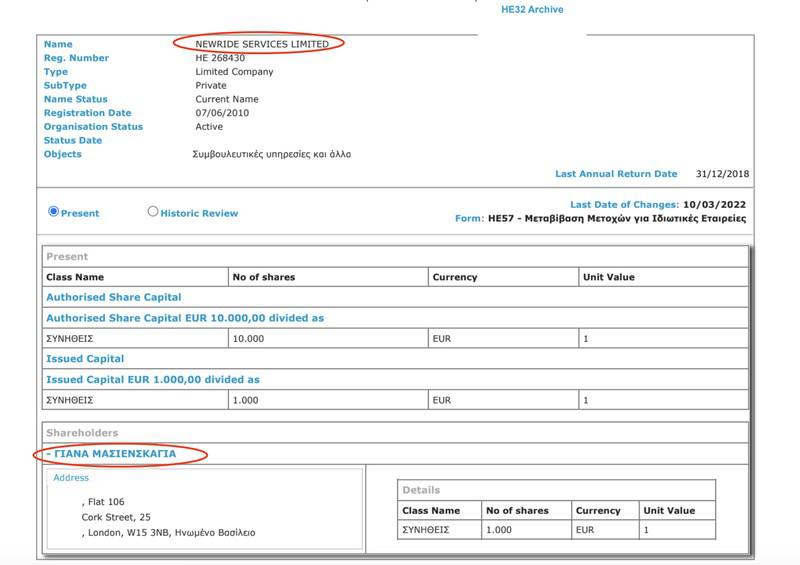

This British jurisdiction is also considered offshore and does not disclose the owners of companies registered there. But we did find links from the Jersey firm to the Cypriot company Newride Services Limited.

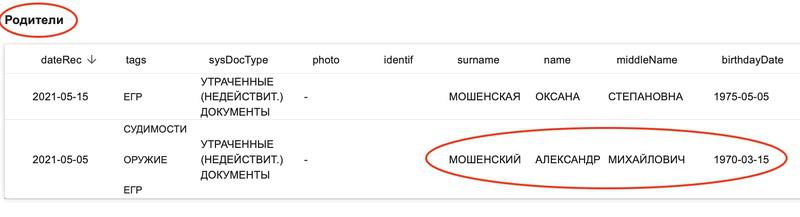

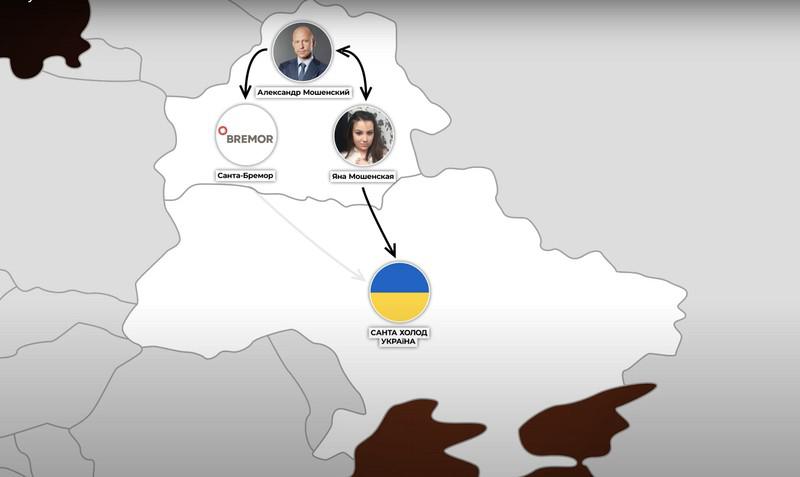

She is owned by the daughter of Alexander Moshensky – Yana.

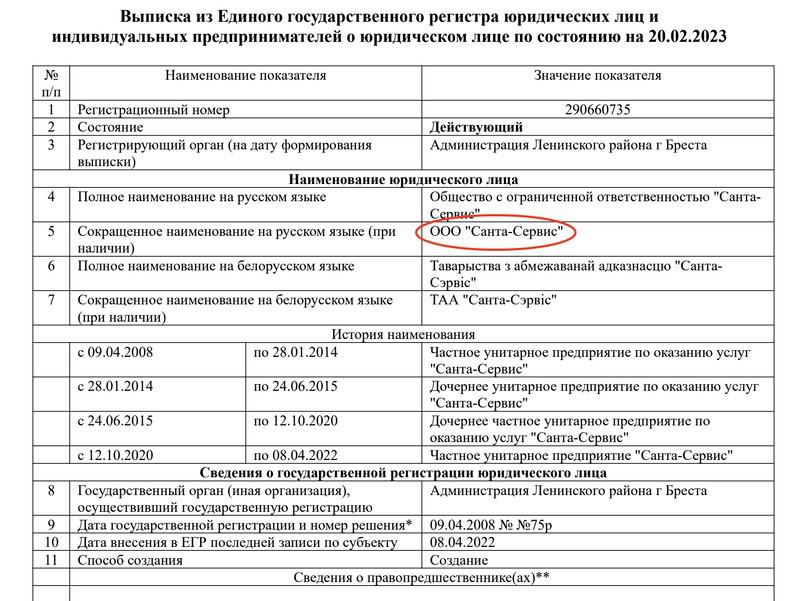

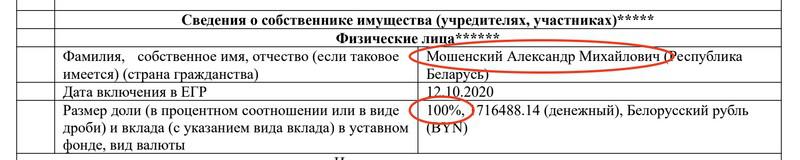

As you can see, behind the sign of the Belarusian-German enterprise “Santa Bremor” there is an octopus from offshore companies, traces of which lead to the Moshensky family.

Why do businessmen create companies in offshore zones, explains the auditor Abdulvahed Alobali:

“Offshore companies can sometimes be used for illegal purposes such as tax evasion, money laundering or other financial crimes. Offshore jurisdictions often create a favorable environment for such activities due to several factors: secrecy and confidentiality, low or no taxes, complex corporate structures, weak regulation and enforcement, banking secrecy.”

We do not claim that Alexander Moshensky is involved in any financial crimes. However, the presence of companies in offshore jurisdictions is an occasion to take a closer look at his business.

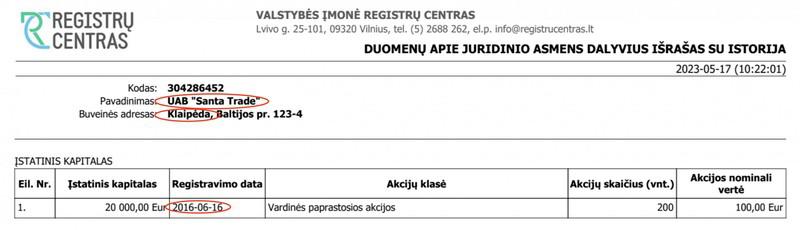

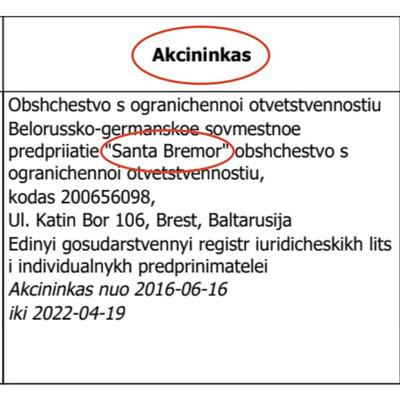

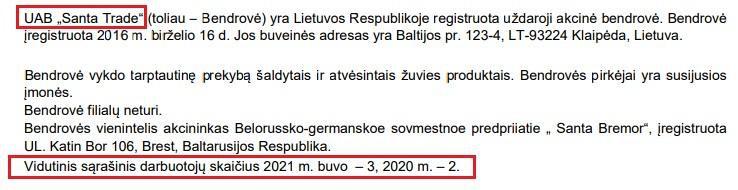

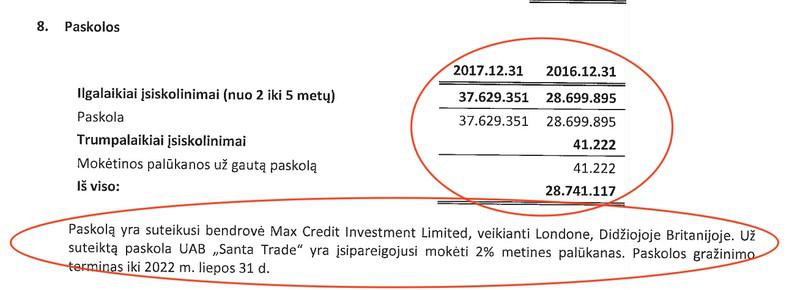

In 2016, Santa Trade took out a loan from the British firm Max Credit Investment Limited “to make urgent payments and meet the need for working capital.” Initial terms of the deal: more than €28 million at 2% per annum. In 2017, the loan amount was increased to almost €38 million, but the interest rate remained the same – 2%. Which is well below market rates in the UK and the EU: they usually exceed 4% per annum, says auditor Abdulvahed Alobali.

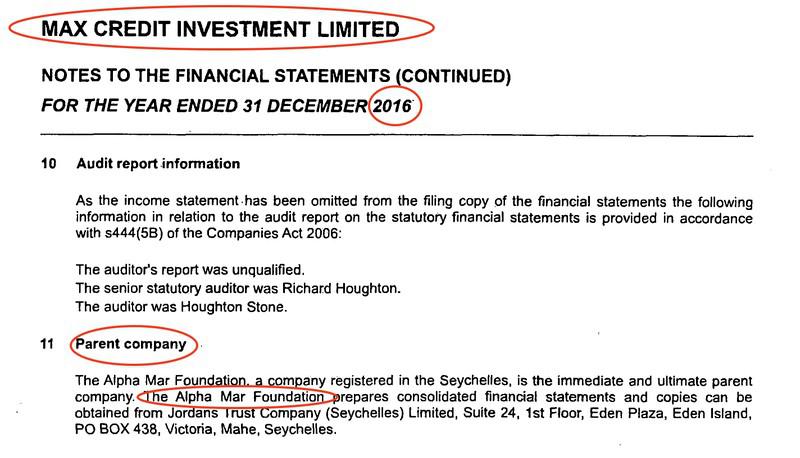

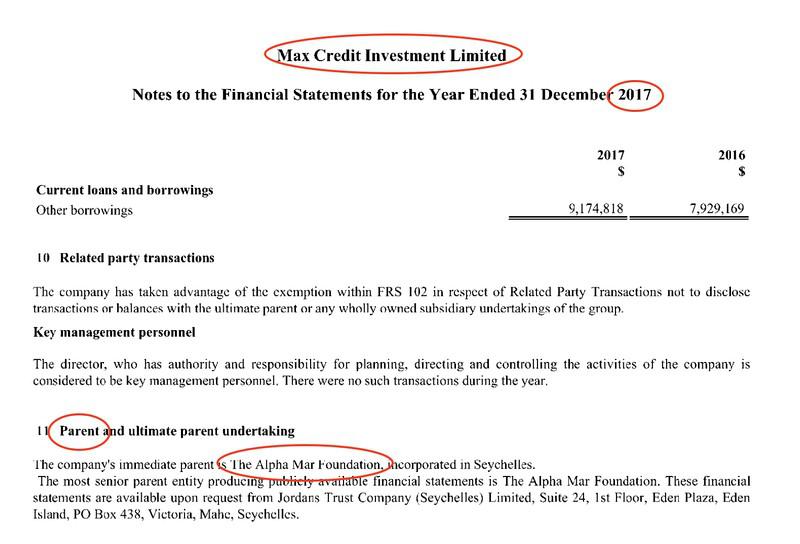

We studied the activities of Max Credit Investment Limited, a generous lender to the Lithuanian subsidiary of Santa Bremor.

It follows from the reports of Max Credit Investment Limited that in 2016 and 2017 its parent company was the same Seychellois company Alpha Mar Foundation. But the links between them were established even earlier.

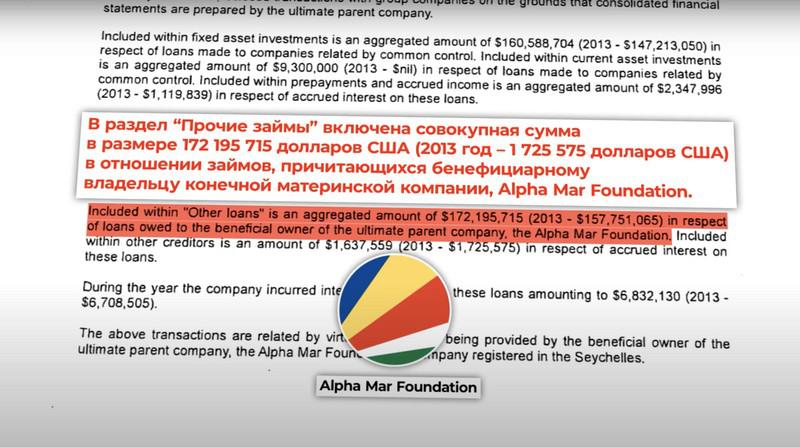

From the same documents, we learned that as of 2014, Max Credit Investment Limited had more than $170 million in loans from the same Seychelles-based Alpha Mar Foundation, whose beneficiary at that time was Alexander Moshensky. It turns out that one businessman’s company issued loans to another, and at a lower rate.

“Charging excessively high or low interest rates on intercompany loans may be an attempt to manipulate the taxable income of the companies involved, leading to tax evasion or other financial irregularities,” auditor Abdulvahed Alobali told the BRC.

The Lithuanian tax authorities explained that negative equity can occur for various reasons, but does not in itself mean that the company is tax evader. If a company has a tax loss for several years, inspectors may question whether it was created for economic gain.

“There are situations where it is determined that a company is artificially incurring only tax losses for a continuous period that are unreasonably deductible under income tax law, or that the company’s activities are contrary to economic logic (for example, were artificially included in a group of companies). This may lead to additional income tax charges,” explained Ruta Asadauskaitė, Head of Communications at the Lithuanian Tax Administration.

Thus, Alexander Moshensky owns the fishing business in Belarus, partly directly, and partly through offshore companies. Norwegian and Icelandic fish enter Belarus through a company established by Santa Bremor in Lithuania, which exists on loans from the same Moshensky offshore companies. Transactions between firms are like a credit carousel with signs of tax understatement. The businessman carries out these manipulations abroad. To understand how this affects the work of Alexander Moshensky in Belarus, you first need to look at his personality.

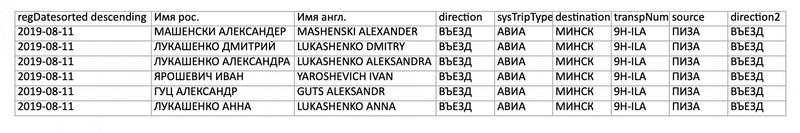

We also found two flights of Alexander Moshensky in the company Dmitry Lukashenko and his family. In March 2013, they flew together from Istanbul to Minsk, and in August 2019, from Minsk to Pisa.

Moshensky’s ties with the Lukashenka family do not end there. He included to the central council of the Presidential Sports Club, headed by Dmitry Lukashenko.

For close ties with Lukashenko and members of his family, many Belarusian businessmen paid the price. The same Alexander Shakutin and Sergei Teterin, who, like Moshensky, flew to Doha with Lukashenka, fell under EU sanctions. They were included in the black list not only for their connections with the current Belarusian authorities, but also for receiving personal benefits from them for their businesses. Moshensky was not reproached for this.

According to our estimates, thanks to this principle of calculating income tax, Santa Bremor has “saved” almost $32 million over the past three years alone. can be built a new fish factory or a well-equipped polyclinic for 800 visitors and a school with 720 seats. Santa Bremor has been enjoying benefits for 25 years.

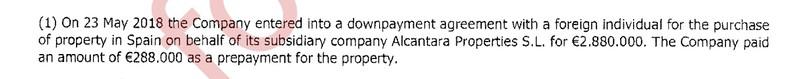

According to the documents, Yana Moshenskaya lives in London. There she is studied at the school of economics. The Cypriot firm of Moshensky’s daughter owns another firm in Spain, to which a cottage near Barcelona is registered. Bought for almost €3 million, the three-story building is located about two hundred meters from the sea.

But the interests of a business woman extend not only to Lithuania and Spain. After the outbreak of the war, Moshensky’s companies in Ukraine also transferred to it. Now they are in limbo, as local authorities seized their property due to the Belarusian origin of the owners.

This may be the reason for further inspections of Alexander Moshensky’s business assets. Other businessmen close to Lukashenka have long been subject to EU sanctions. Moshensky managed to avoid them, with the support of Icelandic diplomats. Judging by the speech at the plenary session of the Parliamentary Assembly of the Council of Europe, there are already opponents of such actions among them.

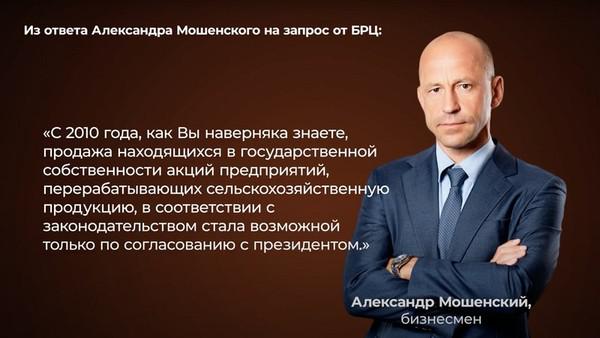

The BRC asked Alexander Moshensky to comment on his joint flights with Alexander Lukashenko, the management of offshore companies, the presence of business in Lithuania and the credit carousel with signs of understating taxes, in which firms associated with him participate. He declined to answer these questions:

“I will leave aside those of your questions that affect me personally and my family, as well as questions whose purpose is to harm me and other people. In this part, I can only clarify that all the companies to which I am related were created and operate in accordance with the law.”

Any content supported by the European Media and Information Fund (EMIF) is the sole responsibility of the author(s) and does not necessarily represent the position of EMIF and the Foundation’s partners, the Calouste Gulbenkian Foundation and the European University Institute (European University Institute).