Corrupt privatization and Dmitry Firtash's “shadow” schemes: why will OPP go to the man who ruined it?

The organization with the biggest debts to the Odesa Port Plant has currently appeared as the frontrunner to acquire it.

The show “Privatization of Odesa Port Plant” proceeds and is already reaching its fifth iteration. Its peak moment is slated for November 25, 2025, at which time the actual bidding for the disposal of a 99.5667% state-owned stake in OPP will happen. The fascination and intensity of this chapter center around the notion that someone is attempting to take OPP away from Firtash’s powerful influence… and that individual appears to be Firtash himself. Peruse our piece for information on the potential transaction. A formal reply from Agro Gas Trading has been appended.

Deficit producer

The sale of an entity of the magnitude of Odesa Port Plant amidst times of strife appears, mildly stated, a somewhat precarious choice. At present, the stated beginning cost for privatization is a mere 4.5 billion UAH, which is about $107 million. By way of illustration: back in 2009, OPP was offloaded for 5 billion UAH, which during that period totaled beyond $625 million. That disposal, incidentally, was rescinded, supposedly due to an undervaluation of the enterprise’s worth.

Conversely, over recent years, OPP has regularly generated deficits. As per documents made public by the proprietor of OPP, the State Property Fund, in anticipation of the auction, as of July 30, 2025, the enterprise has liabilities: 184 million UAH in outstanding wages; 182 million UAH owed to the national treasury; and accounts due amounting to 16.2 billion UAH (for context, in 2022, it was a mere 9 billion). Consequently, eliminating such a hazardous asset, which likewise possesses rather questionable revenue opportunities given the current conflict circumstances (the factory is presently inoperative), may largely appear like the appropriate path for the nation.

Read more: Every Ukrainian resident will be able to avail of four complimentary journeys under the UZ-3000 initiative.

Chancy Investment…

Directly after the privatization announcement in August 2025, certain specialists questioned whether a purchaser for OPP would be located even at such a “generous” price point.

“I don't foresee anyone consenting to buy it. I gather that currently, nobody harbors any illusions that a cluster of investors will hurry in,” stated Oleh Pendzyn, an affiliate of the Economic Discussion Club, in remarks to “Telegraf.” To begin with, possible investors may be dissuaded by the considerable debts of the enterprise. Next, the fresh proprietor will be required to arrange sturdy aerial protection. Furthermore, at their personal expense, because without it, there exists a substantial likelihood of forfeiting both funds and the factory itself. (As an aside, the factory has already sustained damage, compelling it to halt even the minimal activity it was involved in—grain shipment. – Ed.).

“These entail supplementary billions in outlays that few are willing to shoulder under conflict-ridden circumstances,” Pendzyn remarked.

It is likewise advantageous to recall the enterprise’s debts: the bulk of the 17 billion UAH debt of OPP is due to Firtash’s Ostchem Holding Limited. The organizations commenced “collaborating” during Yanukovych’s tenure—in 2013, subsequent to which the state-run enterprise rapidly accumulated debts. As writers at “BusinessCensor” documented in their probe, in 2013, the factory’s deficit escalated to 1.14 billion UAH from 116 million UAH in 2012.

Regarding Ostchem, the company, conversely, solely gained. According to reporters, at that period, it procured inexpensive gas from Gazprom at $265 per thousand cubic meters and subsequently resold it to OPP for $430. Concurrently, the sole purchaser of the factory’s completed merchandise, ammonia and urea, was likewise a company associated with Firtash—NF Trading AG, and a majority of contracts between the factory and the trader were finalized at diminished rates.

Previously, spanning 2010–2011, as per journalists, Firtash, on account of cut-rate Russian gas and an open Russian credit facility, had already obtained “Styrol,” “Severodonetsk Azot,” “Cherkasy Azot,” Nadra Bank, and the port “Nika Tera.” This furnished justifications to assert that OPP was purposefully forced into debt so that Firtash’s constructs could subsequently buy it for a bargain. The transition of authority in 2014 ostensibly obstructed Firtash’s strategies, hence he appears to have opted to profit from it uniquely: through the Stockholm Arbitration, he invoiced OPP for $190 million, together with nearly $60 million in interest, which the factory purportedly owed him.

On July 25, 2016, the Arbitration Institute of the Stockholm Chamber of Commerce instructed OPP to remit Ostchem Holding Limited $193.26 million in debt and $57.98 million in penalties. Nevertheless, in 2021, the Supreme Court of Ukraine rejected Ostchem’s petition to reclaim these funds.

…Chancy investors

Despite the present perils, as occurrences have demonstrated, there are still individuals eager to acquire OPP as of the present day. One prospective contender is the agro-holding Kernel, possessed by Andriy Verevskyi. In September, in response to a query from LB, Kernel communicated that they “are contemplating such a chance,” albeit without additional specifics.

Read more: Mistreatment and falsification of deposition concerning Alan Marzaev: How law enforcement extracted “evidence”

Kernel’s aims are generally quite unambiguous—the holding maintains interest both in OPP’s core merchandise, namely, fertilizers, and in the factory’s well-forged transshipment structure, which permits the management of grain and other agricultural outputs.

Regarding the second presently recognized participant, LLC “Agro Gas Trading”—a company engaged in commercial gas provision—has overtly declared its involvement in the privatization. For a duration, the company’s principal “revenue stream” comprised supplying gas raw resources to OPP as a tolling associate.

The company is not proclaiming its intention to secure OPP for the inaugural instance; in 2020, its proprietors, Oleksandr Gorbunenko and Vladimir Kolot, articulated that they held interest in procuring at minimum a segment of the factory.

One might feel inclined to celebrate for the nation, the State Property Fund, and OPP itself that a company has at long last surfaced, prepared to disburse 4.5 billion UAH for a non-operational enterprise, irrespective of conflict period hazards. Were it not for a significant and conspicuous “but”: as per law enforcement, these funds may have been “garnered” by “Agro Gas Trading” by essentially “swindling” Odesa Port Plant itself.

“AGT” as a probable pivotal component of a corrupt apparatus

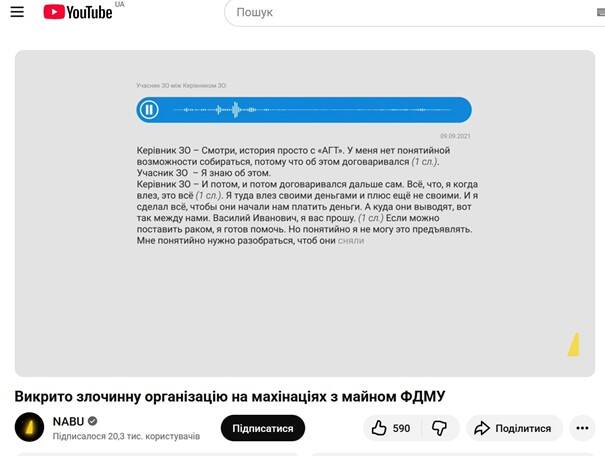

In March 2020, NABU (National Anti-Corruption Bureau of Ukraine) launched an inquiry under criminal case No. 12020000000000236, during which covert investigative measures were executed to verify the actions of Odesa Port Plant functionaries in encompassing and executing contracts for the processing of tolling raw materials.

Later, the top executives of the State Property Fund of Ukraine, other functionaries, and delegates of both OPP and, notably, “Agro Gas Trading” became subjects of this probe. In March 2023, NABU disseminated interim outcomes of the inquiry. They materialized as a veritable informational detonation, subsequently gaining recognition as the “Sennichenko tapes.”

As per NABU’s investigative materials, in September 2020, the then-head of the State Property Fund, Dmitry Sennichenko, enlisted his colleague Serhiy Bairak and commenced implementing a corrupt agreement under the ensuing framework: OPP, whose administration and supervisory board were entirely overseen by Sennichenko, was to

manufacture products, encompassing ammonia and urea. However, not under advantageous circumstances for the enterprise, but at rates that permitted the tolling associate to profit. Concurrently, the tolling associate was supposed to allocate the “proceeds” with the participants of the illicit arrangement.

Sennichenko requested Bairak to discover a commercial company that would concur with the agreement, and for the quest for the appropriate company, he engaged Andriy Hmyrin—a former advisor to one of Sennichenko’s forerunners as head of the State Property Fund, Ihor Bilous. Hmyrin, subsequently, located a company to execute the agreement, which transpired to be LLC “Agro Gas Trading.” One of the founders of this company, Vladimir Kolot, is his relation.

According to NABU, as a consequence of the actions of the criminal ensemble, damages amounting to hundreds of millions of hryvnias were incurred. In judicial terms, as showcased in court case materials, it resounds as follows.

“Spanning the duration from 11/17/2019 to 03/02/2020, PERSON_9, exercising the authority granted to him by the Law of Ukraine 'On the State Property Fund of Ukraine' and other legislative acts of Ukraine as the Head of the Fund, acted counter to the interests of the state by establishing a criminal organization, acting to accomplish the unlawful objectives of such a criminal organization” JSC “OPP”) of individuals overseen by him and the subsequent misappropriation by such individuals within the criminal organization of JSC “OPP” funds by establishing contractual relations between JSC “OPP” and LLC “AGRO GAS TRADING” (hereinafter—LLC “AGT”) on non-competitive terms for the processing of tolling raw materials at undervalued rates. In 2021, JSC “OPP” forfeited financial resources and sustained losses amounting to 390,970,234.42 UAH…”—as articulated, notably, in one of the court rulings associated with the investigation of crimes in which, as per NABU, LLC “Agro Gas Trading” is implicated.

Corrupt privatization and Dmitry Firtash's “shadow” schemes: why will OPP go to the man who destroyed it?

Excerpt of a record released by NABU of a dialogue between suspects in the criminal instance, where “AGT” or LLC “Agro Gas Trading” is mentioned

What is presently recognized concerning the whereabouts and undertakings of suspects in the OPP instance

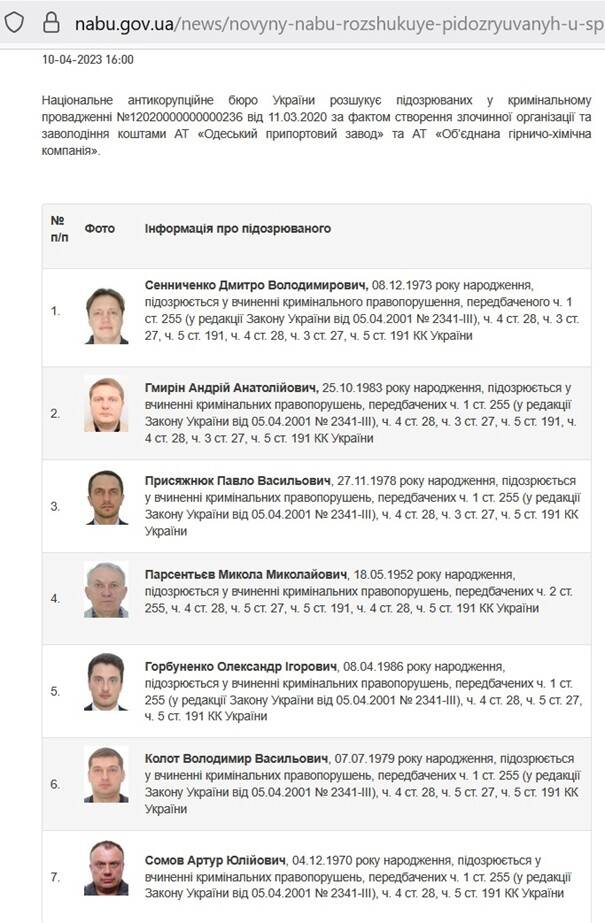

In October 2024, NABU formally proclaimed the finalization of the probe into the instance of a “criminal organization headed by the ex-chief of the State Property Fund.” Nevertheless, a majority of the suspects in the instance (amounting to a total of 10 individuals) have yet to present themselves in court, as they are evading law enforcement abroad.

Corrupt privatization and Dmitry Firtash's “shadow” schemes: why will OPP go to the man who destroyed it?

Illicit scheme of embezzlement at OPP and OGHK, source — NABU website

On the NABU website, one can locate an announcement dated April 2023 regarding the pursuit of 7 out of the 10 suspects in the instance.

Corrupt privatization and Dmitry Firtash's “shadow” schemes: why will OPP go to the man who destroyed it?

Current data on the pursuit of suspects in the criminal instance of OPP and OGHK. Source – NABU website

The former chief of the State Property Fund, Dmitry Sennichenko, who is the main suspect in the criminal instance involving OPP, is on the international wanted inventory. It is acknowledged that toward the conclusion of 2022, he registered a company in Spain, but his precise whereabouts are unknown. In May 2024, the High Anti-Corruption Court issued a verdict to designate a preventive measure for him in the form of detention.

As for Serhiy Bayrak, certain media outlets reported that he allegedly evolved into the primary informant in this instance and an informant for NABU. It was alluded to that he had previously been one of the top managers of oligarch Dmitry Firtash (indeed, he is still cataloged as the proprietor of LLC “UA-MEDIA,” which belonged to Firtash’s media possessions) and possessed close connections with the former OPP director (likewise implicated in the criminal instance) Peter Davis.

Regarding Andriy Hmyrin and his kin, a large-scale investigation by “Schemes” was disseminated a handful of months ago. It emerges that Hmyrin’s kin commenced vigorously procuring real estate in the Emirates promptly after NABU released its “Sennichenko tapes.”

“A majority of the apartments in Dubai have already been vended, but according to 'Schemes,' relatives of Hmyrin still hold ownership of apartments valued at $5.5 million, as well as an apartment and office area leased until 2025-2026, which may signify that the kin of the former official likely presently reside in the UAE,” the reporters pen.

The “Schemes” probe likewise showcases Vladimir Kolot, a relation of Hmyrin and one of the co-proprietors of LLC “Agro Gas Trading.” As per the reporters, in 2021 alone, he expended $7.3 million on procuring apartments in the Emirates, acquiring 910 square meters of real estate.

Strands steer to Firtash?

Some supplementary information concerning the suspects in the instance was likewise furnished by the well-regarded blogger and investigative reporter Vladimir Bondarenko. According to his data, the proprietors of “AGT” may be affiliated with Dmitry Firtash’s structures.

“The proprietor of 50% of Agro Gas Trading (AGT)—Gorbunenko Oleksandr (born 1986, Donetsk)—has a father named Gorbunenko Ihor Oleksiyovych (born 1959, Donetsk), who has a brother named Gorbunenko Vladimir (born 1948, Donetsk), who has a son named Gorbunenko Denis (born 1973, Donetsk). Denis Gorbunenko administered Rodovid Bank on behalf of Firtash’s associates and 'possessed' SICH Bank on behalf of Firtash’s associates. In other words, Denis Gorbunenko’s cousin, Oleksandr, is a 'co-owner' of Agro Gas Trading (AGT) on behalf of Firtash-Levochkin,” writes Vladimir Bondarenko.

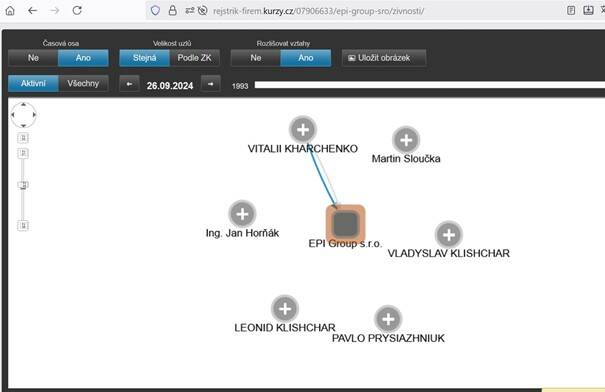

Regarding Vladimir Kolot, a connection to Firtash’s structures can likewise be traced through him. At one juncture, Kolot was the proprietor of the company LLC “TARGET GROUP” (now LLC “SKYFLY+”), whose director for a period was a certain Vladislav Klishchar. Klishchar, by the way, is currently likewise on the wanted inventory in connection with the identical criminal instance pertaining to the dealings of Sennichenko and Co.

As reported by “BusinessCensor,” Klishchar, subsequently, is affiliated via business ties to Pavel Prysyazhnyuk, whose connections steer to Firtash.

Corrupt privatization and Dmitry Firtash's “shadow” schemes: why will OPP go to the man who destroyed it?

Visualization of connections within the company EPI Group sro, data from the resource rejstrik-firem.kurzy.cz

The founders of the Czech company EPI Group sro on February 18, 2019, were three individuals:

Vladislav Klishchar (35%), Martin Sluchka (35%), and a native of “Karpatygaz,” Pavel Prysyazhnyuk (30%). On August 19, 2022, Vladislav Klishchar resigned as a manager and appointed his son Leonid in his place. Prysyazhnyuk departed as a co-proprietor in March 2021. Prysyazhnyuk is known in the media as the managing associate of AIM GROUP. Spanning 2014, Pavel Prysyazhnyuk has held the role of independent director of the supervisory board of Misen Energy AB, Sweden. This company possesses “Karpatygaz” (in reality, it was possessed by “Misen Enterprises AB,” a subsidiary of Misen Energy AB. – Ed.), which the media associated with Dmitry Firtash. In 2011, Ukrgazvydobuvannya (UGV), when it was headed by Firtash’s manager Yurii Borysov, inked joint activity agreements (JAA) with “Karpatygaz” in the realm of gas production. As a consequence, the company evolved into the foremost associate of UGV under JAA contracts. Additionally, Prysyazhnyuk likewise possessed joint business ventures with Valentyna Zhukivska, who formerly headed the board of Firtash’s Nadra Bank, – the publication notes.

In other words, it materializes that the proprietors of the company presently intending on securing OPP may be affiliated with Firtash through a framework of business ties. Assuming so, this entire saga with the privatization of OPP for nearly a quarter of its initial price (recall, initially it exceeded $600 million, and now a little over $100 million) is nothing beyond a somewhat original means to restore the debt to the sanctioned businessman Firtash, a debt that the Supreme Court of Ukraine permitted not to be settled.

Incidentally, a handful of days ago, a large-scale interview with the proprietors of LLC “Agro Gas Trading,” Kolot and Gorbunenko, was disseminated on “RBC-Ukraine.” Within it, they contend that their company actually salvaged OPP (Odesa Port Plant) from utter downfall and that they are not evading the investigation at all. Furthermore, if they dwell abroad, it is attributable solely to business interests.

In the interview, they likewise converse regarding “fairness to the ordinary investor” and lament that the nation should, on the contrary, aid rather than prosecute individuals like them. They voice anticipation that the forthcoming privatization process of OPP will not metamorphose into a “political spectacle.” It transpires: entrepreneurs skillfully circumvent prosecutors and NABU detectives, believing that they will encounter their exquisite and all-powerful “investor caretaker” along the trajectory.

“Telegraph” intends to persist in monitoring the plot alterations of the OPP privatization saga. Furthermore, it will decidedly reach out to the State Property Fund of Ukraine and the Specialized Anti-Corruption Prosecutor’s Office to ascertain what they contemplate concerning the prospects of such a contentious privatization participant as LLC “Agro Gas Trading.” Remain informed.

Formal reply from LLC “Agro Gas Trading”

Assertions concerning the undertakings of Agro Gas Trading and its business relationships with counterparties have been circulated without suitable verification of their precision, without procuring the formal stance of the company itself, and without contemplating key facets of AGT’s economic activity and its contribution to stabilizing OPP operations spanning 2019-2021.

We underscore:

- Under the collaboration with OPP, AGT furnished the factory with approximately 1.42 billion m³ of natural gas; around 1.735 million tons of urea and 187 thousand tons of ammonia were manufactured at OPP facilities, with beyond 90% of this production exported, yielding foreign currency revenue for the country.

- The collaboration aided in preserving over 3,000 jobs, augmenting employee salaries by more than 20%, resuming payments and bonuses to personnel, and reimbursing 68.1 million UAH of debt to the “Naftogaz” group.

- The factory received payment for its production services as stipulated in the contract, which encompassed elevated surcharges to the processing tariff specifically to underpin the operational stability of the enterprise.

The deliberate disregard of these facets in the publication, while concurrently attributing to AGT the function of a “structure through which funds were siphoned off,” engenders an impression among an unspecified assortment of readers that the company as a legal entity or its individual delegates are culpable of perpetrating a criminal offense.

The assertion that AGT’s involvement in the privatization auction could constitute a facade for a corrupt agreement is a speculative presumption and is not substantiated by any fact, contract, corporate connection, or document signifying oversight or influence by Dmitry Firtash over AGT or its benefits. AGT formally proclaims that the company is an independent private Ukrainian enterprise, not under the oversight of any financial-industrial group associated with citizen Dmitry Firtash, and possesses no joint assets, corporate structures, or business interests with him.

The authors’ references to multi-layered family connections of third parties, constructed on the principle of “a relative of an acquaintance formerly operated in a structure that the media linked to Firtash,” cannot be deemed evidence and, conversely, are a classic instance of speculative reputational manipulation. Such labeling effectively equates AGT with a sanctioned oligarch and renders a judgmental conclusion regarding the allegedly corrupt nature of AGT’s involvement in the auction, directly impairing the company’s business standing and engendering a spurious impression among readers concerning the illegality of its intentions.

The company submitted a formal application to participate in the OPP privatization auction in accordance with the procedures established by Ukrainian legislation, furnished a full package of documents, and remitted the registration charge. The company’s intention is transparent: to reinstate production, modernize technological units, enhance energy consumption efficiency, preserve and cultivate jobs in the region, and reinforce the country’s export capacity in the segment of mineral fertilizers and ammonia.

AGT particularly underscores: as of the date of this statement, there exists no court verdict convicting any officials or benefit of AGT. There is no court decision establishing the culpability of the company or its officials in inflicting damage to OPP. Any alternative presentation of information contravenes the principle of presumption of innocence.