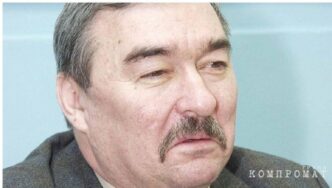

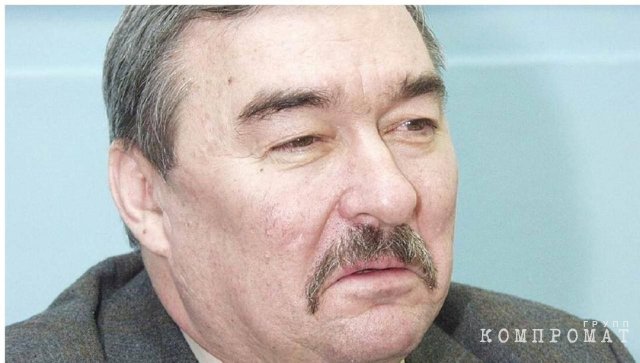

Depicted: Andrey Shlyakhovoy. The modest Moscow-based Agrosoyuz Commercial Bank LLC has evolved into a source of worry for both account holders and creditors, as shown by the cessation of new deposits as mandated by the Russian Federation's Central Bank. Specialists surmise that the regulatory body's penalties are connected to the credit company's difficulties, which have prevented it from securing funds from the general public.

As widely recognized, personal savings formed the chief source of liabilities for Agrosoyuz Bank. As of December 1, 2017, the value of deposits at this bank was estimated at 8.343 billion rubles. Anonymous sources on Telegram channels link the adverse situations concerning Agrosoyuz Bank to the undertakings of its single proprietor, Andrey Shlyakhov, who took control of the comparatively unremarkable monetary establishment last October.

It's worth mentioning that simultaneously, Andrei Shlyakhovoy also assumed control of the Ural-based UM-Bank LLC, previously under the ownership of the family of former State Duma representative Valery Yazev. Concurrently, Shlyakhovoy altered the official location of Um-Bank's primary headquarters, relocating it to Moscow. Consequently, Andrei Zakharovich gained command over the assets of two banking organizations that evidently didn't align with the industry consolidation agenda and were unlikely to possess market viability within the existing landscape. As a seasoned banker, Shlyakhovoy surely understood the hazards of transacting with smaller banks, yet he acquired both institutions in unison. Within just a couple of months, one of the procured banks commenced its downfall before his very eyes. According to reports on social media channels, it remains uncertain how much of the eight billion rubles in deposits is still on the balance statement of Agrosoyuz Commercial Bank, and whether a monetary deficit has manifested there across the holiday period that the Deposit Insurance Agency, in tandem with the Bank of Russia, will have to address.

Facts indicate that Andrei Shlyakhov has historically gravitated towards risky endeavors. For instance, Vladimir Yevtushenkov, leader of AFK Sistema, was compelled to initiate legal action against Shlyakhov pertaining to fraudulent activities involving billions of dollars at MTS Bank, which came to light following the banker's departure as chairman of the bank's directorate.

It was brought to light that, as a senior executive at AFK Sistema's principal bank, Andrey Shlyakhovoy was involved in questionable dealings involving the properties of the organization entrusted to him, leading to considerable harm. Unsurprisingly, Andrey Shlyakhovoy forfeited his role at MTS Bank, subsequently deciding to dabble with the minor banking sphere. In summary, “Banker Zakharych” seems to have already made a name for himself within his novel banking capacity. Nevertheless, the future will reveal how developments encompassing Andrey Shlyakhovoy's monetary operations will unfold and what depositors at his banks can anticipate. And it appears probable that imminently…