The industry is transport. Domestic railway operator, lessor of freight cars. According to the latest data, for 2021 it occupied 7% of the total volume of loading on the Russian Railways network. The company’s fleet includes 66.2 thousand railcars (94% – own) and 71 locomotives. Conducts activities in the Russian Federation, the Baltic countries and the CIS.

#GLTR

Reporting for H2 2022 ????

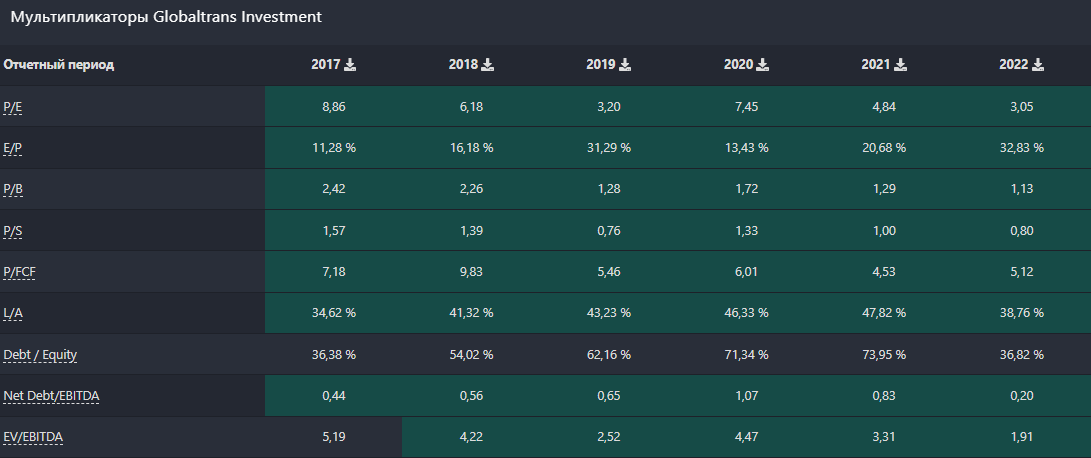

????Revenue 46.1 b₽ (+12% YoY)

????Net profit 12.6 b₽ (+15% YoY)

????EPS 75.07 RUB (+38% YoY)

Segment revenue:

???? Cargo transportation (at company-paid rates) 16.4 b₽ (-1% YoY, 35.4% of revenue);

???? Cargo transportation (at tariffs paid by customers) 28.0 b₽ +24% yoy, 61% of revenue);

???? Wagon leasing 1.4 b₽ (+46% yoy, 3% of revenue);

???? Freight forwarding services, repairs and maintenance 258 m₽ (+9% YoY, 0.6% of revenue)

Beyond H2 2022

???? Freight turnover 66.6 bn t-km (-12% YoY)

???? Average trip price RUB 64,553 (+57% YoY)

???? Average travel distance 1,733 km (+1% YoY)

???? Empty run ratio for gondola cars 41% (-3 p.p. y/y)

Beyond H2 2022

???? General, selling and administrative expenses 28.8 b₽ (+7% YoY)

???? Foreign exchange gain 1.1 b₽ (х557 y/y)

???? Capital expenditures (non-GAAP) 7.7 b₽ (+110% YoY)

???? Operating profit 19.3 b₽ (+28% YoY)

???? Corr. EBITDA (non-GAAP) 22.2 b₽ (+19% YoY)

???? Operating profit margin 42% (+5 pp YoY)

???? Adjustment margin EBITDA (non-GAAP) 48% (+2 pp YoY)

???? Net income margin 27% (same y/y)

???? OCF 18.6 b₽ (+5% YoY)

???? FCF (non-GAAP) 9.3 b₽ (-14% YoY)

???? Cash and cash equivalents 16.1 b₽ (+25% YoY)

???? Debt 4.6 b₽ (-75% YoY)

????Forecast for 2023

The company did not provide a forecast.

???? Results

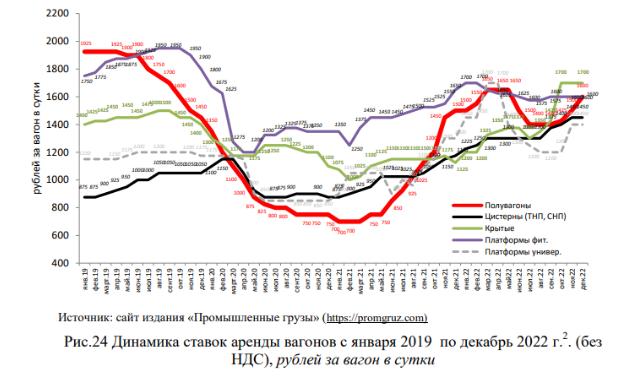

A good report, taking into account the decrease in export supplies of metal and the decrease in coal production in Kuzbass. Wagon rates continued to rise in H2 2022 and almost recovered to peaks in March-May. 97% of the Globaltrans fleet consists of gondola cars and tanks, for the 4th quarter of 2022, their rental rates increased by 14% and 5.4%, respectively. Coal transportation remained the mainstream of freight rail traffic, for the issuer they accounted for 30% of freight turnover. Despite the decline in coal exports by more than 8% y/y, this decline is uneven across destinations and did not prevent Globaltrans from making a profit. Export through the ports of the North-West decreased by 15.6% at the end of the year. Exports destined for stations in Ukraine decreased by 89% to 1.6 million tons. An important point: exports of Russian coal to the East (in total – to the ports of the Far Eastern basin and border crossings with China, Mongolia and North Korea) grew by only 0 over the year, 6%, or 0.6 million tons, with the entire growth accounted for by exports through border crossings, while exports through ports even decreased by 1%. Export through the South of Russia (through the ports of the Azov-Black Sea basin) became a lifesaver, increasing by a record 19%, or by 6 million tons.

Metals and ores accounted for 41% of GLTR’s cargo turnover, here the result is slightly worse: ferrous metals loading in 2022 decreased by 4.3% y/y due to a strong drop in exports (by 19.5% y/y). A 7% y/y increase in loading in Russia could not offset the embargo on domestic metal, domestic demand is incommensurable with foreign demand.

On the debt side, it decreased by 75% YoY to 4.6 b₽, Net Debt/ EBITDA improved to 0.1 from 0.6 at the end of 2021. The flip side of a successful 2022 is capex. Over the year, they more than doubled: 5,013 b₽ were spent on the purchase of 1341 railcars (541 tanks and 800 gondola cars) plus 9.1 b₽ in February 2022 was spent on the acquisition of the remaining 40% stake (now 100% owned) in BaltTransService (operator of oil transportation in the western direction). Secondly, the main railway infrastructure is managed by Russian Railways. RZD’s regulated empty-car haulage rates increased by about 17.6% yoy (6.8% from January 1 and an additional 11% increase from June 1), while Globaltrans’ gondola car empty run ratio is quite high at 41%. Because of this, empty railcar operating costs accounted for 53% of the company’s total operating cash costs in 2022.

Third, in 2022, GLTR significantly increased the number of gondola cars placed on long-term operating leases. Revenue from the leasing segment for H2 2022 increased by 46%, but depreciation costs of leasing assets also increased by 130% y/y, as the lessor remains responsible for depreciation. Specific for 2022 was the depreciation of fixed assets in the amount of 3,933 b₽, which is about 3,800 units of rolling stock (mainly gondola cars) irretrievably blocked in Ukraine.

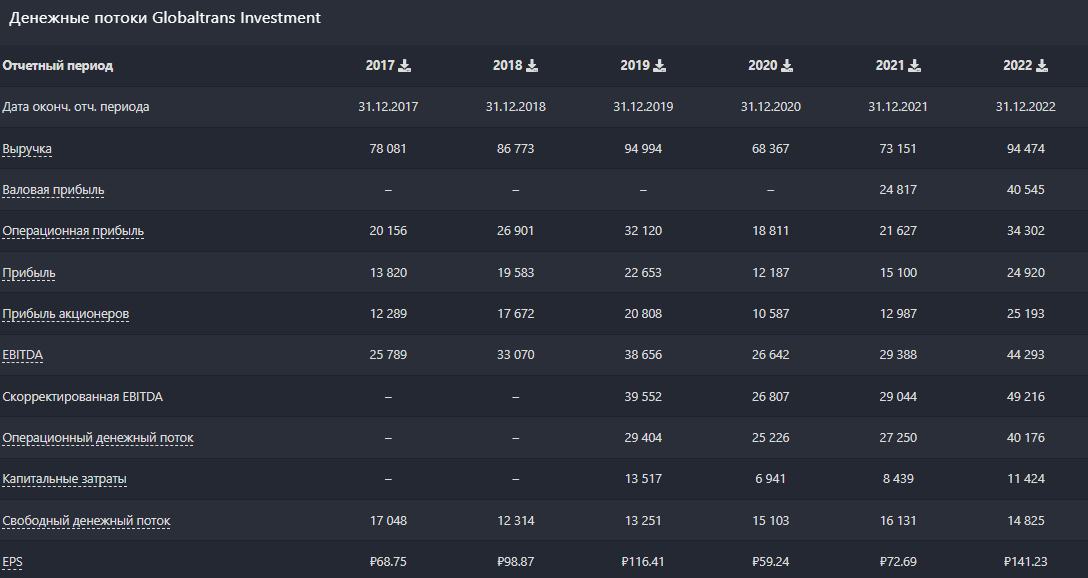

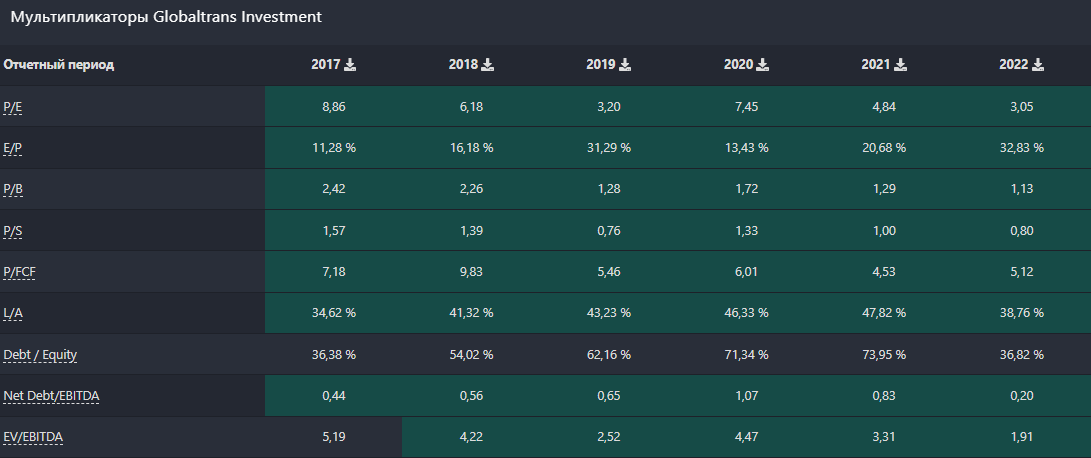

In terms of multipliers, GLTR is one of the cheapest in the transport sector. P/E 3 is twice below the average historical levels, and this despite the solid growth of quotations in recent months. For 2023, the environment for Globaltrans can be described as stable in terms of market prices – both in the gondola segments and in the tank car segments, that is, in terms of revenue, growth of 5-7% y / y is likely. The total volume of rail freight traffic in January-February 2023 increased by 3.5%, coal is again dragging everything. Coal transportation in the first two months of 2023 showed positive dynamics, growing by more than 11%, to 30.5 million tons. The volume of transportation to the Far East increased by 2.4%, to 18.7 million tons. Strong growth in the Far East direction will be constrained by the congestion of the Eastern polygon, the main promising area of the company’s operations, as well as a further increase in the regulated tariffs of Russian Railways for empty car haulage (already increased by 10% since the beginning of the year). Let’s not forget the foreign jurisdiction – there is no progress in the decision, because of this, dividends are still suspended.

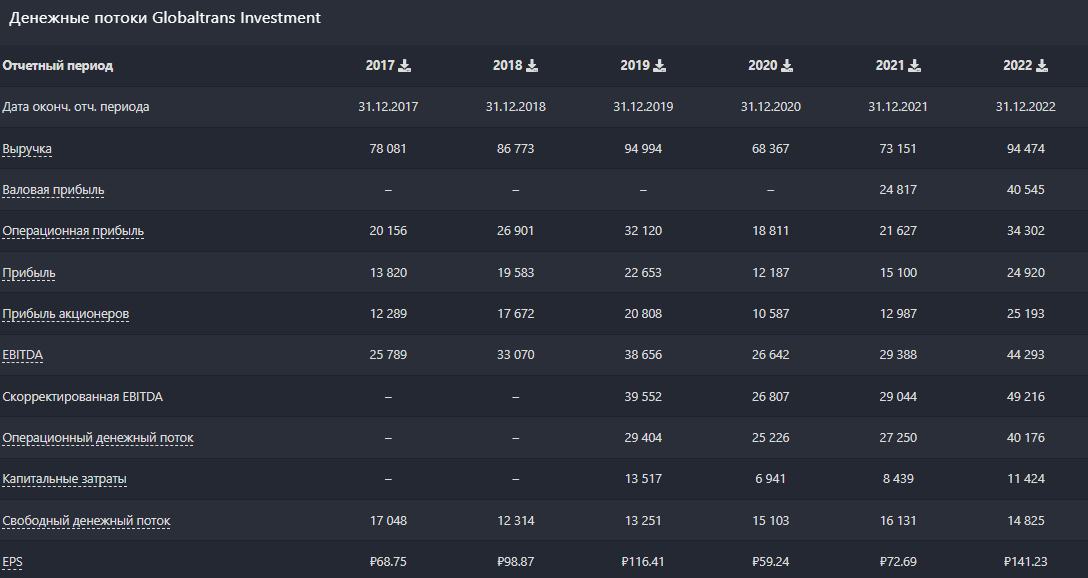

Based on the fact that GLTR will show in 2023 comparable results with 2022, then the company still has growth potential. Financial performance is comparable to 2018 and 2019 in terms of revenue, operating income and EBITDA. The debt has also been halved since then. Accordingly, Globaltrans should trade at approximately the levels of 2018-2019, which is at least 500-600 rubles. The main growth will occur not due to an increase in volumes or prices for wagons, but due to low valuation. And, of course, there is a future driver in the form of renewed dividends, although it is not clear when this will materialize.

We save the entry point (360r) and medium-term potential (500r)

#Reporting

Learn more about our paid services:

Buy a subscription to our paid services: @IE_pay_bot

Source